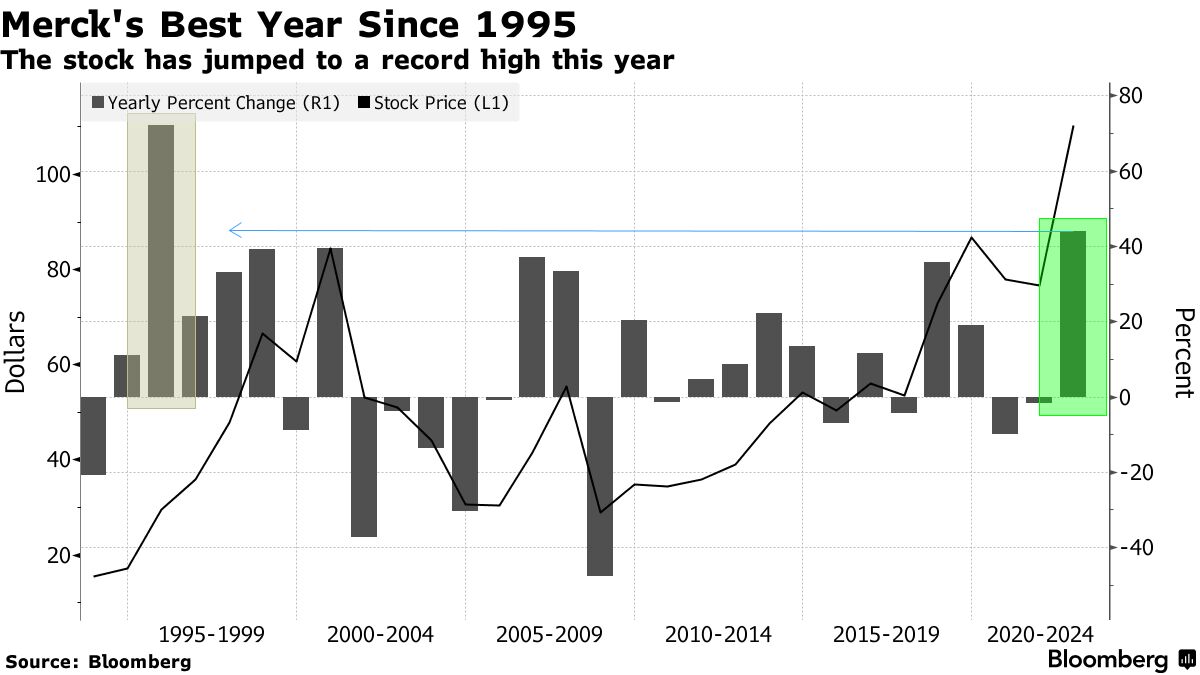

The company is poised for its best yearly gain in more than two decades as investors rewarded it for strong earnings and upbeat clinical trial data.

The maker of the blockbuster cancer drug Keytruda got a boost from the company's solid earnings results and is currently trading at a record high. China approved the antiviral for emergency use this week, and Covid-19 brought in billions of dollars.

According to Carter Gould, an analyst with an overweight rating on the stock,Merck went from strength to strength.

There is a shortage of drugs in China, and it has been approved by the country.

Positive clinical updates have made a difference for the company. A trial of Keytruda with Moderna Inc.'s cancer vaccine reduced melanoma deaths and a late-stage trial of sotatercept met the main goal.

The stock's surge this year has lifted it near the average 12-month target price of analysts, meaning little return potential for next year. Some still believe in the future. The analysts at Cantor Fitzgerald named a pharma stock they think will perform well in the years to come. The stock was dubbed a preferred choice by the broker.

MRK is a compelling long-term growth story as it continues to expand Keytruda into additional and earlier-line indications.

Jeremy R Cooke helped with the project.