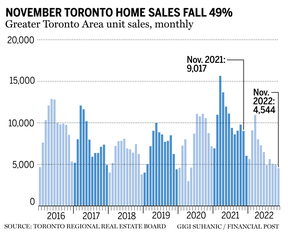

The real estate market in the Greater Toronto Area has been negatively affected by rising interest rates, with home sales, listings and the benchmark price all falling over the last month.

The Toronto Regional Real Estate Board reported on Tuesday that the number of homes sold in the Greater Toronto Area fell by 49 per cent in November compared to the same month last year.

The Financial Post is part of Postmedia Network Inc. There was an issue with signing you up. Try again.

The number of new listings in November fell by more than 10 per cent. The benchmark price went down to $1,089,800 from $1,163,323. The average price of all home types sold fell over the course of the year.

The president of the TRREB said that increased borrowing costs were a short-term shock to the housing market. The demand for ownership housing will increase over time. The Greater Golden Horseshoe and the Greater Toronto Area will see a lot of record immigration in the coming years, and all of these people will need a place to live, with the majority looking to buy. Ensuring we have enough housing will be the long-term problem for policymakers.

The Bank of Canada raised interest rates in March. TRREB thinks that immigration will force people to stay on the sidelines.

According to TRREB's chief market analyst, immigrant households tend to focus on becoming homeowners. Canada will open its borders to a record number of immigrants in the coming years.

The Greater Golden Horseshoe and the Toronto area are the greatest beneficiaries of immigration in Canada.

Competition in the housing market will cause buyers to return to the market.

The data from TRREB shows that semi-detached homes have been hit the hardest with an average price decline of 13.9% over the course of the year.

The average price of a condo fell in November after it rose in October.

Shcampbell@postmedia is the email address.