The interchange is where you'll find us. Thank you for signing up and voting for confidence after you received this. If you read this as a post on our site, you should sign up here so you can receive it in the future. I take a look at the hottest news from the last week. This will include everything from funding rounds to trends to an analysis of a particular space. My job is to stay on top of the news and make sense of it so I can keep you up to date.

I wish you a happy new year. It has been a long time since I wrote this newsletter. I haven't seen it yet.

I wanted to let you know that I hope you had a great holiday. That is not a bad thing, ours was very low-key. It took me a bit to get back to work mode this week.

On Friday, I published an article about Doorstead. There is evidence that people are interested in technology that relates to the property rental market, specifically when it comes to investing, as evidenced by the fact that the story was one of the most read on the site that day. Doorstead is more than a full-service property management company in that it guarantees the homeowners it works with a minimum amount of rent. The difference will be coughed up if it can't get the amount it promised. The company doesn't get the extra money if it gets more. Doorstead decided to only make money by charging an 8% management fee in order to align its incentives with those of the homeowners it works with. The company says it can reduce the amount of time rental properties are vacant by paying the difference. Homeowners are getting a guaranteed rental income, as well as having their properties rented out faster and making more money, according to the company's founders. Doorstead picked up the Boston assets of another venture-backed proptech, which I had covered in a previous article. I don't know what led to the winding down of the company, but I think we'll see more of it in the next few years. I mean startup acquiring assets from other startup You can listen to the EquityPodcast crew's thoughts on the model.

We published an interview I had done with GGV Capital's Hans Tung and Robin Li during the fourth quarter. GGV has $9.2 billion in assets under management and invests in startups from seed to growth stages in a variety of sectors. There are some highlights of the interview with Tung. He told me that he would rather see a startup raise a down round than not raise any money at all. It was refreshing. He gave some advice to his portfolio companies. Li gave her thoughts on why embedded financial services will remain popular.

I'm sure there were many down rounds in 2022, but I think we'll see more in 2023 as the startup community gets low on cash. There is no shame in raising a down round. Most down rounds that are announced this year reflect valuations that are more realistic and easier to defend, because valuations were over inflated.

Ryan Waliany is the CEO of Doorstead.

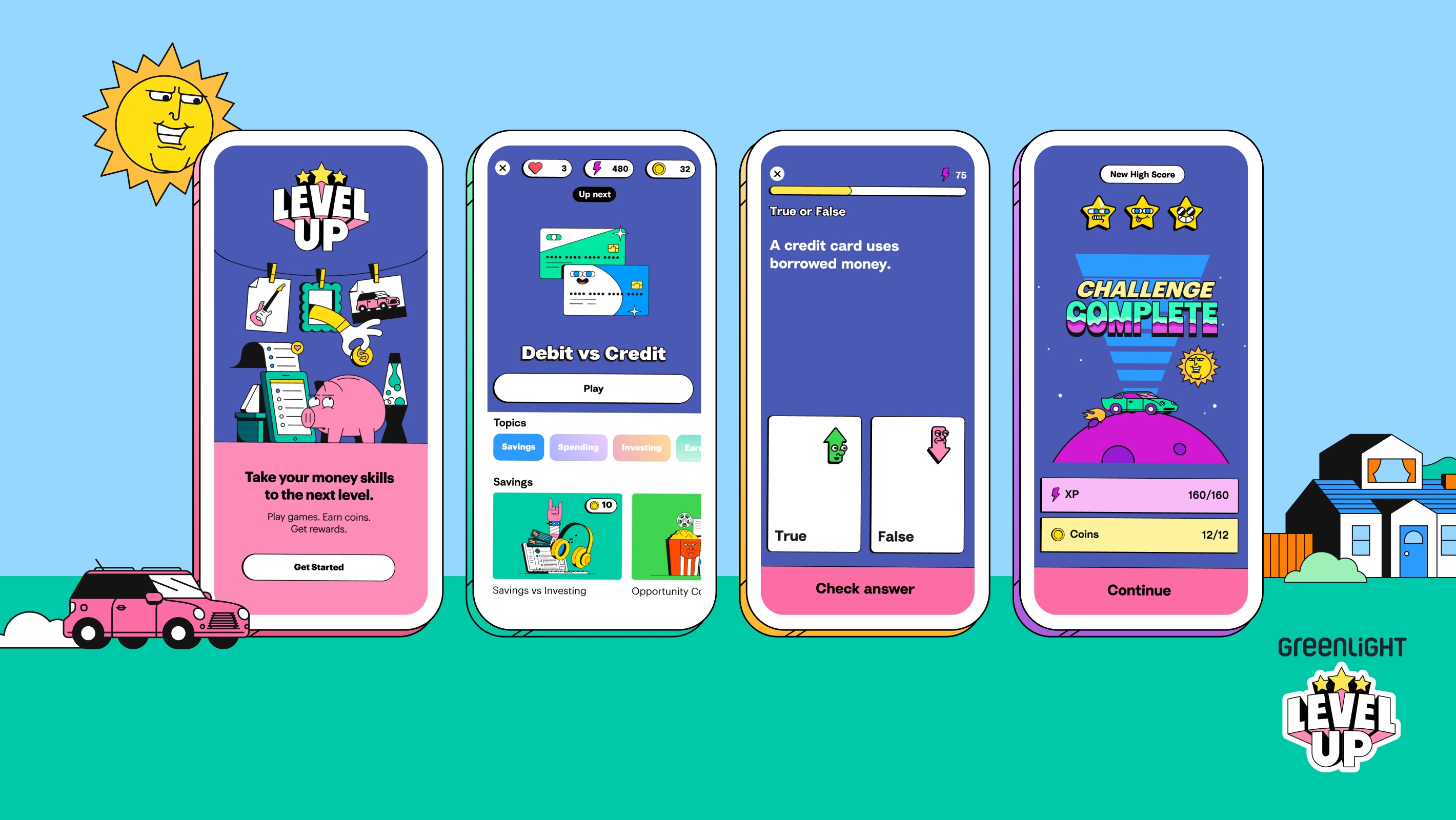

Greenlight Level Up was launched on January 6. One has to wonder why it took so long for the company to include a game in its offerings. Kids can earn virtual coins, experience points, and engage with real-life money lessons through dynamic graphics, story-driven gaming, and animations on their cell phones or tablets. Gamification of finances is a concept that has been around for a long time. Truist, one of the nation's largest financial institutions, acquired Long Game in order to appeal to a younger clientele.

There is a digital Islamic investment platform that describes itself as the world's first halal investment app. The 3.5 million residents of Muslim faith in the U.S. will now be able to receive services from Wahed, thanks to the infrastructure provided by the company. Wahed currently offers investments that are compliant with established Islamic principles and standards to US customers. They will be able to provide their customers with bank accounts and debit cards. Peter Hazlehurst wrote that he was excited to help Wahed launch banking products for their US customers. Hispanics, Blacks, Asian Americans and immigrants are some of the demographic groups that we have seen more and more fintechs cater to. Time will tell if that kind of focus will work.

The Boston-based firm, which describes itself as a female and Latinx- founded fintech, artificial intelligence, and cybersecurity venture capital firm, has achieved a first close on its third fund. The fund will prioritize investing in early growth stage startups with a focus on diverse founding teams, according to a press release. We are always here for any initiatives aimed at elevating diverse founding teams. Bank of America led the initial close with participation from other investors.

Victoria Treyger, managing director of Felicis Venture, wrote a guest post for TechCrunch, offering up her predictions and where she sees opportunities in the field of financial technology. With FedNow finally slated to launch more broadly in mid-2023, all eyes will be on opportunities around faster payments. Adoption of the Clearing House's RTP scheme has been moderate to date, but we expect FedNow's use of the existing Fed Line network to accelerate payment adoption. There will be a lot of opportunity to build the enabling modern infrastructure for use-case like payroll, insurance disbursements, supplier payments and more and at the application layer for more seamless b2b and consumer payments experiences He is still positive about the continued institutional adoption of the technology. He predicts that more banks will join theUSDF Consortium to facilitate compliant transfer of value over Blockchains via bank-minted tokenized deposit stable coins.

Mercuryo, a startup that has built a cross-border payments network, has now launched a BaaS solution, which it claims is the first of its kind. The company's goal is to make it easier for traditional banks to open virtual bank accounts for their users and to give them a way to open bank accounts that would allow their clients to store, transfer and pay in digital currency. The company's raise was covered by me.

A startup that I covered last year was named a Time Best Invention of the Year. In May of last year, Altro raised $18 million to help people build credit through recurring payment forms such as digital subscription services. I am a fan of the startup's credit-building efforts, which challenge the outdated credit score model here in the U.S.

Brex co-founder and co-CEO Henrique Dubugras joined Darrell Etherington and Becca Szkutak last week to talk about why they decided to start the corporate card company.

According to pay transparency tracker Comprehensive.io, Stripe isn't as transparent about its pay as it could be. The company doesn't include salary ranges in its job postings. A strategic account executive at Bolt can make between $374,000 and $462,000 OTE/year.

The chief executive of the Indian startup will leave later this week, as the company scrambles to steer the ship after expelling its founder for alleged misuse of company funds. There's more here.

The image is called Greenlight.

In the last few weeks, India has seen two significant raises in the world of financial technology.

The Money View is valued at $900 million.

New funding has a valuation of $700 million.

In South Korea, the valuation of the company was raised to $7 billion.

The South Korean financial super app is closing.

There are other funding deals reported on the website.

The company launched out of the blue to lend money for software.

Wine and spirits could be turned into an asset class.

It is easy to get a loan from Mexico's early-stage fintech.

Elsewhere.

Saudi start-up raises money to expand.

That is a done deal. I am not usually one for resolutions, but I am trying to start this year off on a positive note. It doesn't help to be negative or gloomy last year. There is still a lot to be thankful for. While we can't always control what happens, we can control how we respond. Thanks for reading and for supporting us. I will always be here to listen to you. Mary Ann...until next week.