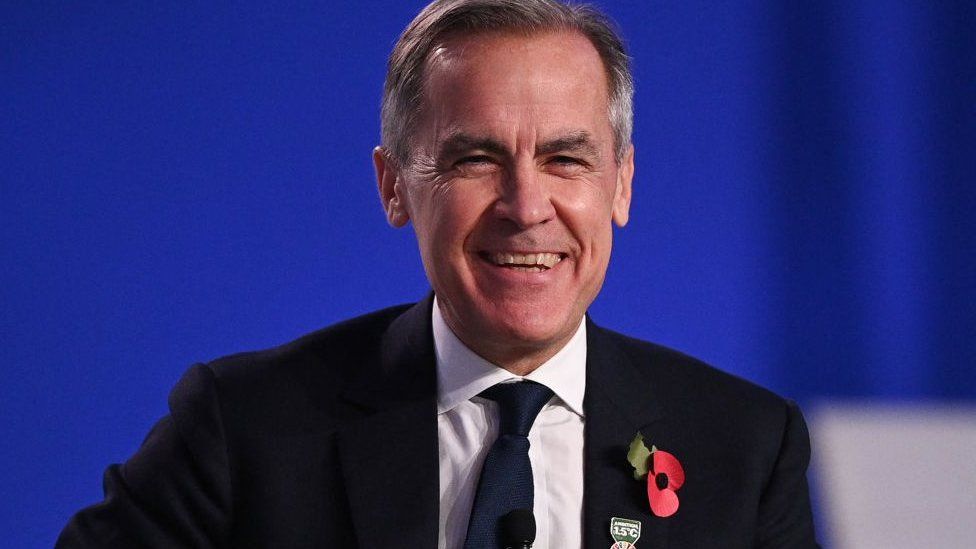

Mark Carney's firm sold farms in Brazil that were linked to the destruction of rainforests.

He called on owners to fix rather than sell.

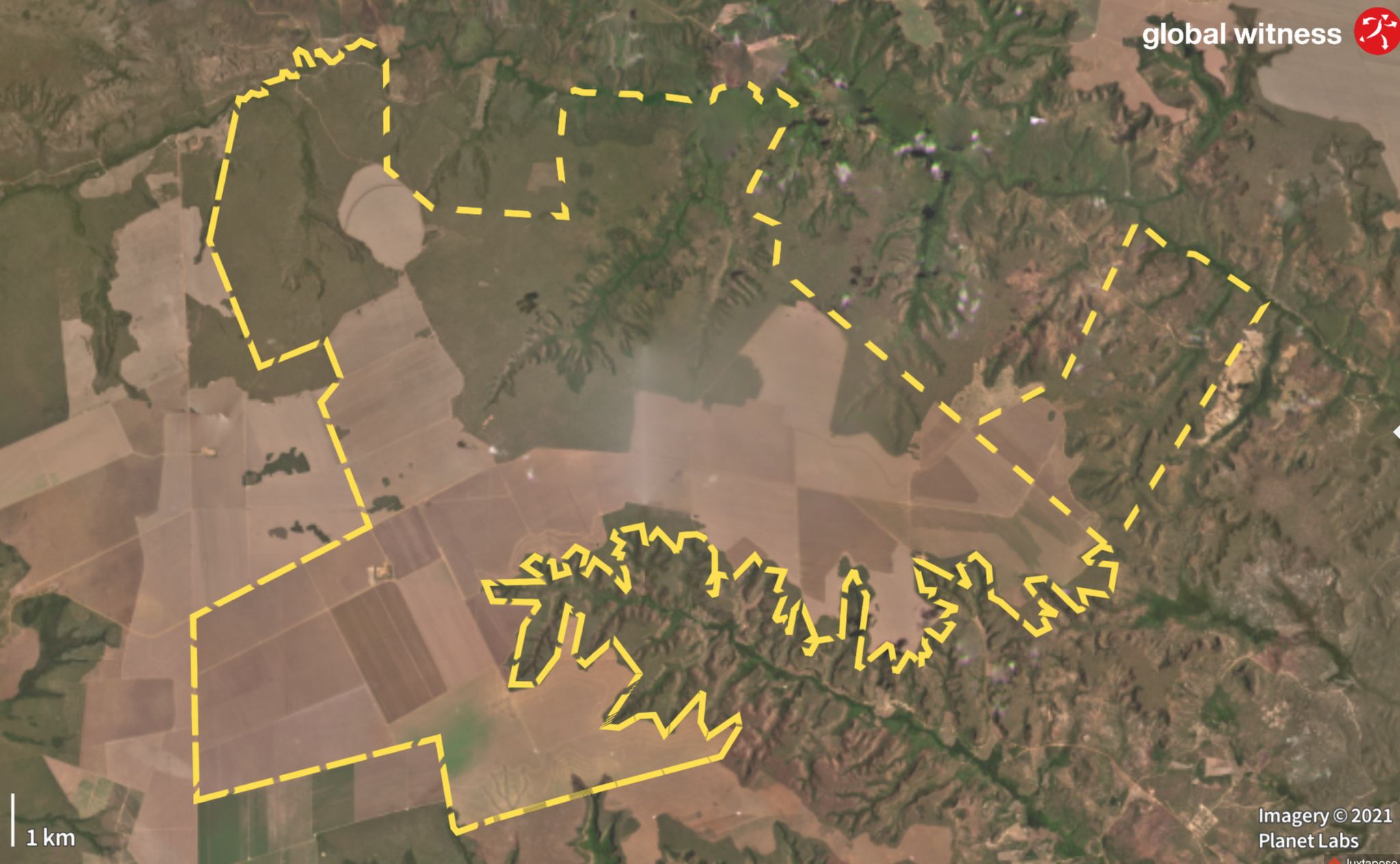

According to an analysis by Global Witness, a Canadian company deforested 9000 hectares of savanna.

The company said it decided to sell several years ago.

Mark Carney became one of the world's leading advocates for action to tackle climate change after he left the Bank of England.

He helped to launch the Glasgow Financial Alliance for Net Zero, a coalition of more than 500 financial institutions working on ways to decarbonise the economy, after he was appointed UN Special Envoy on Climate Action and Finance in 2019.

He has a job with a lower profile. He joined one of Canada's largest businesses, with over $700 billion in assets under management.

It recently purchased the rights to a number of Whitney Houston songs.

He was made chair of the asset management arm of the firm this month after being made vice chair and environmental transition lead.

The management and disposal of 267,000 hectares in Brazil, which was part of the collection of assets, is at odds with the policies he advocates as a climate leader.

According to a report by Global Witness, companies owned or controlled by Brookfield were linked to the National Institute for Space Research.

The company's subsidiaries deforested around 9000 hectares on eight large farms in Brazil over the course of two years.

The World Wide Fund for Nature says that the preservation of the Cerrado is necessary to keep global warming below 1.5%.

The deforested areas were converted to soybean farms.

It is estimated that 600,000 tonnes of CO2 was emitted by deforesting these areas, the equivalent of 1.2 million flights.

The company made limited investments in Brazil's agriculture sector during the last 10 years. We had an obligation to return capital to investors when we decided to sell these businesses because the fund they were held in was nearing the end of its life.

According to Global Witness, the decision to sell clashed with public statements made by Mr Carney as a global leader on climate policy, which called upon companies not to sell off climate- damaging assets, but to clean them up or close them down.

The easiest thing for an institution to do if they have exposure in an emerging economy to coal is to leave. We want to make sure that the institution has a managed phase-out.

At the COP 27 environment conference in Egypt, Carney said that you have to have ownership of the problem. Don't give up on the solution.

Veronica Oakeshott is the forests campaign lead at Global Witness.

To meet climate targets and limit global warming to no more than 1.5 degrees, we need to stop the destruction of forests. We have to reverse it as well.

The financial mechanisms to compensate them weren't in place so there was no way to restore the vegetation without making a loss.

The debate about phasing out carbon-intensive assets is new and participants recognise that innovative forms of financing are needed to support the early retirement of such assets. The spokesman said that the company is working with policymakers and financial institutions around the world.

A $15 billion transition fund is needed to invest in decarbonisation projects such as renewable and nuclear energy. The company no longer holds any investments in Brazil.