The Federal Reserve is expected to raise its benchmark interest rates by 50 basis points on Wednesday, which would be an easing of its recent rate-hiking path. The Fed's monetary policy is likely to stay the same. Hopes that the cooler than expected data from this week will lead the Fed to reverse course sooner rather than later aren't taking into account what the Fed is watching closely in its inflation fight

Employment data is troubling for the Fed and it is the labor market that is more important.

At Tuesday's CNBC CFO Council Fed Matters call with chief financial officers from major companies across the economy, signals of higher-than-average annual raises for 2023 speak to why the labor market strength may remain the bigger issue for the Fed. The CFOs on the call said that employee raises will stay above the high two percent to low three percent annual merit pay increases that had been standard in the labor market. According to recent data from compensation consultants, the average raises will reach as high as 4.8% in 2023, after a previous year in which the average raises reached as high as 4.8%. It's a little cooler than last year but still too high for comfort.

Even in Silicon Valley, where layoffs have been concentrated, CFOs say that the labor market is still running hot and there will be no return to a 3% merit raise budget for the next five years. Employee expectations for raises are still high even though inflation is down.

One CFO said on the call that the base case is going up.

Pressure will be put on companies to use price as a lever to make up for labor costs. One of the greatest fears of the Fed is the wage price spiral, a cycle in which wages rise in response to prices and prices fall in response to wages.

In some industries, recent gains made by union workers in annual pay, as high as 7% in some cases, will lead to additional pressure from white- collar workers for bigger raises, and while not nearly as high as the union deals, the expectation in a hot labor market is for raises to

Bigger raises will help the Fed in some way. Raising unemployment to a higher target level of 4% is one of the goals of the Fed, and companies will be looking to offset the cost of higher annual wages by reducing their labor force. Some firms will offer one-time bonuses to reflect the inflationary pinch on workers. The approach of offering more pay doesn't tie them into salary increases which can't be easily reversed and also doesn't factor into the wage inflation trend for long

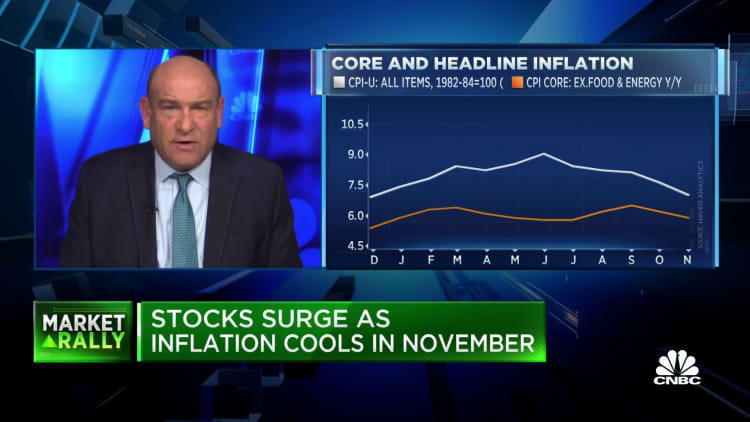

CNBC's senior economics reporter Steve Liesman shared with CFOs a view that was not necessarily bearish, but cautious as inflation comes down, and based on the three areas that Fed Chair Powell has signaled the central bank is watching. The positive news on inflation is only one part of the puzzle and not the biggest part of the Fed's concern. The Fed is not likely to make a major move away from its tightening course until it sees that labor market inflation is coming into line.

Even as the Fed is expected to raise rates by a little less, the market remains of the view that the Fed will raise at least another 25 basis points early next year, and possibly up to 75 basis points in total more, ultimately reaching near or even above 5% at its peak rate, Market strategists and economists expect the Fed to hold rates in the range of 5% for nine months after reaching that level next March, according to CNBC.

Recent history shows that euphoria is not a good position for investors to be in when the Fed is fighting inflation. In his Jackson Hole speech in August, Powell made it clear to the markets that there was still a long way to go in the inflation battle, and with inflation still above 7% year over year, there's reason to expect that the Fed remains reluctant to signal that it feels like victory is Powell has been telling people that it is a long battle to bring prices down, and it is also about labor.