The Air Passenger Duty (APD) is the highest tax for passengers flying from the UK. This post will explain how the APD works. What is it, what does it cost, when it applies, and are there ways to minimize it.

What is the UK Air Passenger Duty (UK)?

The UK's Air Passenger Duty (or UK's Air Passenger Tax) is a high tax that is levied on all flights originating from the UK. This means that even if you are just transiting between countries in the UK on one ticket, then you wont be charged this. It is charged on the basis of having a return flight from the UK, regardless of where you are connecting.

It is not necessary to mention that the UK APD has been controversial.

It is a tax on those who travel from the United Kingdom and not those who just connect in the United Kingdom. The former group does not have to pay this tax.

High taxes have a negative impact on air travel demand as it increases the cost of flying. Airlines serving the UK have been fighting this tax for years, as it raises the price of tickets.

The UK APD was introduced in 1994 to raise funds for government. It was initially 5 euros per destination within Europe. 10 euros for destinations outside Europe. As you'll see, the tax has gone up significantly since then.

The tax has been almost viewed as an environment impact over the years, meant to encourage other modes of transportation. These are not applicable if you travel long distances from the UK. Two issues are raised from an environmental perspective.

It is not a good idea to encourage airlines invest in more efficient aircraft.

Transit passengers are more likely to be held responsible if this is about the environment than passengers on other flights. They have a greater environmental impact from taking two flights.

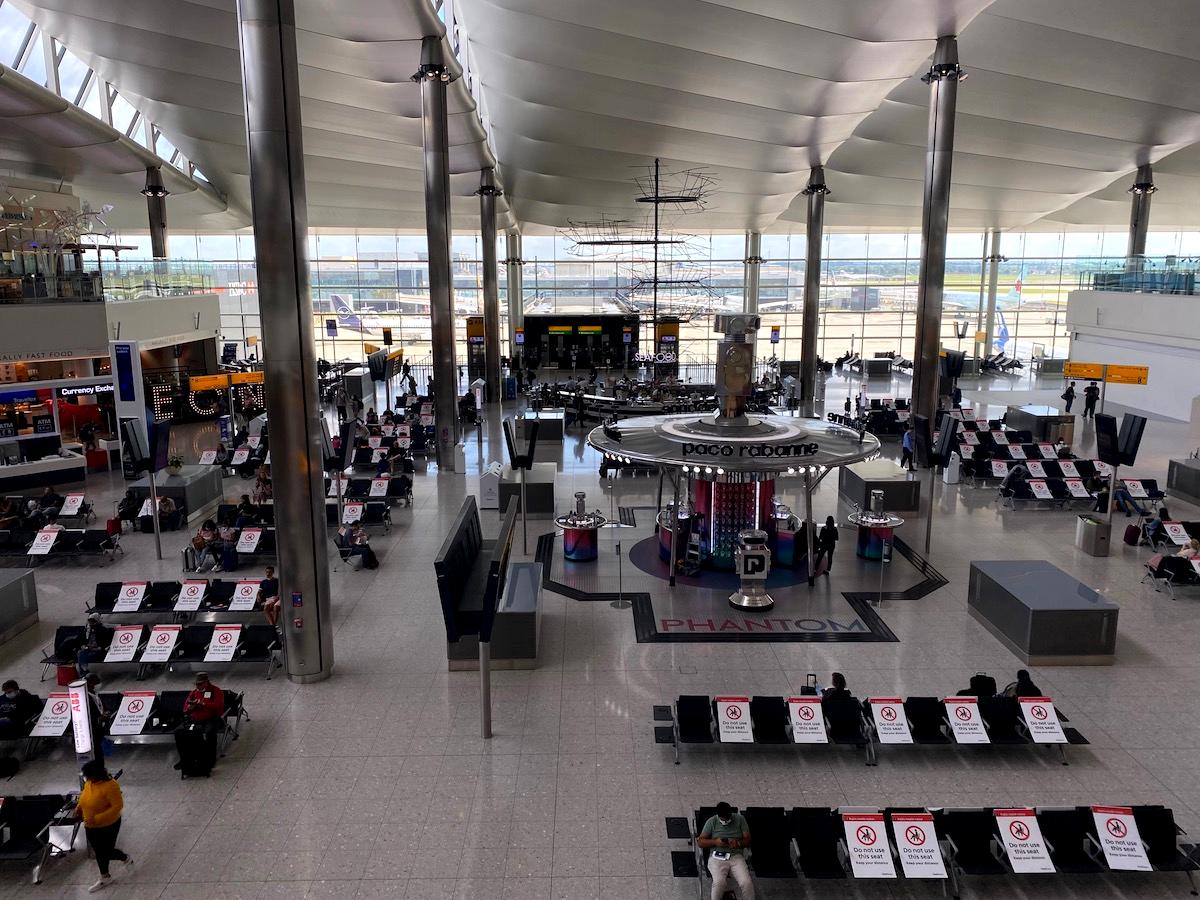

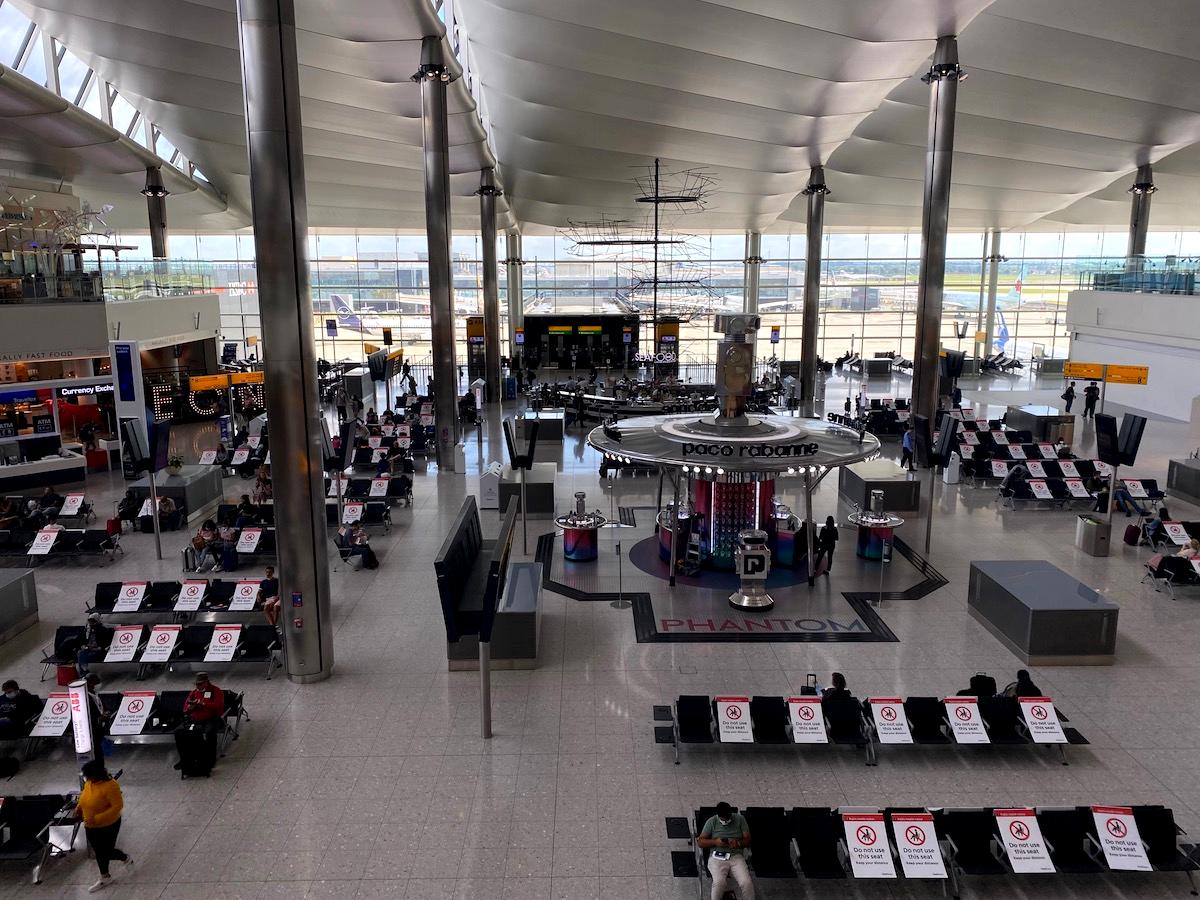

The UK has one of the highest aviation taxes in the world

What is the UK Air Passenger Duty Rate?

The distance you fly and the type of service you use determine the amount of UK Air Passenger Duty.

The APD for flights up to 2,000mi (short-haul) is 13 ($18), in economy, and 26 in premium.

The APD for flights over 2,000 miles (long-haul) is 82 ($113 in economy and 180 ($247) for premium cabins.

The APD for long-haul flights will increase again as of April 1, 2022

Long-term economy APD will rise by 2 from 82 to 84.

Long haul premium cabin APD will rise by 5 from 180 to 185

There are some additional details you should be aware of.

These are the purposes of a premium cabin. It would also include economy.

To cover this cost, many airlines ask for a co-pay if you are upgrading your seat.

Distance is not measured between your destination and your origin, but between London and the capital of the country you are traveling to

Distance is not measured by distance from the UK. It is measured by your final destination (assuming continuous travel with no stops of more than 24hrs). In other words, the APD is the same regardless of whether you fly nonstop from London to New York or London to Paris to New York. The former itinerary, however, has a longer nonstop flight out from London.

You will also have to pay any applicable airport taxes and fees.

The APD in the UK could be as high as $250 for a one-way trip

What is the UK Air Passenger Duty?

There is confusion as to when the UK Air Passenger Duty applies. Let me explain it as clearly as I can.

The UK APD is based on whether your flight itinerary originated in the UK. If you are on the ground for longer than 24 hours, an itinerary is considered to have originated in the UK.

The UK APD does not apply to flights to the UK as it is purely a departure tax

People who connect in the UK for less than 24 hours on one ticket are not eligible for the UK APD

Children under 16 years old are not eligible for the UK APD.

Let me show you some examples and then I'll tell you if the UK APD applies to them.

Are you planning to fly from London to Los Angeles by APD? The long-haul APD will cost you extra

Are you planning to fly from Los Angeles to London, United States? The APD is not required.

Are you flying from New York City to London to Paris and connecting in London for less than 24 hours? The APD is not required.

You are flying from Dubai to London and connecting in London within 24 hours. The APD is not required.

Flying from London to Amsterdam to Los Angeles with less than 24 hours of connection in Amsterdam? The long-haul APD will cost you more

Flying from London to Amsterdam to Los Angeles with a connection lasting over 24 hours in Amsterdam. The short-haul APD will cost you just £6

This should cover most situations. The APD is calculated on your final destination, departing from the UK. Continuous travel takes place within 24 hours.

When traveling to the UK, the UK APD does not apply

What time do you have to pay UK Air Passenger Duty

Airlines collect the UK Air Passenger Duty directly when they book a flight. If you purchase a ticket subject to the APD, the price of your ticket will reflect this. This is not something you can pay at the airport or after the fact.

Your ticket price will be increased by the UK APD

What is the difference between APD in the UK and fuel surcharges?

It is often confusing to distinguish between UK Air Passenger Duty (or fuel surcharges) because many UK airlines charge both. This is also why it can be so expensive to purchase award tickets from the UK. Let me clarify:

A UK APD is a fee that the government imposes on flights. It can be as high as 180 for a single-way flight.

Fuel surcharges, which airlines impose directly, are a junk fee that does not have anything to do with government.

Only a few airlines charge fuel surcharges, such as British Airways. However, all airlines must charge passengers who originate in the UK the Air Passenger Duty. For business class travel between London, New York and London, you can redeem American AAdvantage points.

You don't have to pay fuel surcharges if you book American travel. However, you would still need to pay $335.95 for the UK APD and all airport taxes and fees. If you booked British Airways instead, you would pay $631.25 fuel surcharges. Fuel surcharges in this instance are $295.30.

This can often cause confusion so let's look at flights from New York to London. You would pay $5.60 in taxes, fees and fuel surcharges if you booked American Airlines. There are no APD fees or fuel surcharges in the UK. For $729.20 in fuel surcharges, British Airways would charge you $729.20. Although fuel surcharges in the US are more expensive than those in the UK, there is still no APD for the UK.

We hope that this clarifies any confusion about the difference between fuel surcharges and APD in the UK.

Flying may be subject to high fuel surcharges and the UK APD

Is there a way to reduce the UK APD?

Although there is no way to defeat the UK Air Passenger Duty (or at least minimize it), there are ways to be strategic. These strategies will be worth the effort, though different people may have different opinions. However, I think they are worth noting. Let me share a few.

Strategically plan your stopover

Let's say you redeem British Airways Avios for a roundtrip flight from New York to Paris via London. You plan to spend more than 24 hours in London. If you are planning to do this, I recommend that your stopover in London be on the outbound rather than the return. Why? You would only pay the short-haul (26) APD and not the long-haul (180).

If you've been in London longer than 24 hours, your itinerary will be under 2,000 miles to Paris. You won't have to travel more than 2,000 miles from New York.

If you only plan to visit London for a short time, consider a stopover that lasts less than 24 hours. This will allow you to avoid paying the UK APD and still visit the UK for a while.

Mix economy and business class

Some people prefer to fly one way in business class and one in economy class when booking award tickets. This allows them to spend more without having to redeem too many miles. This strategy is best if you are traveling to and from the UK. Fly business class to the UK and economy to the UK.

This would reduce your APD by 180 to 82 for one direction.

Fly to Inverness

Although Inverness is an area of the United Kingdom (UK), the Scottish Highlands and Islands have been exempted from the UK APD. This exemption is part of an agreement dating back to 1994. It's a nice little loophole. There is a catch. Inverness' service is very limited and not many people would want to start there.

If you fly Inverness to London and New York with British Airways Avios business class, you would pay $393.97. The vast majority of this is carrier-imposed surcharges since there's no APD.

You would pay $625.89 if you flew from London to New York and did not originate in Inverness. This is because you will be charged the UK APD.

You can position yourself in another country

Flying from a country other then the UK can help you avoid the APD. This could save you a lot, especially if you are flying business class. There are several ways to do this.

People will often fly to Dublin to begin their itinerary. This is because flights from Ireland don't have to be subject to the UK APD. In some cases, flights between Ireland and the UK can cost less than $20.

Stopovers are allowed by some frequent flyer programs, which can be used strategically. For example, Air Canada Aeroplan allows stopovers of 5,000 miles one way. This means that you could fly from London, Denmark to New York, with a stopover in Copenhagen lasting just over 24 hours. Then, you would only need to pay the short-haul APD and not the long-haul APD.

Travel from Ireland to avoid the UK APD

Bottom line

The UK Air Passenger duty is the highest tax levied on passengers by an airline. This tax applies to passengers whose itineraries originate in the United Kingdom. It ranges from 13 to 180 for a short-haul economy flight to 180 for a long-haul premium cabin flight.

I hope you find the above summary useful. If you have any questions, please contact me. Although the UK APD cannot be avoided entirely, there are definitely ways to reduce it.

How was your experience with the UK APD system?