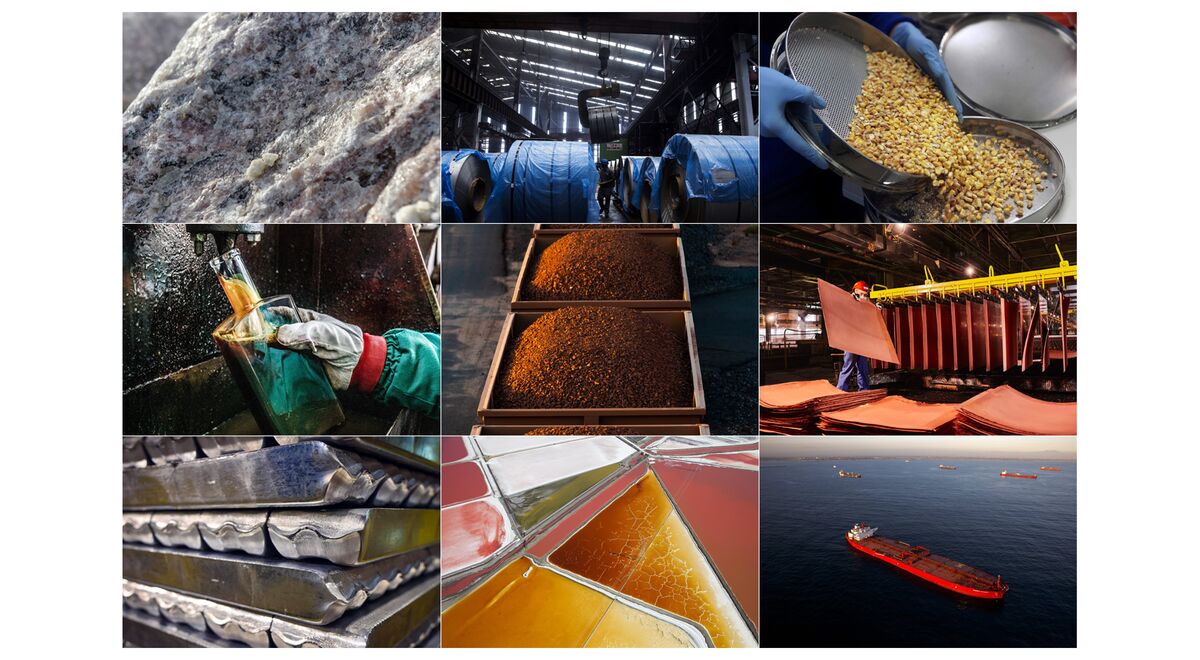

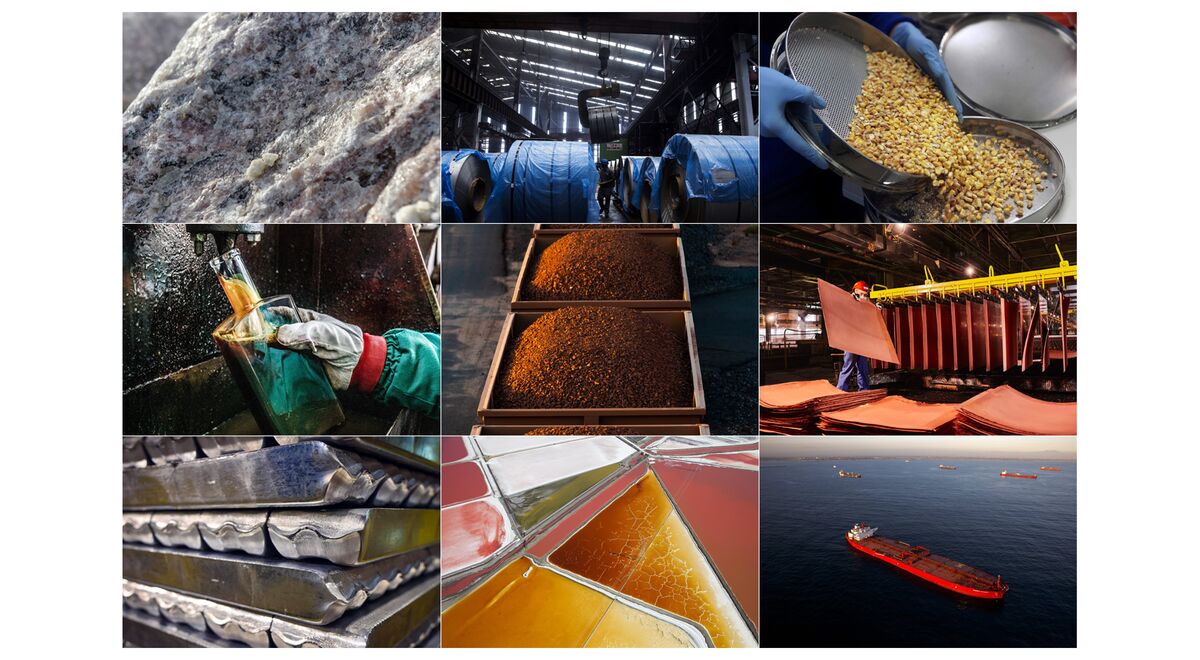

Doug King started his hedge fund during the commodities super-cycle of 2004. It was perfectly placed as the Chinese demand for commodities soared to record levels, causing oil and copper prices to soar. The commodities sector was flooded with investors. Kings Merchant Commodity Fund managed approximately $2 billion at its peak.The 2008 global financial crisis, and the emergence of the U.S. Shale Revolution saw the boom end abruptly. The prices plummeted, and large amounts of institutional money fled. Many specialist hedge funds also closed.Fast forward a decade, and King is enjoying one of the most successful years of his career. A broad-based commodities boom has driven up his hedge fund almost 50% this year. Raw materials such as steel and soybeans have hit multi-year highs. Everyone is making money with commodities, from pension funds to physical commodity traders. It is unclear if this temporary rebound from the pandemic signals a longer-term shift or a temporary respite. King is certain.King stated that we are currently facing a structural inflation shock. There is a lot of demand and everyone wants it now.The commodities boom has led to central banks being concerned about inflation for the first time since 2008's pre-crisis years. This rally will also have a political effect. Oil prices are now at $75 per barrel. This is a remarkable turnaround from the negative oil prices a year ago. This boom is not good news for climate policymakers who are trying to tackle the crisis. Rising commodities prices will make it more costly.A steel rebar yard in Shanghai, China. The boom in commodities has caused factory inflation to soar. Photographer: Qilai Shan/BloombergChina is dependent on imports of raw materials to fuel its factories and buildings. The government has attempted to lower prices by threatening to crackdown on speculators, and releasing strategic stockpiles. Although copper lost some of its gains this year, prices throughout the complex are still strong: U.S. steel prices tripled this year, iron ore prices are near a record, and coal prices rose to a 13 year high. Natural gas prices are also on the rise.Even with the recent pullback the Bloomberg Commodities Spot Index (a measure of 22 raw materials prices) is up 78% compared to the March 2020 low that was the first time the pandemic struck.Crude oil, the most important commodity in the global economy, continues to rise as the world emerges out of lockdown and the OPEC+ alliance keeps the supply under control. Benchmark Brent prices have risen 45% in the past year. Wall Street traders and banks are now discussing the possibility of prices surpassing $100 per barrel for the first-time since 2014.Boom Times: The Bloomberg Commodities Spot Index has reached its peak in 2008-11 Source: BloombergWall Street's interest has increased as prices have risen. Robin Hood's annual investor conference, which draws in hedge fund luminaries such as Ray Dalio and Stanley F. Druckenmiller, hosted a panel discussion on commodities in June. This was the first time that the conference had discussed raw materials in at least five consecutive years.Jeff Currie is Goldman Sachs Group Inc.'s senior head of commodities research. He believes there is room for more investment in the market despite recent sell-offs in metals and grains.Currie stated that commodities are back in fashion, but the hype about sky-high prices isn't yet attracting the money flows that were harnessed during 2004-2011 boom.The rally has brought in a lot of money for investors and traders who have invested cash in commodities, betting on recovery from the pandemic.Take Cargill Inc. As net income soared to over $4 billion, the world's largest agricultural commodity trader made more money in the first nine months than any other full year.Or Trafigura Group. The world's second largest independent oil trader posted a net profit of more than $2B in the six months to March. This was almost as high as the company made in its previous full-year best.Jeremy Weir (chief executive at Trafigura) stated that Trafigura's core trading divisions are firing on all cylinders.A Cargill grain terminal in Ukraine houses corn. In the first nine months, the company's income has increased to over $4 billion. Vincent Mundy/Bloomberg PhotographerConsumers will be able to relive high inflation memories thanks to the commodity boom. Companies are currently absorbing most of the effects, driving factory inflation in certain countries, including China to its highest level in over a decade. However, sooner or later, the cost will be borne by consumers.Companies ranging from Unilever Plc and Procter & Gamble Co. have made plans to increase prices in the near future.After revealing the first quarter results, Unilever's chief financial officer Graeme Pitkethly stated that Unilever was experiencing a level of commodity inflation not seen in a long time. All businesses are affected by the commodity inflation we were seeing.Raw Returns 12 Month Prices Change for Key Commodities Source: Bloomberg Commodities Spot IndexMany are talking about a new commodity supercycle due to the speed and breadth the rally has had on dozens of raw materials, from vegetable oil to coke.Economists define a supercycle to be a time of unusually high demand that oil companies, farmers, and miners cannot match. This creates a rally that lasts longer than a normal business cycle. Modern history witnessed three distinct commodity supercycles before China. Each was triggered by a transformative socioeconomic event. The first was triggered by U.S. Industrialization in the early 1900s. Global rearmament in the 1930s fueled another, while reconstruction of Europe and Japan after World War II fueled a third in the 1950s and 60s.From top left, clockwise: Copper miners in Michigan (USA), circa 1906. In 1939, warships were being built at Tyneside's shipyard. In 1955, the Self Defense Forces Headquarters in Tokyo was constructed. Photographs by Hulton Archive/Getty ImagesA fifth supercycle could be an important event. The price rally supports the idea of a new boom. The Bloomberg Commodity Spot Index (a basket of 23 raw material) is almost 500 points. This index matches the 2007-08 peak and the 2010-11 peak. But, it is more likely that the world continues to feel the effects of the China-led supercycle. These are now being turbo-charged with counterintuitive economic shifts triggered the coronavirus pandemic.Initially, Covid was bad for commodity demand. The world was put into lockdown. Travel plunged and factories were closed. Between March and May last year, the price of everything, from copper to oil, fell sharply. However, after a few months, the world began to recover and consumption patterns started to favor commodities.Understanding the relationship between commodity demand, wealth and other factors is key to understanding what happened. Poor countries generally consume little raw materials, as most of their spending goes to basic necessities like shelter and food.The country with per capita incomes between $4,000 to $18,000 is the best place for commodities. This middle-income group was where China moved in the 2000s. Because it is at the time when countries industrialize and urbanize, this translates into a large amount of commodity demand. Families can afford to purchase cars, household appliances, and other goods that use a lot of raw materials at these per-capita income levels. Industrializing countries also construct railways, highways and hospitals, as well as other infrastructure.The way we spend money has changed from services to goods that are locked down. Photographer: Christopher Dilts/BloombergAbove $20,000 per person, the demand for commodities begins to slow down as more wealthy people invest incremental wealth in services such as education and health.These dynamics were altered by the coronavirus pandemic. Many families were under lockdown and spending moved from services to goods all over the world, even in the wealthiest countries like the U.S. For a few months, American and European consumers behaved in many ways like their counterparts from emerging countries. They spent on everything, including new bikes and television screens.Tale of Two Trends: Americans have been spending less on services and more on goods since the pandemic started Source: Bureau of Economic AnalysisThe U.S. economy is the best example of this trend. While overall consumer spending is still below 2018-19, it masks a large divergence in spending on goods and services. The Peterson Institute for International Economics reports that household spending in goods has increased 11% over the pre-pandemic period, while spending in services like entertainment, holiday, and restaurants is still 7% below its pre-pandemic level.Chief economist at Trafigura, Saad Rahim said that a flexible monetary policy, unprecedented fiscal stimulation, pent up demand, strong household balances, record savings, and ultra-accommodative monetary policy all contribute to a strong growth trajectory. There are other parallels to emerging markets, as Western governments promise to repair their railways, bridges and highways through fiscal stimulus.The government is also eager to create a better future by investing in electrification and moving away from fossil fuels. This is bad news for oil and coal, but it also means that there will be more demand for copper, aluminum, and other battery metals such as cobalt and lithium that are crucial for the energy transition.Ivan Glasenberg (outgoing CEO of Glencore Plc), stated that commodity prices will remain strong for a very long time. He said that for the first time, the two superpowers of the world, the U.S.A and China, simultaneously pushed big infrastructure projects to save their economies from the effects of the coronavirus pandemic.The supply is not keeping up. Some bottlenecks can be attributed to the deliberate actions of producing countries like the OPEC+ alliance which slashed oil production last years. Others are caused by the difficulties of managing mines, smelters and slaughterhouses in the middle the pandemic.Global electrification is possible only if battery metals like lithium are used. Photographer: Qilai Shan/BloombergThe structural supply constraint is crucial for the endurance of the rally. This means that high prices may not work as a signal to increase production, and ultimately bring the market back in balance.Two factors are behind the slowing of supply response. Companies are being pressured by shareholders and courts to reduce their carbon footprint and join the fight against climate change. These shareholders demand that chief executives be rewarded with higher dividends. This will leave less money for new drilling or expansion of mines.Already, the effects of these forces can be seen in certain corners of the commodity markets where companies have stopped investing in new supply many years ago. Let's take, for instance, thermal coal. Since at least 2015, mining companies have been reducing their spending. Coal prices have risen to levels not seen in 10 years as demand has increased. Iron ore prices have also risen to an all-time high, as well. Oil is next, with companies cutting back on spending.It is the signal to double down for commodity bulls like Doug King, the hedge-fund manager. He said that this is the start of a boom cycle, and not a temporary spike.