OMAAT offers a referral bonus to anyone who has been approved by using the links below. This is in the interests of full disclosure. These are the best public offers we found (terms apply). These opinions are solely the author's and not the views of any bank, credit card issuer or airline. They have not been approved or endorsed by any entity. For more information about our partners, please see our advertiser policy. Thank you for your support!

Chase credit cards are some of the best in the world, both in terms of their welcome bonuses and return on investment. This is especially true for business credit cards.

The Ink Business Preferred Credit Card review has the best welcome bonus out of all business credit cards. It is also the most comprehensive business credit card. The Ink Business Unlimited Credit Card and Ink Business Cash Credit Card, both with no annual fees, have the best welcome bonuses ever. They are also great cards for maximizing points.

I own all three cards so I thought I'd share my experience with how to get approved for them all.

Who is eligible for Chase Business Cards

It is much easier to be eligible for a small business credit line than you might imagine. It doesn't matter if you have a large company or if your business is not incorporated. Even if you have a small side-business with low business income, you can still be eligible for a credit card for your business.

Credit card applications should be filled out truthfully, it goes without saying.

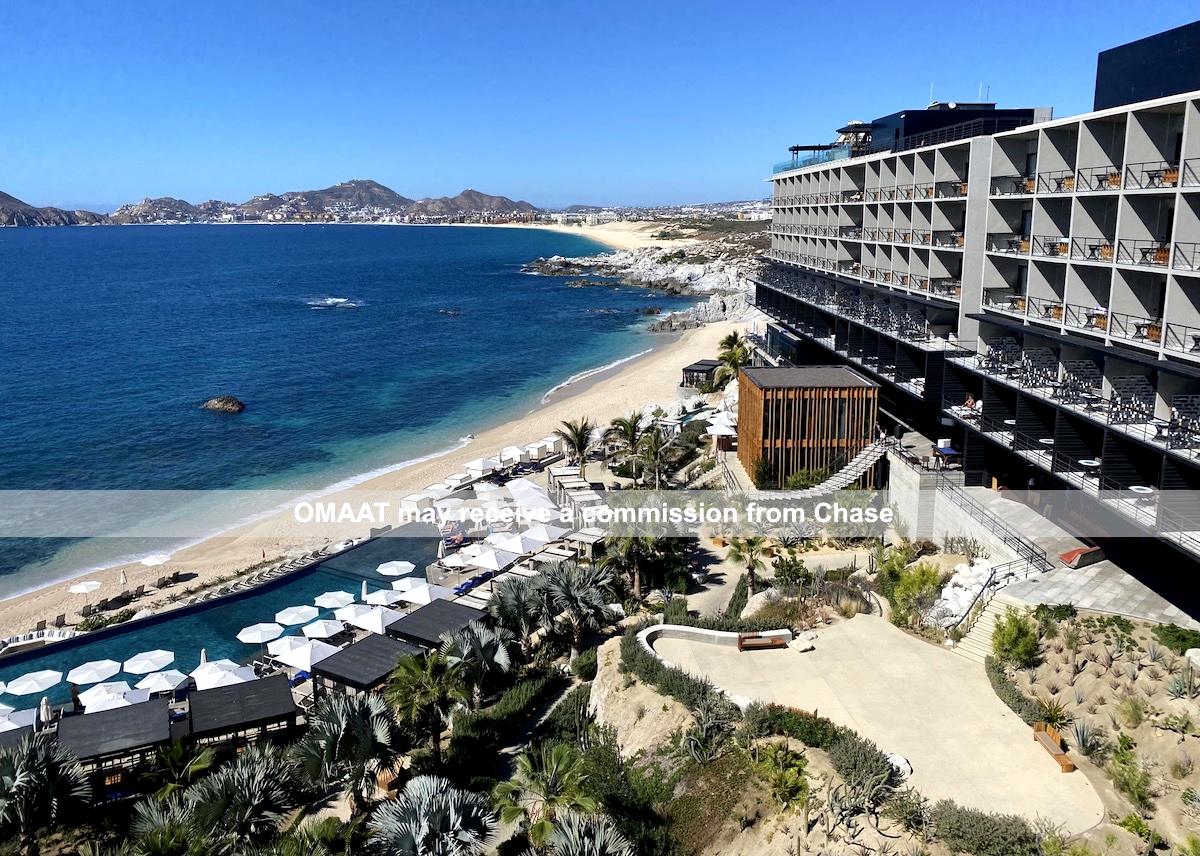

Chase business cards can earn you valuable travel rewards

What are the restrictions on applying for Chase Business Cards?

The following are Chase's general restrictions when applying for cards:

Chase does not have a limit on the number of Chase credit cards that you can get approved for. However, Chase will often allow you to borrow a certain amount of credit. In this instance, you might be asked to change your credit limits to help facilitate approval.

Inconsistent data points exist about how long it takes to process applications. I recommend waiting 30 days between Chase business cards applications in order to be safe.

Chase business cards are subject to the 5/24 rule. This means that you won't get approved if you have opened five or more new accounts within the last 24 months. Ill explain more below.

Each of the Ink Cards can be used to earn the bonus, so if your Ink Business Preferred is active you are eligible for Ink Business Cash or Ink Business Unlimited.

How do you fill out a Chase Business Credit Card Application Form?

Most people who have business credit cards know the process. But for those who don't, here are some things you should know. Although it can seem daunting to apply for your first business card, even if you are a sole proprietorship or small business, you should be eligible.

You will be asked these questions when applying for a Chase Business Card. These questions are:

Name of the business

Business mailing address and phone number

Type of business

Tax identification number

Employees

Annual business revenue/sales

Many years in business

Credit card applications should always be filled out truthfully

How should you approach sole proprietorship? First, and most importantly, be honest about everything. Many people believe they need a separate business or an incorporated business to get a business card. This is not true.

Your name can be used as the legal name for your business

Your business mailing address, phone number and number may be the same as your personal one.

You can choose that type of business if you are a sole proprietorship

You can use your social security number to get the tax identification number

No matter how many employees you have, it is fine to say one.

Be honest about your annual business income

It doesn't matter if it is new or has been around for 1-2 years. This is a shame because its been in business for years.

How difficult is it to get approved for a Chase Business Credit card?

Chase is not the most popular issuer when it comes to business credit cards. American Express business cards are generally the easiest to get approved for. But, getting approved for Chase business card is not as difficult as you might think, especially if your credit score is excellent.

My experience with instant approvals for Chase business cards is very rare. Don't be alarmed if it doesn't happen right away. You will usually receive a pending response and, hopefully, an approval.

Chase cards are not instant approved.

I have had the Ink Business cash for many years and was then approved in 2018 for the Ink Business Preferred as well as the Ink Business Unlimited. In both cases, I didnt get an instant decision.

What are the Best Chase Business Credit Card Options?

Three Chase business cards are worth considering right now. You can also earn the bonus on an existing version of the card.

The Ink Business Preferred has the best welcome bonus I have ever seen on any credit card.

After spending $15,000 in three months, you will receive a 100,000 Ultimate Rewards point welcome bonus

100,000 Ultimate Rewards Points after you spend $15,000 in three months. Annual fee: $95

$95 Return on Spend: 3x Points on the First $150,000 in combined purchases per year for travel, shipping, internet and phone services.

There's also the Ink Business cash, which is offering the best welcome bonus ever:

After spending $7,500 in three months, you will receive a $750 cash bonus. This can be converted into 75,000 Ultimate Reward points.

After spending $7,500 in three months, you will receive $750 cash back. This can be converted into 75,000 Ultimate Reward points.

: $0 Return On Spend: 5x points for the first $25,000 in combined purchases per anniversary year at office supply shops, on internet, cable and phone services, and 2x points for the first $25,000 combined purchases per anniversary year at restaurants or gas stations

There's also Ink Business Unlimited which has the best welcome bonus ever:

After spending $7,500 in three months, you will receive a $750 cash bonus. This can be converted into 75,000 Ultimate Reward points.

After spending $7,500 in three months, you will receive $750 cash back. This can be converted into 75,000 Ultimate Reward points.

This card is a great choice for everyday spending because it offers a $0 return on investment and 1.5x points on all purchases.

Other excellent Chase co-branded business cards are worth looking into, such as the following:

Southwest has a great Chase Business Card

Is there a perfect order in which to apply for Chase Cards?

Applying for Chase business cards will not count towards your 5/24 limit. I recommend that you apply for Chase business cards first before applying for Chase personal cards.

If I were you, I would first pick up the Ink Business Preferred (since it is the most comprehensive of the three cards), then I would choose either the Ink Business cash or Ink Business unlimited, depending on how much you value the 5x points for select categories or 1.5x across the board.

This assumes that you can afford the minimum amount of Preferred. If this is not possible, I would recommend the Ink Cash or Ink Unlimited.

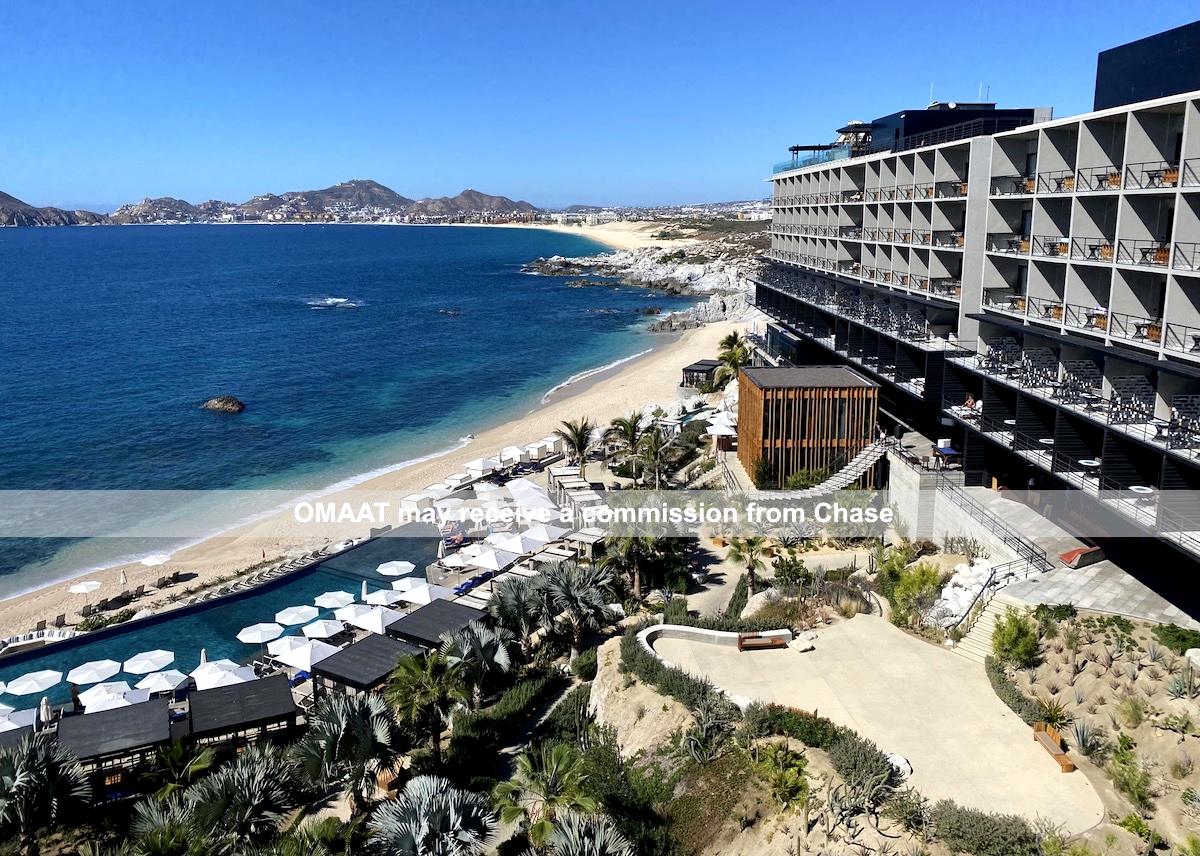

Three amazing Chase Ink cards are available

What Does the 5/24 Rule Mean for Chase Business Credit Cards

Chase uses the 5/24 rule to deny you a Chase card if five or more cards have been opened in the last 24 months.

One exception is that most business cards, such as those issued by American Express or Bank of America, Barclays and Chase, won't count towards the limit because they won't be listed on your credit report.

Before applying for a Chase Business Card, you will need to verify your 5/24 status. Chase business cards can be approved by you, but they don't count towards the limit.

This means that if you have opened four new accounts within the last 24 months, and then apply to for a Chase Business card, you will still have four cards. You'll still have four cards if you apply for another Chase Business Card.

This post will cover everything you need about the Chase 5/24 rule.

Bottom line

Chase offers a variety of credit cards. In particular, Chase offers great business credit cards. There are some amazing bonuses on the Chase Ink cards. You could earn up to 250,000 Ultimate Rewards points between all three cards. This is huge.

The cards offer great initial bonuses and excellent bonus categories. They range from 1.5x points for all purchases to 3-5x points in selected categories.

For new businesses, applying for business credit cards can seem daunting. However, I recommend that you give it a shot using these tips. You'll likely be pleasantly surprised at the results.

Are you a Chase Business Card holder? What was your experience with getting approved for Chase business cards?