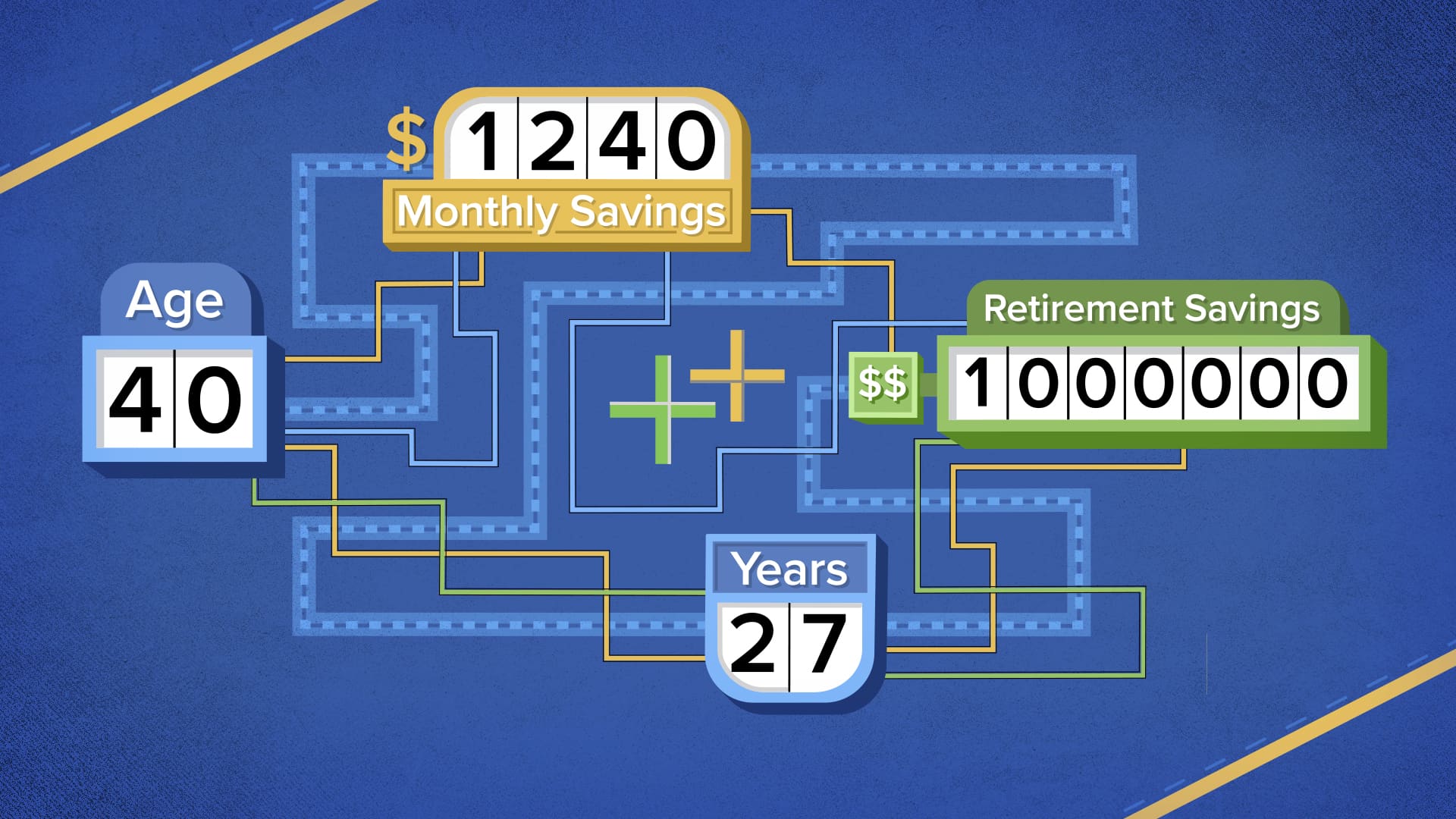

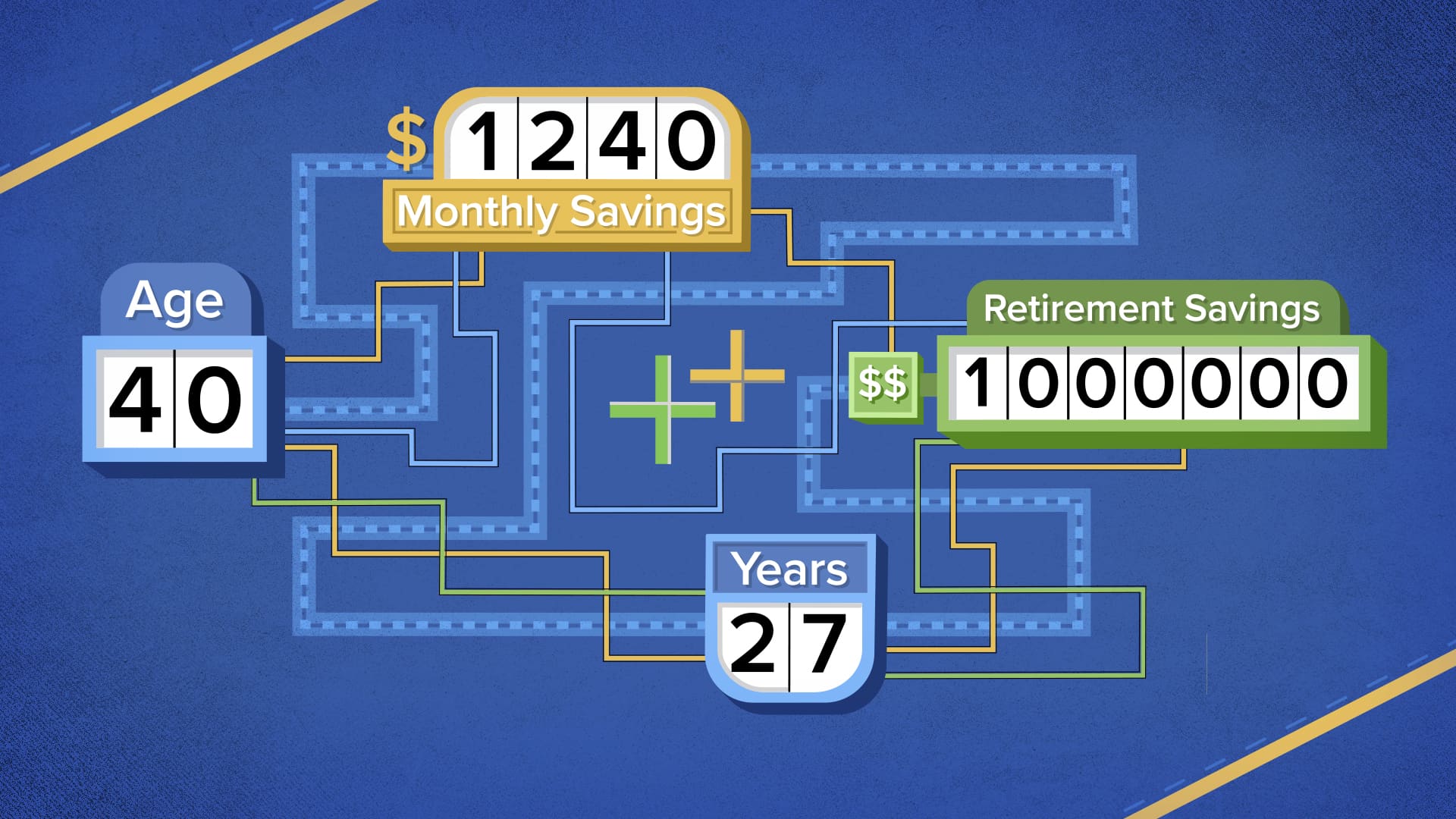

The time can be a powerful investment tool.You can save early in your career to give your money time for growth in the market. However, you can still retire with $1,000,000 even if your start is late.To achieve your goal, you will need some tools.You could use your employer's 401k, which is a tax-advantaged retirement savings plan. It can also include a Roth IRA (or traditional IRA) as a savings plan to help you reach this mark. Low-cost index funds are another option.This video will show you how to get into the figures.Learn more about Invest in YouJosh Brown: CEOs you have never heard of can sometimes bring the greatest returnsYou can multiply your income with compounding.This is how your budget should look if you earn $40,000 annuallyDisclosure: Acorns is an investment by Comcast Ventures and NBCUniversal.