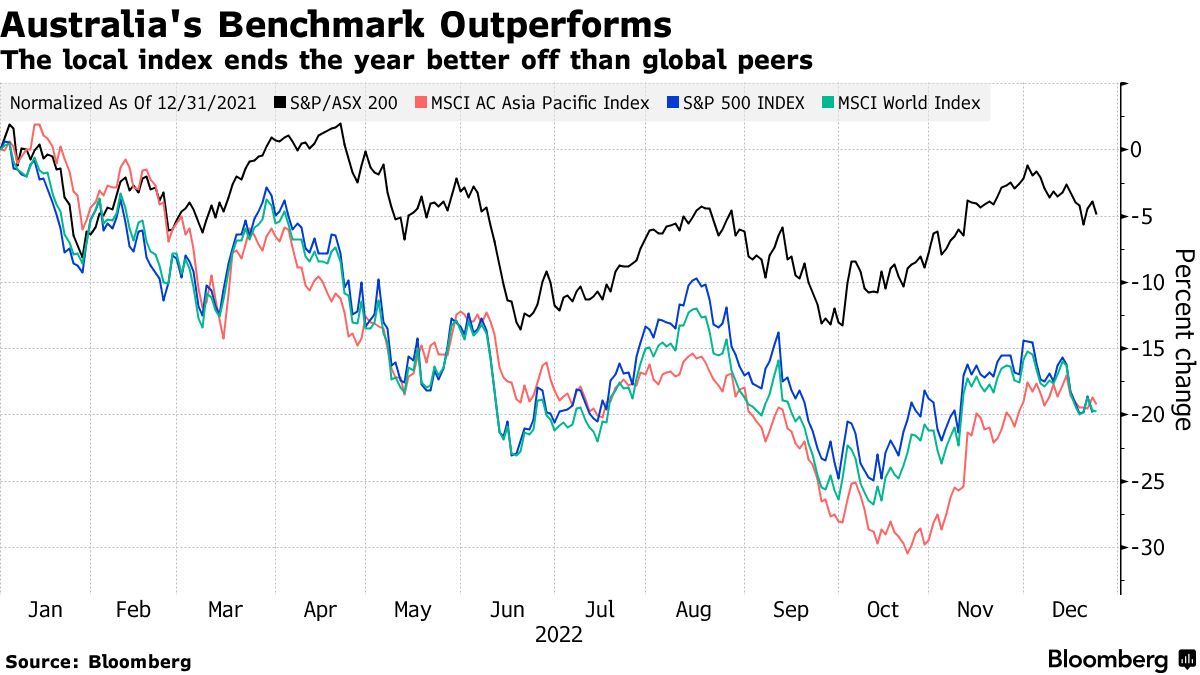

Australian shares are set to end in 2022 as one of the region's more resilient markets, thanks to eye-watering gains from mining firms.

The benchmark S&P/ASX 200 has fallen 4.5% so far in 2022. It is poised for its worst performance in a year.

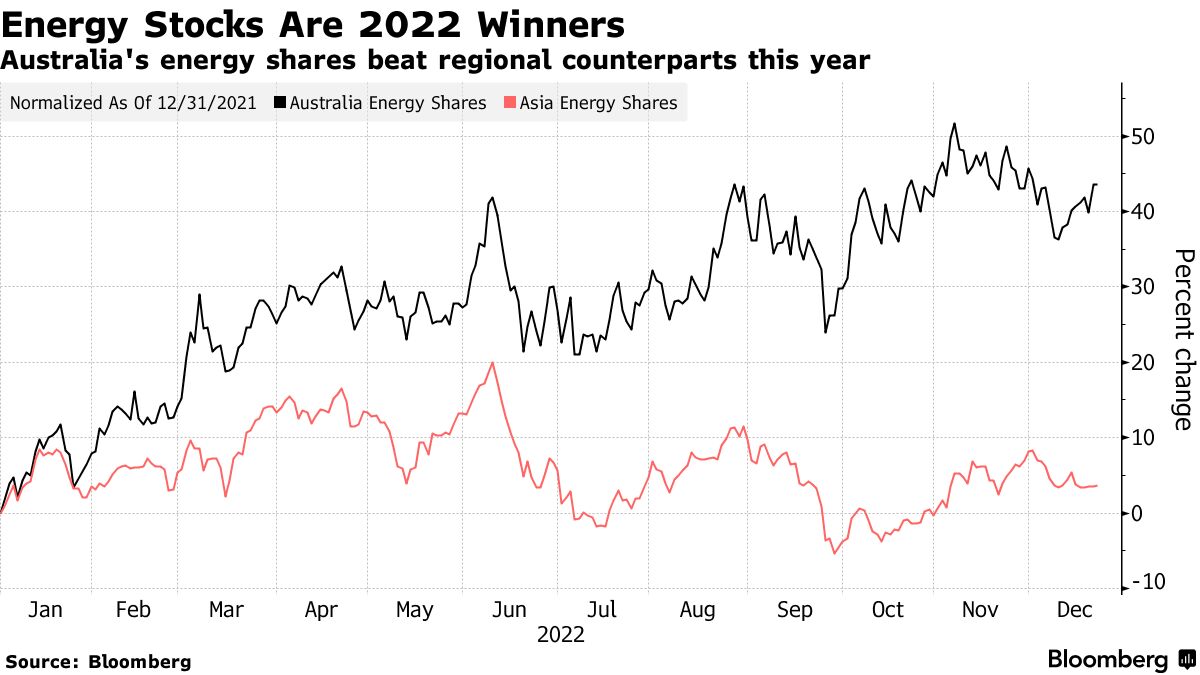

Coal and oil stocks were the top gainers on the index. The technology and real estate sectors were hit hard by rising interest rates and inflationary pressures.

The head of Australian equity research at JP Morgan said that resource stocks are set to benefit from the China re- opening theme. The fading of China re- opening will drag on the miners.

There are some notable moves in the year to date.

Whitehaven Coal, New Hope Corp., and Woodside Energy Group are all listed on the website.

Australian energy firms, one of the world's biggest exporters of coal and natural gas, have been performing better than their regional peers. Russia's invasion ofUkraine disrupted global energy supply.

For the year, Whitehaven Coal has gained more than 300 points. According to analysts, there will be modest gains over the next 12 months.

Demand for coal usually peaks in January, so some of these shareholder returns could grow into the new year. Coal prices may lose heat before the mid year as Europe and the US head into summer.

Sayona Mining, Mineral Resources, and Corelithium all have positive numbers.

Corelithium led the pack with stellar gains.

As a higher-for-longer outlook took hold, the energy analyst at Credit Suisse Group AG said that lithium stocks reached new highs in the year 2000. He said that the year could prove to be a pivotal one as more supply comes to market.

Rio Tinto is up 15 percent.

China's abrupt Covid Zero reversal and a steady stream of supportive policies raised the outlook for demand as the country's iron Ore miners ended the year on a high

China, the world's biggest iron Ore buyer, is pushing for centralized buying under a single state-owned company.

Novonix and Megaport are both owned by the same company.

The two worst-performing stocks on the national benchmark were from the tech sector. Novonix came at the bottom as operating losses mounted. Megaport was the worst company. For the year, the sector's gauge slumped 34%.

The Centuria Capital Group has a negative net worth.

Centuria posted the biggest fall among property names as the sector lag with higher borrowing costs made home purchases costlier and raised the likelihood of defaults. Australia's housing-market downturn is not showing any signs of a let-up and is expected to last until 2023.