Coinbase Ventures and Andreessen Horowitz have created a new Indian unicorn: CoinSwitch Kuber. They announced Tuesday that they co-led a $260m investment in the Bangalore-based cryptocurrency trading company. The young firm was valued at $1.9 billion.

This is the first Indian investment by a16z. TechCrunch reported twice last month that two Indian firms were in discussions to support the startup. They had suggested a valuation of $1.9billion.

The startup, four years old, has raised approximately $300 million through Wednesdays Series C round. It was then valued at more than $500 million by its Series B financing in April.

The new round was also attended by Sequoia Capital India and Tiger Global, existing investors. It is the largest ever for a cryptocurrency startup. CoinSwitch is the third unicorn-making Indian startup this year and the only one in the crypto space. In August, CoinDCX, backed by B Capital, became India's first crypto unicorn.

CoinSwitch, one of the few startups that allow users to trade and buy cryptocurrencies in India, is among those. According to numerous users TechCrunch spoke to, the offerings of CoinSwitch are superior in terms of functionality and user interface.

In an interview with TechCrunch, Ashish Singhal, chief executive and co-founder of CoinSwitch Kuber said that the app has over 70 cryptocurrency options and trading is quick. The app allows users to trade as low as 100 Indian rupees or $1.

He said that CoinSwitch now has over 10 million registered users. Most of these are first-time investors and young people. He said that more than half of the startup users are aged 28 and under.

He said that the excitement surrounding trading in cryptocurrency is due to India's young population. He said that young people are increasingly considering investments as an option.

He said that the Supreme Court of India overturned the ban placed by central banks on cryptocurrency two-years ago. This led to banks being able to work with trading apps, which also helped. He said that many young people who had seen crypto trading on the western markets realized they were too late to invest in crypto.

It has not been lost on the startup that many of its users are still new to the investment world. CoinSwitch Kuber partnered recently with NDTV in India to produce stories about cryptocurrencies, trading, and the risks that come with them. He said that the podcast also covers this topic.

Andreessen Horowitzs first India investment

We are extremely excited about India's crypto market opportunity. CoinSwitch, with its rapid growth, has become the most popular retail platform in India. David George, general partner at Andreessen Horowitz said in a statement. Ashish and his team have shown strong execution skills and the ambition to create an investment platform for the masses of India.

The arrival of A16z in India coincides with record capital raising by startups in India, the second largest internet market in the world. In recent quarters, several of its global peers, including Sequoia and Falcon Edge Capital, Lightspeed Capital, Lightspeed Capital, Temasek, SoftBank, and Sequoia, have increased the pace of their investments in India.

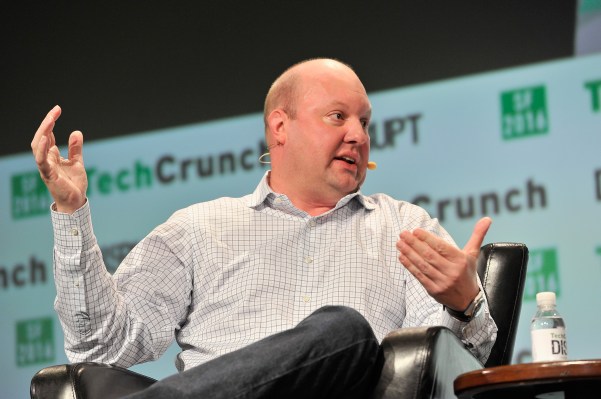

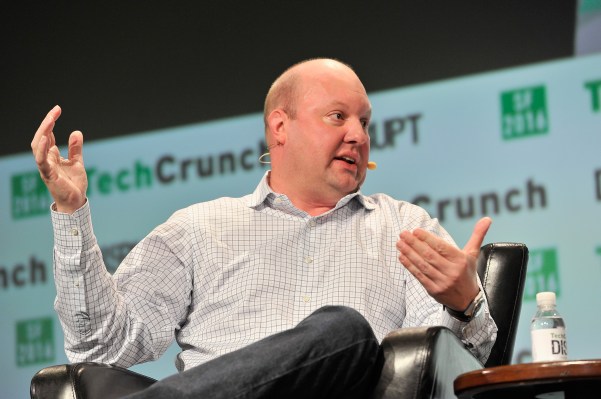

Since years, the firm has been looking into markets such as India. Marc Andreessen, co-founder of a16z and general partner of the firm (pictured above), stated that it was very tempting to support startups in emerging markets. He explained that it was difficult for venture funds to expand into new countries. Venture capital requires you to get to know the people you are working with in order for the company to be evaluated and worked with.

If the business continues to be hands-on, then the problem of geographical remoteness will arise. This is when I am not physically present in another location and do I know the people who can make the decisions. A lot of firms have tried to staff local teams. The problem is that local teams can be easily restructured to run their own businesses if they are really talented. They can also stay with me if they're not good, which has its own problems.

People familiar with the matter say that A16z has evaluated several other Indian startups in recent months. According to the firm, it is investing in CoinSwitch using both its growth and crypto funds.

We are humbled to have been chosen by Andreessen Horowitz and CoinSwitch Kuber as their first investment in India. Singhal said that Coinbase Ventures investment is a testimony to their confidence in CoinSwitch Kubers business model, and the immense potential India's crypto space holds.

Future plans for CoinSwitch Kubers

Singhal stated that the startup will use the new capital to expand its asset classes and allow investors to invest on its app. Singhal declined to disclose the asset classes. He also said that the company is working to provide support for institutional clients who want to use the app. The startup, which hopes to have more than 50 million users, also stated that it is looking for people to fill various roles within the company, including leadership positions.

Many Indian crypto trading startups have expanded outside India over the years. This is a common move. This is partly to counter any adverse regulatory changes in India. Singhal stated that CoinSwitch Kuber will remain focused on Indian users and has no plans for expansion.

Many Indian ministers have expressed concern about cryptocurrency's potential dangers and suggested that they could ban it from the country. Singhal stated that he had good interactions with legislators so far. He hopes CoinSwitch will be able to convince Indian politicians to allow cryptocurrency in India.

He asked if there would be strict regulation of cryptocurrency. Because crypto at the moment is wild and wild west, there should be strict regulation.