OMAAT offers a referral bonus to anyone who has been approved by using the links below. This is in the interests of full disclosure. These are the best public offers we found (terms apply). These opinions are solely the author's and not the views of any bank, credit card issuer or airline. They have not been approved or endorsed by any entity. For more information about our partners, please see our advertiser policy. Thank you for your support!

Marriott Bonvoy is able to offer a wide range of credit cards thanks to its agreements with Chase and American Express. It can be difficult for many to choose the right card.

There are many personal credit cards available, but only one Marriott business creditcard. I decided to look into it and share my thoughts with you. The card is available at a special time, with a limited-time offer that offers the best ever welcome deal.

Marriott Bonvoy Business Card Basics For September 2021

The Marriott Bonvoy Business American Express Card (Marriott's business credit card) is the Marriott Bonvoy Business American Express Card. This card is worth it, but under what conditions? Let's look at the annual fee, welcome bonus and many other details.

Get 125K points + 2 nights free

Marriott Bonvoy Business Card offers a limited-time, two-part welcome bonus. It is valid through November 3, 2021. You'll get $5,000 if you spend eligible purchases in the first three months.

125,000 Marriott Bonvoy Bonus Points

You will receive two bonus night awards that are free of charge, one for each night you stay in a hotel with a maximum cost of 50,000 points

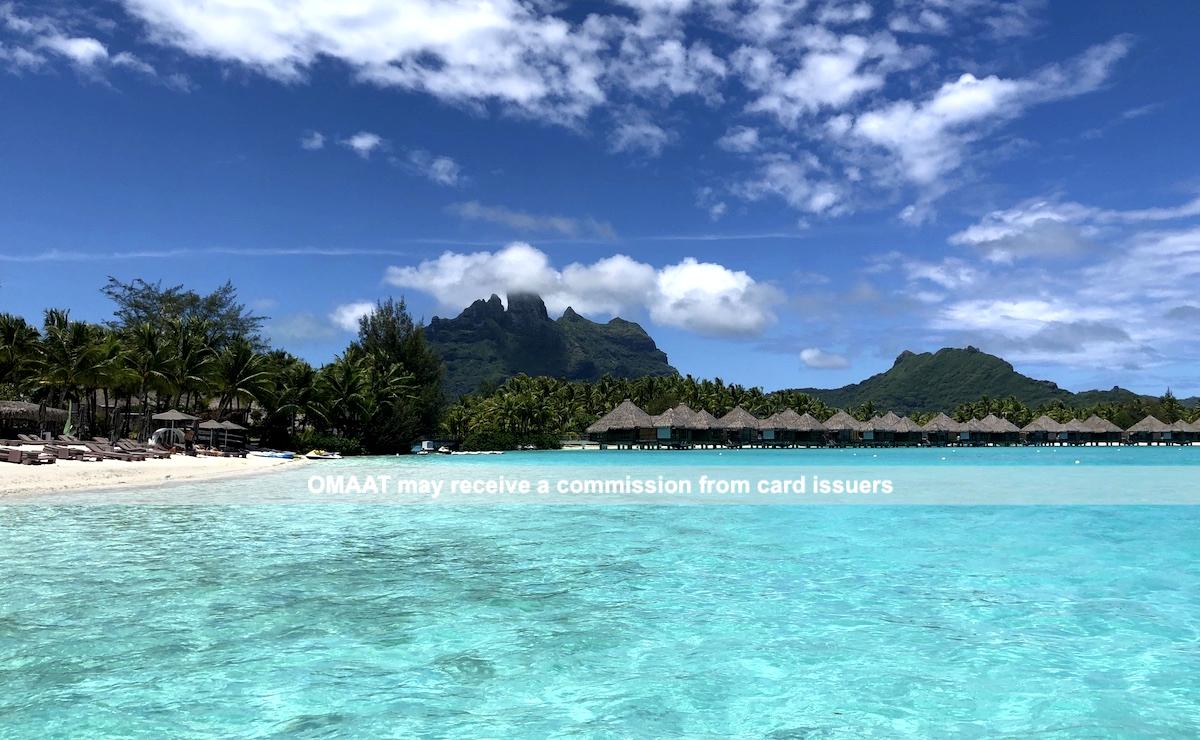

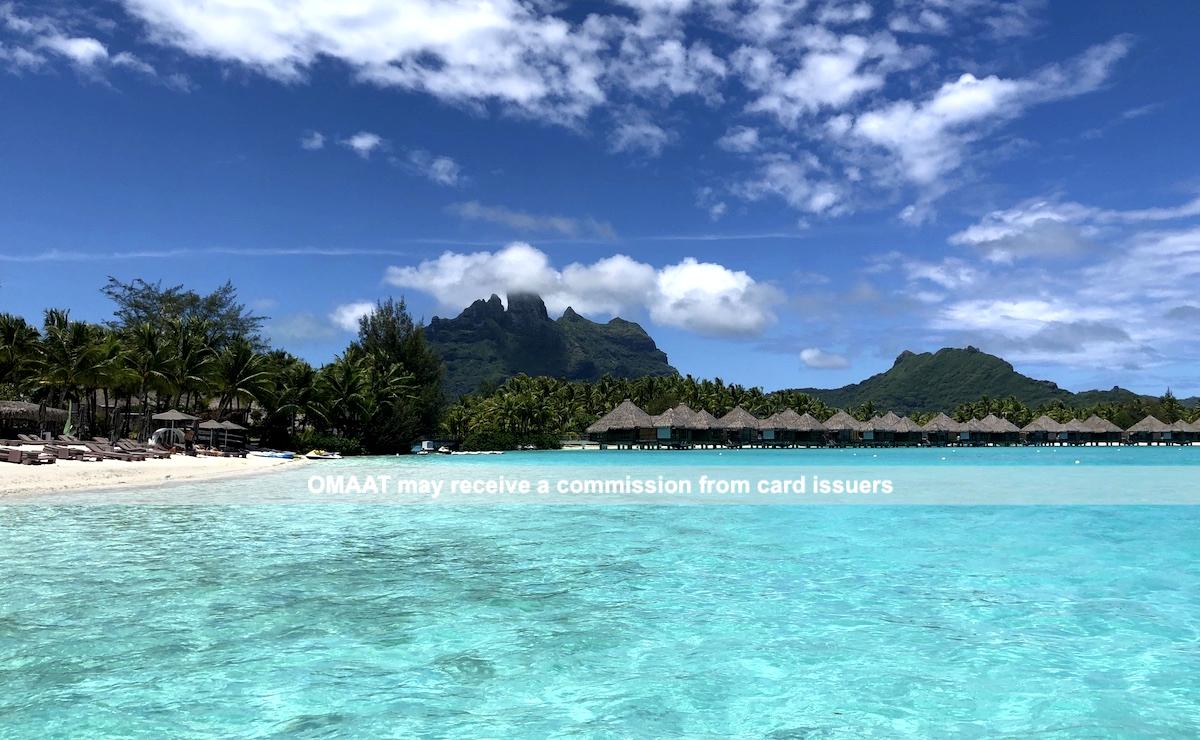

This bonus could potentially be worth as much as 225,000 Bonvoy Points. These free night awards, which are valid at properties that cost up to 50,000 points per evening, are very generous and can often be used to book stays at Ritz-Carlton or St. Regis properties.

To give you some context, Bonvoy points are valued at 0.7c each. That means that 125,000 Bonvoy points are worth $875, even if you don't include the two night awards.

Get a free night at the Ritz Carlton Sarasota

Card Eligibility

There are many Chase Marriott and American Express cards, so there are some very complicated eligibility requirements.

First, this welcome bonus is not available to people who have used the Starwood Preferred Business Credit Card from American Express.

Applicants who are:

In the past 30 days, you have either had or received the Marriott Bonvoy Premier Plus Business credit card from Chase, Marriott Rewards Premier Plus Business credit card from Chase or the Marriott Bonvoy Business credit card from Chase.

In the last 90 days, you have purchased the Marriott Bonvoy Boundless Credit Card From Chase, Marriott Rewards Premium Plus Credit Card From Chase, Marriott Bonvoy Bold Credit Card From Chase, Marriott Bonvoy Premier Credit Card From Chase, Marriott Bonvoy Credit Card From Chase, or the Marriott Rewards Prime Credit Card von Chase.

Received a bonus offer for a new card member within the last 24 month on the Marriott Bonvoy Boundless Credit Card From Chase, Marriott Rewards Premier Plus Credit Card From Chase, Marriott Bonvoy Bold Credit Card From Chase, Marriott Bonvoy Premier Plus Credit Cardfrom Chase, Marriott Bonvoy Premier Plus Credit Cardfrom Chase, Marriott Bonvoy Premier Plus Credit Cardfrom Chase, Marriott Rewards Premier Credit Cardfrom Chase, or Marriott Rewards Premier Credit Cardfrom Chase

Restrictions for General Amex Card

Amex business cards are easy to get approved for by those with good credit. Most people who have received this card have said they were approved instantly.

Make sure that you are aware of this:

In a period of 90 days, you can only be approved for two Amex cards

At any given time, you can only have five American Express credit cards (this does not include cards with a pre-set spending limit).

This post contains all the restrictions that credit card applicants must be aware of.

Annual Fee

The Marriott Bonvoy Business Amex charges a $125 annual fee. (Rates and Fees). Additional cardmembers can be added at no extra cost.

No Foreign Transaction Fees

Bonvoy Business Amex does not charge foreign transaction fees (Rates and Fees). This could make it a great option for international purchases.

Amex Offers

Amex Cards offer members access to Amex Offers which allows them to save money on all purchases at any retailer. It is worth getting multiple Amex cards to get the best deals on multiple cards.

Earn points with the Marriott Business Card

Although the Marriott Bonvoy Business card has some bonus categories that can be useful for business spending, it is not a credit card I would recommend for all business purchases. This is because there are many more generous business cards on the market in terms of points.

6x Bonvoy Points At Marriott Hotels

The Marriott Business Card gives you 6x Bonvoy points to spend at Marriott hotels worldwide. This bonus is a great deal for many businesses.

Bonvoy points are worth 0.7c each. This is equivalent to a return of 4.2% on hotel spending. For my Marriott hotel spending, I prefer the Chase Sapphire Reserve (review), as it offers 3x Ultimate Reward points.

Stay at Marriott Hotels and earn 6x Bonvoy Points

4x Bonvoy points in select categories

You can earn 4x points with the Marriott Business Card by purchasing products with:

U.S. restaurants

U.S. gas stations

Directly from U.S. service provider, wireless telephone services

Shipping costs for U.S. orders

Based on my estimate of 0.7c per point, this is a 2.8% return of spending. This is quite good but not great when you look at some of the other cards.

All other purchases eligible for 2x Bonvoy points

All eligible purchases are eligible for 2x Marriott Business Card points. Personally, I don't find 2x points per $1 spent compelling. I consider that a return of 1.4% is more appealing and there are better cards to use for everyday spending.

Marriott Bonvoy Business Card Perks

The Marriott Bonvoy Business card offers many perks that can more than offset the annual fees. It could be worthwhile for small businesses to get the card simply for the perks.

Let's take a look to see some of the card's benefits.

Reward for Annual Free Nights

This card is worth it because you receive a free night award each year on your account anniversary. It's valid for one-night stays at hotels that cost up to 35,000 points.

This card offers a great deal, and I believe it is well worth the investment. Marriott is the largest hotel chain in the world, so no matter what hotel program you prefer, almost everyone could find themselves in a position where this card could be of use. This certificate is used at hotels that cost $250+ per night. That's more than twice the annual fee.

These free night awards are not included in the welcome bonus. They are valid for properties up to 50,000 points.

I used my Marriott Kigali free night award

Complementary Silver Elite Status

This card is free for Silver Elite and allows you to spend up to Gold Elite. Silver Elite status is not a great deal. It offers perks such as 10% bonus points and priority late checkout, but it doesn't offer perks such as free breakfast, access to the club lounge, or room upgrades.

15 Elite Nights to Obtain Status

The card also offers a great status perk: you can earn 15 elite status nights annually for just having it. This benefit is only available on co-branded Marriott credit card. It can only be used once for a personal and once for a business card.

Also, if you have more than one Marriott card, you won't be eligible for 45 elite nights. However, if one of your personal cards is Marriott, and the other one is a business card, you can get 30 elite nights.

It is now easier to achieve Platinum Elite status over the long-term. This is when status really shines. You need to be able to travel 50 nights to achieve platinum status. If you have the card, you would only need to accumulate 35 elite nights. If you had a personal card, then you would only need 20 elite nights.

This is why you should get the Marriott Bonvoy Business Card. Without it, you won't be eligible to earn 30 elite status nights annually.

Platinum Elite members may receive suite upgrades

Is The Marriott Business Card Worth it?

There are many great small business credit card options, but the Marriott Bonvoy Business Card is the right one for you. Let me first say that this is not a card I would use as my primary business credit. This is because the card does not offer a competitive rewards program for business spending.

However, the card's incredible bonus and the many perks it provides are worth the effort. The annual free night award is something I value more than the annual fee. This alone makes me want to apply for the card.

Let me also discuss some other aspects of the card. How does it compare to Marriotts personal cards? What other business cards should I be looking at?

Personal and Business Cards from Marriott Bonvoy

The Marriott Bonvoy Business Card and the Marriott Bonvoy Boundless credit card (review) are two options when it comes to Marriott's mid-range credit cards.

If all else is equal, how do you decide which card to choose? There are some key differences in the value of each card:

Some bonus categories on the business card earn 4x points. The personal card does not.

Business cards are $30 more expensive ($125 instead of $95)

The current business card offers a much better welcome bonus

It is considerably easier to get approved for a business card, as I find Amex much more easy with approvals than Chase, especially for people with good credit.

If all else is equal, I would get the personal card long term. You still get the free night award and the annual fees are lower. This assumes you are eligible for a Chase Card, and that your credit limit is not greater than the 5/24 limit.

Additionally, it could be a good idea to have both cards so you can get 30 elite nights toward status each year. This will make it easier for you to achieve Platinum Elite status.

Both Marriott cards include an annual free night award

What is the Best Business Credit Card?

The Ink Business Preferred credit card (review) is my top choice for the best business credit card. This card offers a great bonus, which is more valuable than Marriott Points, a low $95 annual fee, 3x points in useful categories, as well as a fantastic bonus.

This is the perfect business reward card.

Marriott Business Amex Summary

The Marriott Bonvoy Business Card can be a solid contender as a long-term business card. It offers great value with 15 elite status nights (which can be combined with a similar offer from a personal card), and an annual free night award. The card's best-ever welcome bonus is a reason to get it now.

Follow this link to find out more information about the Marriott Bonvoy Business Card and how you can apply.

Apply Now

These links will take you to the fees and rates for American Express Cards. These are: Marriott Bonvoy Business American Express Cards (Rates and Fees).