The largest US maker of memory chips gave a lackluster revenue outlook for the current period, indicating the slump in demand for computer components will drag on, and it will reduce its workforce by 10% over the next year.

In the second quarter, sales will be about $3.8 billion, according to a statement from the company. Analysts had an average estimate of $3.88 billion. In the period ending in February, the company projected a loss of about 62 cents a share, compared with a loss of 29 cents predicted by analysts.

Less than a year after being unable to produce enough to meet orders, demand for Semiconductors is falling. Consumers have stopped buying personal computers and phones due to rising inflation. Makers of those devices, the main users of memory chips, are stuck with unused inventories of components and are slow in ordering new stock.

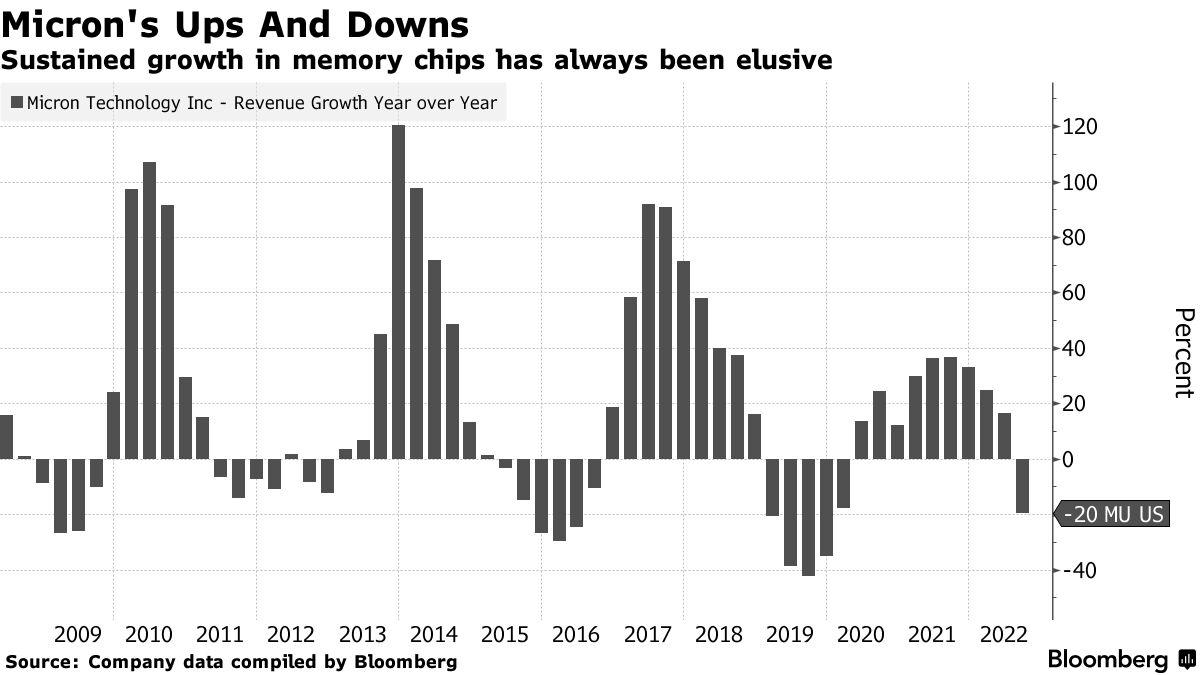

Products from Micron can be swapped out for those of its competitors because they are built to industry standards. The makers of memory are exposed to more pronounced price swings.

The amount of chips available and the amount of output from the factories will be reduced by the company. Rivals will have to follow suit for that to work. The penalty of running expensive plants at less than full capacity can make it hard to support prices.

Sales were $4.09 billion in the three month period. The company lost 4 cents a share. The average estimate of a loss of 1 cent a share on revenue was 888-492-0.

After closing in New York, the shares of the company were little changed. The stock has dropped 45% so far this year. The Semiconductor index on the Philadelphia Stock Exchange is down by a third.

The company warned last month that it would be cutting production. The company had 48,000 employees as of September 1.

(Corrects revenue in the sixth paragraph.)