The electric-car maker's stock has fallen more than 50% this year.

Some bears think that the world's most valuable automaker should see more declines due to Musk's focus on his recent acquisition of the social networking site.

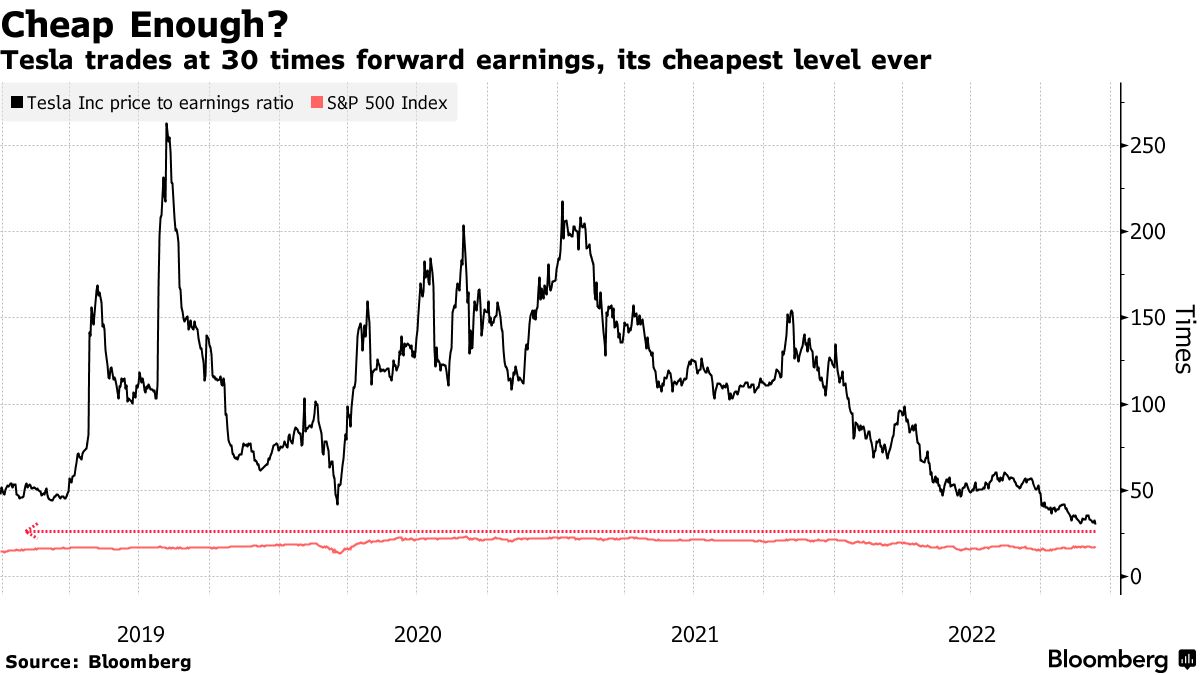

It is now trading at 30 times projected earnings, its lowest ever, and above the S&P 500 index's 17 times forecast earnings. The company is grappling with a broad array of challenges, including risks from its billionaire CEO's association with Twitter to falling demand in China.

Matt Maley, chief market strategist at Miller Tabak + Co., said that he was concerned about the slowdown in China.

According to the report, the production of electric cars at the factory will be suspended from the end of the month until early January due to production line improvements and slowing consumer demand.

There's more to it than that. Some of Musk's high-interest debt may be replaced with new margin loans backed byTesla, people with knowledge of the matter said.

Maley said that the reopening of China may help investor sentiment. He said that it could fall as low as $150 before it becomes appealing to most investors.

As China removed more Covid Zero restrictions on Tuesday,Tesla shares were up 1.6% at $170 in US premarket trading.