Pry Financials aims to make it easy for startups to finance, not just those who manage its accounting spreadsheets. Today, the Y Combinator alumnus announced that it raised $4.2 Million from Global Founders Capital and Pioneer Fund, NOMO VC. Liquid2 is also available.

Pry was launched in March and now boasts more than 200 customers. It claims that it has grown by 35% month-overmonth since YCs Demo Day. It was started by Alex Sailer and Hayden Jensen, Andy Su, and Tiffany Wong.

Su co-founded InDinero before he started Pry. InDinero was another YC alum. It began as a Mint to small businesses and then evolved into a full-service accounting firm. InDinero was founded while Su was still a student in Berkeley. Su later became responsible for the company's financial planning.

TechCrunch was informed by him that startups cannot afford to use Workday Adaptive Planning accounting software. They sometimes use outsourced CFO services but rely mostly on spreadsheets for everything: forecasts, runway predictions, contractor budgets, investor updates, and hiring.

Over the years I was chief technical officer. I also assumed the role of CFO and CTO. This was between 2010 and 2020. As technology improved, the engineering and product teams received new tools about every six months, while the finance team was stuck in Excel.

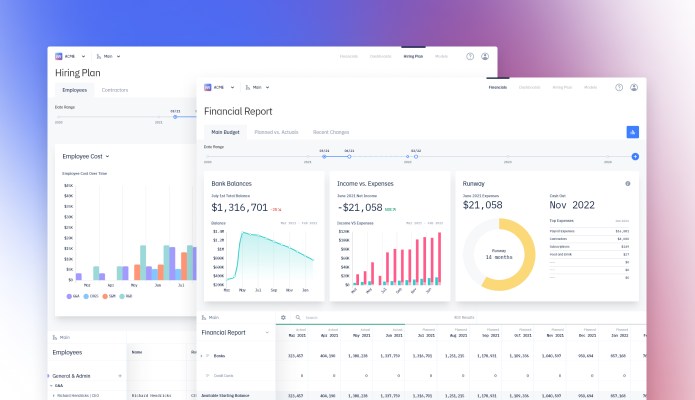

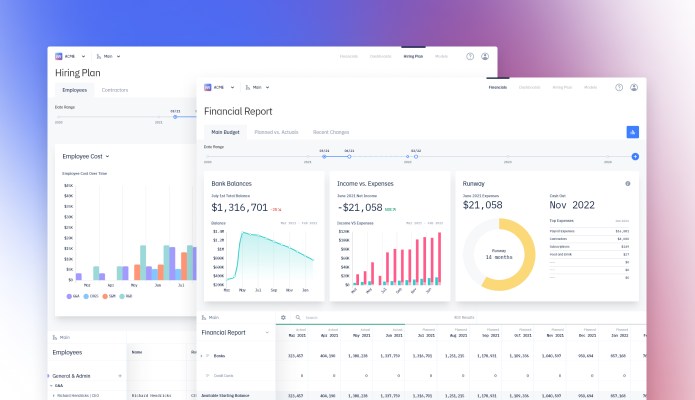

Pry was started as an side project by Su while Su was still at InDinero. It costs $50 per month and replaces spreadsheets with simple-to-understand dashboards that allow for financial planning, accounting, and scenario modeling. These dashboards can be connected to QuickBooks, Xero, or bank accounts so that numbers are constantly updated.

Clients of Prys typically use it once they have raised seed funding. This is because, for most founders, it's the largest amount of money they have ever received. You need to spend more time monitoring it and reviewing it each month. Su stated that you spend a lot of time managing your payroll each month. Pry is a program for second-time founders who are tired of Excel spreadsheets.

Su said that it is difficult to review a spreadsheet. Su said that if you notice a mistake in a number, it is very difficult to review the spreadsheet. This means that you have to send a lengthy email to the financial analyst responsible and wait for them to reply before closing time.

Pry streamlines the process by turning three-way reports of cashflow, profit and loss statements, balance sheets and profit and loss statements into Financial Report dashboards. Then, Pry adds features such as hiring plans, financial modeling, scenario planning and financial modeling.

The scenario planning function acts as a sandbox and allows investors and startup teams to predict how different financial situations will affect finances. For example, they can determine how much runway they have if a certain amount is raised or adjust their product pricing.

We are improving on the company and trying to make collective decisions about it. Su said that Git branching is an analogy to which Su refers. This is when you have your main strategy and you want to explore new revenue models or acquire a company, but don't want to alter your existing strategy. You can create a new branch with a different pricing strategy. You can make any changes you like and then go back to the old branch without worrying overriding it or making conflicts.

These speculative branches can also be updated continuously with the most current bank account and payroll information of the company, so founders don't need to start over if they wish to revisit a possible scenario.

Pry plans to develop more sophisticated predictive tools, and integrate industry standards like benchmarks and statistic into templates that will help founders set their targets.

Su stated that Pry makes it easier for startups to spot important details, as opposed to a series of Excel spreadsheets. One founder saved $15,000 by identifying a tax problem and was able to save it. Pry helps startups understand their finances, even those who have never used accounting spreadsheets. Pry will soon add permissions and roles so that founders can restrict or grant access to certain people like leaders in specific departments.

Su stated that Pry is not comparable to the accounting services startups rely upon until they are able to hire a head in finance. However, it makes it easier for startups and their teams to collaborate since they can share their dashboards.

You can usually outsource your CFO services early in the business. This is the standard in business, and it works well for most businesses. Su said that you get a part time CFO to work hard for a month and help you with your fundraising structure.