Recent headlines have been dominated by announcements of large layoffs in the tech industry. Private software companies have also been implementing hiring freezes and reductions for almost a year now.

As it became clear that the "growth at all costs" mentality was going out of favor and the goal was to extend runway to weather the storm, VCs started pushing for more focus on capital efficiency and the "Rule of 40"

Over the course of 24 months, we tracked the headcount of 150 private Series A to Series C B2B enterprise software companies in various industries.

The highlights of the study are listed.

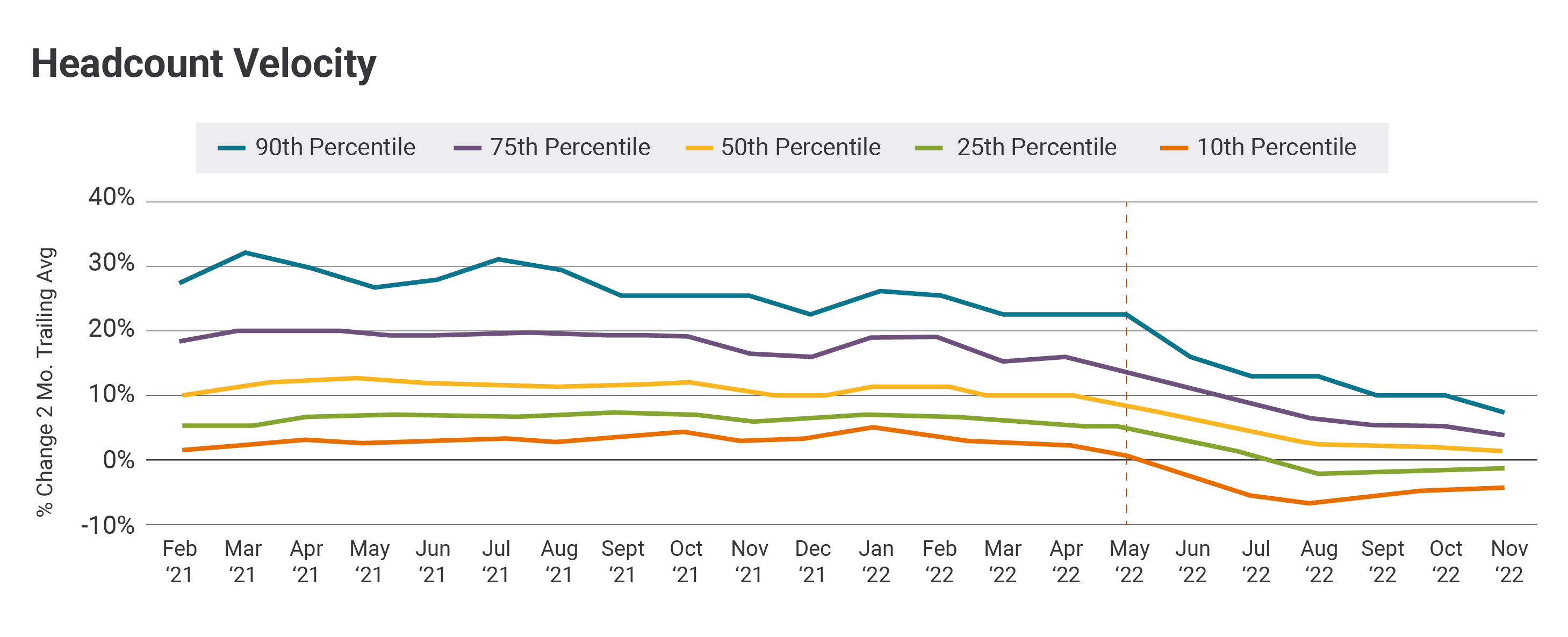

Over the last four months, headcounts have risen at a median rate of 2% compared to the 10% we saw previously. Many companies are taking drastic measures to extend their runway after seeing reductions in the 25th percentile of startup.

For companies with a strong balance sheet, strong backers and low burn/product-market fit, now is the best time to make critical hires.

This is a sign that the startup is bracing for more macro issues.

We would expect another wave of job cuts after the fourth quarter of the year if the macro environment doesn't improve.

Up to 80% of a startup's expenses can be attributed to headcount, which is why many companies discuss their forecasts. It is possible that companies will have to lay off employees to reduce burn.

More firms started acting in unison, as seen from the tighter headcount velocity interquartile range, which was compressed heavily but has now stabilizing.

The companies that provide tech to HR and procurement professionals saw the biggest drop in growth. Customer profiles have trended towards less hiring.

This is an excellent time for companies with product-market fit to hire the right talent, as big tech is downsizing and the market is flooded with exceptional talent.

Until April, most companies were hiring aggressively and the 75th percentile was close to 20%.

The current median is 1% and the 75th percentile is 4%.

In May, this downward trend began. The interquartile range continues to shrink, with the median heading toward flat headcount. The 10th percentile and 25th percentile pulled back after falling into layoff territory.

Eddie Ackerman's image was used.

We have established the stage.