It's a financial burden for many families to pay for college, and education funding myths may be adding to the student loan debt crisis.

The perception is that people are being punished for saving for college. It's not true.

She spoke at the Financial Planning Association's annual conference on Tuesday.

The College Savings Plans Network says that for every $10,000 of savings, roughly $564 is counted towards the family contribution, which could reduce financial aid by roughly the same amount.

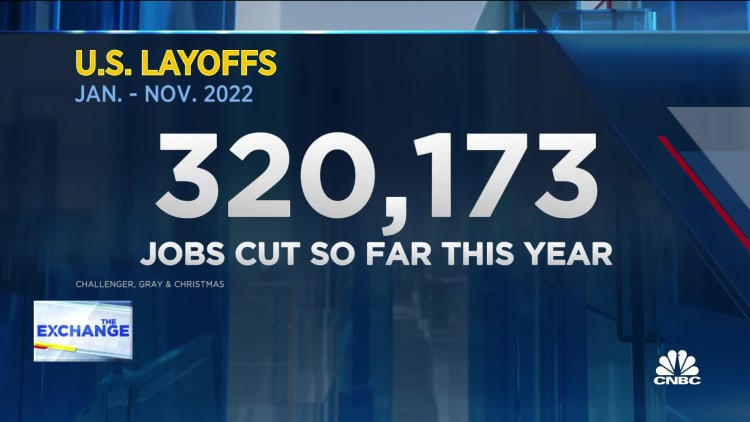

Here is the inflation breakdown for November 2022, in one chart.

The owner keeps control of the funds, there is tax-free growth for qualified expenses, and the owner can change the beneficiary.

The College Savings Plans Network said that the average account value was $30,287.

Wittman said that grandparent-owned plans negatively affected need-based financial aid because distributions counted as student income on the next year's FAFSA.

She said that recent changes to the FAFSA meant that grandparents' savings has no effect on the student.

Wittman said that this has real world implications for where people save.

She said that it would be better for grandparents to contribute to parent-owned plans instead of opening their own.

Wittman said there was a lack of knowledge about college pricing. The idea that public schools are cheap is not serving the narrative well.

She said that the way to think about college is different from public and private.

Wittman said it's the easiest way to find schools with merit-based scholarships. There is no incentive for them to give away money when the acceptance rate is less than 20%.

There is more money to give at private schools than there is at colleges, according to Wittman.

She said you should start the college search during the sophomore or junior year. She said that if you start a month before applications are due, you won't be able to do a good college search.