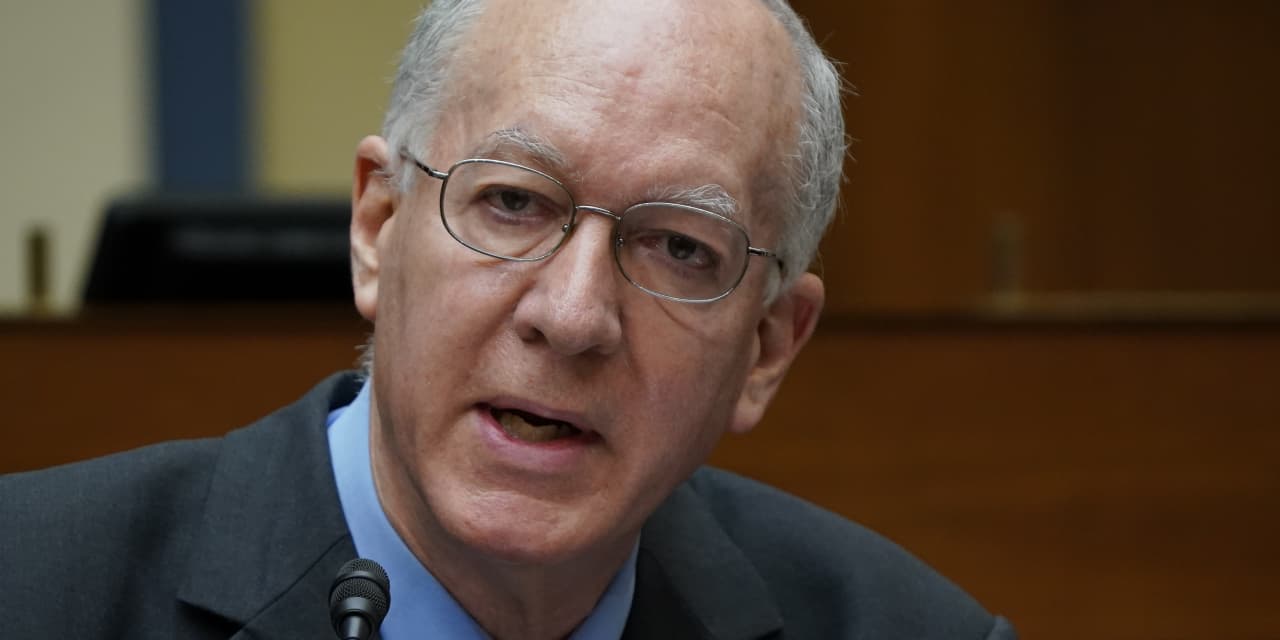

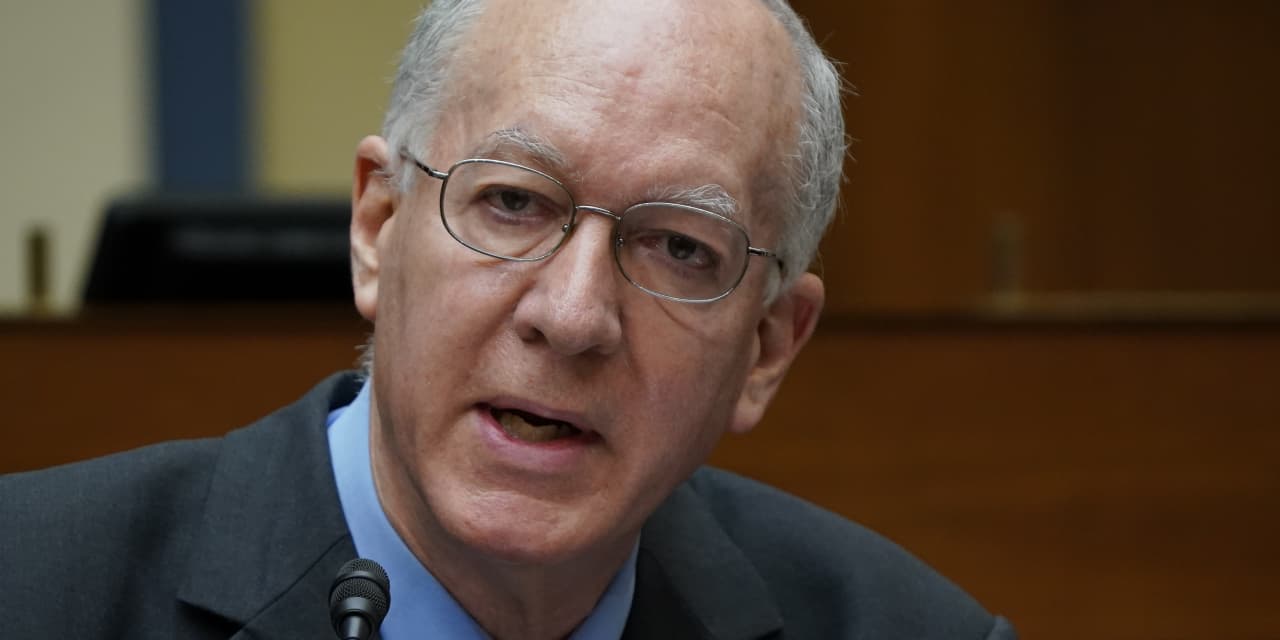

Many in the cryptocurrency industry demand that Congress provides clarity about how it will tax and regulate digital assets. However, Washington's powerful figures are weighing in on the matter and crypto enthusiasts are not liking what they hear.Co-chair of the House Blockchain Caucus, Democratic Rep. Bill Foster, Illinois, stated Tuesday that federal courts must have the authority to identify digital-asset owners and reverse transactions in bitcoin BTCUSD or other digital currencies. This policy is opposed by many cryptocurrency investors.Foster stated Tuesday that you must be able go to court to unmask participants in certain circumstances. Foster also said that crypto currencies must be pseudo anonymous so regulators can determine if any transactions are fraudulent.There are many cryptocurrencies that offer anonymity. Bitcoin is an example of this continuum. Every transaction on the network can be viewed by anyone, but it is still largely anonymous. There are ways to find out someone's real identity. This includes looking at their transaction history and searching for instances where a bitcoin user might have linked their bitcoin wallet address to personal information. For example, a user could send their wallet address and an email signature with personal information such as a phone number or name.Foster suggested that new laws require a different type of pseudo-anonymity. This would allow a court to discover the real-world identity and transactions of cryptocurrency users through a highly guarded key.Foster claimed that such tools are needed to protect the government, American businesses, and Americans from ransomware attacks, like the one used by Colonial Pipeline to extort millions from it. This incident led to widespread gasoline shortages.Three things that will make crypto purists mad, such as the trusted third party, have been mentioned. Foster stated that there is no technological solution. Most people will want the security of a third party to solve their problem if they have large amounts of crypto assets.Many people in the cryptocurrency industry argue that there is no way for a government to stop citizens buying and selling Bitcoin or other cryptocurrencies. Changpeng Zhao (CEO of Binance, the largest cryptocurrency exchange in the world) stated at the CoinDesk Consensus2021 virtual conference that he doesn't believe anyone can close it down right now because this technology, this idea, is already in 500 million peoples minds.A few weeks later, the United Kingdom made it impossible to use the exchange outside its borders. However, it remains to be seen how that decision will impact crypto use in the U.K.Foster stated that cryptocurrency must comply with federal laws and regulations in order to be accepted as a mainstream instrument for transactions.Foster stated that we will need to create a law that distinguishes between legal and illegal regimes. There is a growing sentiment in Congress that anyone participating in anonymous crypto transactions could be considered a participant in a criminal scheme.