For European bond traders, the year of 2022, was the end of an era.

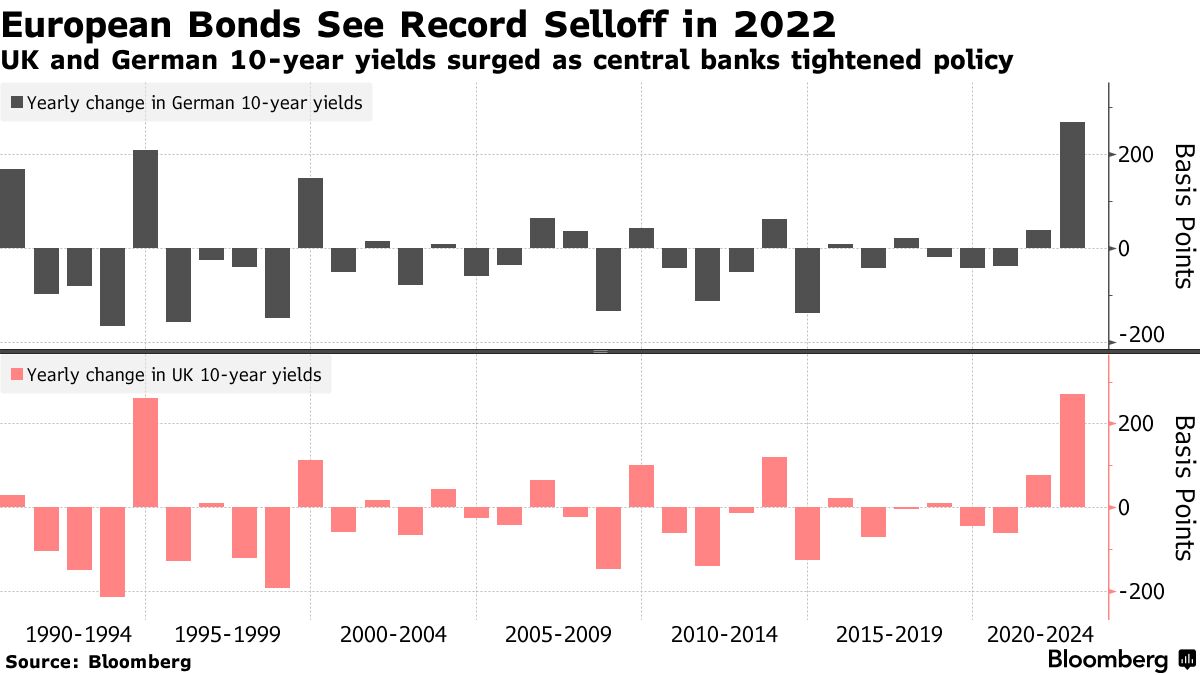

German and UK 10-year yields saw their biggest yearly surge on record, as they were whiplashed by inflation and uncertainty over how policy makers would respond to it.

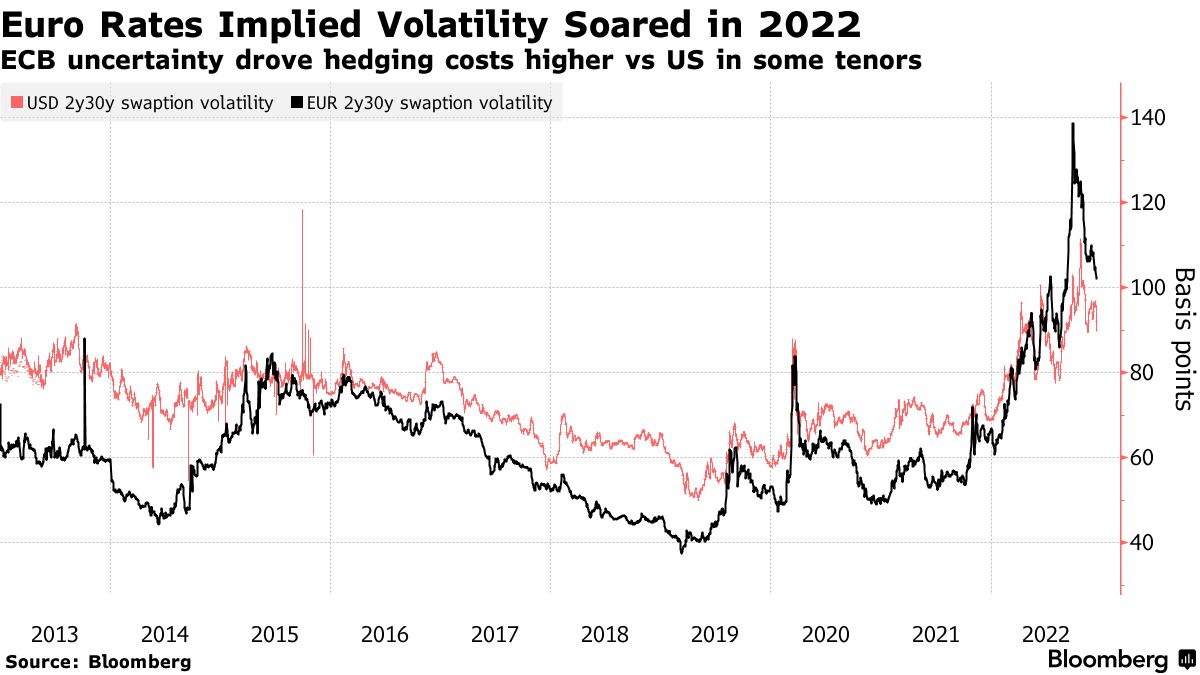

In a rare occurrence that marked a break with the era of negative interest rates and quantitative easing, implied volatility in euro area rates surpassed that of the US.

There is upheaval going on. The European Central Bank and the Bank of England are expected to raise rates again this year as inflation is still far from being quashed.

The war in Ukraine and the end of Covid-19 restrictions in China will add to uncertainty for the region's markets.

This year, there have been some big shake-ups in the markets.

A major shift in market dynamics took place this year as Euro rates volatility as implied by swaptions surpassed its US equivalents. In the past, euro-area bond markets were notoriously low due to the low interest rates.

The European bond market got a wake-up call.

Uncertainty over where interest rates will end up is part of the reason for that. Energy prices make it hard for investors and policymakers to predict Europe's inflation.

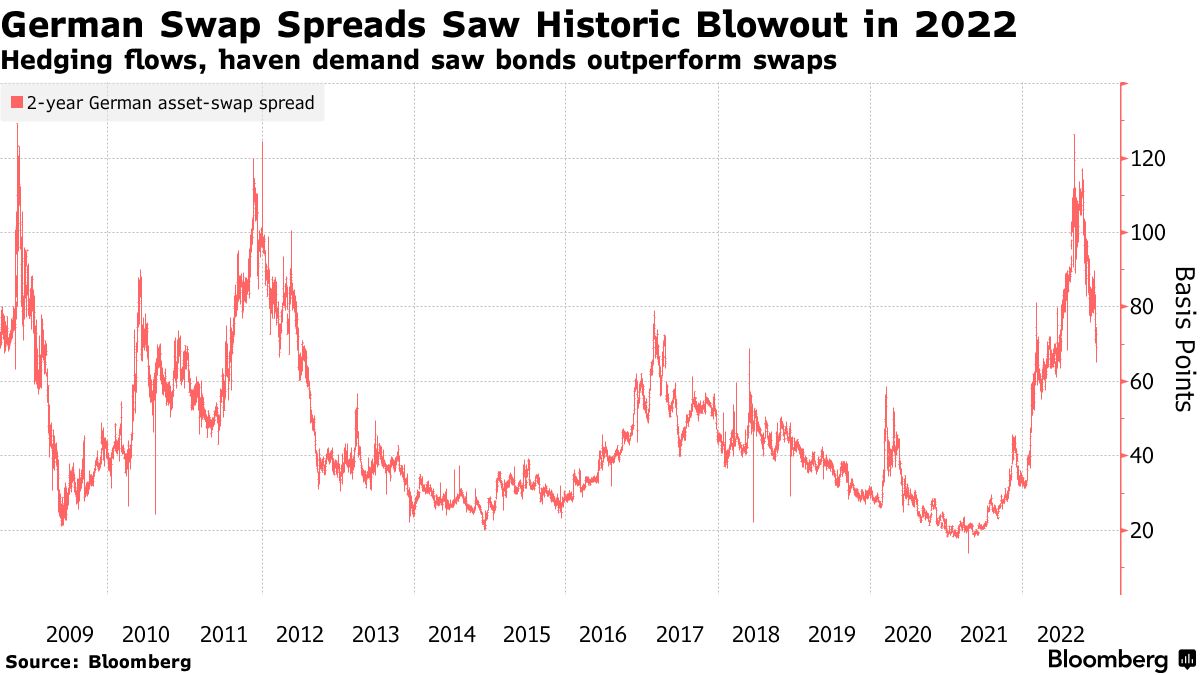

The lack of clarity over inflation and the path of tightening led traders to pile into cash-like highly liquid assets. Demand for hedges against rising borrowing costs caused swap rates to rise. In September, the gap between the yield of short-end bonds and swap rates reached a record high.

Many traders were caught off guard by the unusual situation.

The euro area central banks had a cap on the amount of money they could hold until the end of April. The squeeze was alleviated by moves by Germany's debt agency and the European Central Bank to increase the supply of paper available to be lent in repo markets.

The traders are looking for action on the market.

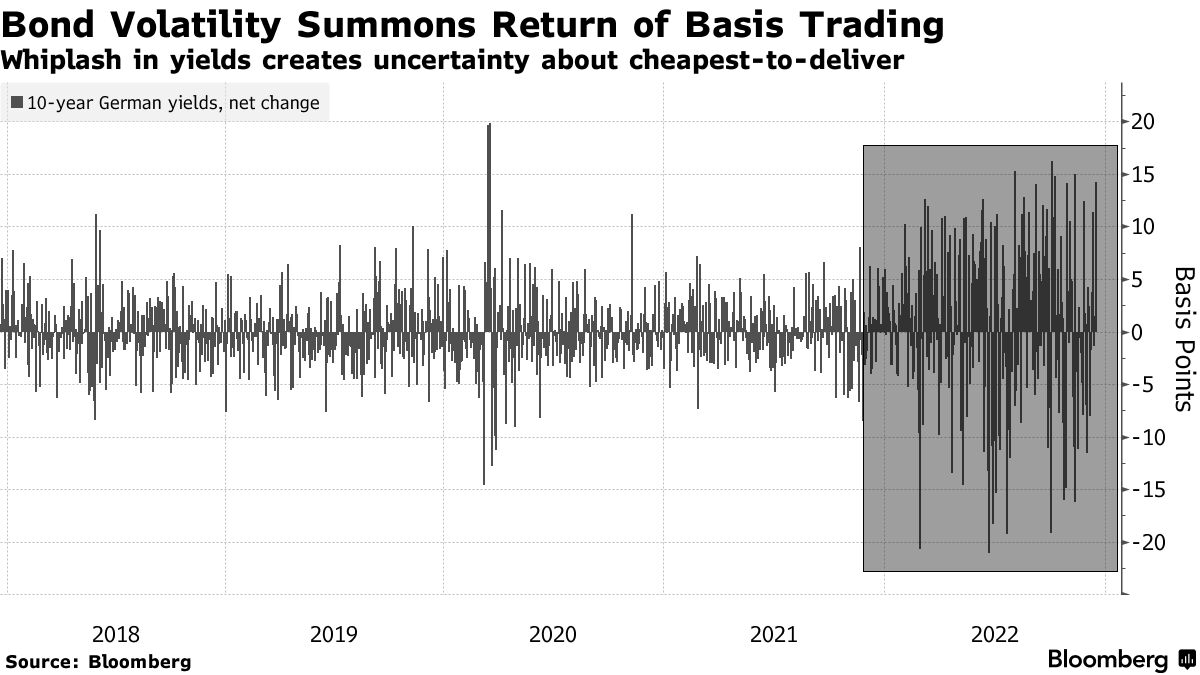

Bond traders' hedging strategies were thrown into disarray by historic moves in yields across the euro area and UK bond markets.

It is easy to determine which bond is cheapest to deliver during periods of low volatility. The yield curves were distorted by violent moves this year.

The March gilt future is the most difficult to price since the contract was introduced, according to Tradition.

It costs more to put on trades according to a gauge from Tradeweb. The firm compares the prices at which trades are actually executed with the prices from a cross section of providers.

The rates of UK pension liquidations are going down.

In the case of the UK gilt market, those costs went past March 2020 levels in some maturities.

The price of trades went up.

The source is Tradeweb.