It has been weighing on the stock of the company. The electric-vehicle maker's leader stirred up more controversy and caused the company's shares to plunge.

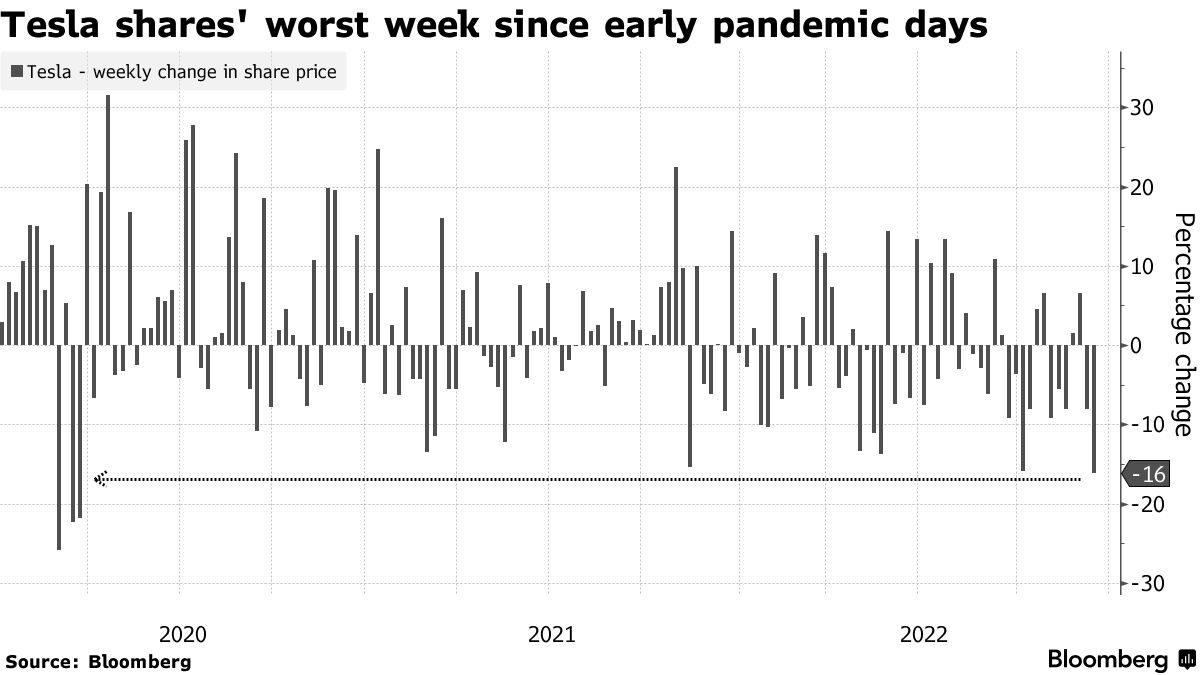

It was the worst week for the stock price in over a year. The S&P 500 index fell less than 3%. The performance is even worse, with the shares tanking 43% so far this quarter as prominent Wall Street analysts dial back their expectations for the company and the industry as a whole.

There has been a lot of activity surrounding Musk and his company. For the first time in more than two years, the company's market value fell below $500 billion. The stock's price targets have been slashed. Musk raised eyebrows when he sold almost $3.6 billion of his shares in the electric car company.

Musk is no longer the richest person in the world as a result of his downfall from the peak of the billionaires index. He suspended the accounts of journalists at outlets like the New York Times and Washington Post on Thursday because of his controversial management of the social media site.

Catherine Faddis is a senior portfolio manager at Fernwood Investment Management. Elon Musk has damaged his reputation with this business.

Musk drew a rare Biden Team Rebuke.

With concerns about the economy and a recession growing, the outlook is likely to be less than ideal. Demand for its expensive electric vehicles may be affected by high inflation and rising interest rates. Equity investors are likely to seek safety in stable buys rather than growth stocks in the event of a slowing economy.

Faddis said that when you have a high-octane growth stock that relies on projections that are years away, confidence is very important, and once the confidence is broken the stock could break down.

There is likely room for further declines based on the valuation of the company. It is still head and shoulders above the top global auto manufacturers. It trades at 36 times forward earnings compared to Ford Motor Co., Honda Motor Co., and Toyota Motor Corp. The average price-to- earnings ratio of the index is 22.

There are risks for the stock beyond valuation, and there are concerns that Musk is too focused on the problem at hand.

A Morgan Stanley analyst warned earlier this week that the brakes were being pulled on demand for electric vehicles because of soaring raw material costs. The rate of adoption of electric-vehicles in the US will be lower than expected. The global supply-demand dynamic is now softer for the company due to the moderation of indicators in several regions.

Ivana Delevska, chief investment officer at SPEAR Invest, said that it will be a tough year for the sector. As other auto manufacturers,Tesla will start to see cyclicality just as they do. The middle-class luxury market may be particularly hard hit byTesla.