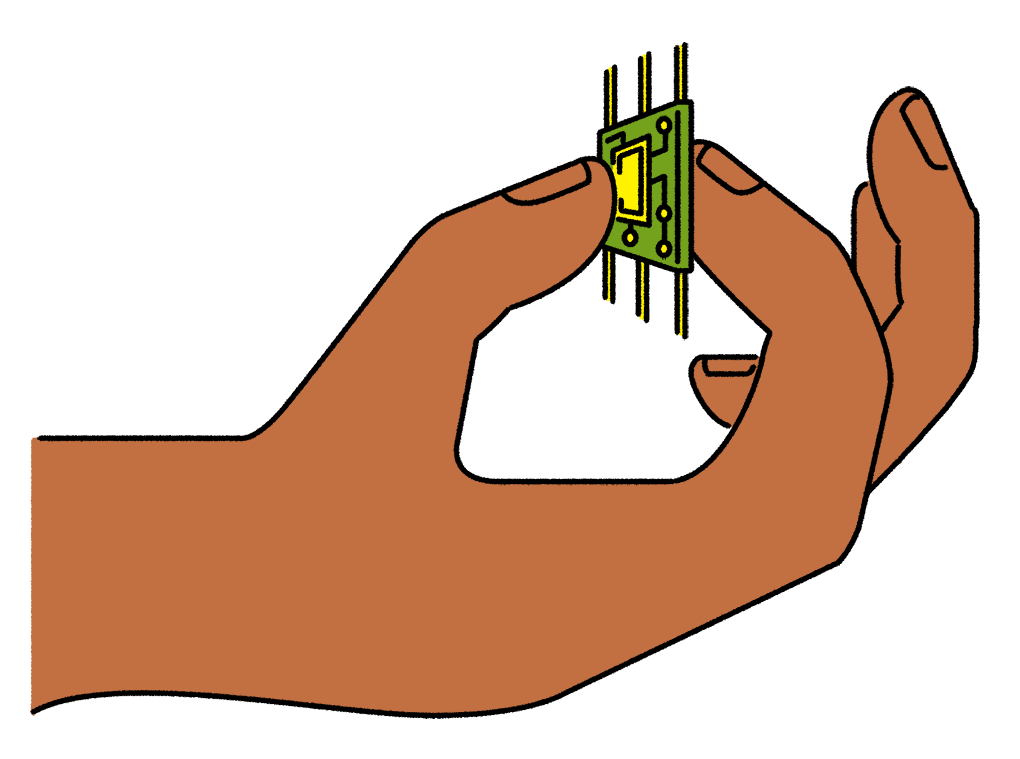

Communications, commodities, finance, and food are some of the sectors tracked by the intelligence service. A list of Focus ideas, which combine contrarian views and upcoming catalysts for change, has been identified by BI as 50 that should be looked at more closely this year. Factors considered by our analysts include growth prospects, resilience in an inflationary environment, changes in the C-suite, and plans for new products and services. Russia's war in Ukraine is important, as is the shift to electric vehicles, challenges in the tech supply chain, China's declining property market, and the continuing effects of the Covid-19 epidemic. The revenue change will be in the mid-20th century. 5% is the upper limit. The footwear maker has stumbled recently and is about to bring on a new CEO. Adidas wants to increase annual sales by 8% and an operating profit margin of 12% to 14% by the year 2025. The company is working on new products, kit deals and endorsements despite the uncertainty about China and the fact that the partnership with Ye was terminated. The revenue change will be in the mid-20th century. It's 6 percent. It's a legal name. The company is called Abu Dhabi National Oil Co. Fuel volumes and operating profits for this Middle Eastern service station operator will be boosted by rising visitor traffic in the winter in the United Arab Emirates. Beyond the global soccer championship, the market doesn't seem to appreciate the company's peer-leading profitability and growth outlook with a favorable regulatory framework. The revenue change will be in the mid-20th century. It was 16. Spending increases for European defense and improved supply chains will support commercial aircraft build rates. The production of the A320 could jump to more than 60 a month in the second half of the year if better component availability is not improved. Tensions between the US and China are helping it win orders in China. The CEO is also the CEO. Ismatthakarn is the name of the person. The revenue change will be in the mid-20th century. The rate was 121%. It's a legal name. The airports of thailand A rebound in the airport operator's retail and duty-free sales could be undermined by shifts in the mix of visitors and spending Purchasing power has fallen for tourists from Southeast Asia. Lower tariffs have spurred Chinese visitors to buy more imported goods, but retail concession revenue will likely lag when they return to destinations such as Thailand. The revenue change will be in the mid-20th century. The rate is 26%. The consensus forecast for free cash flow generation by the Nordic oil producer is low, meaning higher-than- expected shareholder capital returns are likely. There is a chance of a special dividend as well. The market doesn't understand the impact of the acquisition of Lundin. The revenue change will be in the mid-20th century. 3% is how much it is. It's a legal name. Allison Transmission, Inc. is a holding company for Allison Transmission. The earnings per share of the truck transmission supplier could come in less than expected. The alternative powertrain market for electric vehicles has higher research and development spending than the economy. Allison has a leading share in the medium- and heavy-duty vehicle business because of its competitive market for EV products. The revenue change will be in the mid-20th century. 4% is a high percentage. Predicting Lumakras sales will come in as much as 30% below the consensus forecast over the next three years is more pessimistic than expected. Competition is on track to enter the market this year and the FDA has requested more data. The revenue change will be in the mid-20th century. It's 20%. It's a legal name. ASML is a holding company. The impact of US-China tensions and technology-oriented trade restrictions on the world's leading Semiconductor-equipment maker seem overblown. According to an analysis by BI, ASML could increase global sales by 25% in the next few years. It has a dominant position in leading-edge equipment used to make computer chips, and it has limited exposure to mainland China, which reduces its risk of possible sanctions. The revenue change will be in the mid-20th century. The percentage is 3%. The French bank is expected to be one of Europe's top performers in the years to come. It has a good exposure to business banking and a good revenue expectation. The completion of its BankWest sale and redeployment of money across Europe points to more catalysts. The revenue change will be in the mid-20th century. 2% is the upper limit. It's a legal name. The Brown-Forman Corp. is a company. The whiskey maker is expected to beat expectations this year. Jack Daniel's is positioned for rapid gains as consumers return to bars and restaurants Brown-Forman has increased its emphasis on premium-priced Bourbons such as Woodford Reserve and Old Forester, which could help margins. The elimination of tariffs on American whiskies in the EU and UK could result in gains for margins. The revenue change will be in the mid-20th century. 34%. It's a legal name. Amperex Technology Co. is a company The profits of the world's largest maker of batteries for electric vehicles are about to surprise. Expectations of higher battery prices and a sustainable recovery for electric-vehicle sales drive the scenario analysis. The recent cuts to consensus gross margin estimates look excessive, with raw-material costs likely to go down as the year progresses. The revenue change will be in the mid-20th century. -21%. It's a legal name. The company is known as CF industries. An extended global supply crunch for natural gas, which is used to produce nitrogen, may give the US-basedfertilizer maker a long-term cash flow boost. It will be able to capture higher margins due to its access to low-cost US gas. Competition for natural gas is heating up, which could keep the nitrogen market tight for years. The revenue change will be in the mid-20th century. A little over 12%. It's a legal name. China Gas is a company There is too much weight given to a recovery in demand and growth in residential volumes and not enough to rising gas costs and the Chinese government's delayed adjustment to city gas tariffs. A profit margin contraction could reduce estimates by as much as a third. The revenue change will be in the mid-20th century. There was a 7 percent. One of the world's largest insurers is the property-Casualty insurer. The positioning and expertise of the company is thought to be a source of earnings upside this year. Chubb is not immune to the tough economy and is not sensitive to rising prices or inflation. It has a large exposure to Latin America and Asia, which makes it more diversified. The revenue change will be in the mid-20th century. 4% is a high percentage. It's a legal name. The company is called Cognizant Technology Solutions. The IT services consultant has a sales growth risk of less than 7 percent. The company isn't as well positioned as its peers to benefit from the structural growth opportunities from digital services, and it has the worst attrition rate in the industry. The factors together could mean that Cognizant is more at risk. There is a 10% risk to operating income and earnings estimates in the year 2020. The revenue change will be in the mid-20th century. 20% It's a legal name. Computershare is a company The provider of share registries is in a good position to benefit from rising interest rates. US dollars, British pounds, Canadian dollars and Australian dollars are the main foreign currency used in the company's profits. The yield on those holdings could go from 0.6% in fiscal 2022, to 2.3% in fiscal 2023, and to 2.7% in 2024, helping Computershare beat market expectations. The revenue change will be in the mid-20th century. 5% is the upper limit. It's a legal name. There is a company called Constellation Brands Inc.. Mergers and acquisitions may be on the horizon for the drinks maker. The elimination of the supervoting class of common stock gave it more flexibility to restructure. Expanding the scope of its beer business, adding scale to its wine and spirits segment, and possibly pursuing a transformational deal are all possibilities. The revenue change will be in the mid-20th century. 5% is the upper limit. The eye-care company could be in the spotlight this year due to increased growth in the contact lens market. The eye-care survey shows that there is room for expansion with more expensive daily solutions. The new products for kids may be catalysts. The revenue change will be in the mid-20th century. 9% It's a legal name. China Resources Beer is a holding company. The owner of Snow, the world's best-selling beer brand, looks set to lose money. A consensus expectation for an increase in the brewer's profit margin underestimates the negative impact of elevated costs for materials such as barley and packaging, as well as higher spending on marketing for premium products and costs associated with a recent liquor acquisition. The revenue change will be in the mid-20th century. 42%. It's a legal name. CrowdStrike is a company As the proliferation of devices outside corporate firewalls increases demand for its services, the provider of enterprise cybersecurity software is poised to take increased share from traditional software security peers. The growing risk of cyberattacks, CrowdStrike's expanding product suite, and increasing sales via channel partners are all expected to drive a 30%-plus gain in sales over the next two years. The revenue change will be in the mid-20th century. 10% of the population. It's a legal name. The Walt Disney Co. is part of the Disney Company. It could be a tale of two halves. With Disney's shares down about 50% from their 2021 high, the market is focused on content costs, increasing direct to consumer competition and theme park recession risks. In the second half of the year, a reorganization that allows the company to accelerate its streaming strategy could start to bear fruit. Robert Iger's return as CEO gives a chance for a meaningful turn around. The revenue change will be in the mid-20th century. The percentage is 1%. Revenue could grow well above expectations as a result of recent initiatives to build back share at the online retailer. The percentage of sales that EBay keeps is known as the take rate because of the integration of payments and paid listings. The sale of refurbished items is one of the positive moves. The CEO is also the CEO. Surendra Lal Karsanbhai was named after him. The revenue change will be in the mid-20th century. Ten percent. It's a legal name. The company is called Emerson Electric Co.. The electrical equipment powerhouse is tied to the energy sector which has an outlook for sustained elevated prices. A multiyear plan to curb costs may save the company hundreds of millions of dollars. Changes to the strategic business portfolio are possible with a new CEO. The revenue change will be in the mid-20th century. 4% is a high percentage. Weak consumer demand and rising costs will cause its key customers to scrutinize new-product initiatives more closely, posing a challenge for the maker of flavors and fragrances. Givaudan's sales growth is dependent on innovative introductions. The revenue change will be in the mid-20th century. It was 7 percent. The sales are for 12 months. 243. The miner's earnings seem more resilient than those of its peers, but its valuation is depressed relative to long-term averages. Climate concerns have caused investment in new mines to be cut by major mining companies. Coal makes up more than half of the company's operating profit as European utilities switch to the fossil fuel due to gas shortages caused by the war in Ukraine. The revenue change will be in the mid-20th century. A little over 12%. It's a legal name. The Henderson Land Development Co. is a land development company. Weak home sales in the region and higher financing costs will hurt the Hong Kong property developer. Expectations that an increase in new home completions will lead to meaningful earnings growth are likely to be disappointed. The new Kai Tak development is problematic for investment demand due to weak sell-through rates of smallershoe box units. The revenue change will be in the mid-20th century. The percentage is 22%. It's a legal name. KE is a company China's largest property agent is at risk of missing earnings estimates due to wariness among potential customers. A revenue miss of more than 15% and an earnings-per-share disappointment of 30% are potential consequences of buyers deferrals. The revenue change will be in the mid-20th century. 5% is the upper limit. It's a legal name. Eli Lilly and Co. is part of Eli Lilly and Co. The drugmaker is looking at a big year: Sales expectations for its new diabetes medication could prove conservative, and the drug's approval for treating obese people may add to the company's growth. Sales of new drugs for cancer and other diseases should increase. The Alzheimer's drug and marketing costs present risks. The revenue change will be in the mid-20th century. 18% of the population. It's a legal name. The Luxshare Precision Industry Co. is a company One of the few Apple suppliers that can consistently gain market share is the electronics manufacturer. Up to 25% of iPhone assembly orders could be grabbed by Luxshare, according to a new report. GoerTek, a key competitor, will lose a contract in late 2022. The revenue change will be in the mid-20th century. 9% It's a legal name. The Louis Vuitton company is part of the LVMH group. China's easing of Covid-19 restrictions and the global recovery of travel and tourism bode well for the luxury goods maker. Wines and spirits, perfume and cosmetics, and retail are the biggest contributors to the revenue of the company. The company shows that consumer demand isn't being rattled by price increases. The revenue change will be in the mid-20th century. The percentage is 3%. The expansion of the chipmaker into the premium smartphone processor segment is gathering speed and should lead to better sales growth than the leader. The company plans to launch higher- performance and more cost-effective system-on-a-chip products for 5G phones. India is one of the key emerging markets that will see the release of 5G this year. The revenue change will be in the mid-20th century. 4% is a high percentage. The medical device company launched a new treatment for high blood pressure in the US. The FDA is expected to approve the minimally-invagant procedure for treating high blood pressure in the next few years. The market for this type of hypertension treatment could double management's expectations by the year 2030. The revenue change will be in the mid-20th century. 5% is the upper limit. The sales are for 12 months. 118.6 It's a legal name. Meta Platforms Inc. is a company The challenges it faces this year may be even more daunting than in the past, and the estimates for its profit margin seem too optimistic. Meta is facing a sharp deceleration in top-line growth at its core advertising business and higher operational costs associated with its Reality Labs segment. The creators of content for its Reels product could be paid more. The scenario suggests that profit growth could be revised down. The revenue change will be in the mid-20th century. 10% of the population. The sales are for 12 months. 20. It's a legal name. Microsoft Corp. is a software company A recovery in spending on cloud computing after a slowdown could spur surprises to the upside over the next two years for Microsoft. Although weak economic conditions will hurt the early part of next year's top-line results, the importance of Microsoft's cloud suite and the critical nature of its desktop products bode well for second-half sales. The revenue change will be in the mid-20th century. 9% The sales of the streaming-video provider are expected to be conservative in the years to come. More than $1 billion in additional revenue and potential sales growth has been found by the analysis. Advertising should support a higher average revenue per user. The CEO is also the CEO. There is a person named Lars Fruergaard. The revenue change will be in the mid-20th century. It was 16. It's a legal name. The company is called Novo Nordisk A/S. The market seems to beunderestimating the long-term sales and earnings potential of the company. Supply chain issues should be solved by the company in the next few years. A fast-track FDA approval of another related product could bring more attention to opportunities in this class of drugs. The revenue change will be in the mid-20th century. It's 1%. The French telecommunications operator is on track to deliver positive dividends in 2023, with an estimated distribution beating consensus by more than 20%. Enhancement of shareholder returns is dependent upon better cash flow. There is a pending deal with Orange's Spanish unit as well as a possible sale of its bank business. The revenue change will be in the mid-20th century. The percentage is 1%. It's a legal name. Penske automotive group As economic growth slows, the auto retailer is driving an increasingly profitable business by shifting between new and used-car sales. Decreased inventories of unsold new cars boosted profitability. Penske is moving its preowned mix towards higher-end cars, which should help push its earnings above expectations. The revenue change will be in the mid-20th century. 5% is the upper limit. It's a legal name. H.c. is the name of the doctor. The F.Porsche Aktiengesellschaft is a company. The sports-car maker had a great year. The shift to electric vehicles could make up 45% of the company's sales in five years. There are new software advances and technology partners that will help with the transition. In the meantime, all models have strong order backlogs, which helps shield them from recession risk. The revenue change will be in the mid-20th century. 34% of the population. It's a legal name. It's a company called Prudential Inc. The Asia focused life insurer lost its CEO and CFO last year and is poised for a rebound. The relaxation of Beijing's Covid Zero policy could accelerate the growth of the Hong Kong-based China business. Estimates may rise through the year. The revenue change will be in the mid-20th century. It was 16. The Spanish energy major is well positioned for the future. It has a higher percentage of sales in refined products than its peers. The analysis suggests that consensus is too conservative. The revenue change will be in the mid-20th century. The percentage is 2%. It's a legal name. The company is named Shaftesbury. The owner of retail property in London's West End is at risk of seeing the value of its portfolio decline as interest rates rise, but the market suggests a decline of 40%. The real estate investment trust is going to close in the first quarter of 2023. The areas of the capital that are benefiting from increased tourist traffic due to the weakened pound are retail areas. If a rebound comes later this year, the real estate investment trust could recover quicker than its peers. The revenue change will be in the mid-20th century. The percentage is 22%. It's a legal name. Singapore Airlines is a company The flag carrier could make more money this year than analysts think. Higher earnings should be supported by increased passenger capacity, strong travel demand, elevated cargo pricing, and lower fuel costs. A convertible bond may be redeemed if the cash flow is strong. The revenue change will be in the mid-20th century. 3% is how much it is. The smart-speaker maker faces a David-versus-Goliath patent case, but is optimistic that it will succeed in the dispute. Sonos could top consensus estimates of earnings by 20% if it secures a royalty agreement for the use of its patented wireless speaker technology. There is a chance of a large damages award. The revenue change will be in the mid-20th century. It was -11%. This European steelmaker has defensive qualities. Thanks to a streamlining of its European unit, robust margins at its niche specialty steel division and revenue exposure to heavy-plate products, it is better positioned to protect earnings than it has been in the past. The decarbonization efforts have the potential to be funded. The revenue change will be in the mid-20th century. It's 6 percent. It's a legal name. Suncorp is a group of companies. Significant dividends are expected to be paid to shareholders by the insurer. An agreement to sell its banking unit to ANZ, excess capital above regulatory requirements and a payout ratio at the high end of its range could add up to A$6 billion of distributions. This equates to 40% of the company's market cap. The revenue change will be in the mid-20th century. 9% It's a legal name. Taiwan Semiconductor Manufacturing Co. is located in Taiwan The world's largest chip maker is in a good position to weather a downturn. The analysis shows that sales will grow in the midteens for the year. The pricing power of its industry position, which includes a new generation of miniaturization and chipset packaging technology, should support its pricing power and a strong recovery as industry demand improves. The revenue change will be in the mid-20th century. It's 6 percent. It's a legal name. Universal Display Corp. is a company New adoptions of the lighting company's innovative blue-emitter technology could accelerate the commercialization of the lighting company's innovative blue-emitter technology in the years to come. The Display Week event in Los Angeles in May is expected to bring an update from SAMSUNG on its plans to integrate display technology into its phones. Revenue and earnings expectations should increase as a result. The revenue change will be in the mid-20th century. 3% is how much it is. It's a legal name. The wind systems from Vestas. The supplier of wind turbines is expected to see average annual growth of 7% over the course of the next ten years. Increased US and European policy support, as well as an accelerated offshore wind market, point toward this scenario. The case for robust operating profit potential is strengthened by falling steel prices. The revenue change will be in the mid-20th century. 3% is how much it is. Europe's infrastructure investment promises peer-beating growth and resilience for Vinci. The scenario points to a double-digit revenue increase in its concessions and energy projects, which will drive operating profit well above market expectations.