Cramer told investors to exercise caution when approaching mega-cap tech stocks that have been hammered.

He said that they don't want to get burned the next time they go too high. Cheap stocks of companies that make things or do things at a profit are what we want right now.

The stock market was down for the week as investors worried about a possible recession.

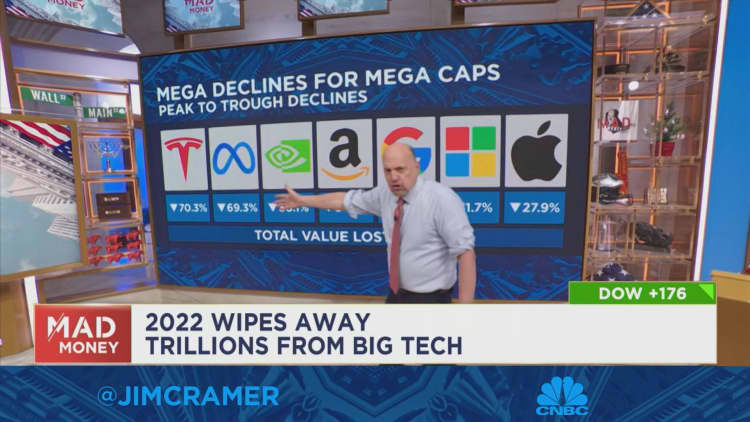

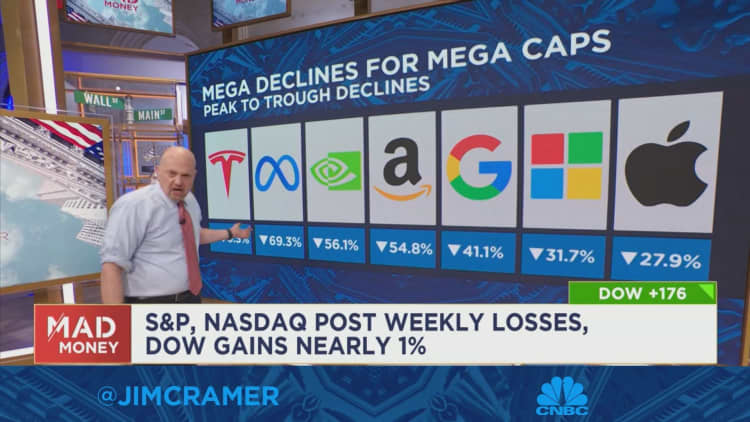

Tech stocks have been hammered this year by inflation, interest rate hikes and Covid shutdowns. Mega-cap tech names were responsible for the market's strength prior to this year.

Major stocks in the S&P 500 lost over $5 billion in value, according to Cramer.

He doesn't blame investors for betting on those stocks, but he does think they need to learn from their mistakes in the future.

They will bounce the next time there is a nice rally in the broader index. I think you should reduce the size of your tech companies. You will be able to buy them a little lower.

Cramer's Charitable Trust has shares of several companies.

Jim Cramer has a guide to investing that you can download for free.