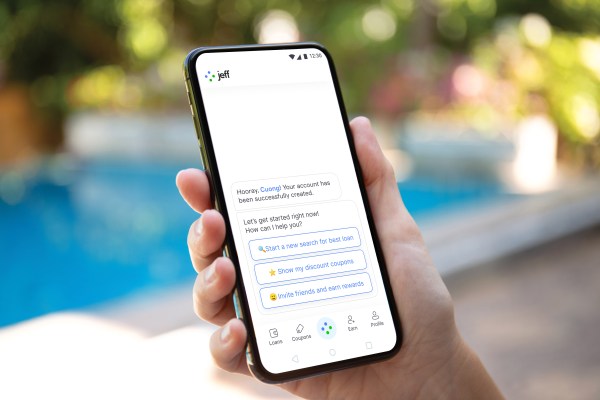

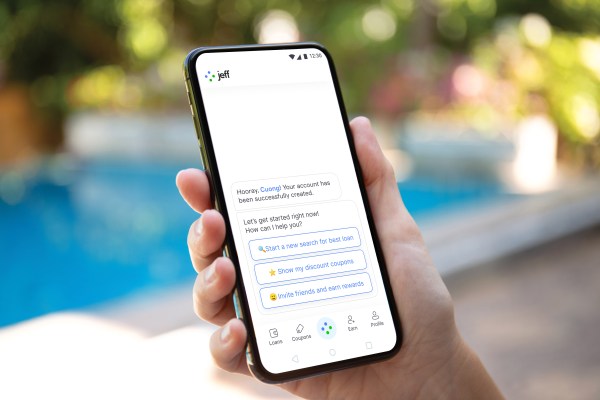

Southeast Asia is seeing a rise in financial services, particularly for those who don't have access to traditional bank accounts and credit lines. Jeff App wants to provide a super app that allows consumers to compare financial products and then apply using the startup's data-scoring algorithms. Jeff acts as a distributor, helping service providers find and retain customers. J12 Ventures led the seed extension for the startup of $1.5 million. Toy Ventures and iSeed Ventures were also involved, as well as returning investors EstBAN and Startup Wise Guys, and other angels.

Jeff's total funding has now reached $2.5 million. In March, it announced a $1million seed round. TechCrunch's founder and chief executive officer Tom Niparts said that Jeff had a net profit second quarter and was not planning to raise again. However, investors were interested due to the company's strong growth since the start of the year. According to the startup, 700,000. users have compared four million products in the six months since January.

The startup was founded in 2019 and is now operational in Vietnam. It has also applied for a license in Indonesia to launch. The startup plans to expand into the Philippines during the third quarter. The funding will also be used to expand Jeffs staff from 15 to 40 people, which is currently the case for its offices in Latvia or Southeast Asia.

Niparts, who was the CEO of Spain For Digital Finance International before launching Jeff, was also part of Finstar Financial Group. Niparts noticed that many people in Southeast Asia were struggling to obtain loans due to their income or credit history. Jeff was established to create alternative data scoring models for financial service.

Jeffs' goal, according to Niparts, is to be the main channel for financial services in Southeast Asia. It will also be the best place for customers to compare products and to apply for them.

Jeff's strong growth in the first half of 2015 was due to the success of its Vietnamese user acquisition strategy. It initially relied on global channels like Facebook ads and Google search to acquire users. But now, its number one acquisition channel is through local affiliates. These include bloggers and social media influencers that have built large followings by sharing financial education.

We were surprised to learn that TikTok in Europe would not work for financial services. But in Vietnam, we found that it was a very impressive channel, according Niparts.

Jeffs' main feature is loan comparison. However, the company started expanding its offerings as most people only borrow money occasionally.

Jeff offers coupons such as Shopee discounts to encourage people to return to Jeff. He also plans to launch telecom top ups with cashback and user referral functionality. It is also developing neobank mobile wallet comparisons, payment functionality, installment financing, services to micro-to-small-sized merchants, and a data science model that will increase provider conversions.