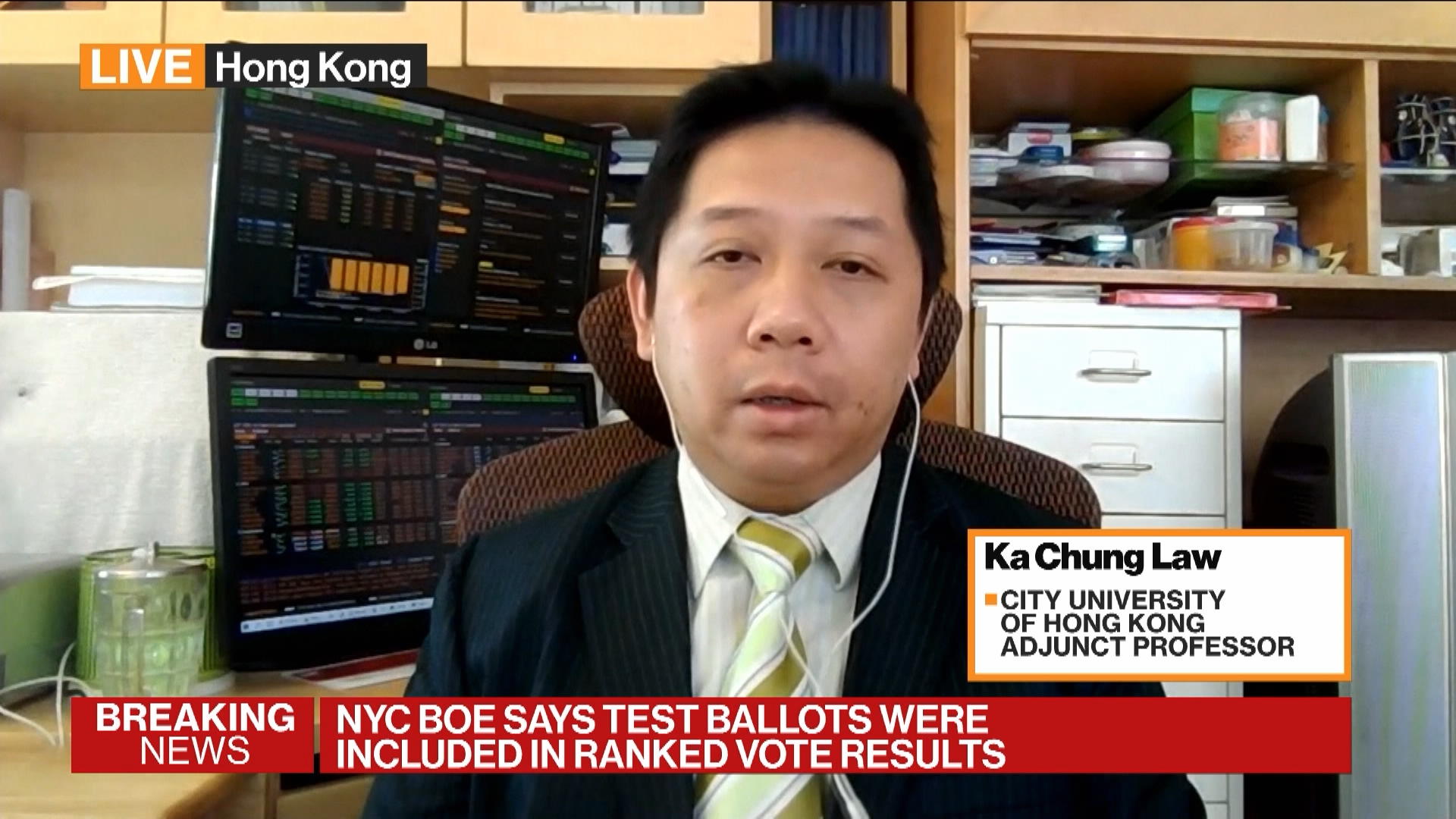

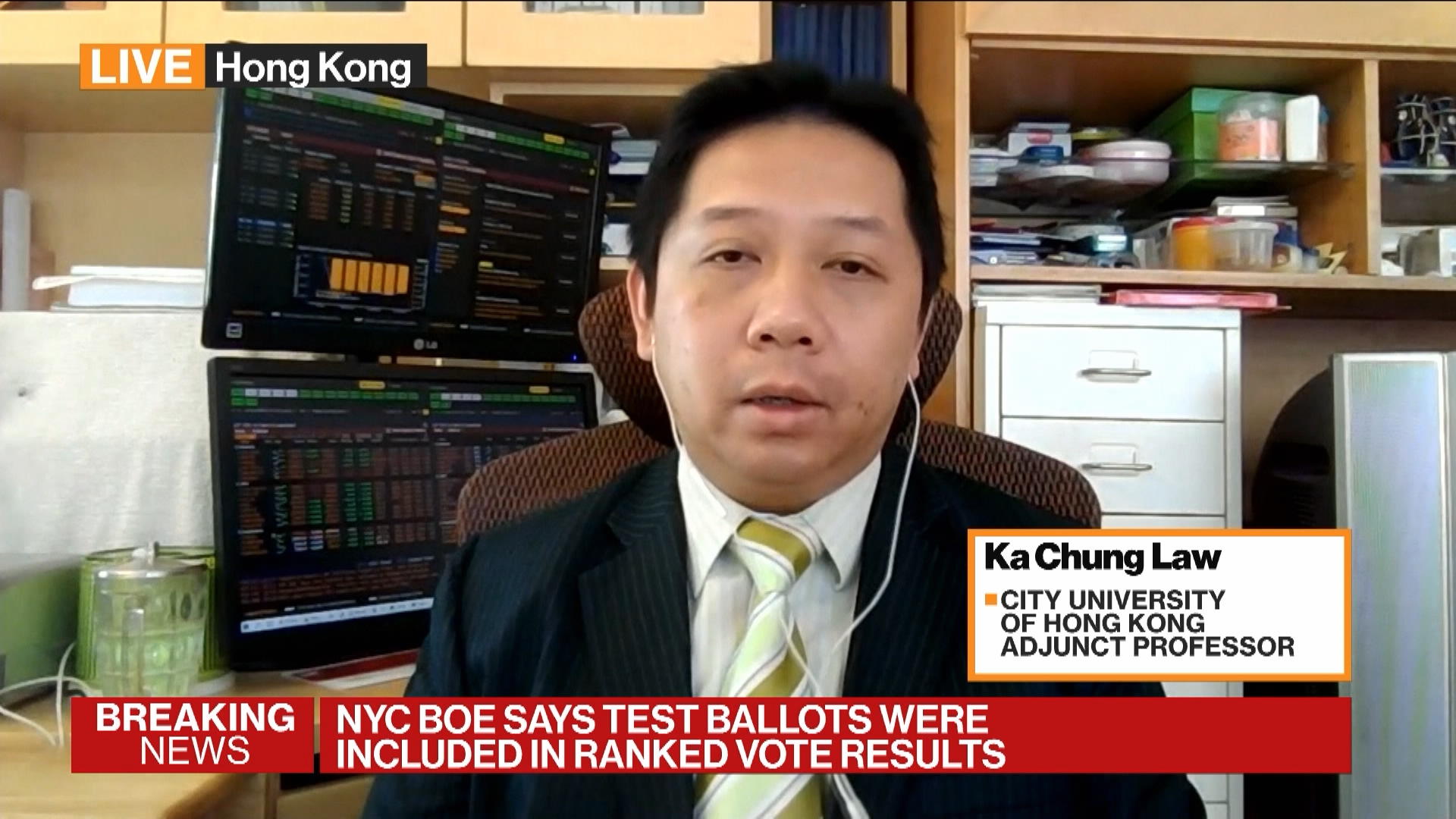

00:00I will ask a simple question about what has changed in the past year. I saw a lot of changes as I RTS it. It is clear that freedom and harmony are being eroded. This includes the right to demonstrate in public as well as freedom speech we don't allow. It's very real that people are going to be afraid of being arrested and taken to jail, even if they don't go to court, just for having written or spoken something. We would love to hear about your experiences at bow com. There you were chiefeconomist. You claim that you were fired because of your negative research on Hong Kong and China. How did managers pressure you to censor your research? They had been submitting everything since 2014 to them for censorship, especially regarding legal aspects. The content could then be published or released. Three months ago, I was talking about August 20, 19. I was projecting that economists would be in severe recession. This was not at all consistent with the total government. This is what I believe was the trigger point. It was the restriction of thejurisdiction and even freedomofexpression for me since then. You'll also remember that it was quite another thing to do on the streets towards the end. Their thoughts are not appropriate to talk about the market on television. They just want everything to be lower and they closed down all research thereafter. I was no longer valued. That's why I quit coaching Stephen Engle. Based on what happened to you, and maybe I'm just guessing from your answer, you felt a little bit of chill publishing certain research. This chill can be felt not only in the news media, but also in the economic and financial research. Can Hong Kong still fulfill its strategic vital role as the International Finance Centre? It doesn't seem so. It's because even years ago, when men were writing negative things about China like their views about the CNY NYSE please Asia or about the downside of Asia. Yes. They won't get much support from their companies, or they wouldn't be able to publish these pieces to the media. This is what you now see. It's not just limited to the financial sector, or the financial system. We're also talking about anyone who is interested in China. It is unlikely that it will lead to a D outcome. It is very possible that there are a lot of problems within the sector, such as financialproblems in certain firms. You're not allowed talk about the economic threat we face. It is unlikely that you will talk about it. You can tell people that Hong Kong is still an international financial center. But how could they just transfer money to this country without access to free information? The most important thing is that private SSAs are not secure. The government can take it away at any time. Our personal freedom could be threatened as well. If we discuss something really serious, we could be sent to jail. Keep reading. You can't help but think about those who are mostly pro-establishment and say that after the chaos and protests here, the city needed stability. Beijing saw an avenue through Article 18 Annex 3, which allowed them to do exactly what they thought would bring stability. There are also areas in the business community that want and need stability. What do you tell them? Leaders in business and government who put stability first. Even if you don't want people to invest here, You must meet certain conditions. You have the right to your property rights. All these rights you have seen in recent years are not necessarily guaranteed. The most important thing is the noconcrete rule-of-law mindset. Many cases will be put in prison without ever going through the courts. Even if they do go through court, the information or clues could be obtained in the bank land and ocean or by the CCP. This is unacceptable from the west. You should listen to her because the government is currently in the enforcement phase of the national security laws. I wouldn't be surprised to see the government putting people who are well-versed in law enforcement in senior positions within the next year. She also spoke out about foreigners she knows who want to remain in the same position as Matthew Chung. The last few days have seen here have been on a tear. Just spoke to God Capital, a private equity company. This is the largest non-developer who is willing put in a lot of money in Hong Kong. It is also the most he has done in the past two or three years. There is still a lot of money being put into Hong Kong. There's plenty of money in Europe under QE Europe. But the question is how much you get compared to other international financialcenters. Hong Kong has a relatively flat marketcap over the past 15 years. This is evident from the same level of Hang Sengindex as some 20 20 0 6. Hang Seng is directly proportional to the marketcap. You will also see a similar trend in turnover. You will see that the turnover has remained flat for more than a decade, which is quite striking in comparison to the outside world. That's just one thing. Another important thing is the FDIto GDP ratio. This means that inflows from one fund say well are down and there has been a decline over the years. They are simply moving on. We have data for 2090, but it is almost zero. The data for 2020 and 2021 will be negative, I believe.