A staff level funding agreement with the International Monetary Fund may have caused the cedi to rally, easing price pressures that have plagued industry for more than a year.

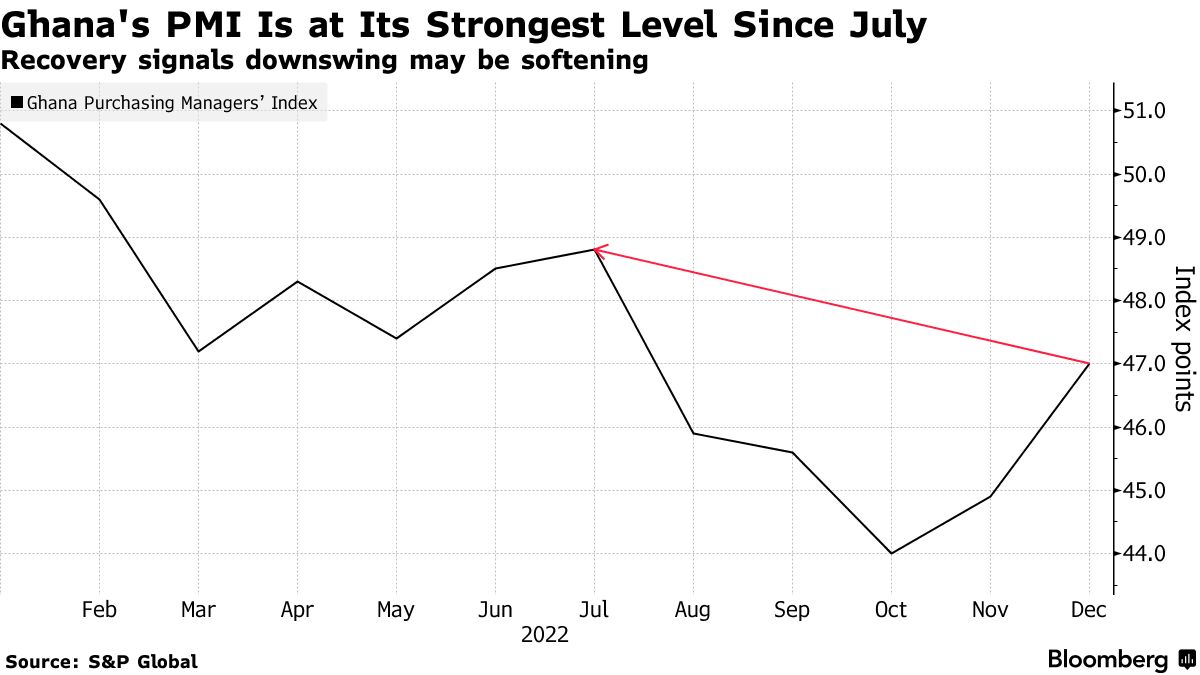

The private sector economy inched up to 47 in December from 44.9 in November but remained below the 50 mark that separates growth from contraction for a 11th straight month.

According to Andrew Harker, economics director at S&P Global Market Intelligence, there were some signs that the worst of the current downturn may have passed.

According to the statement, survey participants' optimism rose sharply over the month, reaching the highest levels in more than a year. More than 75% of respondents said they were positive about output over the course of the year.

After investor concerns about ballooning government debt led to a selloff of government bonds that effectively locked the country out of global capital markets, the country asked the International Monetary Fund for help.

The West African nation secured a $3 billion loan from the International Monetary Fund on December 12th. That caused the cedi to appreciate 41% against the dollar last month and trimmed its losses to 39% by the year's end, providing some respite for firms trying to secure new business.

The rate of inflation in November was quintuple the ceiling of the central bank, making it the seventh- highest rate in the world. Consumer spending has been adversely affected by high inflation.

The S&P Global Market Intelligence predicts that the economy will expand at a slower rate in the next few years.