Capital OneMiles have become a premier currency system. Capital One miles cards feature 1:1 transfers to a range of valuable airline and hotel partners, as well as covering travel charges with points. Capital One makes it simple to combine rewards between your cards. Capital One has a rewards program called "Miles" that competes with other programs.

Capital OneMiles can be used for travel purchases or transferred to most airlines and hotels. Cash back can be converted to miles if you transfer it to a miles earning card. Capital One Miles can be used to cover travel purchases and can also be redeemed for gift cards or cash back.

What has changed? The latest information about earning and redeeming Capital One miles has been added to the guide.

The easiest and fastest way to earn Capital One miles is through the Capital One cards.

| Card Offer and Details |

|---|

| Capital One Venture X Rewards Credit Card 100k after 10k spend in 6 months + $200 credit for vacation rental spend in first year is a better offer. FM Mini Review: This card offers annual rebates that easily mitigate the fee for those who travel often and could be worth it for the lounge access and travel protections given the cost/benefit ratio. Authorized users are free and also get access to perks like Priority Pass, Capital One Lounges, Plaza Premium lounges, and Hertz President's Circle status. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. There is a card type called Visa Infinite. The earning rate is 10X on hotels and rental cars booked via Capital One Travel. Up to $300 in statement credits annually for bookings made through Capital One Travel, and 10,000 bonus miles each year starting at the first anniversary, are noteworthy perks. |

| Card Offer and Details |

|---|

| Capital One Venture Rewards Credit Card 50K after $3K in the first 3 months, 20K after 20K in the first 6 months, and 100K after 20k in the first 6 months. FM Mini Review: This card earns 2 "miles" per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. The card type is Visa signature. Capital One Travel's earning rate is 5X on hotels and rental cars. Receive up to $100 application fee credit for Global Entry, convert "miles" to airline miles, and 2 complimentary visits per year to Capital. |

| Card Offer and Details |

|---|

| Capital One VentureOne Rewards Credit Card FM Mini Review: Decent welcome bonus for a fee-free card, but other cards offer better rewards for ongoing spend. There is a card type called Mastercard. Capital One Travel has an earning rate of 1.25X everywhere. It's worth mentioning that you can redeem miles for travel at a value of 1 cent per mile. |

| Card Offer and Details |

|---|

| Capital One Spark Miles for Business FM Mini Review: This card is similar to the Spark Cash Plus card, but it has the advantage that "miles" earned with this card can be transferred to a large number of airline & hotel programs. There is a card type called Mastercard. Earning rate: 2X everywhere ⚬ Earn 5X miles on hotel and rental car It's worth mentioning that you can redeem miles for travel at a value of 1 cent per mile. |

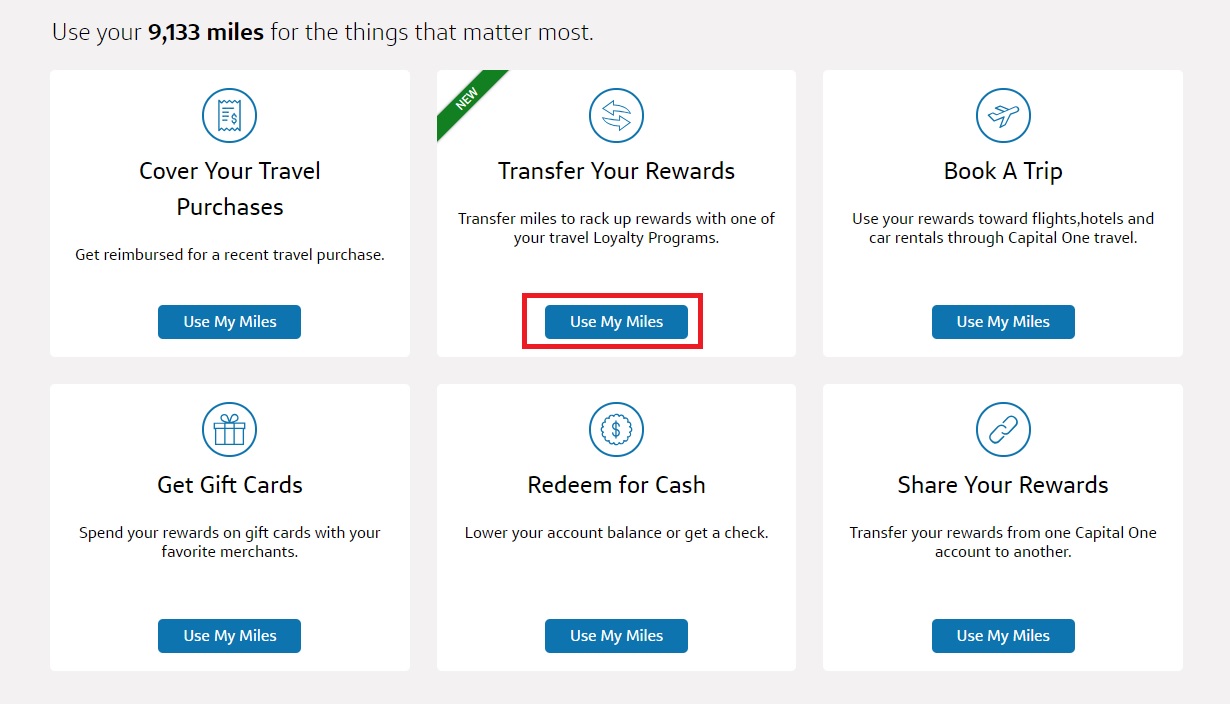

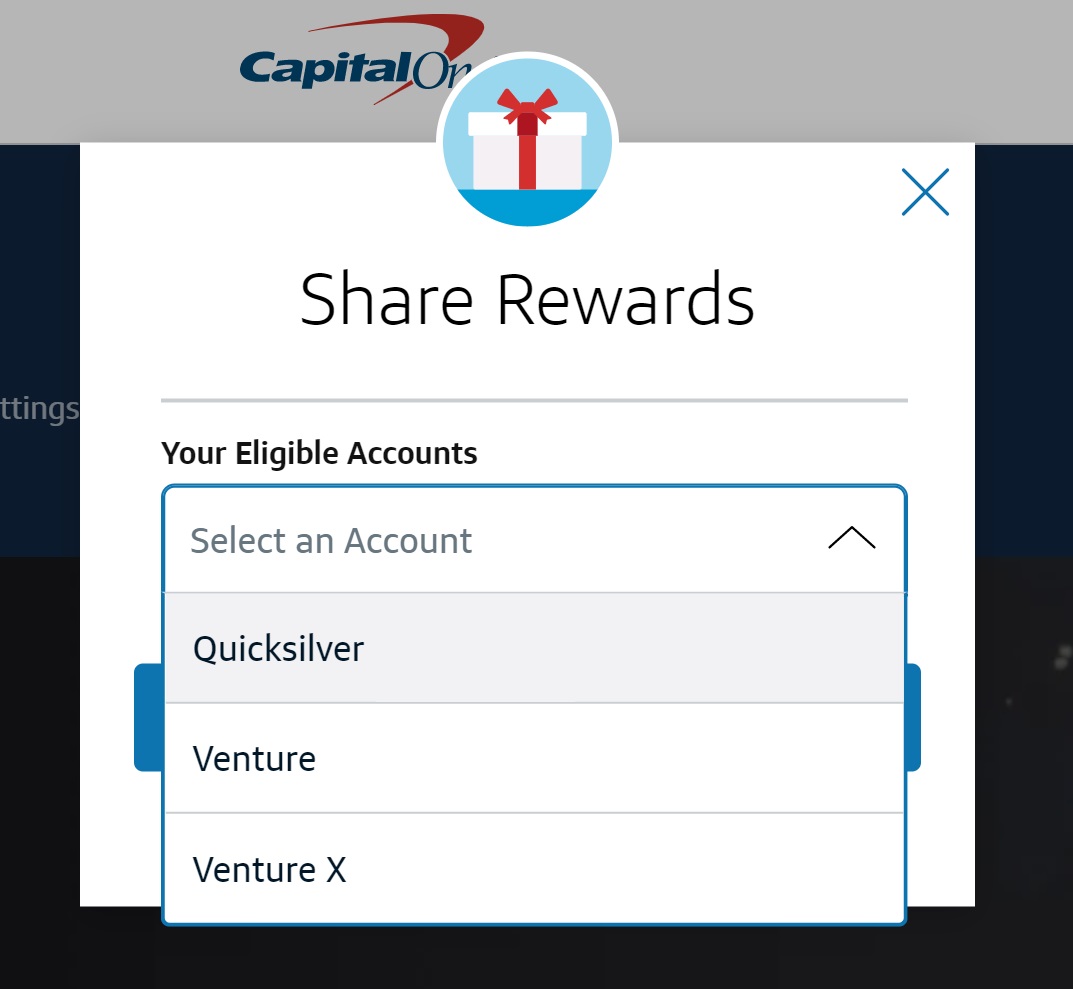

It's very easy to combine rewards with Capital One. You can combine your rewards online. It is easy to move rewards from one card to another.

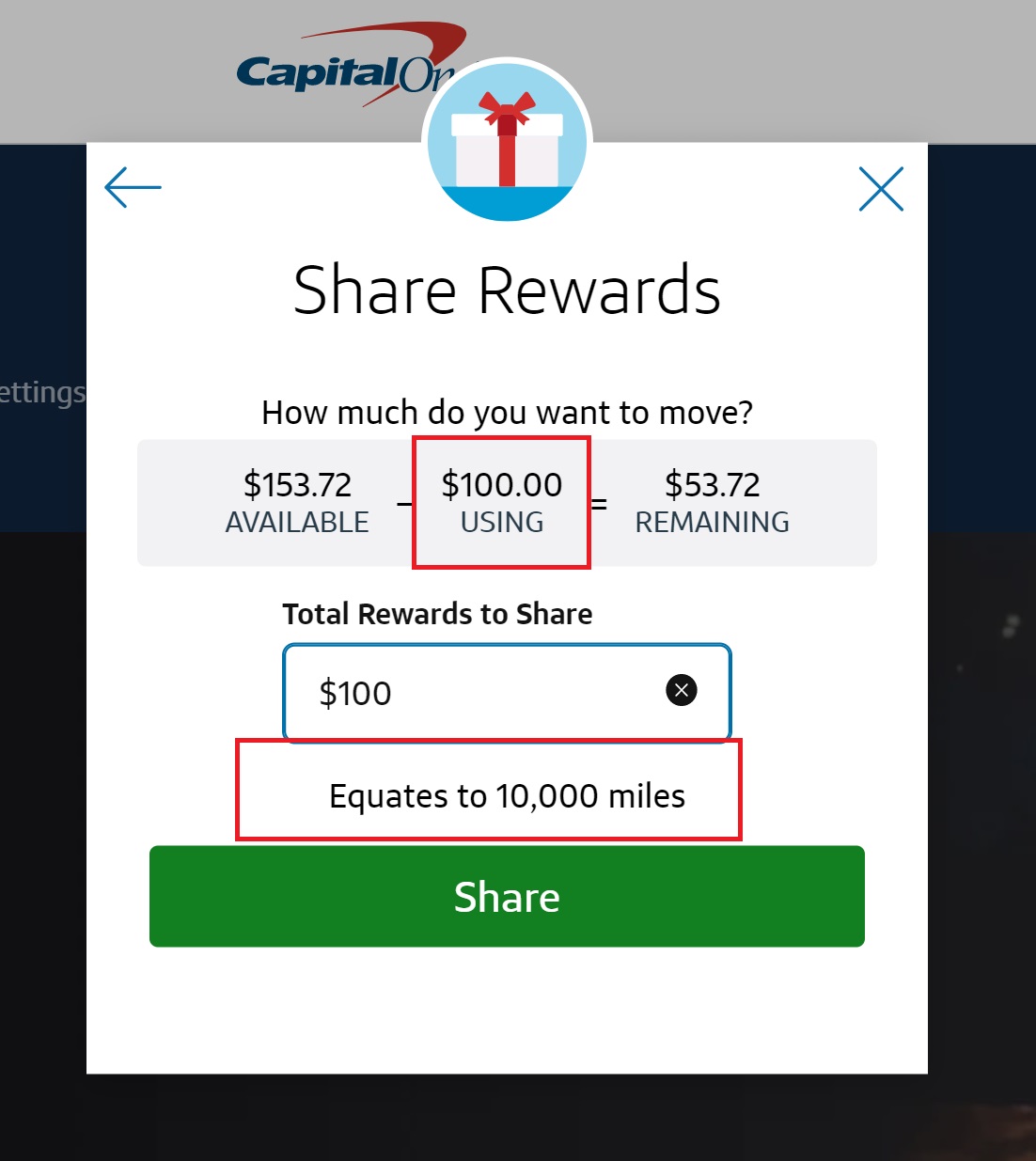

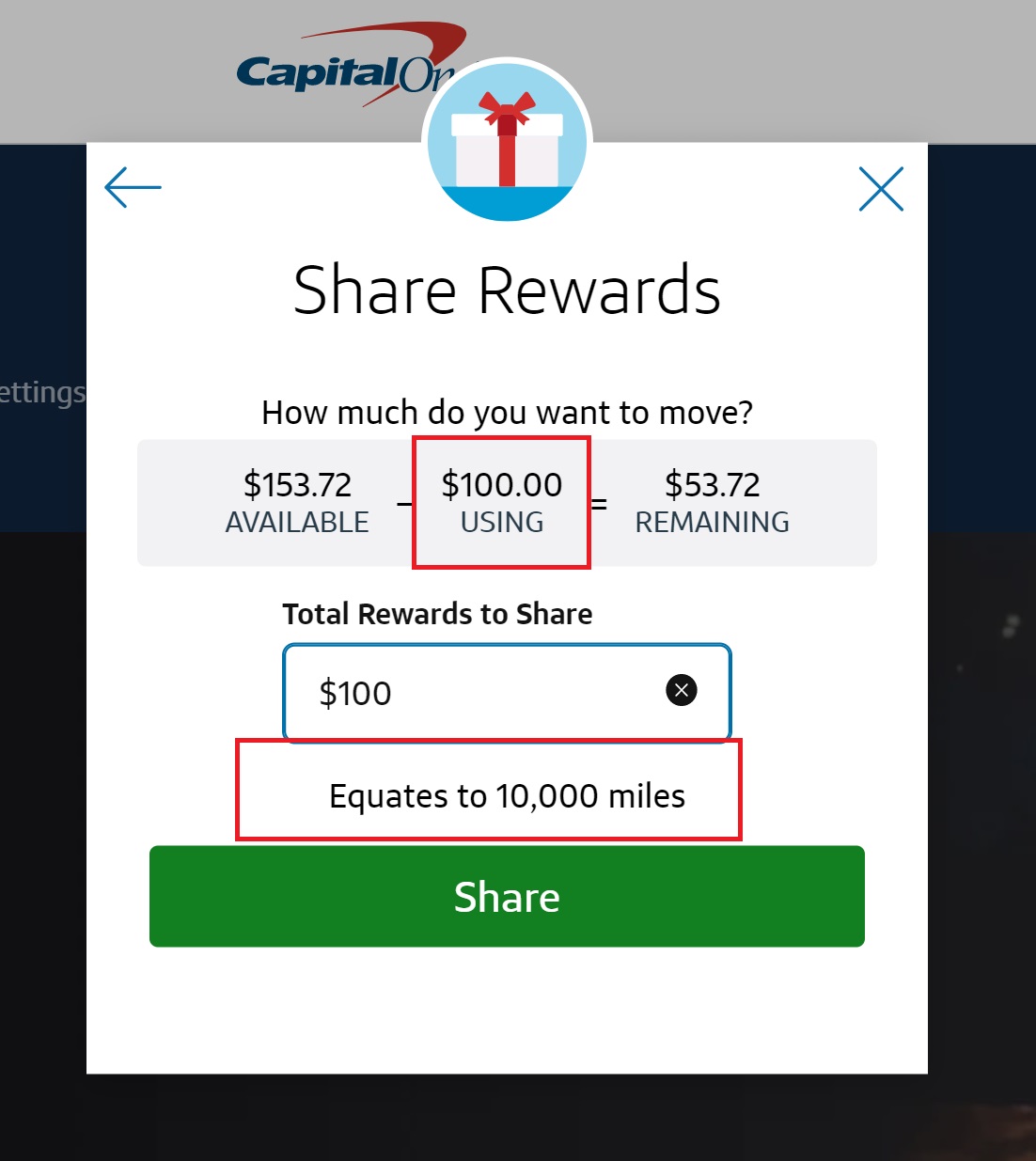

Cash back earned on Capital One cards can be converted to miles if you transfer your rewards to someone else. Cash back can be converted to miles at a rate of $0.01 to 1 mile, even if it is not a published benefit. Cash back earned from spend and welcome bonuses on cash back cards can become airline miles.

The screen shot below shows a person who has cash back earned on their card. $100 in cash can be converted to 10,000 miles by the same person with a Venture card.

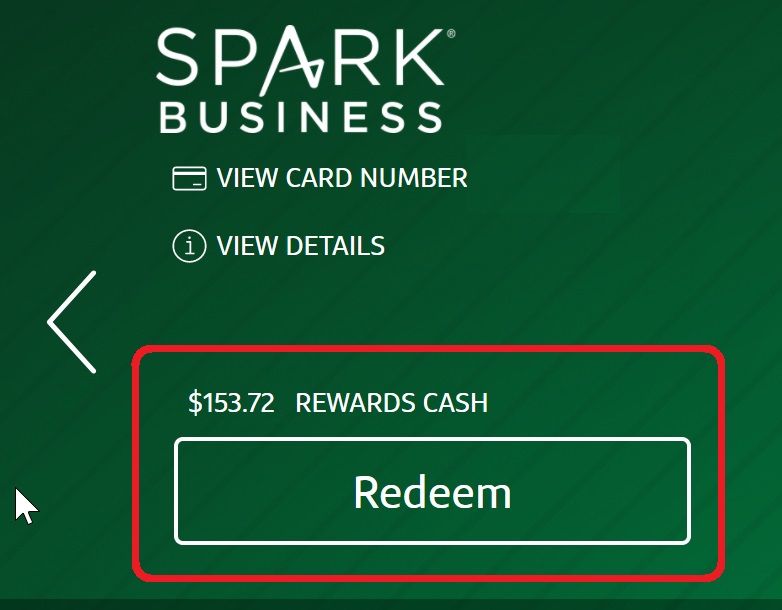

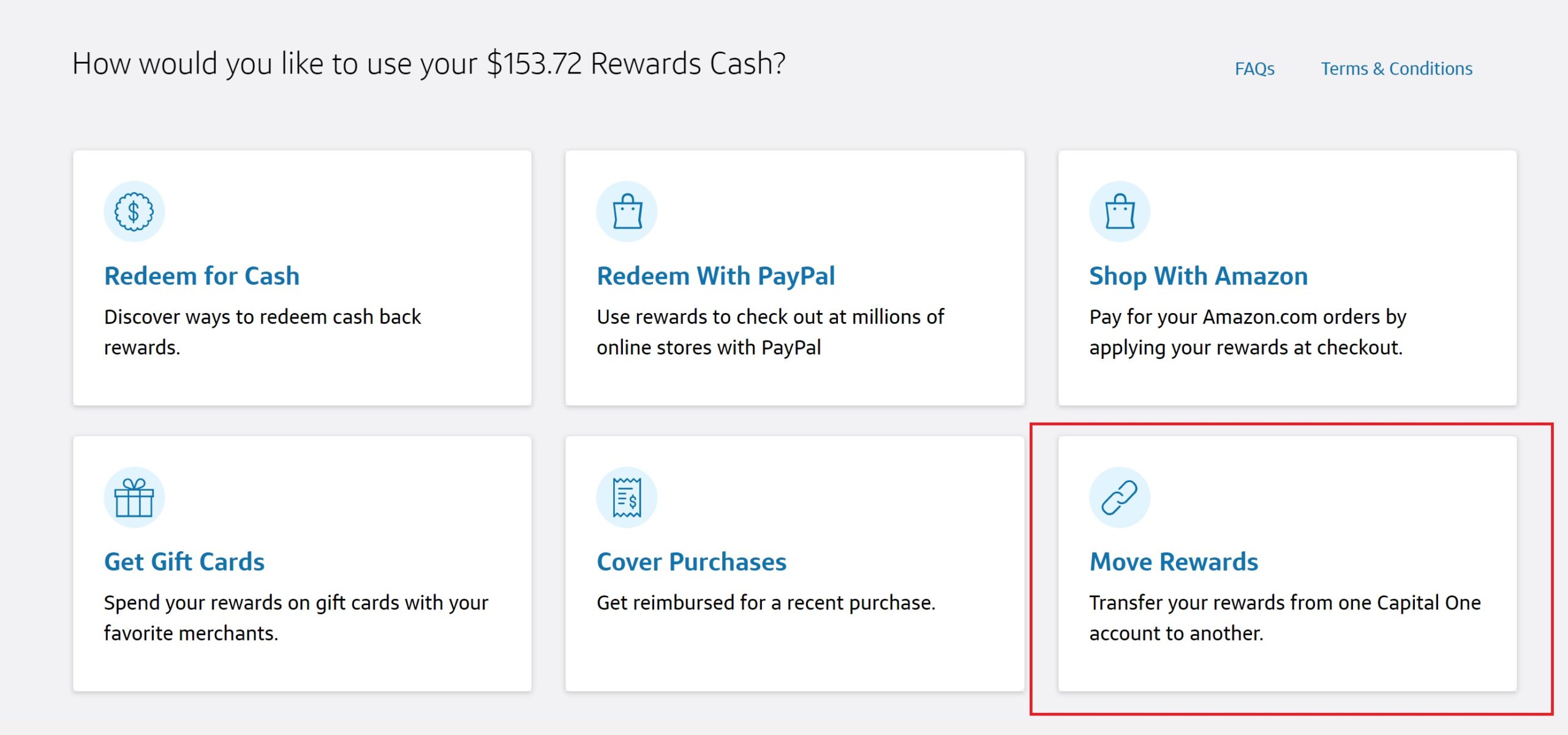

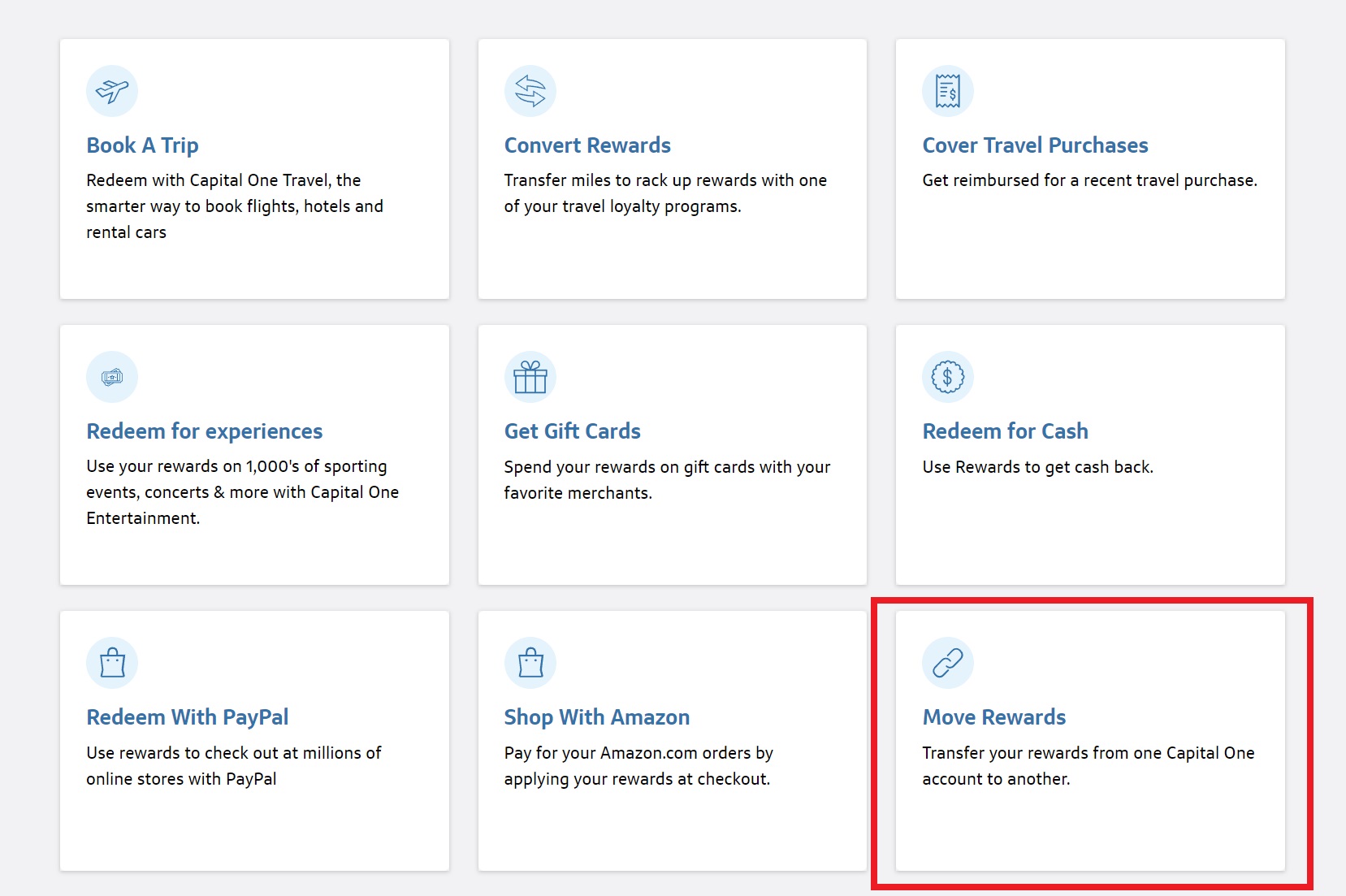

Clicking "Redeem" under your rewards balance will allow you to convert between your own accounts.

Pick "Move rewards".

You can move rewards from one account to another.

Cash back can be moved to a miles card, but miles can't be moved to a cash back card. There is only one way to convert.

You will need to call the number on the back of your card to transfer rewards from one account to another. Capital One allows unlimited transfers from a card to a card, and my wife has been able to call and transfer cash from her card to my Venture card. This isn't a published benefit and there is a chance that a phone representative won't know how to do it, but personal experience shows that it can be done.

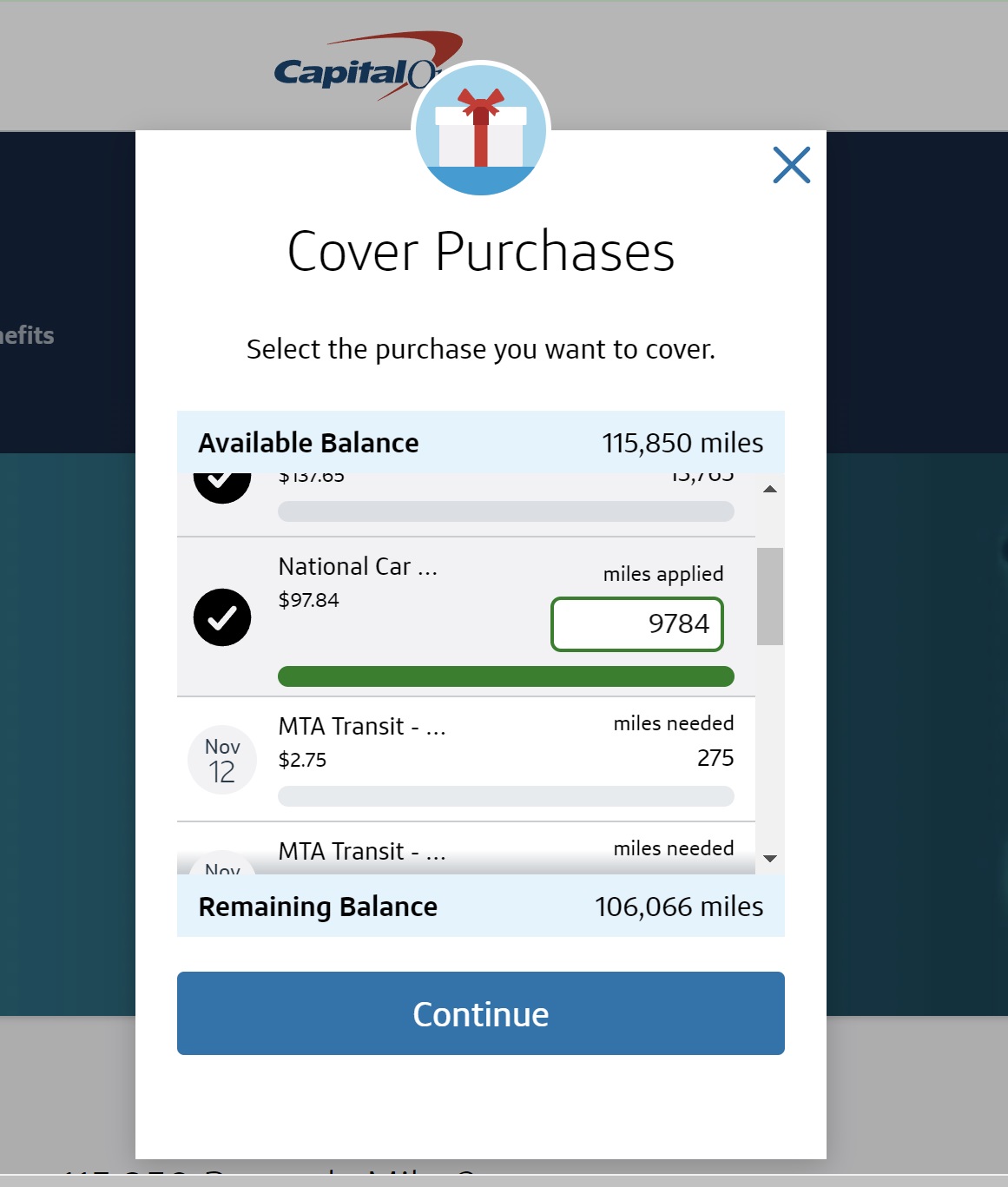

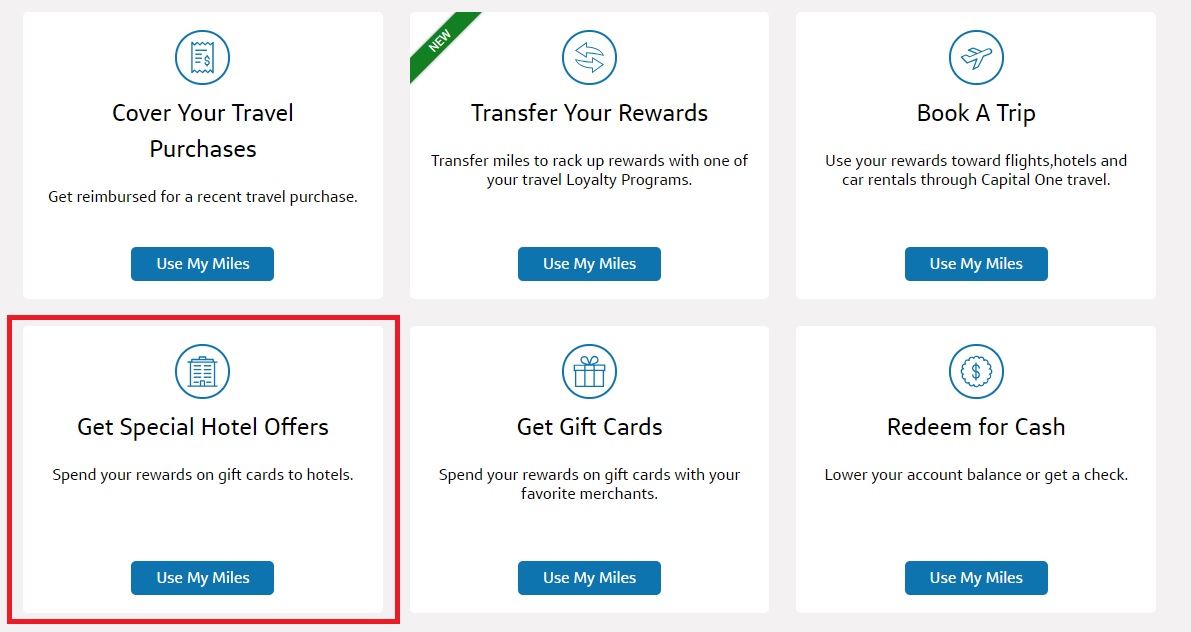

Capital One miles can be used to cover travel purchases. Gift cards with a value of $0.01 per mile can be used to redeem miles. Transferring points to airline partners can give you more value.

Purchases made from airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and time shares are typically considered to be travel purchases for the purposes of requesting a statement credit via Capital One's "Cover Travel Purchases" It's easy to request a statement credit for a travel purchase if you make it within 90 days.

Since you can make your purchases directly from travel providers, you can make booking that qualifies for elite credit / benefits and then apply your Capital One rewards miles after the fact. The Capital One system does not require you to have earned the necessary miles before making a booking, since you have 90 days from the time the charge is posted to your account to redeem.

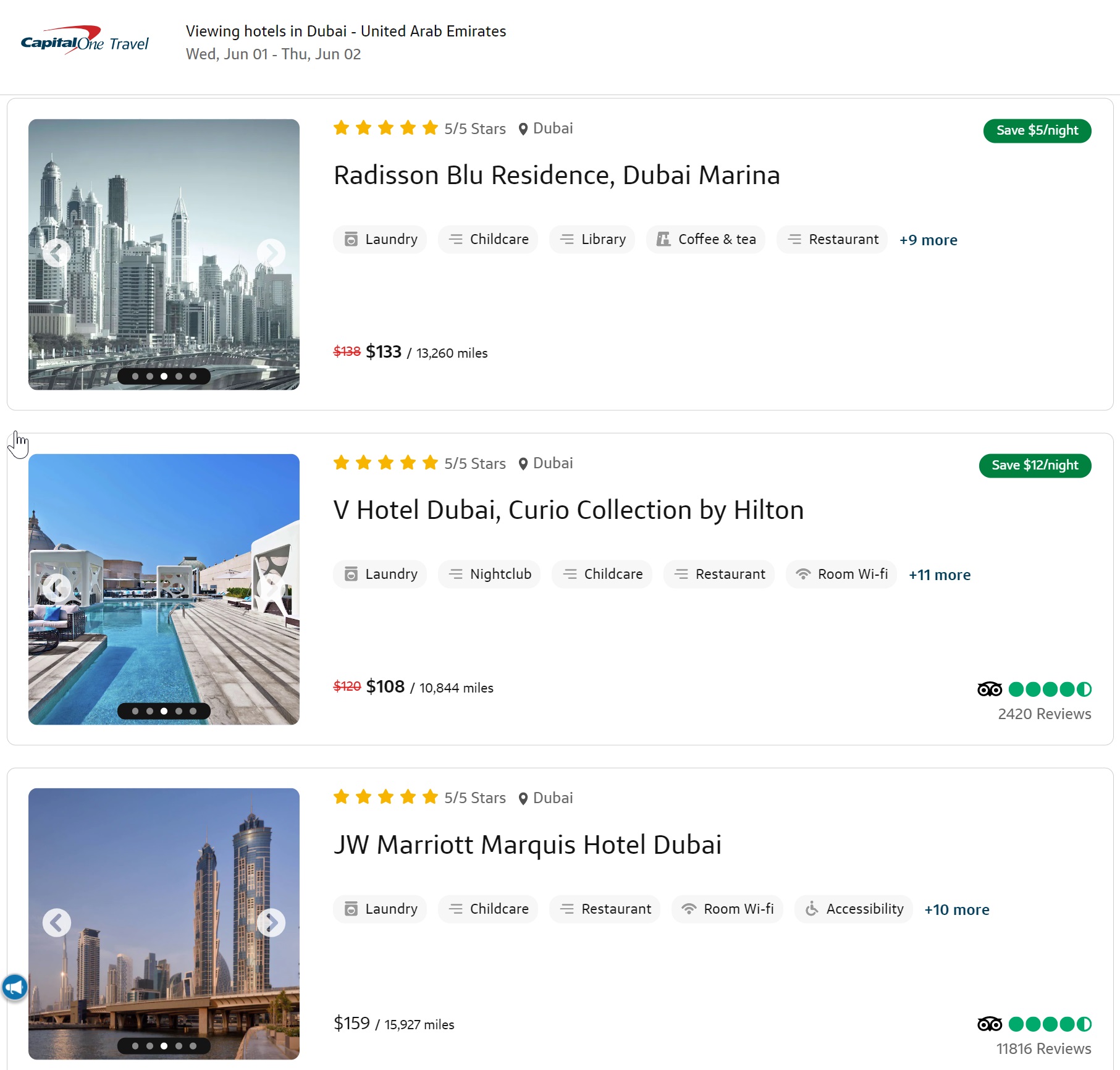

To book travel through Capital One Travel, miles can be used at a value of $0.01 per mile. There are a number of reasons one might consider booking through the Capital One Travel portal.

One can redeem miles from the start through the portal, eliminating the need to remember to erase the charges after they finalize/post to their account. Capital One Travel gives Venture X card holders an annual $300 credit for travel purchases, so they will want to book through the travel company. There are travel-booking bonuses offered by the Capital One Travel portal. Capital One Venture Credit Card holders earn 5X miles for Capital One Travel purchases.

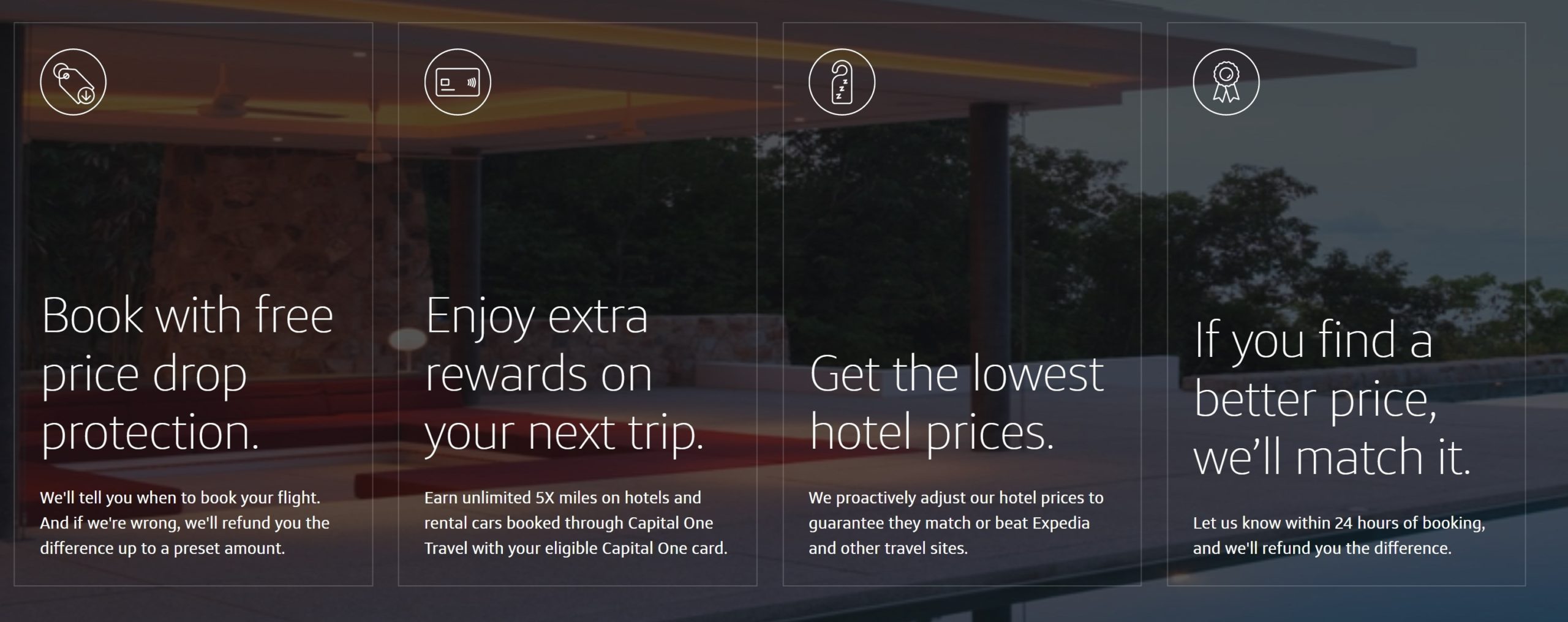

There are some interesting benefits to Capital One Travel. Capital One recommends price match and price drop protection when booking flights.

Price matching within 24 hours of booking is a standard practice in the online travel agency business, but it's not as common via credit card booking portals. This is a great place to see that feature.

We haven't tested out price drop protection on flights yet, but it sounds interesting.

We’re so confident in our price prediction tool for flights that if you ‘book now’ when we recommend, we automatically offer free price drop protection. With price drop protection, we keep monitoring the price of the flight after you buy it, and if the price drops, we’ll give you a refund up to the maximum amount specified when you booked.

It's worth booking via Capital One Travel if you think there will be price fluctuations.

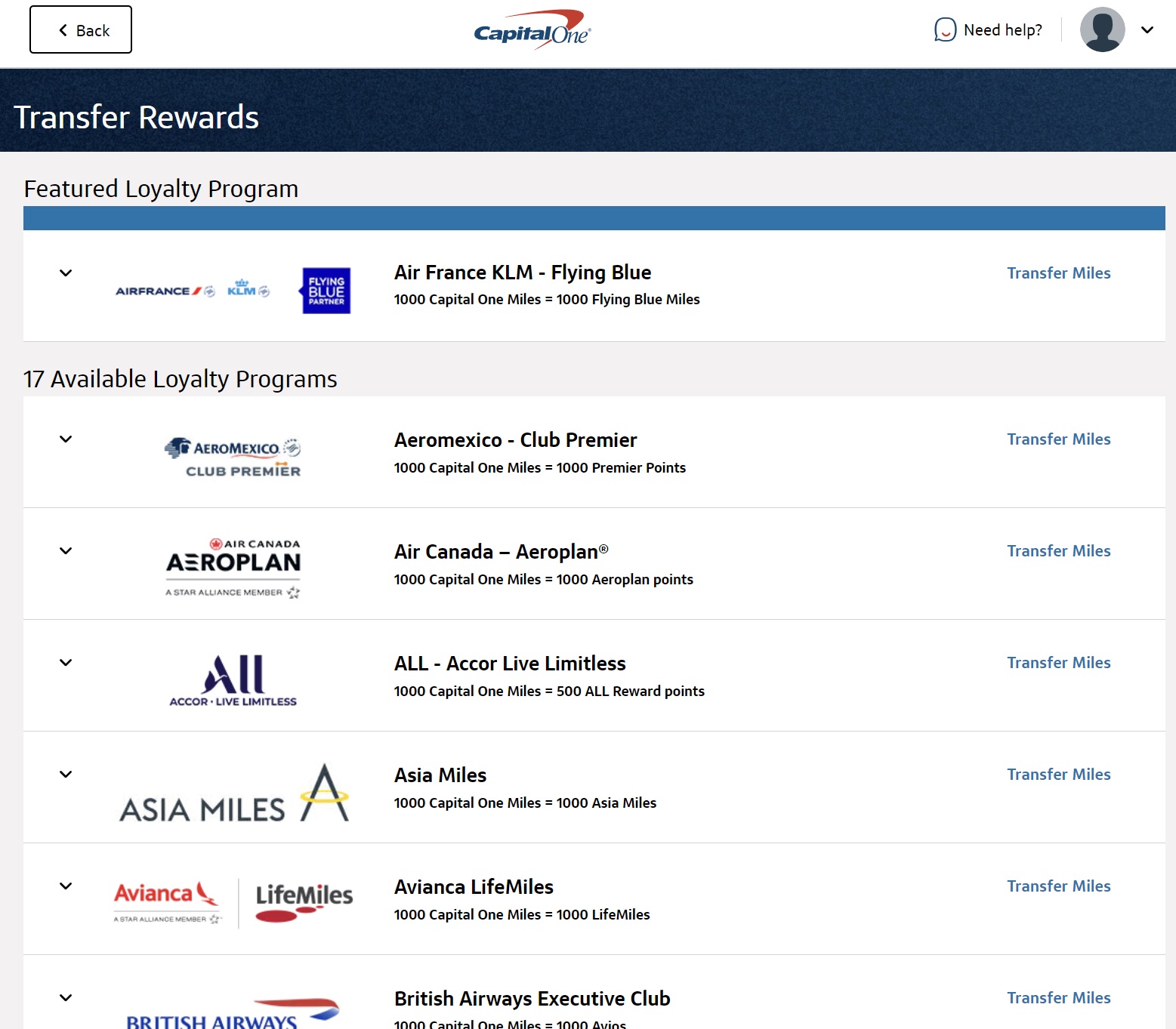

Transferring points to airline partners is often the best way to get high value awards.

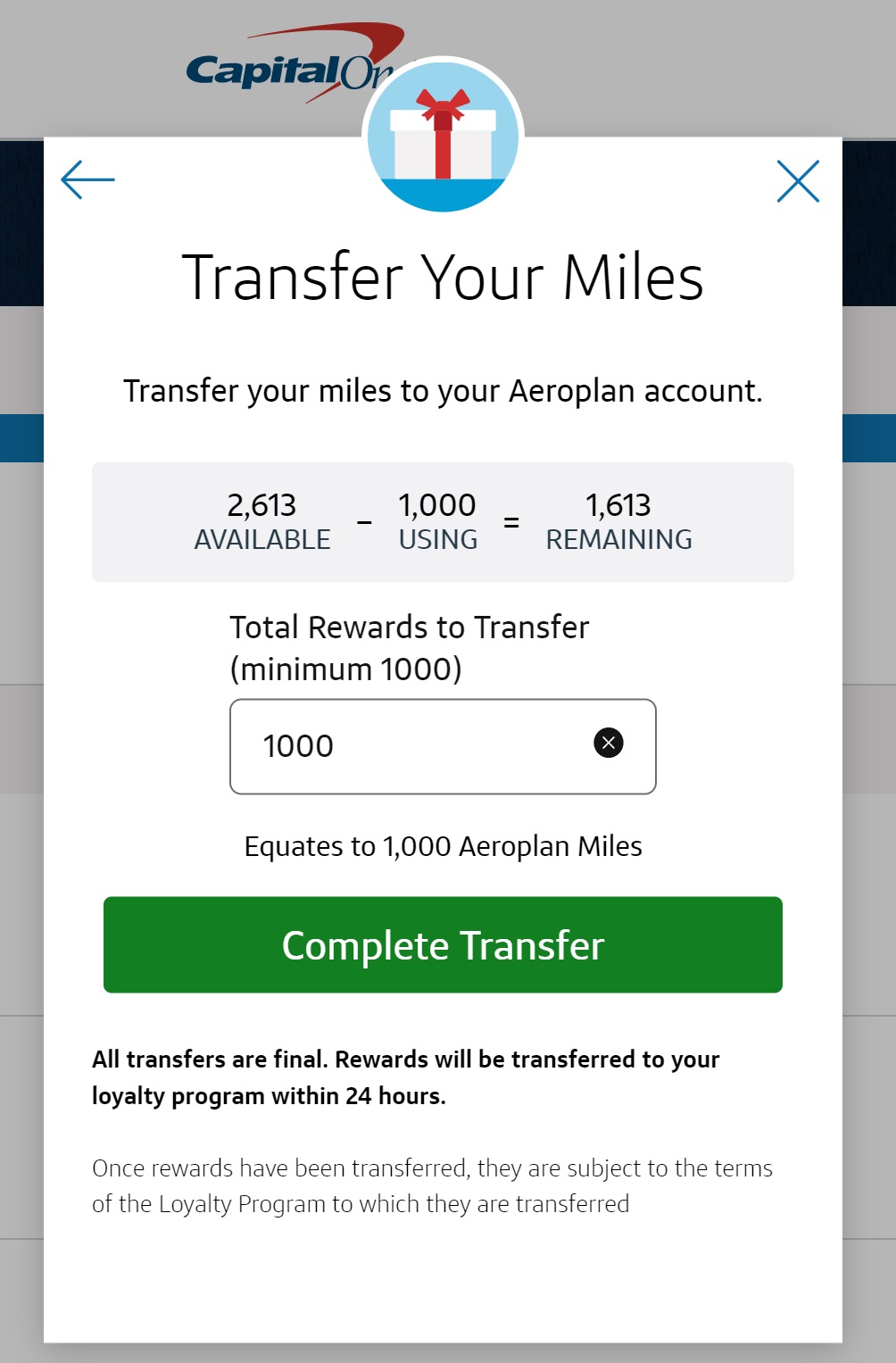

Simply log in to your credit card account, click "Redeem" under your rewards miles balance, then choose "ConvertRewards" to transfer to airline and hotel partners

Enter your loyalty account information and the number of miles you wish to transfer in a certain amount at the bottom of the page. The process of transferring Capital one miles to partners is explained in more detail.

Capital One allows transfers of 100 miles in a single transaction. It's easier to top off an account more precisely.

Transfer bonuses have been offered by Capital One many times. Here you can find any current transfer bonuses.

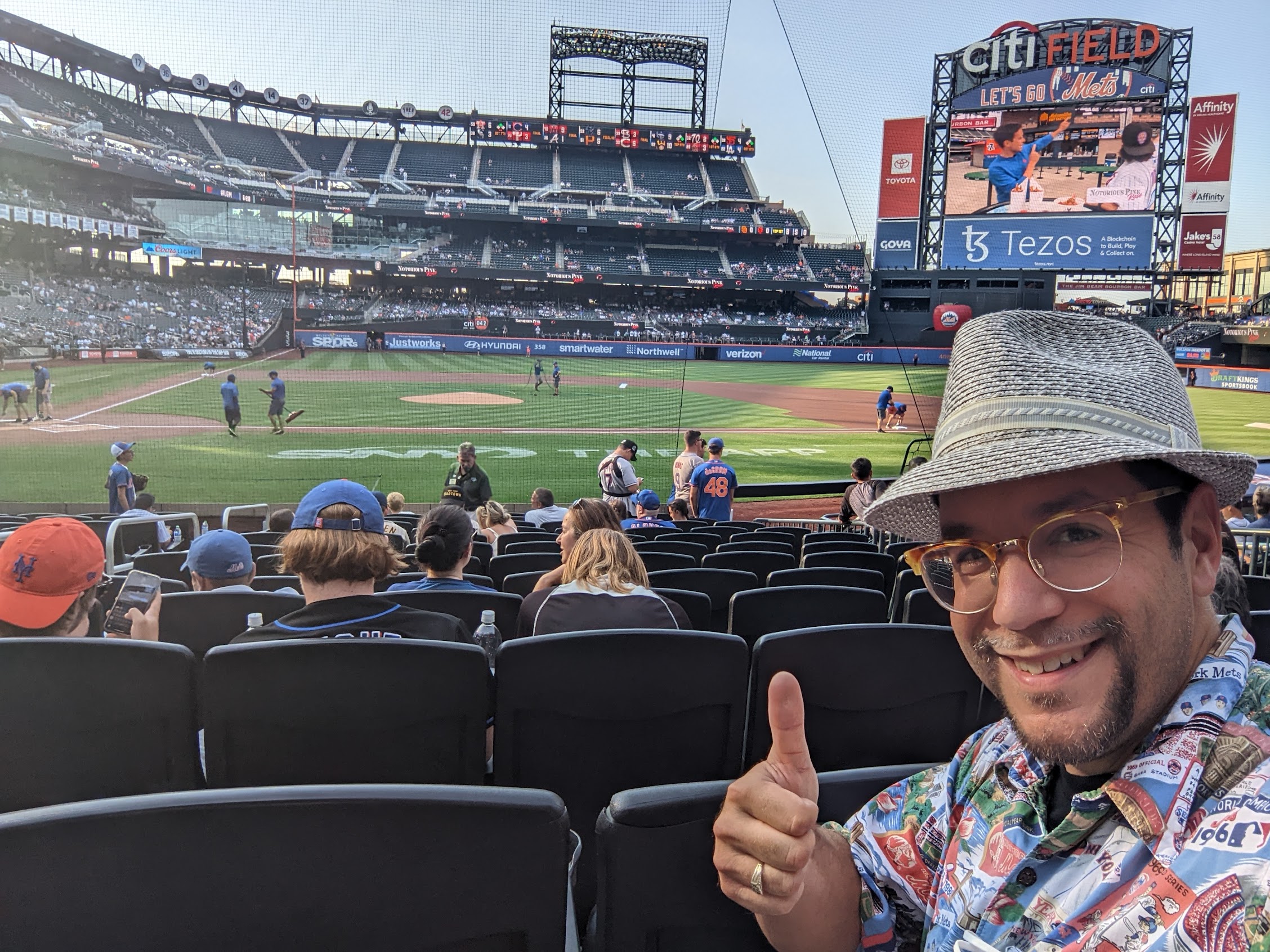

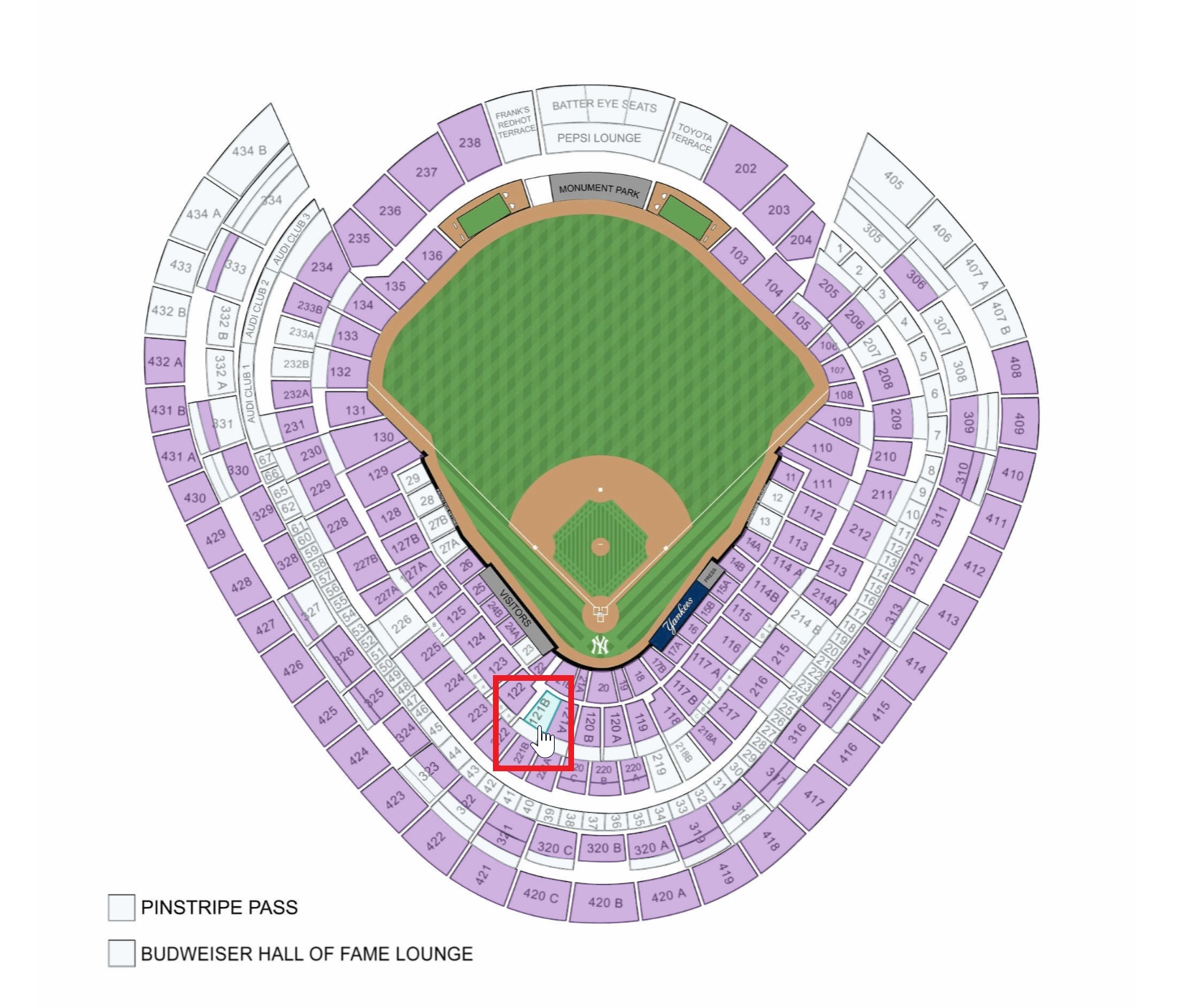

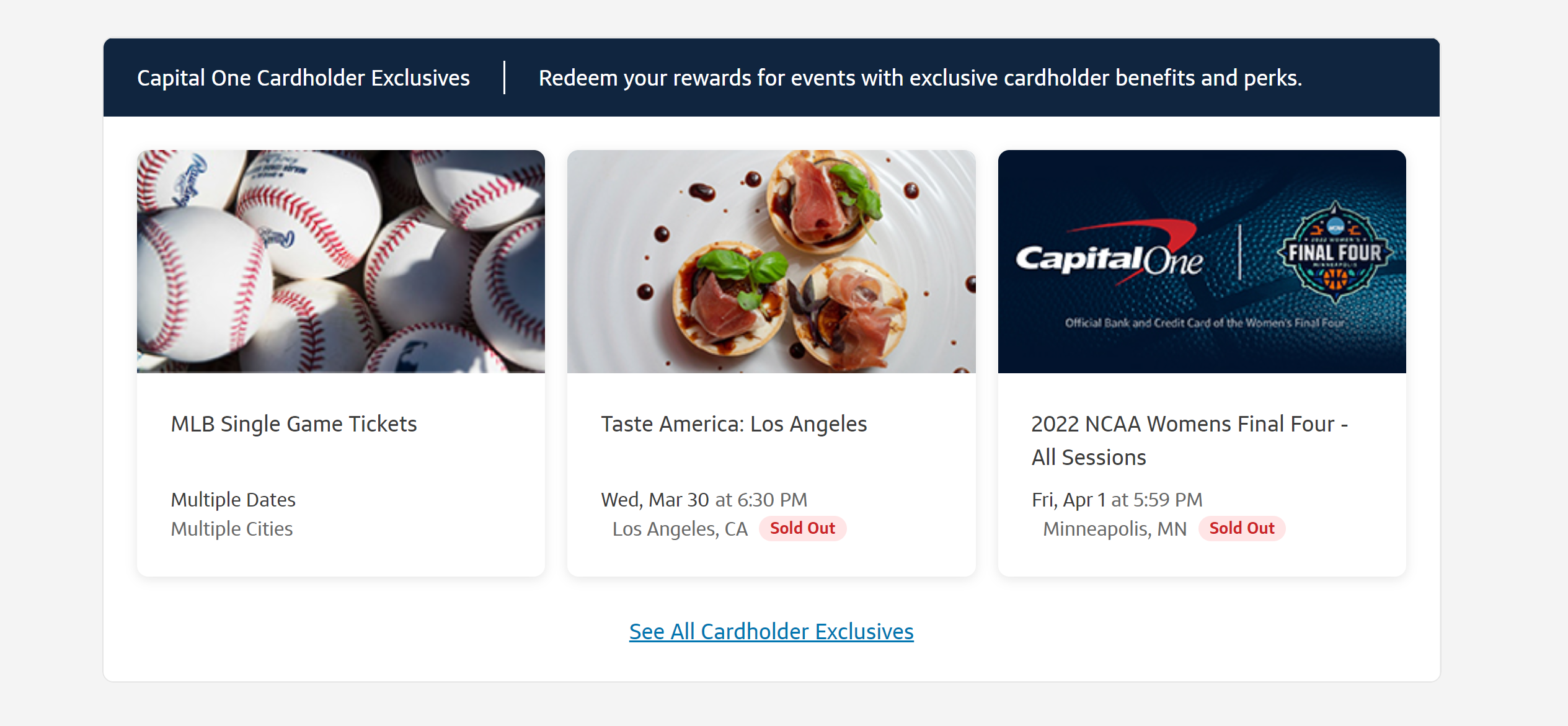

Capital One Entertainment is a place to buy and sell tickets. Some of the events offer good value for miles.

We've seen Capital One Entertainment offer great seats to Major League Baseball games for 5000 miles per ticket, which is an amazing deal.

Capital One Entertainment has the baseball schedule loaded, so it is worth keeping an eye on, but we don't know if those same tickets will be available for the next season. If you want to know how to find the 5K seats, you should read this post.

There are a number of unique ticket opportunities to other events like concerts and dining experiences, often times including meet and greet access or other special perks. Points can be used to purchase tickets to events like the NCAA Final Four. The Cardholder Exclusives section at Capital One Entertainment is a good place to keep an eye on.

Capital One rewards miles can be used as statement credits or cash back, but that is not a good value.

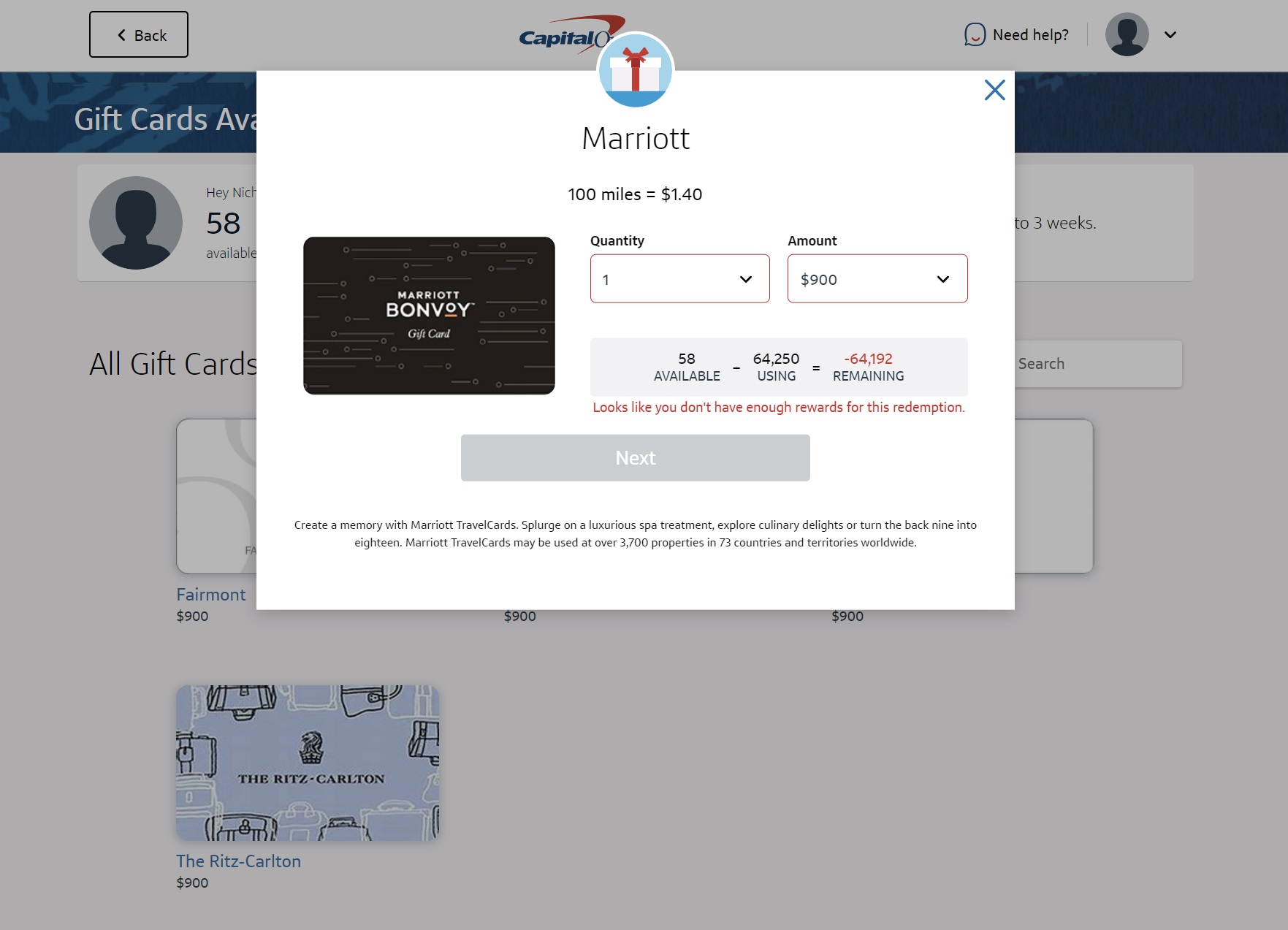

Capital One rewards can be used for gift cards. A $25 gift card costs 2,500 rewards miles and most merchant gift cards only yield $0.01 per mile. If you value the gift cards at very near face value, you can get a full $0.01 per mile toward travel booking with transfer partners and some brands of gift cards are often available for purchase below face value.

The ability for a small number of cardholders to redeem for special hotel offers is an exception. At the time of writing, you can get a $900 gift card from this section of the rewards portal. It's worth considering if you're one of the few people targeted by this redemption. This redemption capability won't apply to most Capital One cards because they only exist on some cards that were opened during a specific window of time when this benefit was offered. If you have an old Capital One account, you can check it out.

The special hotel offers will not be found by those targeted for this redemption. If you don't see the option to get special hotel offers, you won't have access to this redemption.

Click here or click below to read the rest of the post.

It's very easy to combine your rewards with your own accounts. Simply open the card account from which you wish to move the miles, click on "redeem" under your rewards miles balance, and choose "move rewards"

You can choose the account to which you want to send your rewards miles. The amount you want to transfer can be entered. No minimum transfer is required. The maximum is how much you have left in your rewards account.

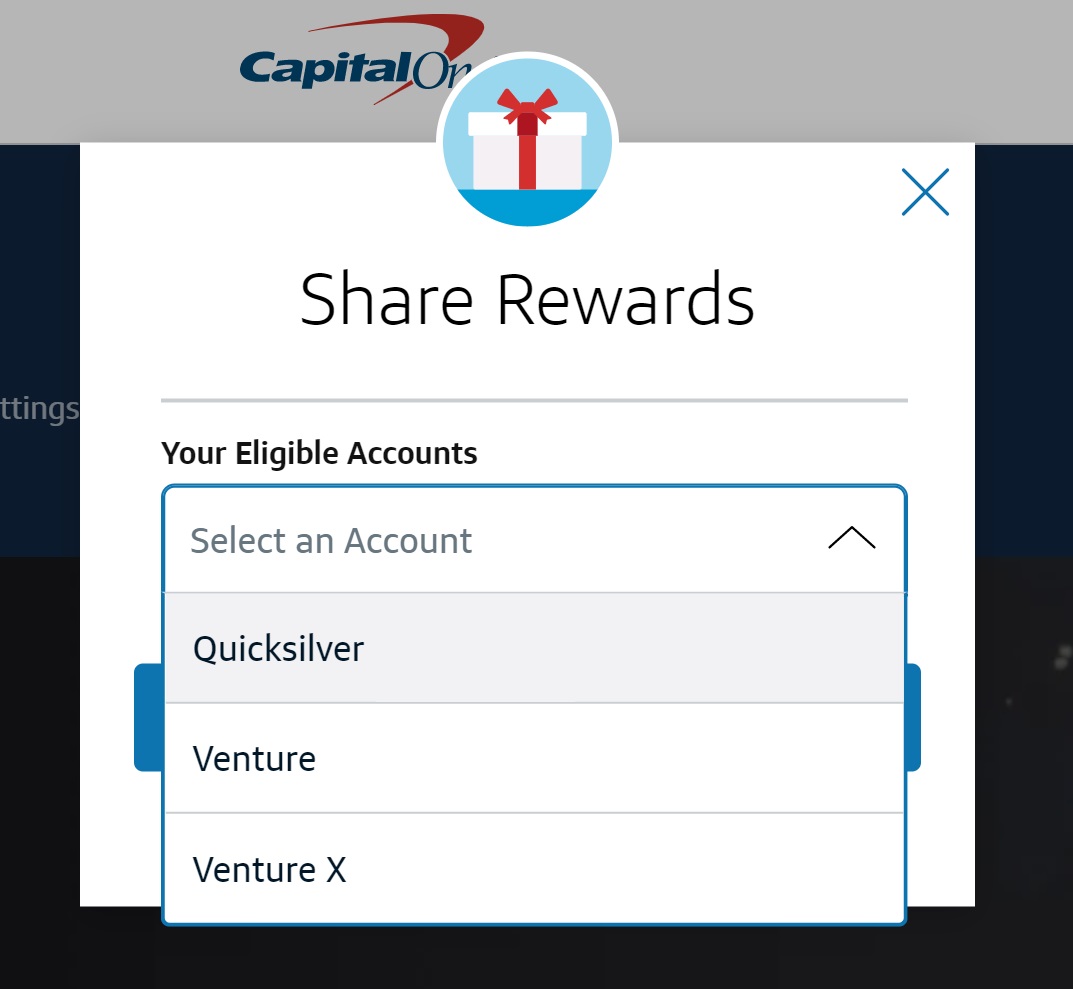

Capital One miles can be shared with other people for more on this.

Capital One cash back cards can be used to move cash back from one card to another. You can move cash back to your miles card at a value of $0.01 to 1 mile if you click "Redeem" under your cash back rewards.

People can transfer their rewards to anyone for free. There is no limit on the number of rewards miles you can transfer to another card.

This can't be done on the internet. You need to call the number on the back of your card and give the agent the card number of the person you want to transfer your rewards miles to. The recipient will need to have a Capital One rewards card in order to get your miles.

This is important.

Capital One miles can be shared with other people for more on this.

If your account is open and in good standing, you can keep your Capital One rewards miles. You will lose the rewards if you cancel the account. If you want to transfer to an airline partner or another Capital One miles-earning card, you need to use the methods above.

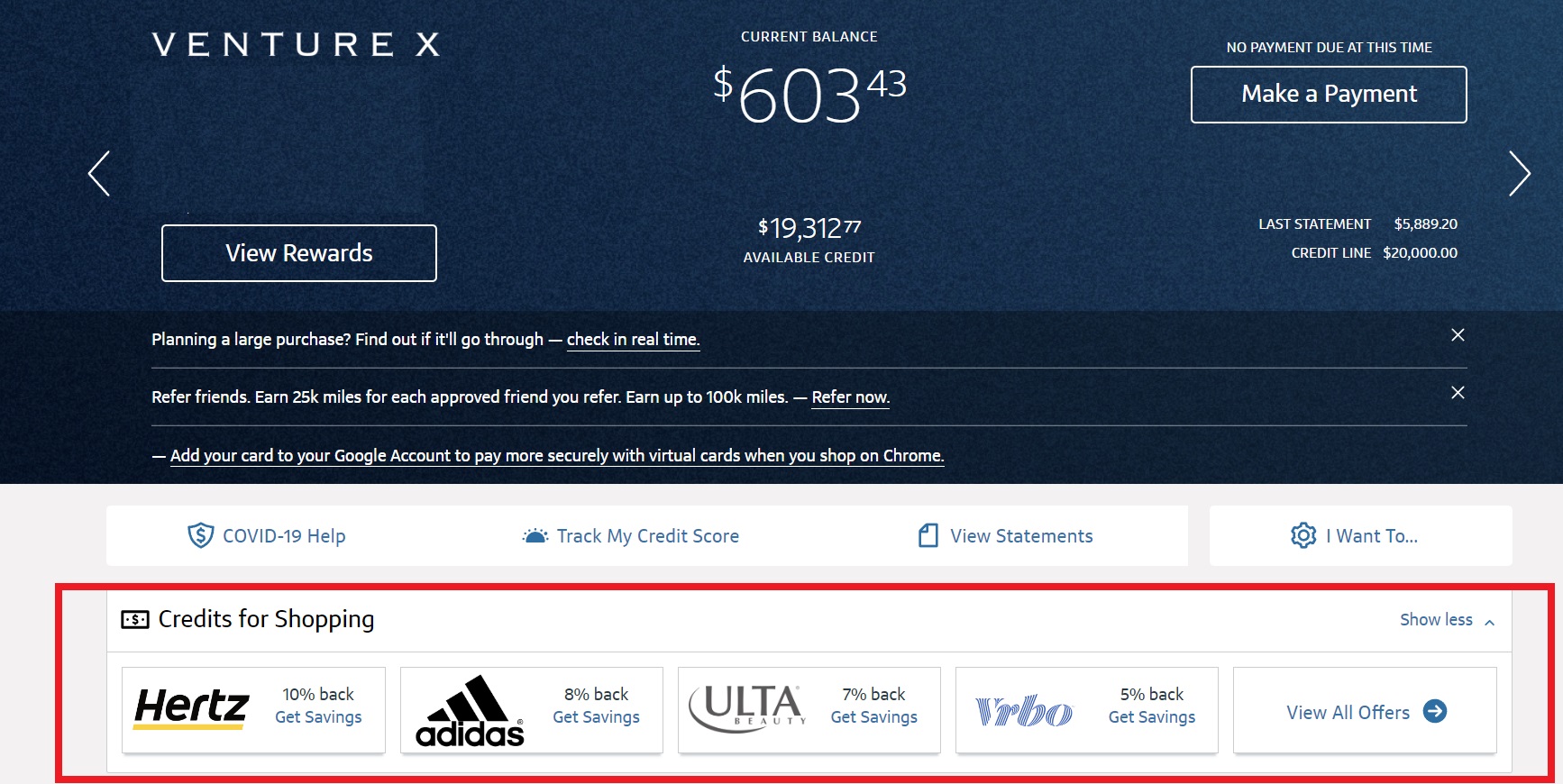

Cardholders and non-cardholders can both earn rewards through shopping at Capital One. For a more detailed comparison of these rewards programs, see: "C" is for confusion.

Capital One doesn't require a card or account to shop on Capital One Shopping. The Capital One Shopping portal is irrelevant to Capital One credit cards as it is not linked to a Capital One account. Cash back rewards can only be used for gift cards in your shopping portal account. Capital One Shopping is a website, an app, and a browser extension. There are some very good offers for those with the extension.

Capital One credit card holders can find offers in their online account. Clicking "view all offers" will take you to a Capital One offers page. Clicking through the buttons on the page will take you to a retailer where you can make a purchase. Within a few billing cycles, Capital One will apply the cash back rewards to your account.

I only earn rewards when I use the Capital One card to pay for these purchases. A person who clicked through to the Capital One offers and used a non-Capital One card to pay for their purchase received the statement credit rewards from Capital One, despite using a non-Capital One card. It's YSMV.

The full terms and conditions for your card can be found by logging in to your account, clicking on your rewards balance, and clicking on the terms and conditions.