China's economy has been hit by covid. Australian house prices have dropped the most in five years. Dozens of Russian troops were killed. Today is what you need to know.

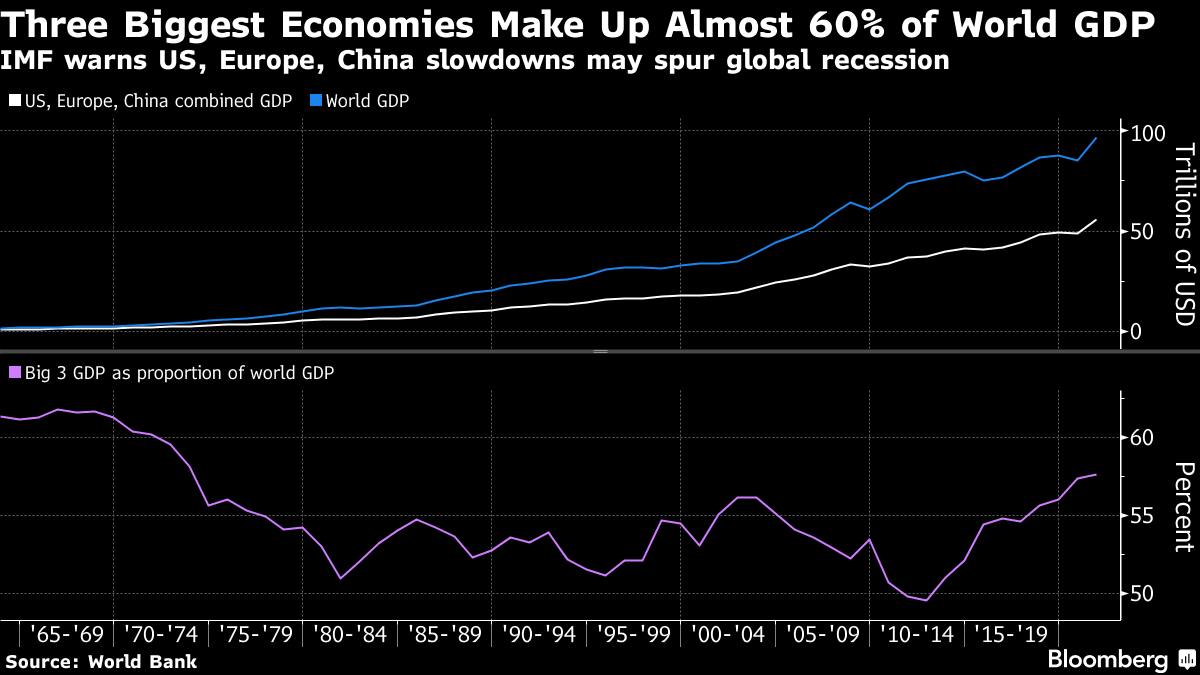

China's economy ended the year in a major slump, with business and consumer spending plunging in December. The manufacturing decline worsened last month, while activity in the services sector fell the most in more than a year. Kristalina Georgieva, the head of the International Monetary Fund, warned that one third of the world would be in a recession in the next five years.

Australia's housing market suffered its biggest annual decline since 2008 last year due to interest rate hikes. The value of the national home fell. In Sydney, prices fell 12.1%, followed by an 8.1% drop. Values could fall further in the early months of 2020.

The Bank of Japan's efforts to depress yields on government debt helped the Japanese currency strengthen towards its highest level in six months. South Korea's shares fell on Monday. Last year, the value of global stocks was wiped out by sharp swings.

Despite offering hefty incentives in China and the US,Tesla did not deliver as many vehicles as analysts expected. The company handed over a record number of vehicles in the last three months, but the number fell short of expectations. The company's market value of $389 billion makes it more valuable than Ford and Toyota combined, even though the company's stock price has plummeted.

Russia's defense ministry said 63 troops were killed in a Ukrainian strike on a Russian military facility in the east of the country. It is one of the biggest losses acknowledged by Moscow. Ukrainian President Volodymyr Zelenskiy warned that Russia is planning a lengthy attack on his country to exhaustion. The war in Ukraine is covered here.

The year that just passed delivered double-digit losses for both global equities and bonds, and investors are hoping for a better year in the future. Kristalina is the Managing Director of the International Monetary Fund. She reiterated the Fund's projection that a world recession is possible, as she highlighted expectations that the US, Europe and China will all fall.

Brighter times for bonds then? They are likely to face both inflation and excess supply of debt from slowing economies and central banks trimming balance sheets. We have a good chance of getting a better outcome than 2022. It might take a bit more time to get the investment environment back to normal.

Garfield Reynolds is based in Australia.

Garfield Clinton Reynolds helped with the project.