OMAAT has collected the card independently and it has not been provided or reviewed by the card issuer. These are the best public offers (terms apply), that we found for any product or service. These opinions are solely the author's and not the views of any bank, credit card issuer or airline. They have not been approved or endorsed by any other entity. OMAAT receives a referral bonus for any person who has been approved using the links below. OMAAT has collected the information and associated card details for the Hilton Honors American Express SurpassCard. This information has not been reviewed by the card issuer. These are the best public offers (terms apply), that we found for any product or service. These opinions are solely the author's and not the views of any bank, credit card issuer or airline. They have not been approved or endorsed by any entity. For more information about our partners, please see our advertiser policy. Thank you for your support!

The huge benefits and perks offered by hotel credit cards are often overlooked. Hilton's mid-range personal credit card is the Hilton Surpass Card. It has a low annual fee and offers useful perks. You can read my full review of Hilton Surpass Card here. In this post, I want to share seven reasons why you should apply for the card. In no particular order:

Up To 180,000 Hilton Honors bonus points

Hilton Honors points can be used to get a Welcome Bonus of up 180,000 on the Hilton Surpass Card

Spend $2,000 in the first three months to earn 130,000 Hilton Honors points

Spend $10,000 in the first six months to earn an additional 50,000 Hilton Honors Bonus Points

Hilton Honors points are worth 0.5 cents per, so that bonus to me is worth $900 is huge.

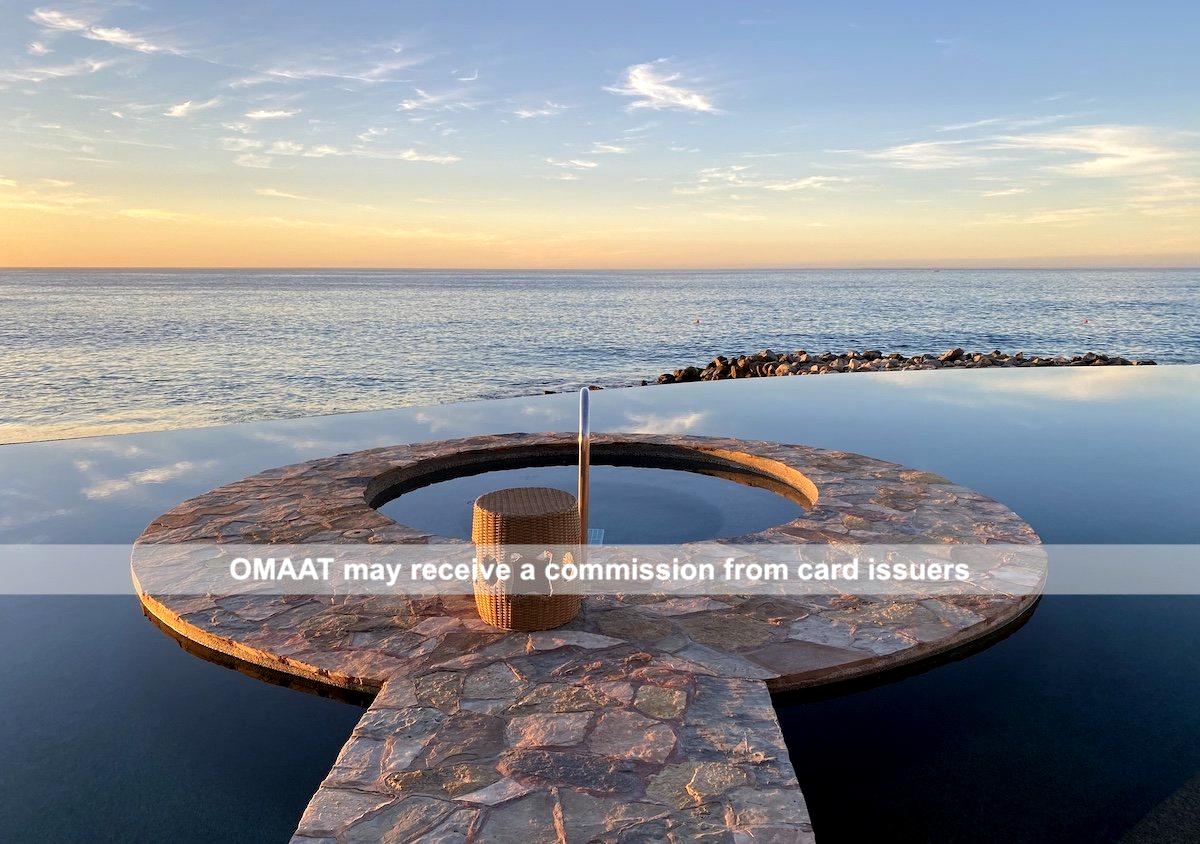

Hilton Honors points can be redeemed at Conrad Bora Bora

Hilton Honors Gold status

The Hilton Surpass Card's best perk is its hotel elite status. For as long as your card is active, you will receive Hilton Honors Gold status. This status is my favorite mid-tier hotel status. It offers perks such as complimentary breakfast, daily food and beverage credit, executive lounge access, bonus points, room upgrades and more.

Hilton Honors Gold members get an executive-level upgrade

Spending and a free night certificate

The Hilton Surpass Card is worth keeping for its perks and it's also worth spending money. You will receive a Hilton free hotel night reward for spending $15,000 on the Hilton Surpass Card within a calendar year. This reward can be used to book a hotel stay at any Hilton-family property around the globe, which may otherwise cost up to 150,000 Hilton Honors Points per night.

It is absolutely worth getting this card if you are able to spend that much.

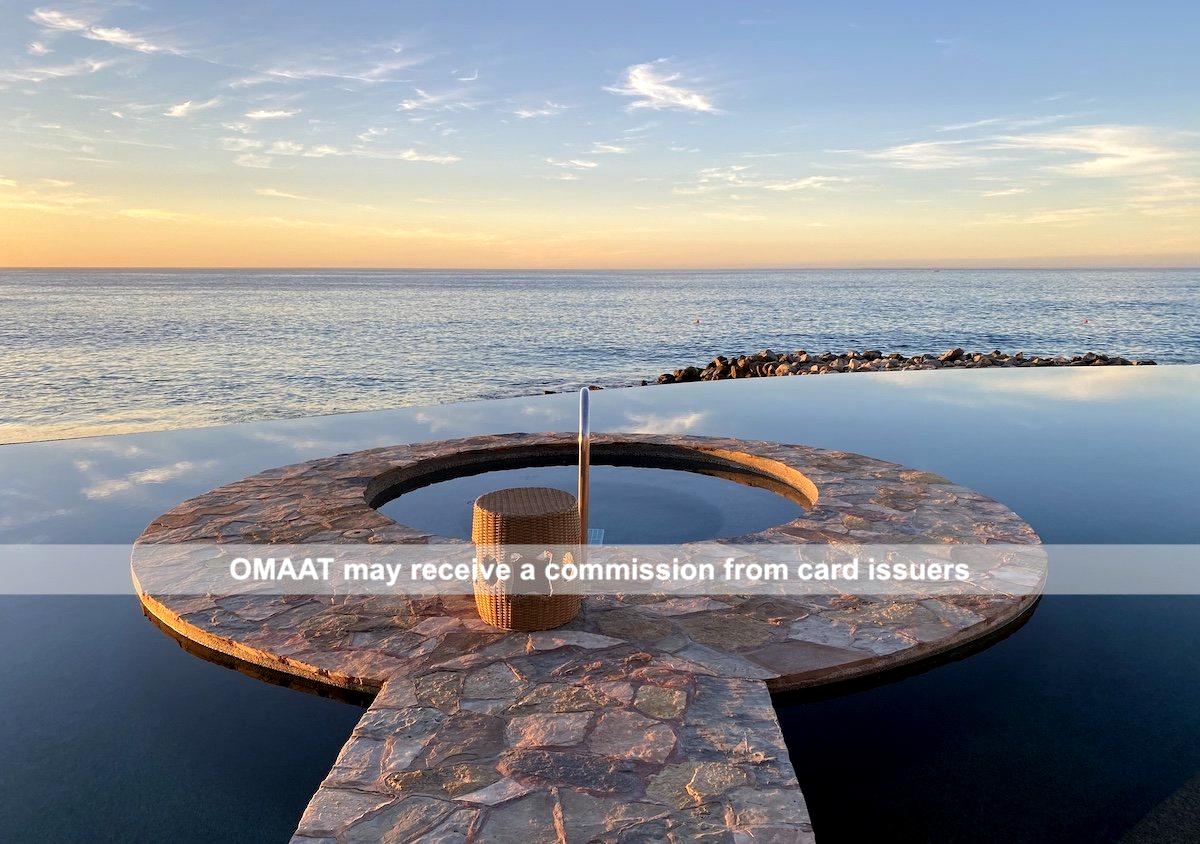

Get a free night at Waldorf Astoria Los Cabos

Each year, 10 Priority Pass visits

Hilton Surpass Card provides 10 Priority Passes free of charge per year. Although this card isn't a membership that allows you unlimited access to lounges, it should cover most people's travel needs. This lounge perk is rare for a card that costs less than $100.

You get 10 Priority Passes per year when you have the card

Hilton Stays: 12x Honors Points

You can use the Hilton Surpass Card to spend at Hilton-family properties. It earns 12x Honors Points per dollar spent. My Hilton Honors points value of 0.5 cents means that you get a 6% return on Hilton spend, plus the points you normally earn for your stay.

Stay at Hilton properties to earn 12x Honors Points

6x Honors Points on Gas, Groceries, and Dining

The Hilton Surpass Card offers some of the best-rounded bonus categories among hotel credit cards. You can earn 6x Honors Points on this card:

Takeout and delivery available at U.S. restaurants

U.S. Gas Stations

Groceries in U.S. supermarkets

This card is unique because it offers bonus points on gas, groceries and restaurants. You could spend as much as $15,000 annually on this card to earn 90,000 Honors Points and a certificate for a night.

Shop at grocery stores to earn 6x Honors Points

Amex Offers

The Amex Offers program offers discounts on select purchases at select retailers. It is hard to underestimate its value. Amex Offers saves me hundreds of Dollars per year. For many cards, the annual fee is more than worth it. You will have more Amex offers the more Amex cards that you have.

Instead, you might be looking for a business card.

The Hilton Honors American Express Business Card is a great option for those who have had the Hilton Surpass Card or are looking for a business credit card. You may be eligible for both the bonuses and perks offered by the cards. There is a lot of overlap.

A full review of Hilton Business Card can be found here. You can also find a comparison between the Hilton Surpass Card (and the Hilton Business Card) here.

Bottom line

The Hilton Surpass Card, a mid-range hotel credit card, is one of the most valuable. It also has great perks, such as a large welcome bonus and solid incentives to spend on the card.

What has your experience with the Hilton Surpass Card?