Take a look at the companies that are making headlines even before the bell rings.

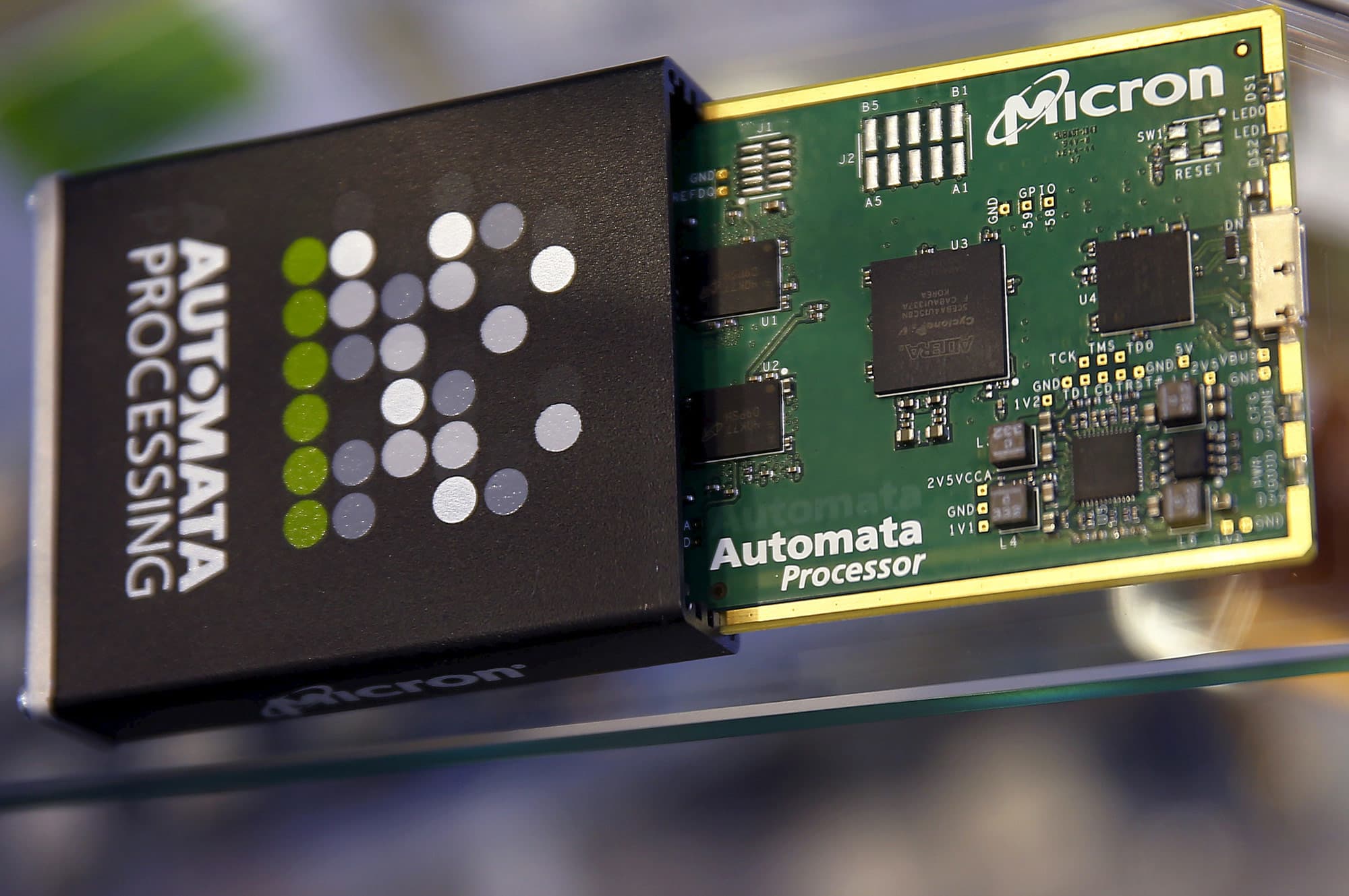

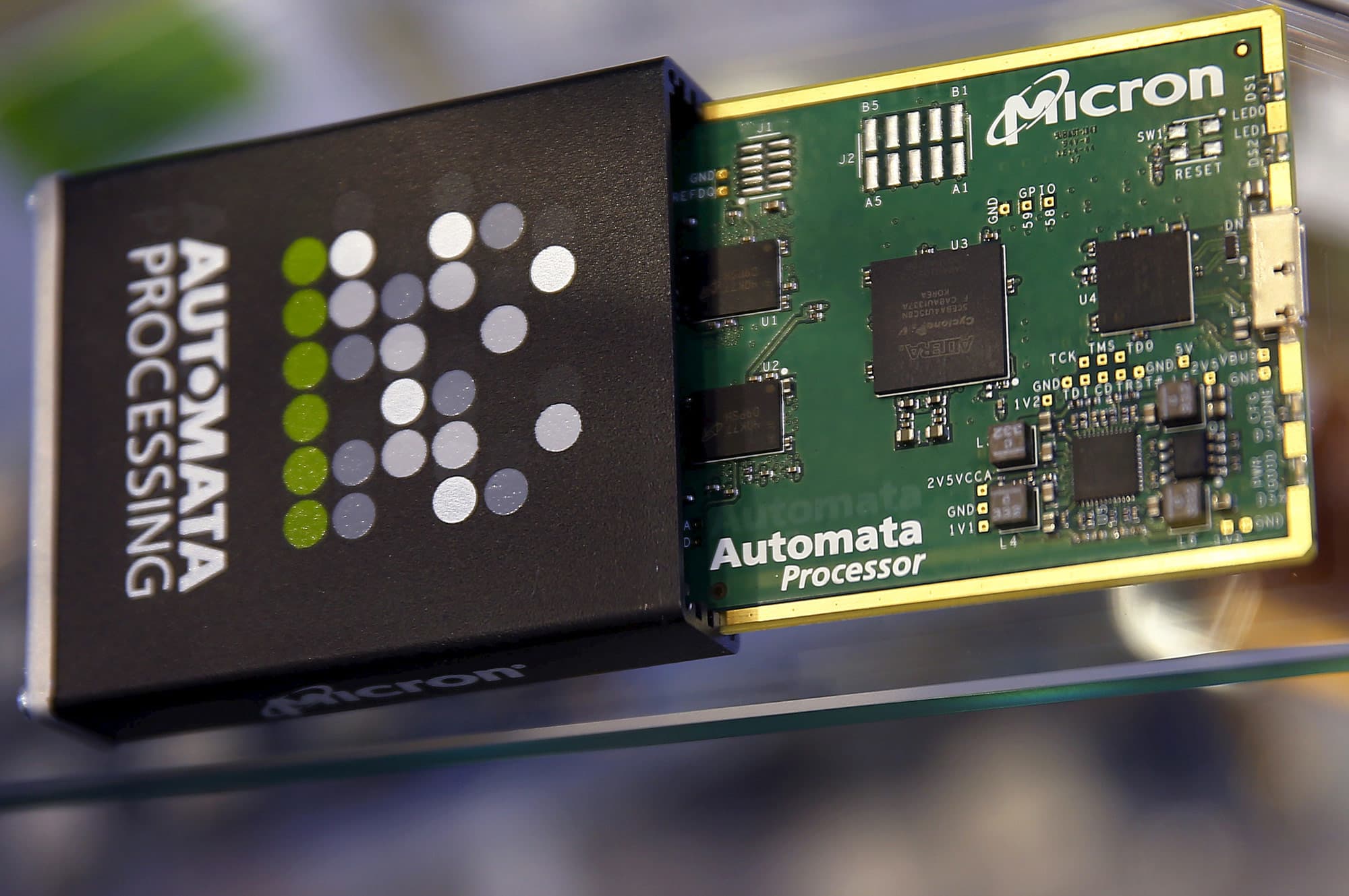

Micron Technology (MU), Micron posted adjusted quarterly earnings at $2.42 per share. This is 9 cents more than estimates. The chip maker's revenue was also above Street forecasts. The stock dropped 3.6% in premarket because of computer-making customers experiencing shortages of other parts.

After Citi upgraded Eli Lilly to "buy" (neutral), the drugmaker's stock rose 2.2% in premarket trades. Citi points out valuation after a drop of more than 15% in share price. Also, it cites its above-Street consensus earnings outlook Lilly following a meeting with management.

Netflix (NFLX). Netflix's premarket share rose 1% after it announced that it had purchased Night School Studio, a videogame developer, in an attempt to diversify its revenue streams. Night School Studio is most well-known for its supernatural-themed videogame "Oxenfree".

Lucid Group (LCID). Lucid will deliver its first electric luxury sedans by October after kicking off production at the Arizona plant on Tuesday. Lucid claimed that its vehicles will be more reliable than similar cars made by rival Tesla (TSLA). Premarket trading saw a 7.3% increase in stock.

Dollar Tree (DLTR). Dollar Tree jumped 3.7% after the discount retailer raised its share repurchase authorization to $1.05 billion, to $2.5 billion.

ASML (ASML). ASML increased its annual sales outlook. The maker of semiconductor manufacturing equipment predicted that it would experience 11% annual growth by 2030, as the demand for its products grows. Premarket sales increased by 1%.

AbbVie, (ABBV) AbbVie received FDA approval for its once daily oral migraine treatment. Qulipta, also known as AbbVie, was one of the treatments that AbbVie acquired last year when it purchased Allergan for $63 billion.

Sherwin-Williams SHW Sherwin-Williams reduced its third-quarter guidance. The paint manufacturer cited increased input costs and raw-material shortages as reasons for the cut. According to the paint maker, it does not expect to see an improvement in supply or lower prices of raw materials during its fourth quarter as it had previously predicted. Premarket action saw Sherwin Williams fall 2%

Affirm Holdings - AFRM The financial services company announced that it will offer a debitcard and allow customers to use their savings accounts to make cryptocurrency transactions. Premarket shares of Affirm rose 3.6%

Cal-Maine Foods (CALM) Cal-Maine rallied 4.4% in premarket trading after it reported a smaller-than-expected loss for its latest quarter. Because of higher egg prices, the egg producer's revenues exceeded Street expectations.

Warby Parker (WRBY), the eyewear manufacturer, makes its debut on Wall Street today. The direct listing will be at $40 per share and it will go public with a reference price. This gives the company a valuation of almost $5 billion.