After the collapse of FTX, investors are still concerned about the future of the exchange.

BNB has fallen 15% in the past week and is down over six percent in the last 24 hours. The market cap of BNB is $39 billion, making it the fifth most valuable coin. It is behind ethereum, tether, andUSD coin

FTX is facing bankruptcy proceedings. Outside investors were the first to invest in FTX. In exiting its equity position in the company, the company paid a total of $2.1 billion.

As FTX winds its way through bankruptcy court, trustees will look to retrieve any fraudulent conveyances made by FTX to outside businesses, according to an interview with CNBC on Thursday.

After he was asked if the company could handle a $2.1 billion demand, Zhao said the company was financially ok.

Top executives have commented on the financial health of their companies. FTX founder and ex-CEO Sam Bankman-Fried said that his company's assets were fine even as executives knew it was in the midst of a liquidity crunch that eventually forced the exchange into Chapter 11. Bankman- Fried was arrested in the Bahamas and charged with fraud and money-laundering.

There are demands for withdrawal. This was not the highest withdrawals we processed, not even the top five. He said the situation had been stable. The number of withdrawals reached as high as $3 billion, according to the firm.

A spokesman for the company said that they passed the stress test because of their simple business model of holding assets in custody and generating revenue. A question about the drop in BNB wasn't answered immediately by the spokesman.

The two companies were connected. Concerns about the solvency of both FTX and its sister trading firm, Alameda Research, prompted the company to liquidate its position in the native coin.

FTX was facing an immediate surge in withdrawal demands, which led to a non-binding agreement being made to acquire the company. FTX's issues are beyond our control or ability to help, so we backed out of the deal.

All of the major projects and companies created their own currency. People can use BNB to pay for goods and services, settle transaction fees, participate in exclusive token sales and more. Payment, travel and entertainment are included in areas where BNB can be used.

Out of a maximum supply of 200 million, there is a circulating supply of 160 million. The SEC is looking into whether the token sale is a security that should have been registered.

The report was contributed to by CNBC.

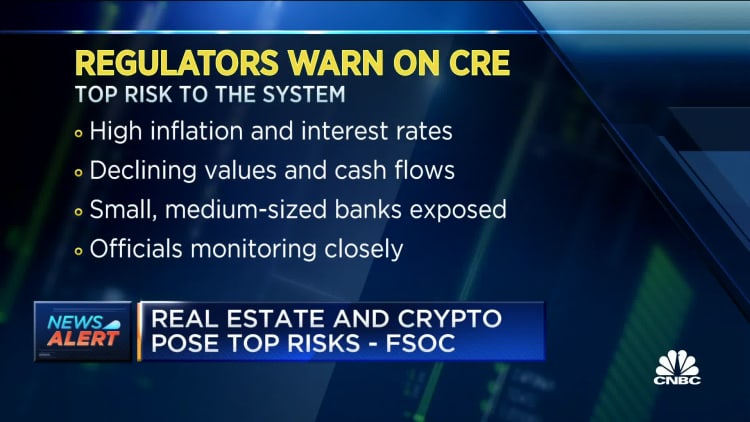

The regulators highlight top risks.