If you open a business checking account that doesn't have any fees, you can earn 60,000 Amex Membership rewards points. I was pleasantly surprised by how easy it was to open an account, so I will share my experience below.

This is the last chance to open an account and earn the bonus, as the offer will end on January 3, 2023.

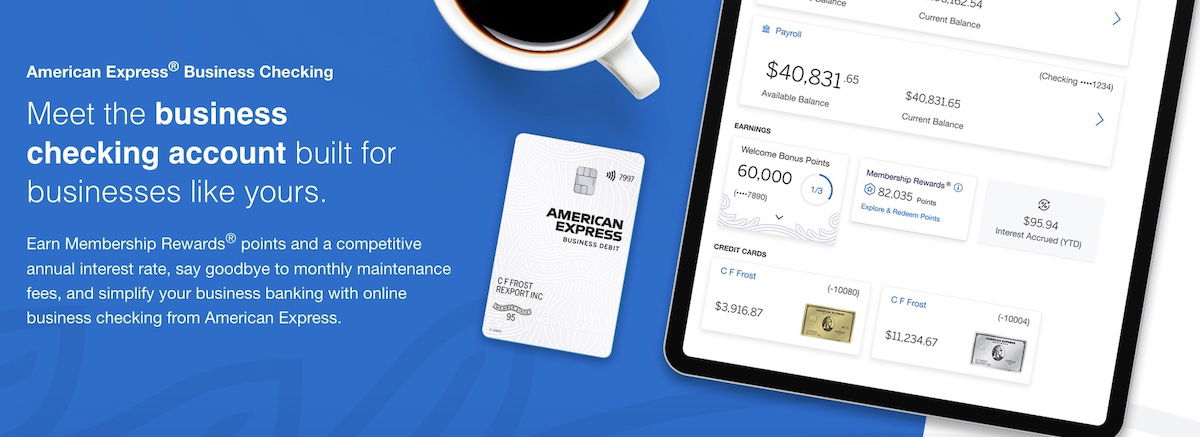

Amex has a business checking account idea. The basics of how this works are listed here.

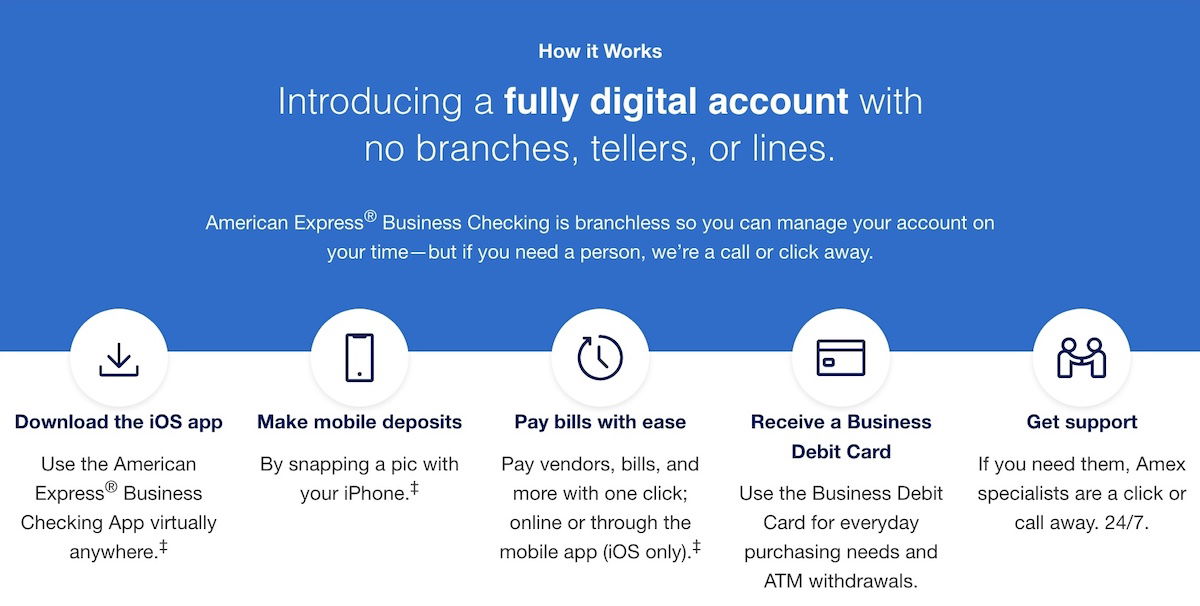

This is a good business checking account if you want to self-service your account. Amex isn't a traditional bank and doesn't have branches, but for a lot of us that's not an issue.

You do need to have a business in order to open one of these accounts.

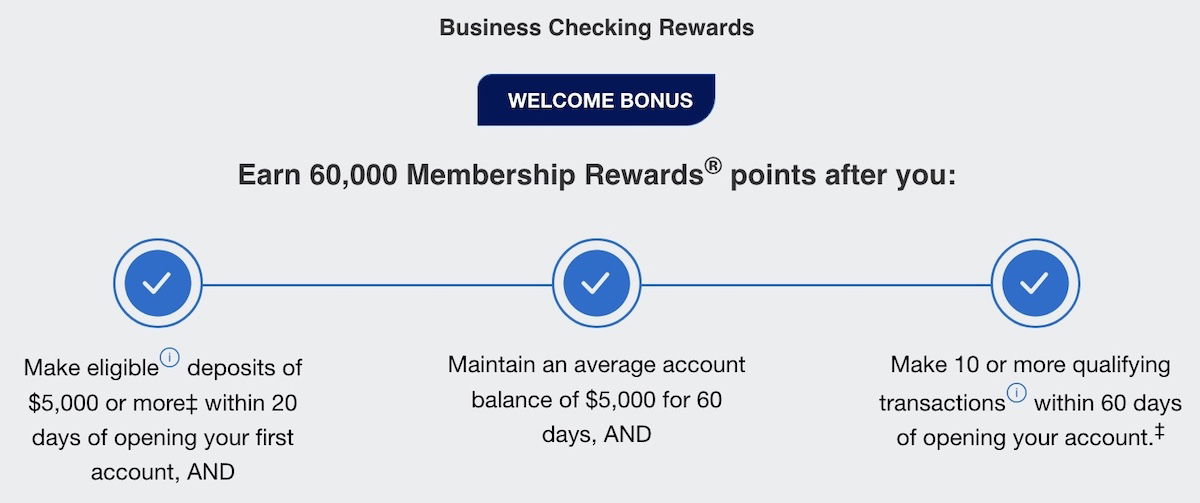

Right now, there is a great incentive to apply for a business checking account. You can earn 60,000 Amex Membership rewards points if you apply by January 3. This bonus needs to be earned in order.

For those who don't know what a qualification transaction is.

It seems like those requirements are easy to complete. Debit card transactions don't count towards the requirement, but electronic transfers from other accounts do, and should be easy to do.

I opened an Amex Business Checking account for my business so I could report back on my experience. The process was very easy for me.

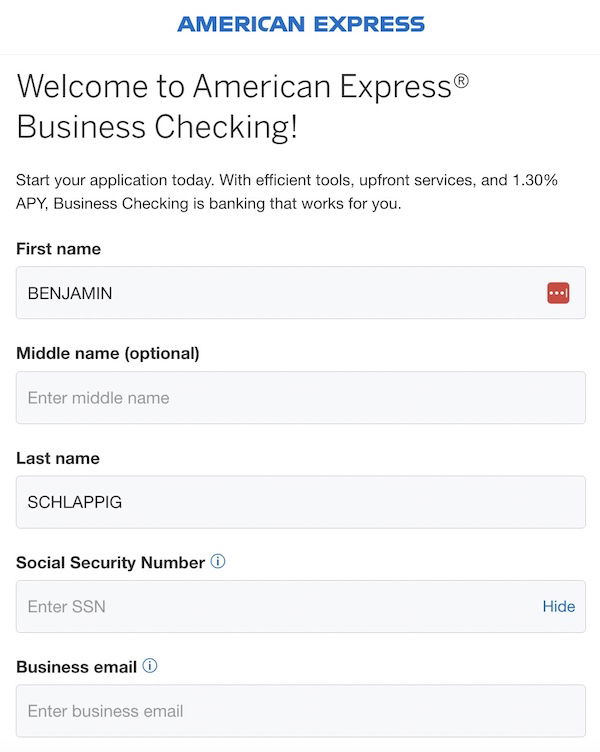

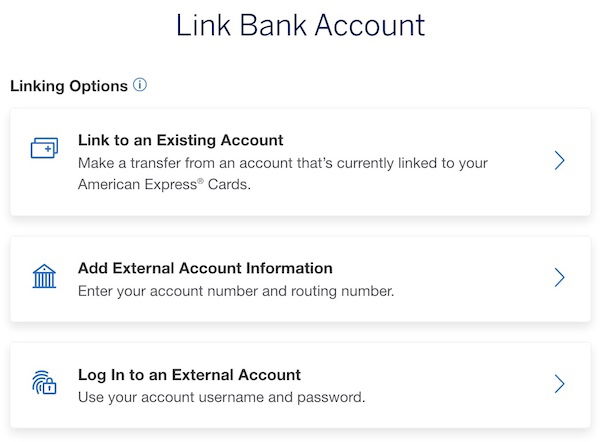

Most of your information will be pre-populated if you already have an Amex account. You don't have to enter that information manually if you link any existing bank accounts.

First, you need to log-in with your existing Amex credentials.

You can begin your application by selecting which account you want to pull information from. One of my business cards was chosen by me.

A lot of the information is pre-populated, but you have to enter some things.

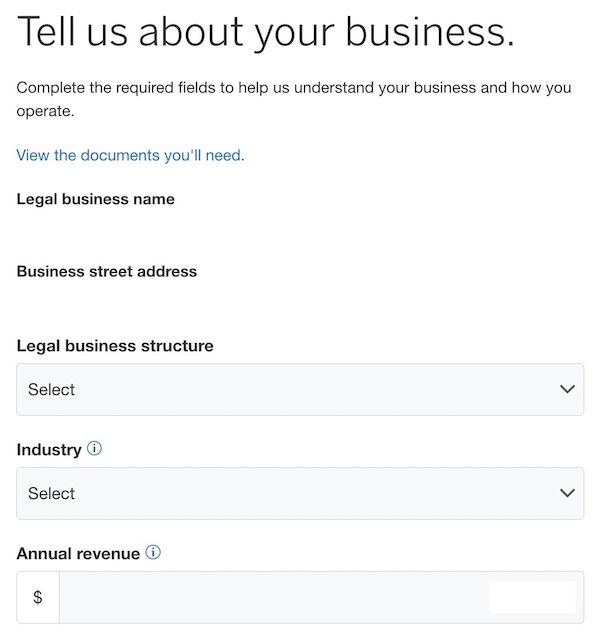

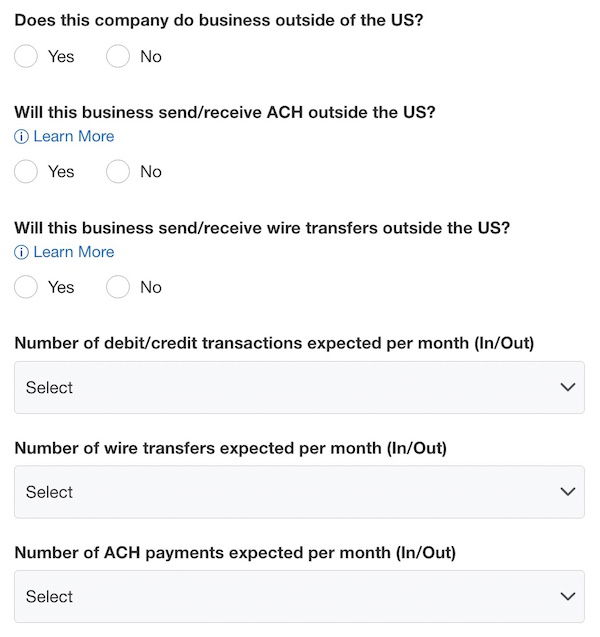

You have to answer a bunch of questions about your business.

I was approved immediately after I submitted my application. It was not something I was asked for during my application process.

My bank account could be linked. It was easy to link the business checking account with my Amex business cards.

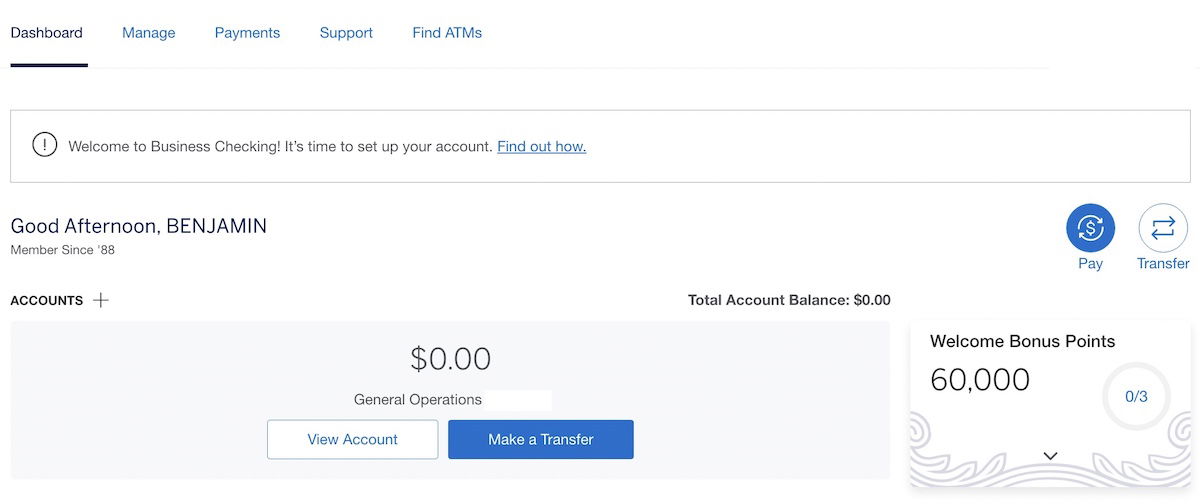

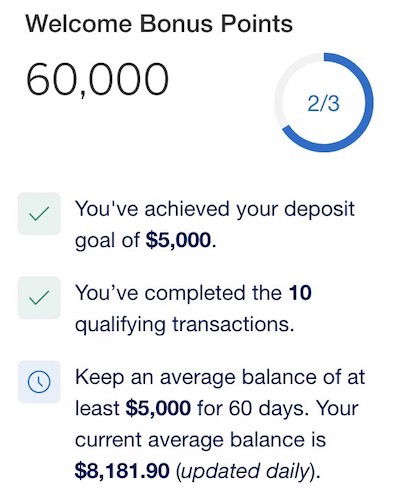

I like the dashboard of the business checking account. It's easy to use and it's integrated into your Amex account. There is a tracker on your dashboard that shows how you are doing in order to earn the welcome bonus.

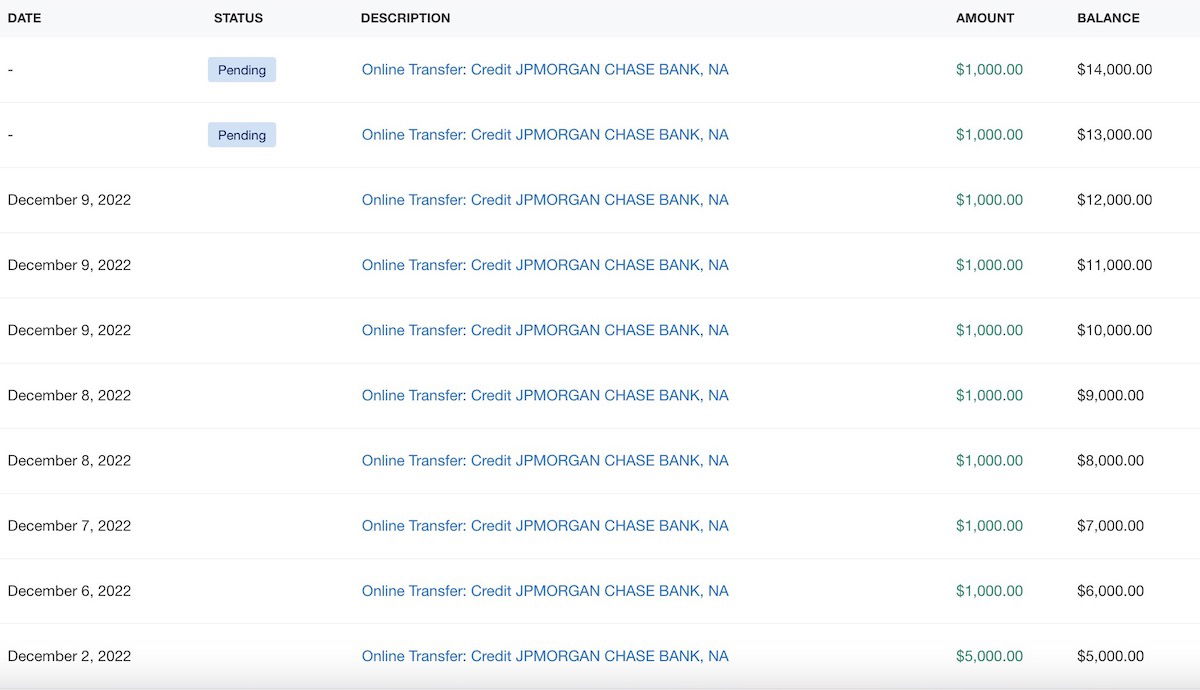

I have completed the 10 transactions needed to get the bonus. I don't know how I did that. I funded my account with $5,000, which is the average balance you have to keep in your account for 60 days. Nine more transfers were made to my account for $1,000 each.

If they're duplicate amounts, I can make multiple transfers per day. Since the interest rate here is higher than for my standard Chase business checking account, I thought this was a great idea.

The dashboard reflected that I had completed two of the three tasks required to earn the bonus after the 10 transactions showed in my Amex account. For 60 days, I have to keep an average balance of $5,000 in the account.

I think I might like this Amex Business Checking concept, and could see myself keeping this account in the future. It will be seen.

American Express Business Checking is a great option for businesses. Membership rewards points can be earned if you open an account and complete certain activities.

I went through the process of opening a business checking account. The experience was easy and I liked the account interface. I would keep this account for a long time.

Is anyone planning on opening a business checking account?