The post has been updated to show that the credit for Platinum is $300 per year, instead of the previous $25 per month. The Platinum credit will cover the entirety of a full year's membership if you pay $300 a year for the app.

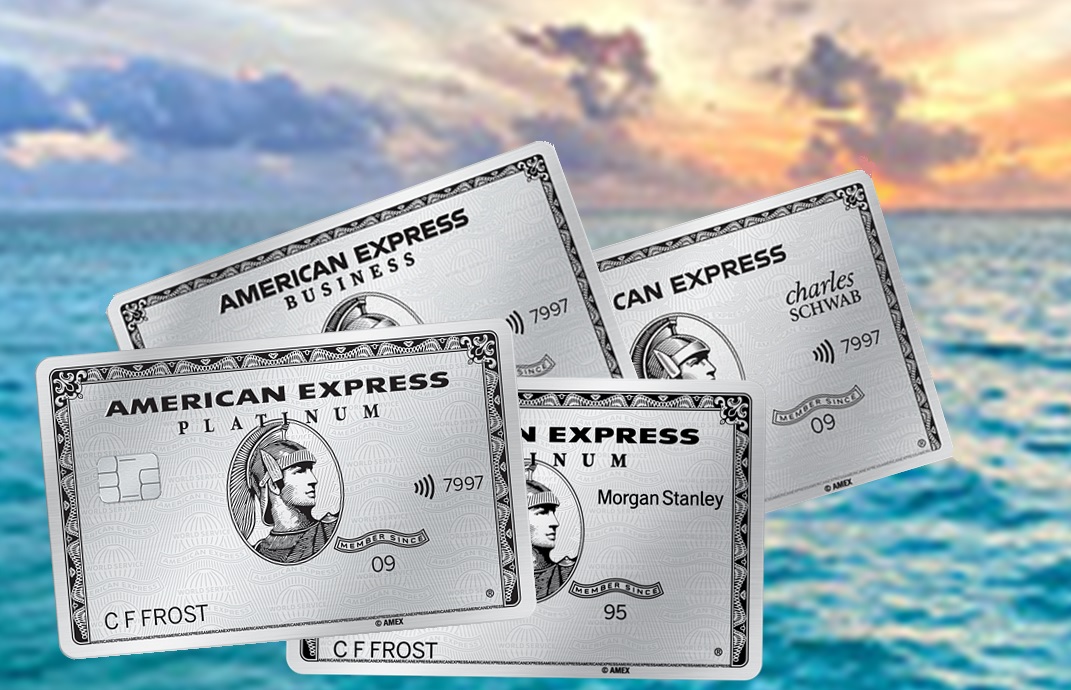

Amex Platinum cards come loaded with high end perks: Hundreds of dollars per year in various credit reimbursements, access to multiple types of airport lounges, hotel and car elite status, and much more. All of this goodness comes at a steep price:

There are several different versions of the consumer Amex Platinum card.

The business Platinum card has a variety of perks.

It is possible to give green or gold cards to authorized users for free.

Adding your friends as authorized users will allow them to get lounge access, elite status, and more.

If you add your friends as authorized users, you can give them the same access as you.

If you don't have a Morgan Stanley card, you can use 3 friends for just $175 more.

The cost of card membership is shown in this table.

| Number of Platinum Cards | Consumer Platinum | Morgan Stanley | Business Platinum |

|---|---|---|---|

| 1 (Primary Only) | $695 | $695 | $695 |

| 2 (Primary + 1 AU) | $870 | $695 | $895 |

| 3 (Primary + 2 AUs) | $870 | $870 | $1195 |

| 4 (Primary + 3 AUs) | $870 | $870 | $1495 |

A Platinum card has access to high end perks.

| Benefit | How to access or enroll | Available to Platinum Authorized users? |

|---|---|---|

| 5X points at amextravel.com: Earn 5X points for prepaid hotel and airline bookings at Amextravel.com | This benefit is automatic. | Yes. Points and bonus points are added to the primary card holder's account. |

| $200 airline fee credit: Amex will automatically reimburse up to $200 per calendar year for airline fees for your selected airline only. Eligible fees include: baggage fees, flight-change fees, in-flight food and beverage purchases, and airport lounge day passes. | Log in and go to Benefit page and click “Select a Qualifying Airline”. For tips on using this benefit, please see: Amex airline fee reimbursements. What still works? | No. Spend on authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| Airport Lounge Access - Centurion Lounges, Airspace Lounges, Escape Lounges: Cardholder plus two guests are allowed free. Beginning 2/1/23, in most cases guests will be charged $50 each (details here). | No need to enroll. Simply show your Platinum card when visiting a Centurion Lounge. | Yes |

| Airport Lounge Access - Delta SkyClubs: Cardholder is allowed free when flying Delta same day. Extra charge for guests. | No need to enroll. Simply show your Platinum card and same day boarding pass when visiting a Delta SkyClub. | Yes |

| Airport Lounge Access - Priority Pass Select Lounges: Priority Pass Select member plus two guests are allowed free entrance. Unfortunately, this membership does not include Priority Pass restaurants. | You must sign up for Priority Pass Select. Go to benefit page and click “Enroll in Priority Pass”. You will receive a membership card by mail. Present Priority Pass card and boarding pass at lounge entrance. | Yes. Each authorized user must sign up for Priority Pass Select. |

| Airport Lounge Access - select Lufthansa Lounges | Free access to Lufthansa Business Lounges (with confirmed ticket) or to Senator Lounges (with Business Class ticket) in the satellite building of Terminal 2 at Munich Airport and in Terminal 1, Departure Area B, at Frankfurt Airport. Valid only when flying Lufthansa, SWISS or Austrian Airlines. | Yes |

| Cell Phone Protection: Max $800 per claim, $50 deductible. | No need to enroll. Pay your cell phone bill with your Platinum card. | Yes |

| CLEAR credit: Get up to $189 per year reimbursed for CLEAR subscriptions. | No need to enroll. Pay for CLEAR with your Platinum card. See also: 5 ways to get CLEAR for less. | No. Spend on authorized user cards does count, but only $189 per year will be reimbursed altogether. |

| Global Entry or TSA Pre fee credit: Full reimbursement for signup fee once every 5 years, per card. Note: signup for Global Entry since that includes TSA Pre. | Sign up for Global Entry here. Pay with your Platinum card. Reimbursement should happen automatically. | Yes. Pay with the authorized user card in order to get reimbursed. Terms state “Additional Cards on eligible Consumer and Business accounts are also eligible for the $100 statement credit”. This works with no fee Green and Gold authorized user cards too. |

| Emergency Medical Transportation Assistance | Call the Premium Global Assist Hotline: 1-800-333-Amex (toll free), or 1-715-343-7977 (direct-dial collect) | Yes |

| Hilton HHonors Gold Status: Hilton Gold members receive free breakfast, room upgrades when available, and other perks at Hilton hotels. | Go to benefit page, find the Hilton HHonors Gold benefit, and click “Enroll Now”. | Yes. Authorized users may have to call Amex to enroll. |

| Marriott Gold Status: Marriott Gold members receive a points welcome gift with each stay, room upgrades when available, 2pm late checkout, and other perks (details here). | Go to benefit page, find the Marriott Gold benefit, and click “Enroll in Marriott Gold”. | Yes. Authorized users may have to call Amex to enroll. |

| International Airline Program: Save money when booking premium cabin international flights originating in the US or Canada. | Book your flight on amextravel.com. Make sure to log into your Amex account to see flight discounts. | Yes |

| Fine Hotels & Resorts: Book high-end hotels through Amex Fine Hotels & Resorts and get: room upgrade, daily breakfast for 2, 4pm late checkout, noon check-in, free wifi, and unique property amenity. Also: Earn 5X Membership Rewards for prepaid bookings. | Browse to www.americanexpressfhr.com and log into your Platinum account. | Yes |

| Preferred Hotels & Resorts Elite Status: Lifetime elite status offers perks such as extra points, welcome amenity | Click here to enroll | Yes |

| Fiesta Rewards Platinum Status | Use the Spanish language page: http://www.fiestarewards.com/inscripcion and enter code: AMEXPLATINUM | Yes |

| National Car Rental Executive status: Book midsize cars and select any car from the Executive Aisle for no extra charge. | Enroll here. | Yes |

| Hertz Rental Car Privileges: President's Circle Status, discounts, plus four hour grace period for rental car returns. | Details and enrollment form found here. | Yes |

| Cruise Benefits: Pay for your cruise with your Platinum card and receive $100 to $300 per stateroom shipboard credit plus additional amenities unique to each cruise line | Participating cruise lines and other info can be found here. | Yes |

| Premium Private Jet Program: 20% off plus one time $500 credit towards Wheels Up Connect or 40% off plus one time $2K towards Wheels Up Core memberships. | Sign up here. | Yes |

| ShopRunner: Free shipping at a number of merchants. | Sign up here. | Yes |

| Neiman Marcus In-Circle | Call 1-800-525-3355 to enroll | Yes |

| Benefit | How to access or enroll | Available to Platinum Employee Cards? |

|---|---|---|

| 1.5X points per dollar: Earn 1.5X on individual purchases of $5000 or more; and on select categories: Construction material & hardware, Electronic goods retailers and software & cloud system providers, and Shipping providers | Automatic | Yes. Points and bonus points are added to the primary card holder's account. |

| $400 in Dell Credits: Up to $200 in credits each year from January through June; and another $200 July through December. | Go to benefit page to enroll. | No. Employee cards do not receive their own Dell credits. |

| $120 in Wireless Credits: Up to $10 per month when you use your card to pay for wireless telephone service. | Go to benefit page to enroll. | No. Employee cards do not receive their own wireless credits. |

| $360 in Indeed Credits: Up to $90 per quarter for purchases with Indeed | Go to benefit page to enroll. | No. Employee cards do not receive their own Indeed credits. |

| $150 Adobe Credits: Up to $150 per year on annual prepaid plans for Creative Cloud for teams and Acrobat Pro DC with e-sign for teams | Go to benefit page to enroll. | No. Employee cards do not receive their own Adobe credits. |

| 35% points rebate on airfare: Pay with points for airfare on your selected airline or for business or first class with any airline and get 35% of your points back. | Book flights through AmexTravel.com and select to pay with points. | No. |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| $200 in Uber / Uber Eats Credits: Amex will reimburse $15 per month ($35 in December) for Uber charges. You will also get Uber VIP status. | Add your Platinum card number to your Uber account as a payment method. You do not have to pay with the Platinum card in order to get this benefit. Important: when requesting a ride, select Uber Cash for payment in order to use your credits. | No. Authorized user cards do not receive their own $200 in Uber credits or VIP status. |

| $200 Hotel Credit: Get $200 back per calendar year towards prepaid Fine Hotels + Resorts or The Hotel Collection bookings | No need to enroll. Book through Amex Travel and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $200 per year will be reimbursed altogether. |

| $240 Digital Entertainment Credit: Up to $20 per month rebate for select digital entertainment services (Audible, Disney+, The Disney Bundle, ESPN+, Hulu, Peacock, SiriusXM, and The New York Times ) | Enroll here. Enroll in any of the listed services and pay with your Platinum card. | No. Spend on Authorized user cards does count, but only $20 per month will be reimbursed altogether. |

| $100 in Saks Fifth Avenue Credits: Up to $50 in credits each year from January through June; and another $50 July through December. | Enroll here. Pay with your consumer Platinum card at Saks Fifth Avenue online or at locations in the US and US Territories. | No. Spend on Authorized user cards does count, but only $50 per 6 months will be reimbursed altogether. |

| Free Walmart+ Subscription: Get back the full cost, including taxes, for a Walmart+ monthly subscription. | No need to enroll. Use your Platinum card to pay for a monthly Walmart+ subscription. | No. You can use an Authorized user card to pay, but you won't get more than one credit per month. |

| $300 Equinox Credit: Get $300 back per year for a digital or club membership at Equinox. There is a yearly option for Equinox+ (the app) membership that is $300 annually. | Enroll here. Use your Platinum card to pay for a digital or club membership at Equinox. | No. Spend on Authorized user cards does count, but only $300 will be reimbursed altogether. |

| $300 SoulCycle Rebate: Charge the full price of a SoulCycle at-home bike and get $300 back. | Must join Equinox first (see above) | Sort of: Each Platinum account can get $300 back on each of 15 bikes purchased per year. |

| 5X points on flights booked directly with airlines. With business cards you must book through Amex Travel to get 5X. | Automatic benefit | Yes. Points and bonus points are added to the primary card holder's account. |

| Active Military Fee Waiver: Amex will waive consumer card fees (including annual fees) for US active military personnel. | Call the number of the back of your card and tell them you are serving on active duty military and had heard that AMEX offers to handle your account in accordance with the Military Lending Act (MLA) | Yes (primary user must call and can get fees waived for additional cardholders) |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| First authorized user free: Add one Platinum authorized user for free. Add up to 3 more for $175. | Simply add an authorized user to your account | N/A |

| Invest with rewards: Liquidate Membership Rewards points for 1 cent each when deposited to your Morgan Stanley brokerage account. | Log into your account to redeem points to your brokerage account. | No. |

| $500 anniversary spend award: Spend $100K in a cardmember year to get $500. If you spend exactly $100K per year, that amounts to a bonus of half of 1 cent per dollar spent. | This benefit is automatic | Not really. Authorized user card spend does contribute towards the required $100K spend, but authorized users do not get their own $500. |

| $695 Annual Engagement Bonus: Platinum CashPlus clients can get a $695 Annual Engagement Bonus. | Details here: Morgan Stanley Platinum Card Fee Free (how to earn the Annual Engagement Bonus) | No |

| Benefit | How to access or enroll | Available to Platinum Authorized Users? |

|---|---|---|

| Invest with Rewards: Liquidate Membership Rewards points for 1.1 cents each when deposited to your eligible Schwab account. | Log into your account to redeem points to your Schwab account. | No. |

| $100 to $200 statement credit | Receive a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000, when measured following Card account approval and annually thereafter. | No. |

Consumer vs. business should be your first point of contact.

Consider these decision points if you decide that a consumer card is right for you.

It makes sense to sign up for a Platinum card if you can use some of the perks, and if you can meet the minimum spend requirements.

The Platinum card is available to anyone with decent credit.

You need a business to apply for business credit cards. Even if you don't know it, you have a business. If you want to sign up for a business credit card, you have to have a business. It's normal for people to have businesses. You have a business if you sell items at a yard sale or on eBay. In any of these cases, your business is considered a sole proprietor. If you apply for a business credit card as a sole proprietor, you can use your own name, address, and phone number, as well as your tax ID and EIN. You can get a tax ID for free through this website. Business cards can be used for personal expenses. People use business cards for personal expenses. Most business card applications say that you should only use the card for business purposes. Business cards do not have the same protections as consumer credit cards. If you don't want to use the card for personal expenses, don't use it.

Click the offer you are interested in for more information, and then click through to the application page.

Application status can be checked after you apply.

If denied, call for a second opinion.

Membership rewards points can be earned through Amex credit card welcome bonuses.

If you have had that card before, you can't get the bonus. It is possible to get a bonus for all versions of the same card. There are 8 ways to get the best welcome bonuses.

The best Membership rewards welcome offers can be found below.

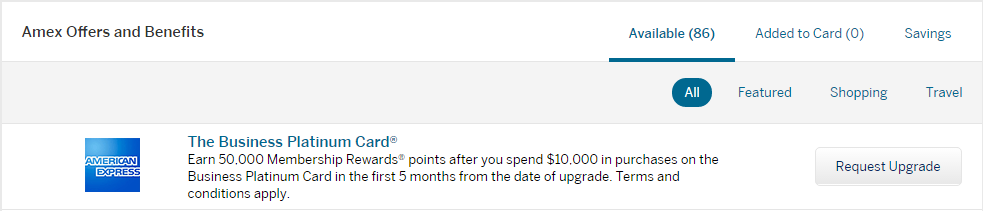

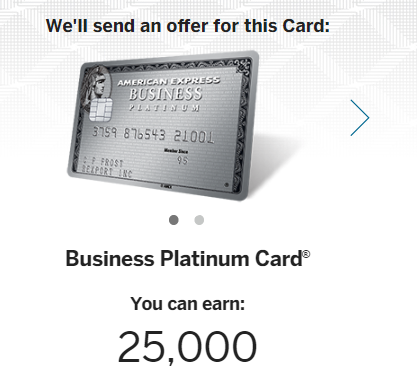

If you upgrade from the Business Gold rewards card to the Business Platinum card you will get 50,000 bonus points.

When your second year annual fee arrives, you can try to get a lower priced Green card.

If you spend a lot through your business, the Blue Business Plus Credit Card is a great option.

When the card is used for 30 or more transactions, the card gets a 50% bonus.

The Business Gold Card gives 4X on the two categories where your business spends the most each billing cycle. 4X applies to the first $150,000 in combined purchases, 1X point per dollar thereafter and on other purchases. The terms are applicable.

If you want to keep your friends, you need to make sure that the offer they get is as good as the public one.

Check your account to see if there are any special referral offers.

You can now refer friends to other cards even if you don't have a card.

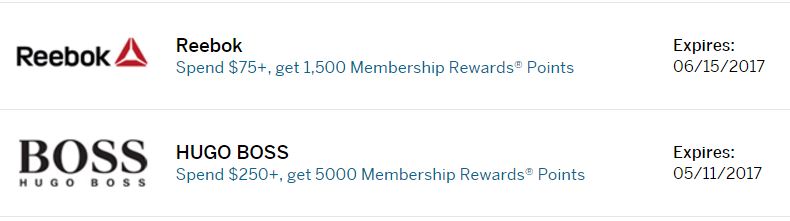

Amex offers can be great for point earning. One for Hugo Boss is to spend $250 or more and get 5000 points.

Amex offers can be more like a new category bonus.

The section titled "Amex offers and benefits" can be found in your account.

Amex gives businesses the ability to earn 1 Membership Rewards point for every $30 of foreign wire payments, and you can even get a welcome bonus offer.

Membership rewards points can be used to redeem for merchandise or gift cards. You can redeem points for flights, transfer points to hotel or airline partners, or invest rewards. Below you'll find more on each.

Transferring Membership rewards points to airline and hotel partners is the best way to book high value awards. Wait until you find a great award before you transfer points. It is possible to transfer points if you are confident that you will use them for good value.

There are some great ways to use points transferred to airline miles.

The table will be updated automatically when new offers are found.

| Transfer Bonus Details | End Date |

Points can be transferred from one account to another.

Membership rewards can be transferred to foreign airlines. Thecise tax offset fee is charged for transfers to US airlines. The airlines that are subject to this fee are listed below.

Points can be redeemed for gift cards. Most of the time, with this approach, you will get 1 cent per point value.

Some merchants can be paid directly with points. Don't do this These options aren't worth much. If someone hacks into your Amazon account, they could spend your Ultimate rewards points, which could cause you a problem in getting your points back.

Amex automatically pools all of your points together. When you earn points with different cards, the point total shown when viewing either card is the total across cards. Unlike Chase and Citibank, Amex doesn’t allow members to move points from one person’s account to another. That said, it is possible to transfer one person’s points to another person’s loyalty program account. The key is that the person who receives the points must be an authorized user or employee on the other person’s account. For example, my wife can transfer Membership Rewards points to my Virgin Atlantic account as long as I’m an authorized user (or employee) on any of her Membership Rewards cards. An authorized user card must be active for 90 days before it will unlock the ability to transfer your points to the authorized user’s loyalty program account. Thankfully, it is very easy to keep Amex Membership Rewards points alive. Simply keep any Membership Rewards card open. For example, if you are about to close your one and only Membership Rewards card, then open another Membership Rewards card account first in order to preserve your points. Amex offers some no-fee Membership Rewards cards, such as the Blue Business Plus and the Amex Everyday, so this shouldn't be much of a burden.It can be difficult to decide if you should keep the card or not.

Clicking through any of the links will reveal more information.

| Card Offer and Details |

|---|

| The Business Platinum Card® from American Express The card is loaded with perks. Those perks might be worth more than the annual fee. The Amex pay over time card has a card type. 1.5X points per dollar on eligible purchases of $5,000 or more, 1.5x on US construction/hardware stores, 1.5x on US electronic goods, and 1.5x on US shipping are included. Up to $200 a year in statement credits for airline ancillary fees, and up to $200 a year in statement credits for Dell purchases. You have to enroll for certain benefits. Amex Platinum Guide is another one. |

| The Platinum Card® from American Express The card is loaded with perks. Those perks might be worth more than the annual fee. The Amex pay over time card has a card type. 5X points are earned for flights booked directly with airlines or with American Express Travel, and 5X points for hotels booked through American Express Travel. The airline fee credit is worth $200. Up to $200 a year in baggage fees and more at one of the airlines. If you are a Basic Member you will get a $300 credit when you buy a SoulCycle bike directly from the studio. The rates and fees are applied. Amex Platinum Guide is another one. |

| The Platinum Card® from American Express Exclusively for Morgan Stanley When you need two cards, this is the best of the Amex Platinum cards because Morgan Stanley gives one free authorized user. You must have a Morgan Stanley account to apply. The Amex pay over time card has a card type. You can earn 5X points for flights booked directly with airlines or with American Express Travel. $500 is the big spend bonus after a hundred thousand dollars. All of the great perks that come with the American Express Platinum Card are included, as well as a free authorized user. Amex Platinum Guide is another one. |

| The Platinum Card® from American Express for Schwab The Amex pay over time card has a card type. You can earn 5X points for flights booked directly with airlines or through American Express Travel. All of the great perks that come with the American Express Platinum Card are included. There is a $100 credit with holdings of $250,000+ or $200 credit with holdings of $1,000,000+ on approval. Amex Platinum Guide is another one. |