Energy shares are set to trounce the broader US market for the second year in a row and most Wall Street analysts see that run extending into 2023 because they are still the cheapest stocks around.

The year has not been close. The runner-up among the 11 major S&P 500 Index segments is barely positive, while energy has soared about 45% in the next four years. The gap shows how little the industry has done for shareholders.

Energy bulls say the industry still looks attractive even though there are questions about the future. They point to the fact that no S&P 500 sector has a lower price-to-earnings ratio and to the fact that oil prices will be stable in the near term.

Ben Cook, a portfolio manager at Hennessy Funds who expects oil and gas stocks to lead again in 2023, says energy screens more cheaply than any other sector. It has the highest free cash flow yield of any sector. He said in an interview that it looks like energy can threepeat.

The energy's annual out performance streak has been going on for a long time.

There is a source for this.

After crude surged following Russia's invasion of Ukraine, the stocks came off another big quarter of earnings. The price of the commodity has since fallen, but some analysts think it may find a floor with the war still going on.

The median forecast for West Texas Intermediate is for it to trade around $93 per barrel in three years. There is a scenario where crude could rebound.

There could be a change in crude oil.

Over the next year, Wall Street sees roughly 16% potential upside for the energy index, compared with 10% for the market as a whole. More than half of the energy index companies have a buy rating.

Growth in earnings and dividends have been the main drivers.

"Energy management teams want to deliver that free cash flow so that people don't think of these companies as just a proxy for oil prices."

Some analysts think the companies may have just seen their last great quarter of profits because earnings growth is slowing.

The earnings watch is on the waning days of energy profit out performance.

The likelihood of a material price tailwind that helped most operators the past two years is not expected to happen in the foreseeable future.

He said in a research note that it will be more expensive to produce the same amount of oil and gas in the future.

Energy wouldn't be immune to a possible recession. Morgan Stanley's chief investment officer, Mike Wilson, said last week that value stocks, including in energy, are vulnerable to the economic downturn and urged investors to position in defensive sectors.

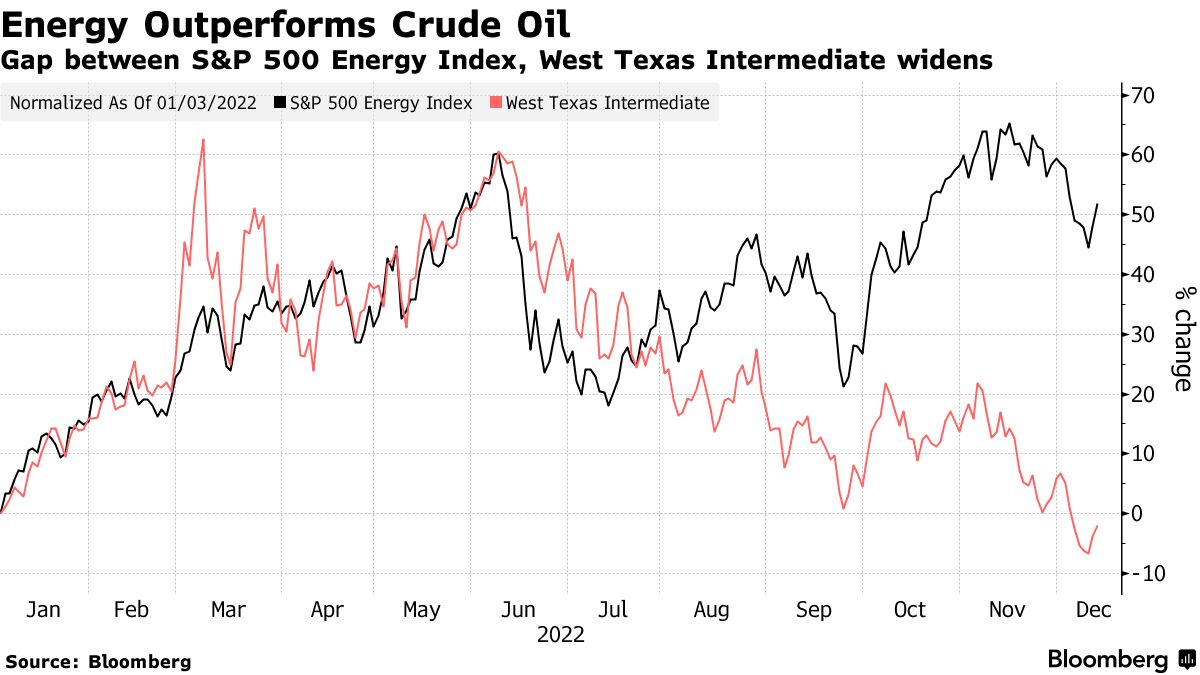

Some argue that the shares are going to struggle because of the divergence between the price of crude and energy stocks.

The chief global markets strategist at JP Morgan encouraged investors to sell their oil and gas stocks in the short term as energy shares have performed better than crude.

He expects the share prices to fall in the near term.

There will be an opportunity to buy after that, according to the speaker. The best-performing sector in the stock market will likely be energy stocks.