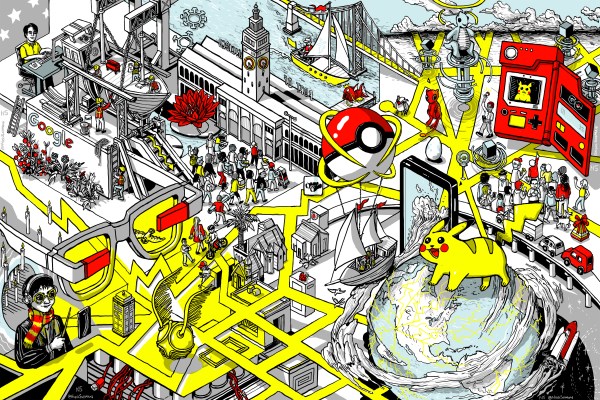

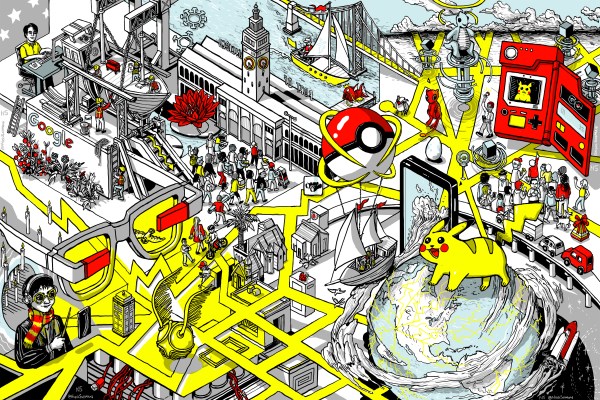

Hello friends! This is what Lucas always begins with.Lucas will be out for a few more weeks so Week In Review will be my responsibility until he returns. My name is Greg and I've been with TechCrunch since a very long time. I joined TechCrunch just as Twitter added vowels to its name. People thought that Facebook's valuation of $15 billion was absurd. (Refer to Facebook's $1 trillion market cap last month.Let's not get into my head! This is what you want every week in your inbox. Register here. By the way, Sarah Perez's popular column This Week In Apps is now available as a weekly newsletter. Sarah is a master of applicability and does an excellent job wrapping up all you need about the world of apps. Sign up today to get your weekly newsletter in your inbox every Saturday morning.Here's a quick summary of what you may have missed this week.The Big ThingZoom has been around since 2011, but its growth in 2020 was quite a different story. The pandemic blasted Zoom into the product-name-as-a-verb hall of fame pretty much overnight, with lets Zoom next week joining the ranks of Xerox this for me? or Photoshop it or Google it.Rapid growth is not without its challenges.One of these was an increase in trolling. Zoombombing is a method whereby unapproved participants crash a Zoom conference and flood it with hate speech and images before the moderator, who is often unfamiliar with Zooms interface, decides how to secure it.Zoom had made some adjustments to its settings by April 2020 to make it less zoombomb-able. However, a lawsuit was already filed. In fact, there were 14 lawsuits filed and then one was consolidated. These suits claimed that the company had not done enough to stop Zoombombing and that it had shared user data without permission with third parties.Zoom reached an agreement with the US to settle for $85 million and to provide additional protections against potential crashers. This is a great example of how sudden popularity can lead to new problems. However, Zoom's market cap jumped from $34 billion in March 2020, to $118 billion this week. I don't think anyone is too upset about it.Other ItemsGoogle previews the Pixel 6Google's next flagship Android phone will be available soon! When? TBD. What is the cost? Good question! It's a good question! It has a large ol camera bump, or camera bar as they call it. There will be two models: Pixel 6 and Pixel 6 Pro. We are reliant on leaks for now, however. These leaks have been quite accurate so far.Robinhoods wild rideRobinhood went public this week, fittingly considering the app's role in the GameStop/AMC/etc. Its first few trading days were a rollercoaster. It opened at $38, fell on day 1, and then shot up to the $70s day 2. It is currently trading at $53. Alex Wilhelm stated that volatility is a result of the following: It will happen in 2021. We just need to accept it.Pokmon Go players are insaneBecause Pokmon Go's fundamental concepts (Talk to strangers!) are so important! Hang out in huge groups!) Niantic made some tweaks last year to make it more accessible from home. They increased the distance that players can interact with landmarks in real life. This allows you to do more and move less. They started rolling back those changes this week as a test. Although the company may have data-driven reasons to reverse, from the outside, the decision looks bad considering the ongoing pandemic. Niantic responded to community outrage by creating an internal team to review the options and promising updates by September 1.WhatsApp self-destructs, single-view photosWhatsApp has introduced view once mode. This allows users to send videos and photos that can only be viewed once before they become unreadable. You might not want to use WhatsApp to send top-secret documents and/or butt photos. WhatsApp, unlike Snapchat, won't give you any warning if a viewer takes a screenshot.Amazon will pay $10 to scan your palmAmazon began letting customers pay for their goods at its checkout-free grocery stores last year by scanning their palm prints over a biometric scanner. New customers are now being paid $10 to scan their prints and be onboard. This story was extremely popular on the site this week. I'm left wondering if it's because people are angry at Amazon for stealing all their biometric data, or if they just want the $10. It's probably a little bit of both.Twitter decimates FleetsRIP Fleets. The company decided to abandon the idea less than a year ago, after Twitter decided that it also needed to clone Snapchat Stories. Why? It claims it was hoping it would attract new users, but instead it was only used by people who were already very hardcore.Square purchases AfterpaySquare is looking to enter the buy-now,-pay-later market. Square announced this week its intention to acquire Afterpay for $29 billion. Afterpay allows you to split large purchases over 6 weeks, without any credit checks or interest.Googles new Nest camsGoogle has some new Nest camera gear arriving later in the month. These include a battery-powered outdoor camera, and motion-activated floodlight cameras for your porch.Elons Big ShipSpaceX has assembled the tallest rocket ship ever built. Its fully-stacked Starship rocket stands at a staggering 390 feet (or 475 feet if counting the launch pad). It won't be moving at all for now. This assembly was a test fit. Take it apart and reassemble it. Although an actual launch of this mammoth configuration won't be until later in the year, it should be quite the spectacle.Additional ItemsBefore choosing a VC, founders should consider five factorsIt's a phrase we hear all the time: With so much capital flooding into the market, it is now that founders need to be careful about who they allow to invest. What are some things to consider? Kunal Lunawat, co-founder of Agya Ventures, has some tips to share. These include how well a VC understands you vision, their background, and good ol' gut instinct.These common financial errors can help you avoid letting your startup die.Startups can be difficult enough without having to worry about finances. Swapnil Shinde, founder of Zeni, outlines three financial pitfalls that can be easy to fall into but that can be avoided: old data, fragmented finances, and founders who don't know when/what they should delegate.