Image Credits: Richard Drury (opens in a new window) / Getty Images

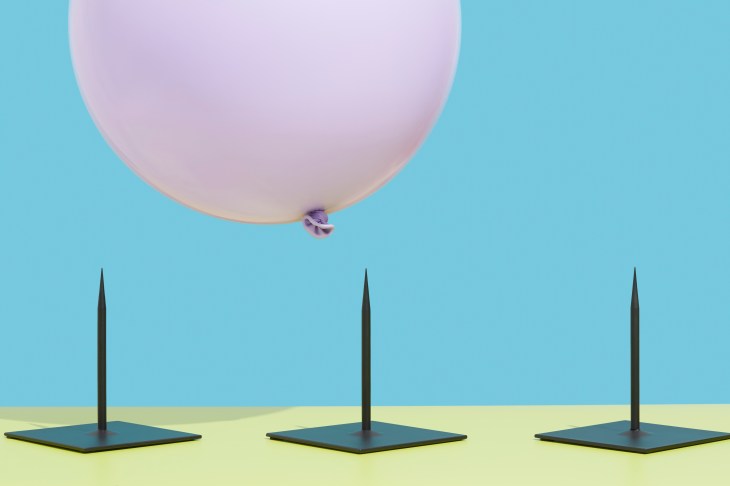

You have probably heard of pre-seed, seed, Series A, Series B and so on. We have seen very small Series A rounds and enormous pre-seed rounds. The most important characteristic of each round is not how much money is changing hands, but how much risk is in the company.

There are two dynamics at play at the same time. By understanding them and the connection between them, you will be able to think about each part of your startup pathway in a different way.

The funding rounds tend to go in a broad line.

For each round, a company becomes more valuable because it gets an increasingly mature product and more revenue as it tries to figure out its growth mechanics. The risk goes down as the company progresses.

It's important that you think about your journey in that last piece. As your company gets more valuable, your risk stays the same. As risk is reduced, the company becomes more valuable. If you can use this to your advantage, you can design your rounds to make them less risky.

If you want to remove as much risk as possible at each stage of your company's existence, let's take a closer look at where risk appears in a startup.

There are many different types of risk. If your company is at the idea stage, you may get together with some co-founders who have good founder- market fit. There's a problem in the market. Your potential customers all agree that this is a problem that needs to be solved and that someone is willing to pay for it. Is it possible to fix this problem?

While people around the globe were watching a thrilling FIFA World Cup final, Twitter decided to drop a bombshell and banned links promoting other social networks. The list currently includes Faceb...Hello, hello! Greg here again with Week in Review, the newsletter where we quickly recap the most read TechCrunch stories from the past seven days. Been too busy to read tech news? WiR should leave...Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy. Global app spending reached $65 billion in...As we near the end of the year, let’s catch up with a few people who kept a close eye on deal flow in 2022 and look at indicators of what might be coming in 2023. The world of mechanical keyboards is a very deep rabbit hole and it’s no secret that more and more people have fallen into it in recent years. So if you have somebody in your life who keeps t...The latest hit Netflix series “Wednesday,” the “Addams Family” spin-off directed by Tim Burton, has reached a milestone that only “Stranger Things” Season 4 and “Squid Game” managed to accomplish. ...While Adobe and Salesforce had similar results, Wall Street seemed to treat the former better. Yesterday, we had the chance to catch up with Fabrice Grinda, a French, New York-based serial entrepreneur who co-founded the free classifieds site OLX — now owned by Prosus — and who h...Hello, friends, and welcome to Daily Crunch, bringing you the most important startup, tech and venture capital news in a single package. U.S. safety regulators have opened a preliminary investigation into the robotaxis developed and operated by GM self-driving subsidiary Cruise. The National Highway Traffic and Safety Administration...This week, I talked with Tim De Chant about his coverage of fusion energy and what feels like a rare hopeful story in renewable energy tech. And Jacquelyn Melinek walks us through Sam Bankman-Fried...For a social media platform that staked its claim on championing free speech, it’s been a remarkably swift turn of events. “Growth at all costs” is a fairy tale made possible by cheap money that helped VCs set expectations for founders — and each other. Amazon announced today that it signed a deal with Games Workshop (GAW), giving it IP rights to the “Warhammer 40,000” universe, a massively popular tabletop miniature wargame. This is the first dea...