There wasn't much sunshine in the forecast that predicted a global economic contraction and rough going for risk assets. A small group of optimists is breaking away from consensus and betting a soft landing can deliver market gains.

According to David Kelly, chief global strategist at JP Morgan Asset Management, the US economy will narrowly escape a recession in the next few years. Ed Yardeni, the long time stock strategist and founder of his eponymous research firm, is putting the odds of a soft landing at 60 percent because of strong economic data, resilient consumers and signs of tumbling price pressures.

It is the worst of all possible worlds according to Kelly. Inflation is coming down, the unemployment rate is low, and we are past the epidemic. Risk assets are likely to do well.

An almost 20% slump in global stocks last year has most analysts and investors cautious, with the majority predicting that historically high inflation is here to stay and a recession is inevitable. Kelly thinks the Federal Reserve will wrap up its hiking cycle after the March meeting and will start cutting rates in the fourth quarter.

Yardeni sees opportunities in financial, industrial, energy and technology stocks that are cheaper now than they were a year ago. He said that the bonds of such companies could do well in the future.

It doesn't go on forever, Yardeni said in an interview. The market has responded to inflation being more persistent and the Fed being more aggressive.

The case for optimism was strengthened by Friday's economic data. Wage gains slowed more than anticipated in the latest US jobs report. Euro-area inflation returned to single digits for the first time since August, fueling hopes that the bloc's worst ever spike in consumer prices has peaked.

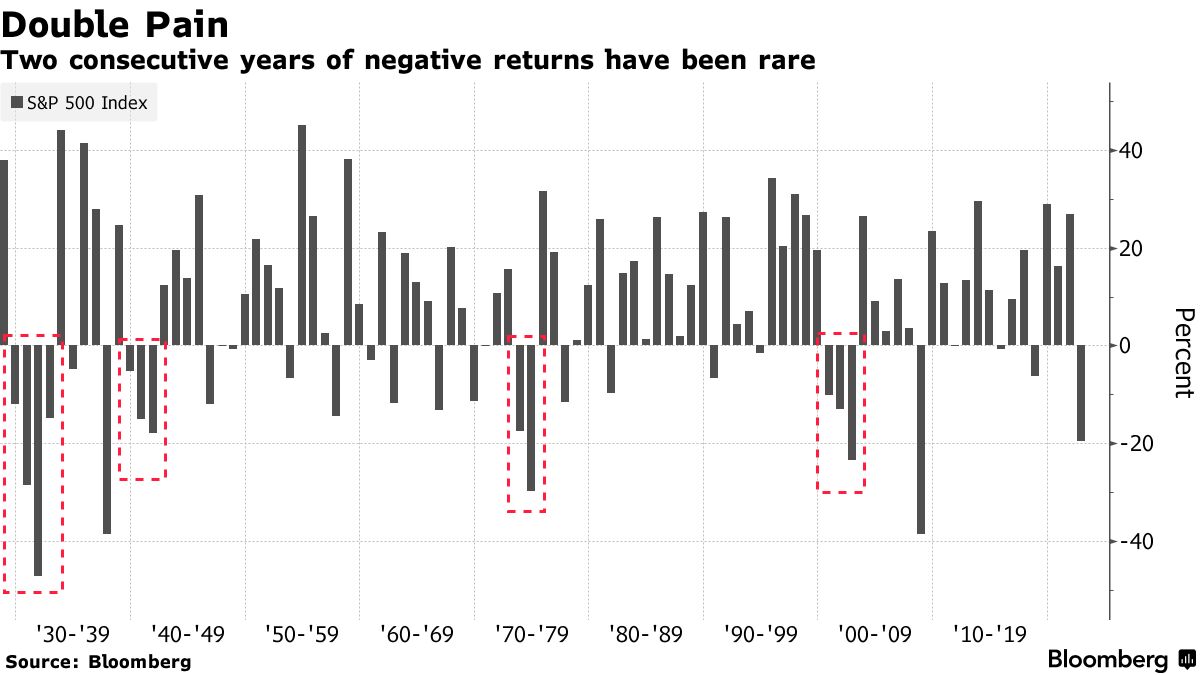

Since 1928, the S&P 500 has only had four Consecutive Down Years. The second year has always been deeper than the first with an average decline of 25%. The average forecast for the month was for a decline.

According to research from the Bespoke Investment Group, year-end targets are usually 5 percentage points off. "We don't generally do targets, just because we think they should be taken with a grain of salt." When there is a lot of agreement on anything, things don't usually play out as planned.

Since September, the gap between the swaps of high- and junk-rated companies has fallen more than 100 basis points. It points to less fear that the weakest credits will be vulnerable to default during a downturn. The measure is still above pre-pandemic levels

Kelly thinks market consensus is too pessimistic, and a Bank of America measure shows it. It looks like it will return around 16% in the next year. He says that the biggest change since last year is that prices have fallen. The average reading this century has the S&P members trading at 17 times projected profits.

Kelly made a resolution at the beginning of the year to avoid unreasonable gloom. Like a new baby, a new year should be welcomed with optimism.

Jan-Patrick Barnert and Vildana Hajric assisted.