Retirement accounts are supposed to be used to fund your lifestyle in later years, but raiding them early can result in a financial penalty.

There are some situations in which account owners can access their money early without penalty.

It's not something they should do.

Ed Slott is a certified public accountant and IRA expert in Rockville Centre, New York. If it was the last resort, I would do this.

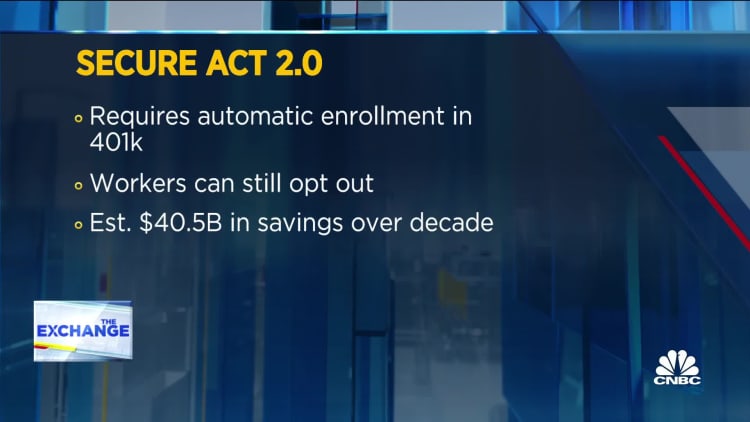

New retirement legislation leaves a huge problem untouched, and may help boost financial security.

If you withdraw money from a retirement account before 5912 you will incur a tax penalty. It's on top of any income taxes that come from the withdrawal.

There are situations in which IRA owners wouldn't have to pay the early withdrawal penalty.

It is possible that Congress will add more. There are a number of retirement provisions in the legislative package to fund the federal government. There are exceptions to the early withdrawal penalty for IRA owners in cases of domestic abuse and terminal illness.

There are exceptions for people under 5912.

Only IRAs are affected by the first three. Both IRAs and workplace retirement plans can be applied to the others.

If IRA funds are used to pay qualified higher-education costs for you, your spouse, children or grandchild, you may be exempt from the penalty.

Tuition, fees, books, supplies, equipment, and expenses for special- needs services are eligible costs. Students who attend school at least half time are eligible for room and board.

To participate in U.S. Department of Education student aid programs, students need to attend a college or university. The IRS says they include "virtually all" accredited, public, nonprofit, and privately owned for-profit institutions.

IRA owners don't have to be first-time home buyers to take advantage of this exception. Someone who hasn't owned a home in the last two years is considered a first-time buyer by the IRS.

Up to $10,000 penalty-free can be withdrawn from IRAs by such owners. The dollar threshold is a lifetime max.

The funds need to be used for acquisition costs. According to the IRS, these are the costs of buying, building or rebuilding a home. It must be used within 120 days.

You can use the IRA withdrawal for your spouse or child. If you and your spouse are first-time buyers, you can take distributions of up to $10,000.

The date of acquisition is the beginning of the two-year-limitation period.

If you lose your job, distributions to cover health insurance premiums for you, your spouse and dependents won't be subject to a penalty.

You need to have received unemployment compensation for 12 weeks in order to be eligible. You have to withdraw from the IRA in the year you got unemployment or the year after. You need to withdraw within 60 days of being reemployed.

If a beneficiary pulls money from an IRA before age 5912 they don't have to pay a penalty.

Penalties may not apply to a distribution to cover medical expenses.

Unreimbursed medical expenses that exceed 7.5% of your adjusted gross income are excluded. It's the income during the year of withdrawal.

You can use a withdrawal this year to cover unreimbursed medical expenses over a certain amount.

To get this benefit, you don't have to include tax deductions. You can get it if you take the standard deduction.

Slott warned against a single end-of- year problem. If you put a medical bill on your credit card this week or next, it will count for the tax year even if you don't pay it until later.

To get the tax benefit, an IRA withdrawal linked to that medical expense needs to take place in 2022.

Up to $5,000 per birth can be used from each parent's retirement account. associated expenses are covered by the funds.

You have to make the account withdrawal within the year after your child was born or the day after the legal adoption is finalized.

The disabled retirement saver under age 5912 isn't beholden to the tax penalty.

They need to be totally and permanently disabled to be eligible. Being unable to do any substantial gainful activity is defined by the IRS. The doctor must certify that the condition can be expected to result in death or be of long, continued, and indefinite duration.

It is a rigid definition that is hard to meet. He said that a person must be near death or immobile to be unable to work.

If the IRS takes your retirement funds to satisfy a tax debt, you won't have to pay a penalty.

Reservists in the Army, Navy, Marine Corps, Air Force, Coast Guard or Public Health Service are not subject to penalty.

They must have been called to active duty after 9/11.

Their account distribution can't be made before the end of the active-duty period and before the call to active duty.

The exemption for IRA owners is very complex and likely requires the assistance of an accountant or advisor, Slott said.

Taxpayers can avoid a penalty if they stick to a formula that outlines the amount of periodic account distributions. These are called 72(t) payments and are similar to an annuity.

Slott said that the saver must determine the right amount to withdraw and stick to the schedule until age 5912 in order to leave plenty of room for error.

It can be expensive to get it right. Taking the wrong amount would void the exception and the taxpayer would have to pay a 10% penalty for each year of withdrawals that already occurred.

It is a very harsh penalty.