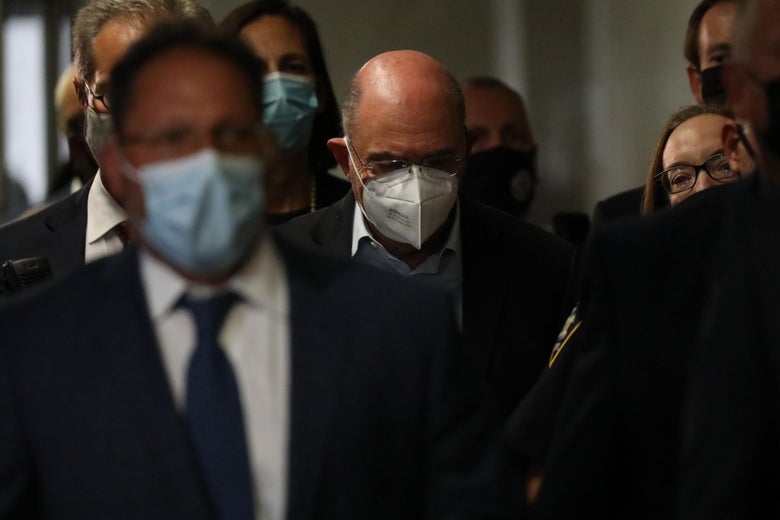

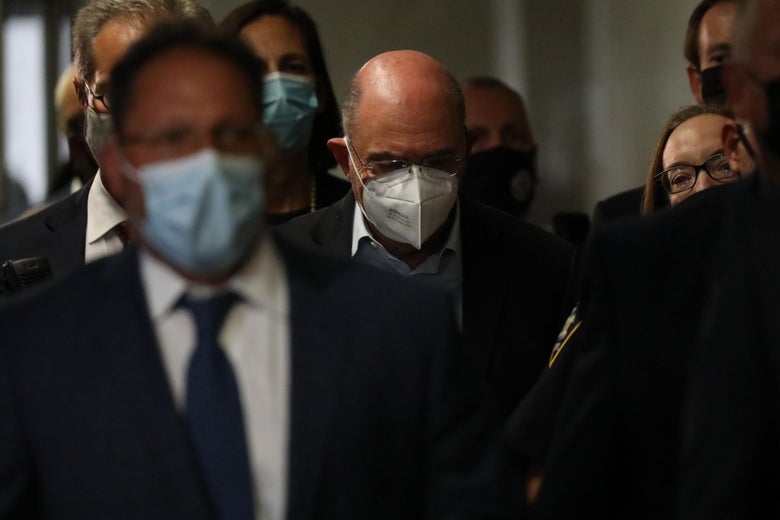

They didn't get Al Capone because of his heinous acts as a gangster. They got him for tax evasion. The Trump Organization and its top players may find tax issues to be their Achilles heel. Capone failed to pay tax on illicitly obtained gains. After an investigation by the New York State Attorney General and the Manhattan District Attorney, Capone is now facing charges of failing to report fringe benefits and not paying taxes to key employees. Trump's lawyers call the charges petty, and claim they are politically motivated. Others see them as a way to pressure the organization's long-serving chief financial officer into turning states witness. They are a great opportunity for tax professors to discuss tax policy and the tricks people play in order to avoid paying their fair share.AdvertisementAdvertisementAdvertisementIndictment claims that state is opposed to federalcrimes. However, the base of the claims are federal income and payroll tax fraud with a little bit of state and local tax fraud. Prosecutors claim that the Trump Organization paid $1.76million in compensation to Allen Weisselberg. Neither the organization nor the organization reported the payments. This allowed Weisselberg to avoid paying $900,000. Weisselberg was also able to improperly claim $130,000 in tax refunds.Let's begin from the employer's perspective. In general, compensation is deductible. It is subject to payroll taxes including Medicare and social security. The employer typically pays half of the tax and the employee the other half. The employer withholds half of the tax from the employee. This is what you see on your pay stub. Employers can hide compensation as a deductible expense to save 14 percent on payroll taxes. Employers will see compensation as a routine expense and avoid the payroll taxes. It's not bad work, if you can do it.AdvertisementAdvertisementWe now have fringe benefits, which are non-cash payments that pay for work done. You owe taxes on $100,000 if you receive $100,000 from your employer as a cash salary. What if your employer could pay for your housing, buy you a car and cover the tuition of your private schools, like Weisselberg? Congress isn't out to get you. The tax code states that income is earned when compensation for services is paid, including commissions, fees, fringe benefits and other similar items.These benefits are income and Weisselberg's salary was reduced dollar-fordollar by the amount paid to him. It's as if Weisselberg was paid by Trump Organization and he paid his expenses. But they decided to eliminate the middleman. Even though the CFO never touched the money, the CFO constructively received it when it had been spent on his behalf. He also received alleged cash payments off-the-record.AdvertisementSome cases, like employer-provided insurance for health, Congress has explicitly excluded fringe benefits. This exclusion acts as a government subsidy. Others include parking and small life insurance policies. These activities have positive externalities that employees don't capture. Therefore, a subsidy may be necessary to maximize the public benefit.AdvertisementIn some cases, Congress has ruled that the employer provides the benefit as a benefit to employees and not as compensation. Employer-provided housing is usually considered income, such as the rent-free apartment Weisselbergs employer paid for. Employer-provided housing is not exempt from tax in certain circumstances. Imagine a fishing boat that has onboard cabins for crew members while it is at sea. The shipboard housing, unlike Weisselberg's apartment, is provided for the employer's convenience. It is necessary for the crew to perform their job. These housing units should not be considered income. (In Weisselberg's case, it seems that Trump Organizations decision not to pay for his housing was also intended to conceal the fact that Weisselberg had lived in New York City. This allowed him to avoid New York City taxes. But this is another issue.AdvertisementIt can be hard to decide where to draw the line between legitimate business expenses and things that are intended to reward employees. This is often referred to by tax professionals as personal consumption. Is it reasonable to allow deductions for 1-ply toilet tissue, but not for 2-ply? What is the best chair or desk? Is a business really going to need a car? It is enough to say that fringe benefits can pose interesting questions in public policy and that it can lead to close calls. The fringe benefits that were allegedly provided by Trump Organization include private-school tuition and apartments. If personal expenses are incurred directly, they cannot be deducted and must be treated like taxable income to employees if paid by an employer.These charges, while minor, may be due to the more serious allegations of tax fraud that Trump made to tax authorities and borrowers about the valuation of his properties. However, they are serious violations of basic tax rules if proven to be true. All taxpayers are expected to be subject to the same tax laws. The fact that the Trump Organization and its employees have been accused of graver crimes should not be taken away from the fact that there is blatant fraud that undermines fairness in the tax system.