Dakotah Rice worked in the investment banking industry for a long time.

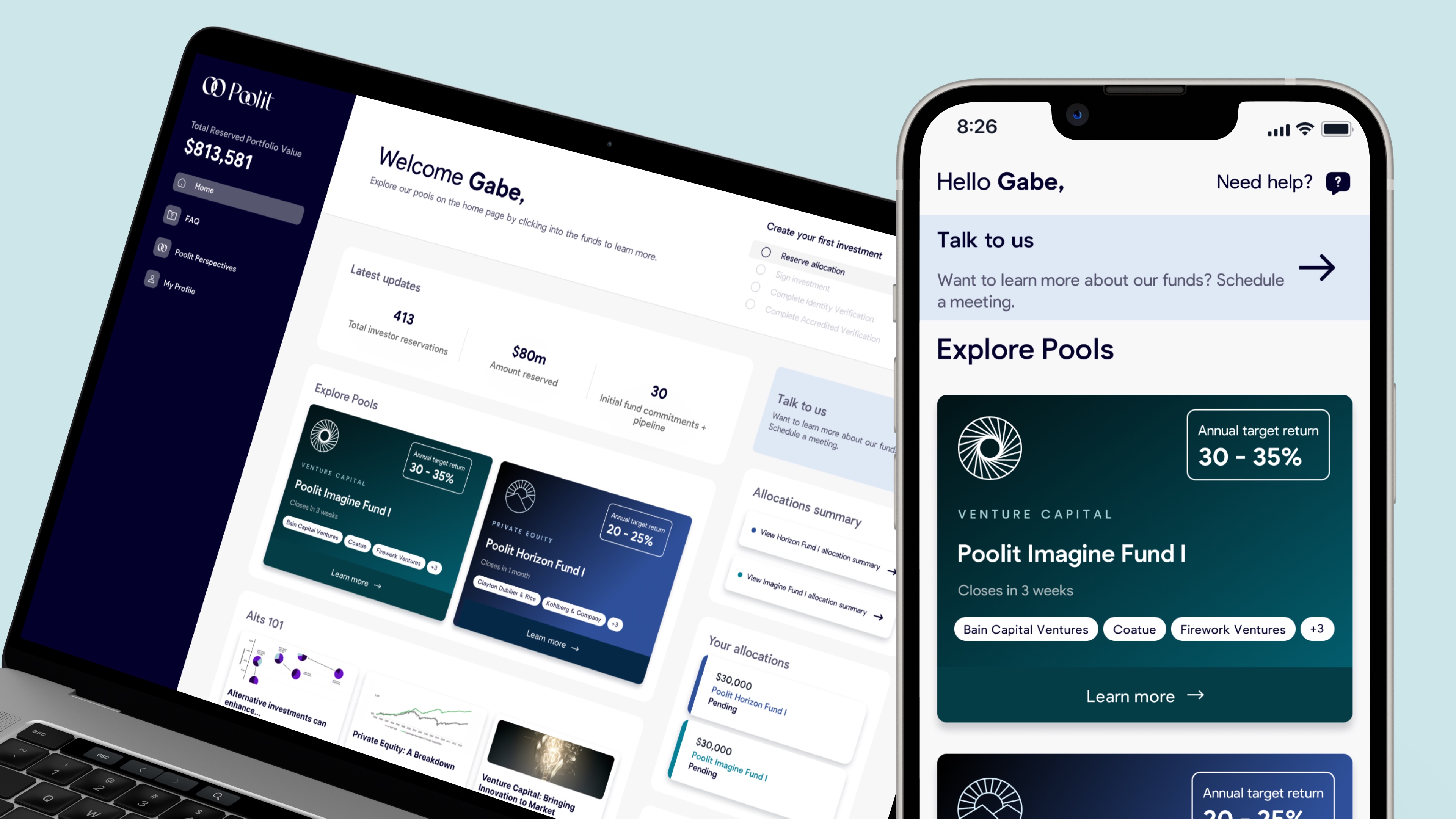

Only a small group of people can invest in venture capital and private equity funds. Minimums to invest in private equity are high. Rice decided to build a platform that would give accredited investors access to invest in entities with as little as $1 in order to give them a way to beLPs.

Several high-profile investors agreed to back Rice's efforts after he talked to players in the space and got feedback that his product would be accepted by the industry. Rice raised $5.3 million in seed funding for Poolit, which aims to open up access to investing in private equity and VC funds.

The family office of The Carlyle Group co- founder David Rubenstein was involved in the financing.

Rice dropped out of Harvard to work full time on the project after being encouraged by the belief that alternative investments should be part of a good investment portfolio. Poolit is emerging from the shadows.

The ability to put money in two funds is currently offered by Poolit. All venture capital firms are included in the Imagine fund. Private equity firms are included in the fund. The platform allows investors to put money into some firms.

Rice said in an interview that it was the first time someone could be anLP in those firms without a minimum amount. There have been no reservations about being on the Poolit platform from any of the funds that we have talked to.

Poolit gives firms on its platform a free way to get investors as well as a diversified channel for distribution, which may be why. Rice said that many firms go to private banks for funding because they pay a marketing fee to get backers.

It will be a great year for private equity. He said it was similar to starting from a new base. Larger institutions that have had exposure that goes up and down now have other channels that they can use to take advantage of the environment. There is something unique about this time.

To ensure that the startup is following federal regulations, Poolit partners with Maketa, which has $2 trillion in assets under advisory, to conduct its due diligence. The company and its sub-adviser rigorously vet managers for inclusion in its funds before putting the funds into a portfolio.

Poolit's registered funds structure is important in today's environment. The Securities and Exchange Commission wants to protect investors more than non- registered funds.

Each fund created on the platform is their own company. The funds will still exist even if Poolit ceases to exist.

Rice said that the people would be able to choose a new advisor. There are a lot of protections for the investors.

Most independent boards are found in registered funds. Poolit has two people that are meant to represent the voices of underlying investors and approve third party fees.

Rice thinks that this is important in the wake of an FTX. They have external third-party custodians, third-party fund administrators and it is codified on the SEC website.

The poolit platform was made available to the public. There are more than 500 users and more than 140 million reservations.

The image is called Poolit.

A percentage of assets under management is what the company makes money on. Rice said that most firms charge investors before they even put their money into any funds.

Poolit has established a limited quarterly share buy back program that kicks in after the first year of the investment.

Poolit has the potential to bring institutional-style funding to more people, but only for those with higher incomes. The criteria to be an accredited investor is having a net worth over $1 million, not including one's primary residence, and having an individual income of $200,000 or more.

One needs over $5 million in liquid assets to be a qualified purchaser in the past.

It would be a dream of Rice's to one day be able to invest in private equity and venture capital funds.

There is a lot of me that wants to expand this to true retail but that is a regulatory question and less of something I could actually control.

Rice believes that working as a young black gay investor as an adult allowed him to tackle the building out of Poolit from a different perspective.

He said it was a worthwhile thing to do because of the disparity. There is a lot of similarity in the background of the people who founded a lot of these companies. People have been tackling the problem in the same way.

Rice was drawn to Harlem Capital because of the company's attempt to democratize access to investments.

Pool it's tech platform is amazing. The relationships with top firms are important. The investor group has an advantage there. Dakotah and the team have a sense of urgentness that is unparalleled.