The idea of "overnight success" is something high-growth companies know well. There is no better time to plan for the leap from a private company to a public one.

It takes time to de-risk the path to go public. Despite the downturn, companies that want to go public in less than three years must plan for it now.

The adverse economy is perfect for planning an IPO and what to do about it.

While some companies delay their IPOs, others can play catch-up and prepare for the time when the open market itches to invest again.

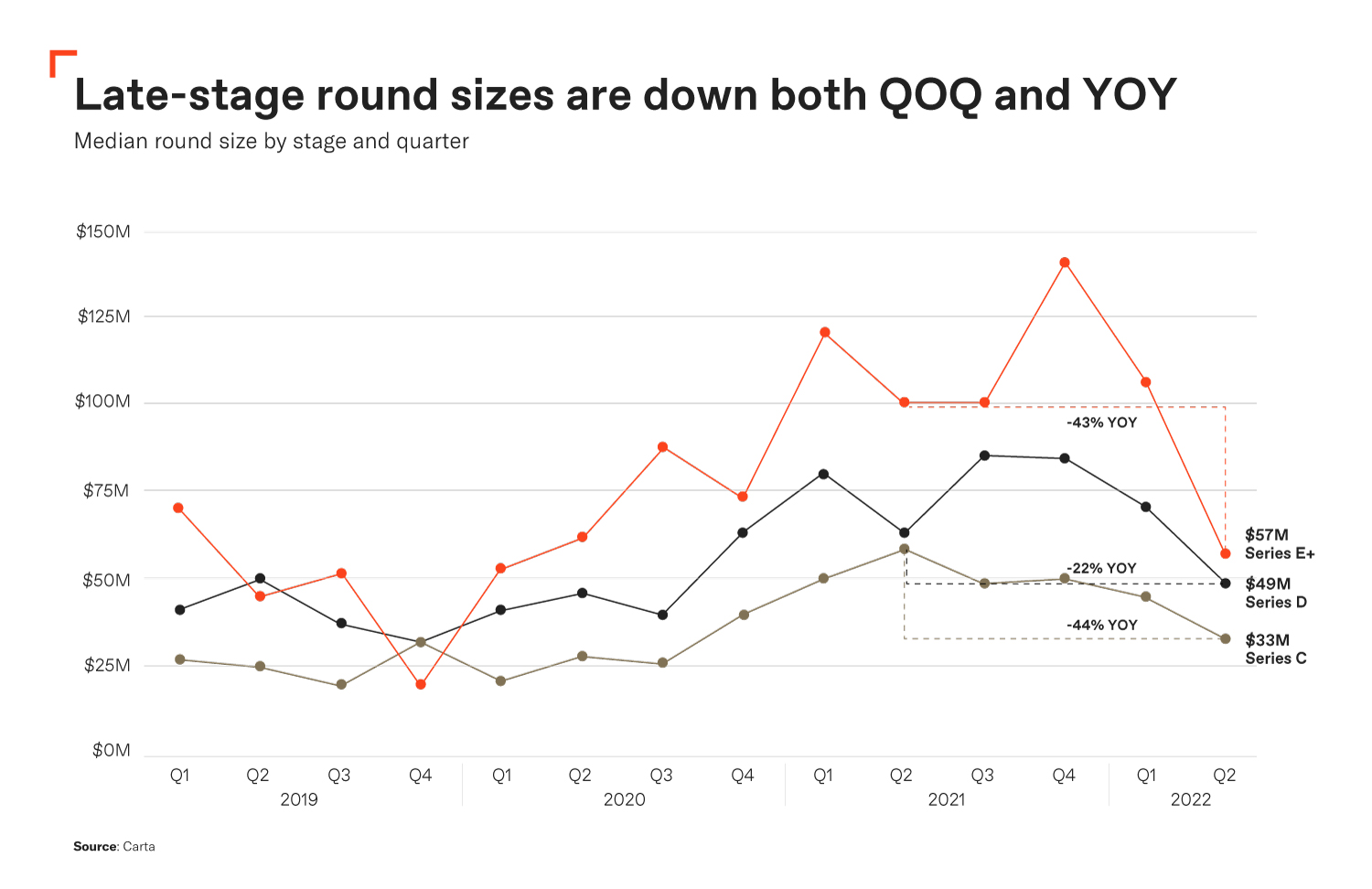

Carta reports that private donations have fallen across the U.S. Late-stage companies have been hardest hit.

Market experts are telling leaders not to pin their hopes on venture capital dry powder. The size of late-stage funding rounds has decreased.

The founder shield is an image.

Even though few enjoy market downturns, how they unfold can deliver insights to late-stage companies. Many leaders are embracing the message of the memo We can agree with their idea to prioritize profits over growth, but we have to swallow that jagged pill.

Cost-cutting and giving up hope of raising money isn't all bad. Some innovative founder will find money when it's available. The path looks different now than it did when we saw it.

Market downturns often lead to the discussion of course-correcting. The pendulum begins its journey towards a more balanced standard when it swings one way. Most startup were overvalued before the open market flourished.

It was stated that the year was a miracle because of the double-digit increase in investment. Over 1,030 IPOs were seen in the U.S., a significant increase over the year before. About 170 public listings have been added this year.