Globally, buy now and pay later is growing with many companies expanding into and out of different parts, including Africa, Latin America, and Asia.

Affirm and Klarna are two major players in the U.S. and Square recently announced plans for Afterpay acquisition. This is another area that Square sees as a potential growth market.

The traditional buy now, pay it later (BNPL), allows consumers to pay in installments at their point of sale. This can be done online, or increasingly in person. The ability to pay in installments even within the domestic market is expanding beyond e-commerce.

Wisetack, a startup that offers in-person services and buy now, pay later, is called Wisetack. It just raised $45 Million in a Series A funding round, led by Insight Partners.

Bain Capital Ventures and Greylock Partners, the company's existing backers, also participated in financing. This brings the total amount raised by the company to $64million since its inception in 2018. This latest round comes six months after Wisetack announced that it had raised $19million in Series A and seed rounds. Both were led by Greylock.

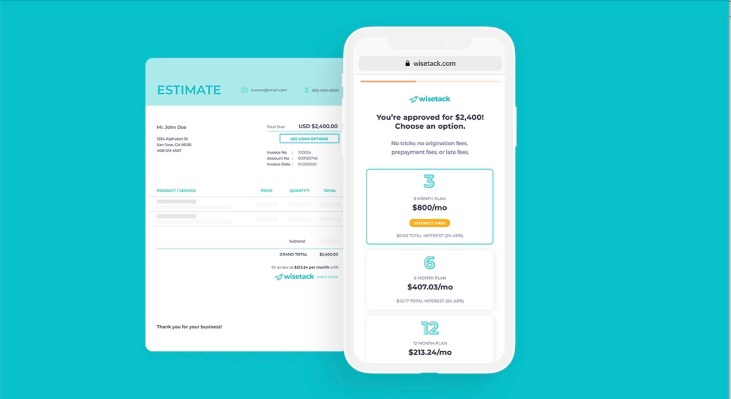

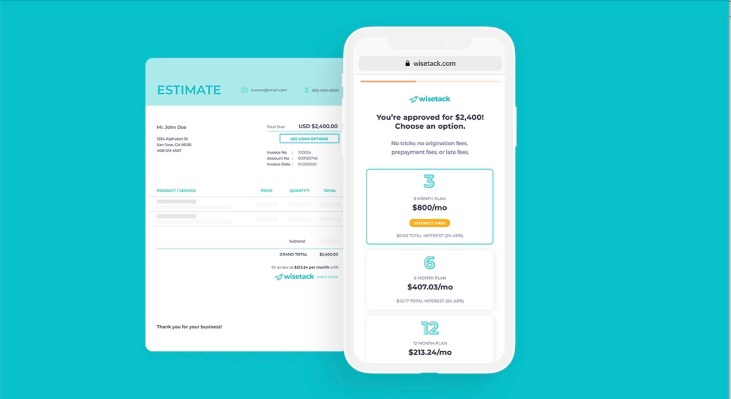

The startup, based in San Francisco, helps businesses to offer financing to customers. Wisetack isn't the first company to do so, but Bobby Tzekin, co-founder, CEO, says that the startup embeds financing options in software platforms that businesses already have and are using.

It focuses on service-based businesses such as plumbers and HVAC contractors. If the contractor embeds Wistacks API into their site, you might be able to pay for your AC unit in installments, even if it breaks down and costs thousands of dollars to replace.

Wisetack has seen rapid growth through partnerships with vertical SaaS companies such as Housecall Pro or Jobber. These companies provide consumer financing to their customer base which includes tens of thousand of home service professionals.

Wisetack seems to be filling the gap. It has increased its revenue and loan volume by more than 10x in 2021 compared to 2020. According to Tzekin, it works with thousands merchants.

Wisetack was founded by Mykola Klymenko and Liz ODonnell, who were co-founders and CTO of VaroMoney (the holding company for Varo Bank).

Wisetack will expand its service-based business with the new capital. This includes auto repair, elective dental, veterinary, and legal services. The company plans to increase its 40-member team by doubling it over the next year.

The opportunity for Tzekin is enormous.

SMBs make up the majority of service businesses. They are typically more difficult to reach than large ecommerce players. According to this Harvard study, Americans spend over $400 billion annually on home renovations and repairs. The market for American automotive repair and maintenance services is expected to grow from $201 billion in 2020 to $250 billion by 2026.

Tzekin reports that while the average BNPL transaction online is a few hundred dollars in value, service-based business purchases average closer to $4,000- $5,000.

For a few reasons, the CEO believes that buying now and paying later is more appealing than using a credit card to make such purchases. Consumers have the option to pay in installments, ranging from 3 months up to 60 months.

He said that this often makes it more affordable to purchase the best equipment because they can spread out the cost over time.

Tzekin explained that the price they will pay over the life of the purchase will be disclosed at the time. However, when paying with a credit or debit card, the amount may change depending on the interest rate and the length of time it takes to repay the money.

According to Tzekin, the company makes its money by charging merchants a processing fee and charging interest to consumers. The amount charged can vary from 0% to 29% depending on their credit score.

He said that credit cards can charge compounded interest while we only charge simple interest.

Rebecca Liu-Doyle, principal at Insight Partners, describes Wisetack in the industry as an exceptional company.

Wisetack offers an embedded BNPL platform that is more flexible and better-suited for complex use cases than e-commerce. She wrote via email.

Note: The headline of the article was changed post-publication in order to reflect the exact funding amount