The Nascar Cup Series race in November had a debate about the future of the auto industry. The plane carrying the banner flew past Phoenix Raceway. Plug in and drive. Do you want to be dull? It's a good idea to drive Toyota.

An open letter to the chief executive officer of the world's largest carmaker from groups including Public Citizen criticized its slow roll out of electric vehicles. The surging consumer demand for battery electric vehicles has not been met by Toyota. Toyota can and must shift quickly to electric vehicles.

Toyota Motor Corp. and other Japanese carmakers are at risk of losing their leading position if they don't shift to EV fast enough.

These storied brands are lagging behind as the auto industry undergoes its biggest transformation in a generation.

China's BYD Co. and Germany's Volkswagen AG are among the companies that make electric vehicles. The auto industry's fastest-growing sector is leaving Japanese carmakers on the sideline.

The BYD has had a year of rapid growth.

Colin said that the Japanese were missing out on a material part of the industry.

More than a third of new car sales in the US and dominating markets from Southeast Asia to Africa are accounted for by Japan's biggest auto brands.

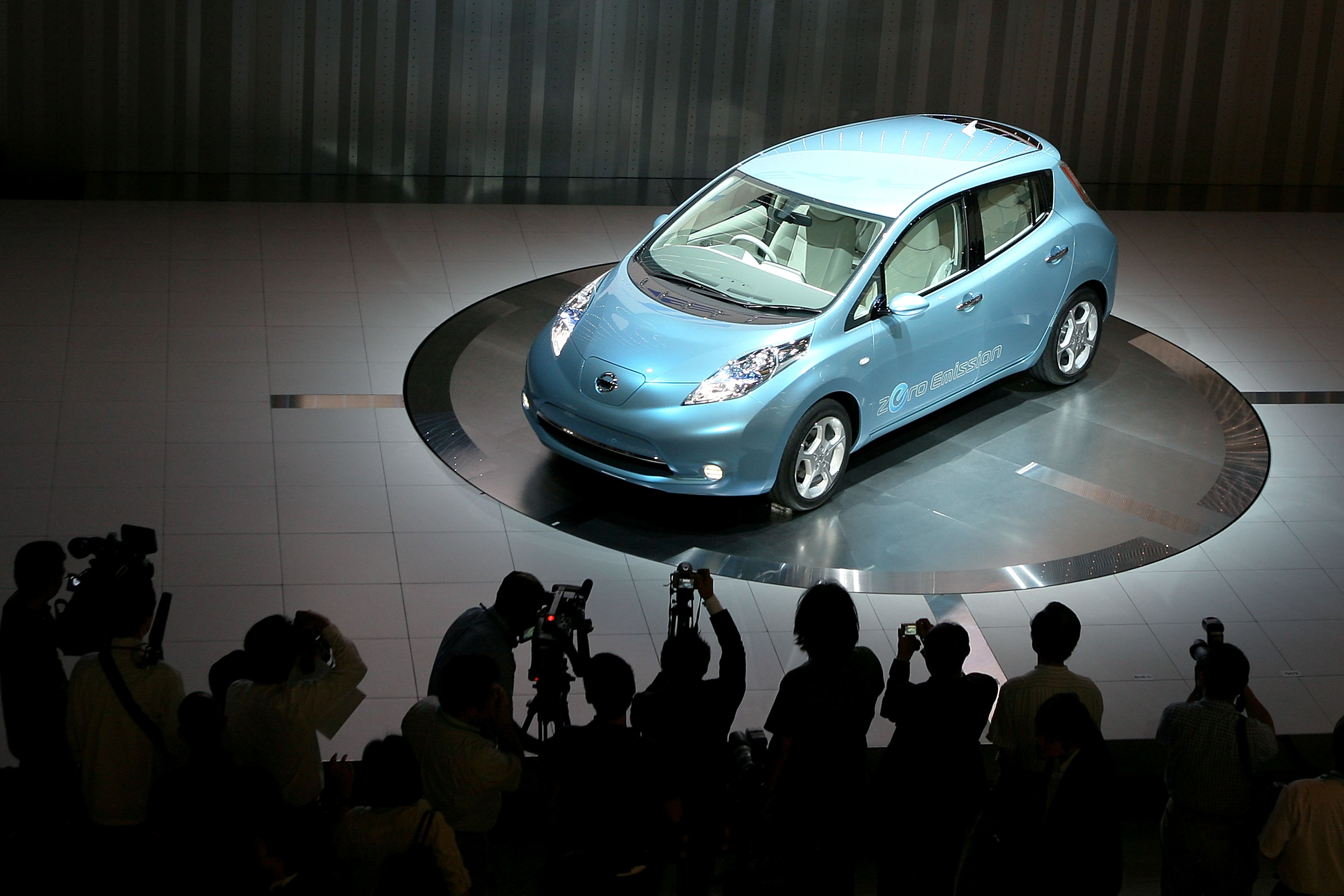

Their omission from the EV segment is baffling because of their early start with eco-friendly vehicles, including Toyota's Prius, the mass-market hybrid launched a quarter of a century ago and one time top pick of Hollywood stars seeking green credentials. The Nissan Leaf is a pioneer in mass-market EV. The same year, Toyota invested in the company.

The enthusiasm over the early EV models faded quickly. Japanese carmakers focused on gasoline-electric hybrid and cooperated with the ambitions of Tokyo technocrats to develop hydrogen fuel-cell vehicles, a technology with potential to be even better than EV.

The media would like us to believe that battery-electric vehicles will take longer than they actually will. The company wants to reduce CO2 emissions but doesn't want to limit its focus to all- battery cars.

In an age where we don't know what the correct answer is, it's hard to make everyone happy with only one option.

Even with high gasoline prices and government incentives, Japan's automakers have little to offer people who want to avoid gasoline-powered cars.

Toyota stopped sales of the bZ4X electric SUV in June because of a defect that could cause the wheels to fall off. In a limited amount, sales have resumed.

There are electric car ratings.

The Nissan Leaf was designed by Masato Inoue, who is now a professor at the Istituto Europeo di Design in Italy. It might be too late.

The former Nissan Chairman and early champion of the Leaf agreed.

He said Nissan lost its early-mover advantage. Investment announcements are too late.

While such criticism is expected from the man who was arrested on charges of financial malfeasance at Nissan and is currently living in Lebanon, he is not the only one who is pessimistic.

Critics worry that the decline of Japan's consumer electronics industries is similar to the decline of the auto industry. They were caught flatfooted by major disruptions such as Apple Inc.'s iPhone and failed to innovate their way out of commoditization.

Shingo Ide, chief equity strategist at the NLI Research Institute, said that Japanese automakers looked like they were already left behind and couldn't take a lead position.

By the third quarter of 2022, their share of the US passenger vehicle market had fallen to 32% from 34% in the second quarter of the same year.

Toyota was the top seller in the US last year, but the Japanese company saw its US sales fall in the years to come.

According to a report published in late November, Toyota and Honda have been unable to keep their internal combustion owners loyal until their own brands start to participate more in the EV transition.

In Germany, the UK and China, more than 20% of new cars were electric in the first three quarters of the year. The Tax Cuts and Jobs Act signed into law in August will likely lead to a jump in demand for electric vehicles. Companies announced almost $28 billion of investment in EV-related manufacturing by the end of the year.

The analysts wrote that Toyota had miscalculated in its EV strategy.

The country's trade ministry believes that hydrogen is the key to achieving net- zero emissions by the year 2050. In June of this year, the government said that all cars should be electric-powered by the year 2035.

Japan's automakers and government leaders have been reluctant to push for a pivot to all-electric for fear it would cannibalize existing car sales. EV's don't need as many parts as traditional cars.

One of the most important industries in Japan is auto production, accounting for 20% of manufacturing and 8% of employment according to a report by the Climate Group. Around a third of Toyota's global output is made in Japan, and the company has promised to keep it that way.

The expert director of financial services company Monex Group said that with an electric vehicle, half of Nagoya became unemployed.

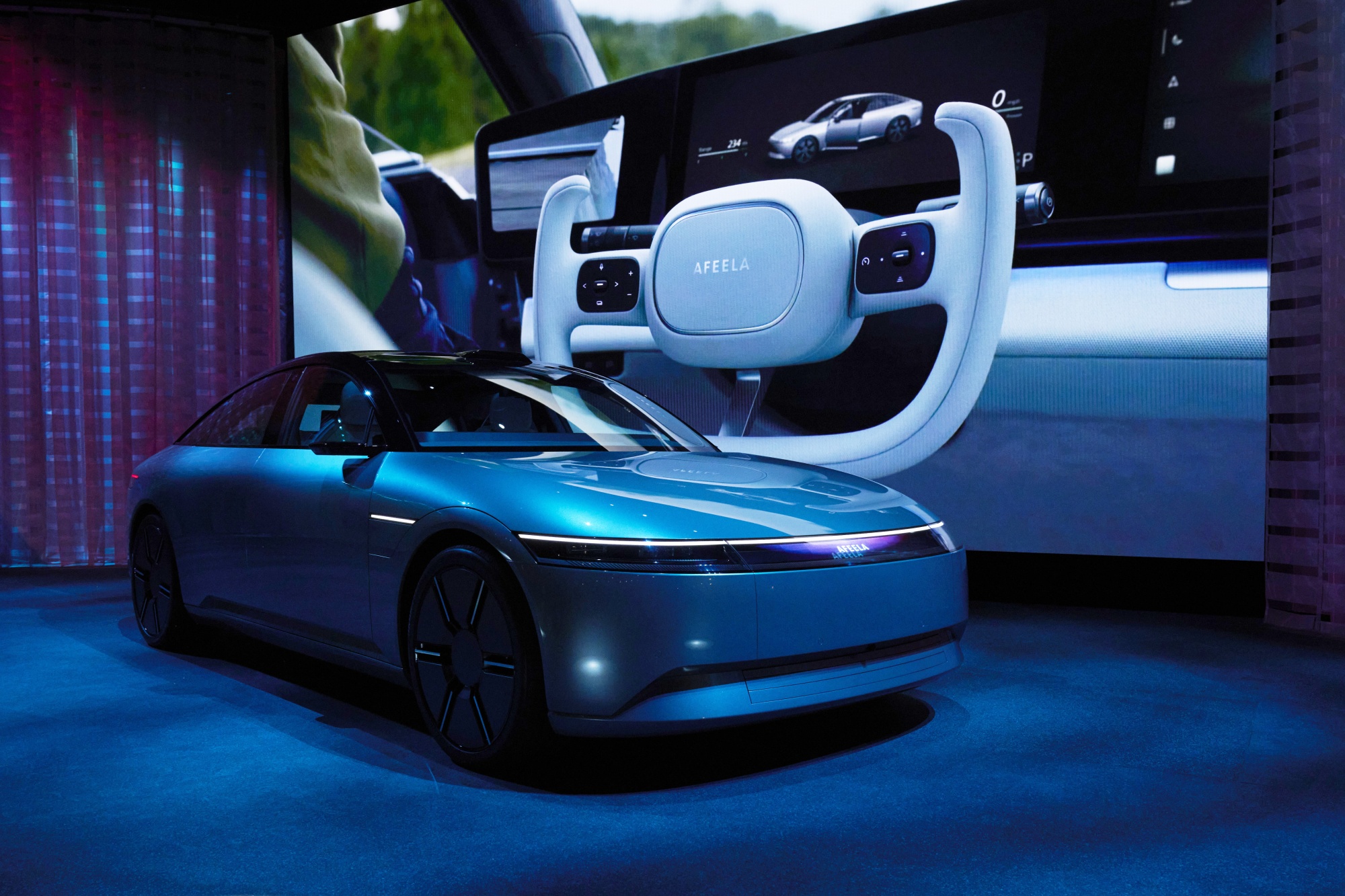

Realizing that electric vehicles are no longer the niche product they once were, Japanese companies are now stepping up investment projects.

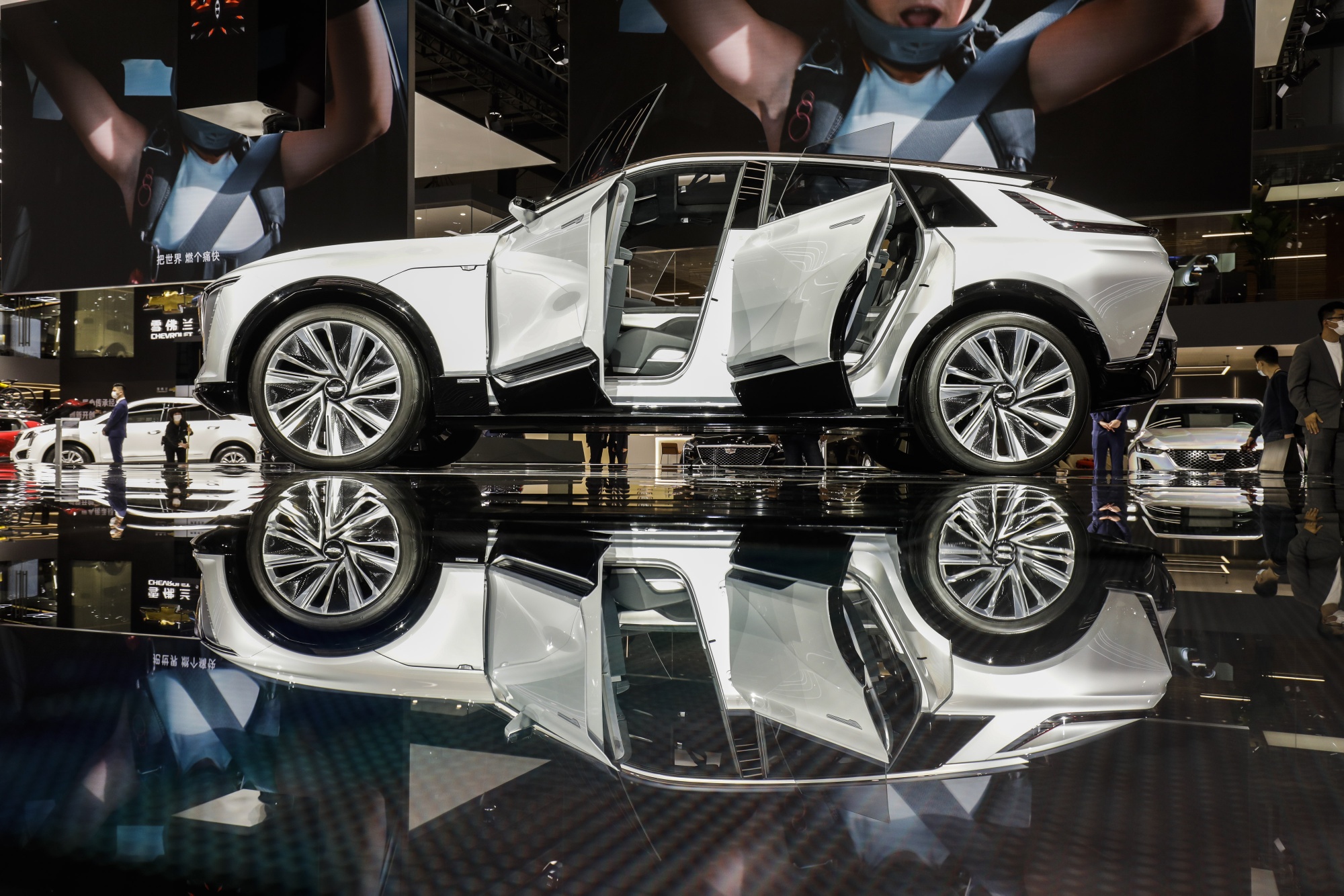

Rivals are also using EV's. According to John Murphy of Bank of America, GM may surpassTesla in EV sales in 25 years. The Chevrolet Bolt is one of the vehicles that GM expects to launch this year.

The lack of charging infrastructure in the developing world is one of the reasons why all-battery cars are too expensive. According to a Kelley Blue Book report, the average EV price in the US was about $65,000, compared to over $50,000 for all new vehicles.

Many countries lack the charging infrastructure to sustain the EV boom, so a mix of EV, plug-in hybrid, and hydrogen powered vehicles is the most realistic option in those markets.

For customers without easy access to charging infrastructure, HEVs and PHEVs are the best way to lower their carbon footprint. It's the best way to reduce net carbon emissions as quickly as possible.

Many advantages accrued during their years at the top of the heap are still retained by Japan's top auto manufacturers. They boast powerful brands as well as distribution and service networks which EV newcomers can't match. Chinese competitors like BYD are not well known in many countries.

The executive analyst with Cox automotive said that she wouldn't count them out. They will continue to be in the game.

Analysts say it will be difficult for the Japanese to catch up as the competition around EV is different. With their late start, the companies are missing out on the chance to get to know their EV suppliers and customers before their rivals do.

He said that even if you have all the resources and ability of Toyota, you still have to go through a learning curve. The other auto manufacturers are ahead of you because they are doing it now.