The disgraced former CEO of FTX has a knack for self-promotional PR. As other players got wiped out, he cast himself in the likeness of a young boy genius who could miraculously grow his empire. Everyone bought the act.

During Bankman-Fried's press junket of the last few weeks, he spun a new story, one in which he was an inexperienced and novice businessman who didn't know what he was doing.

According to former federal prosecutors, trial attorneys and legal experts speaking to CNBC, it recalls a classic legal defense called the "bad businessman strategy."

At least $8 billion in customer funds are missing, and he founded a hedge fund that lost billions. In his 40 years of legal and restructuring experience, John Ray III had never seen a complete failure of corporate controls and a complete lack of trustworthy financial information. This is the same Ray who oversaw the downfall of Enron.

It's not a crime to be a bad CEO in America. Bankman- Fried blamed FTX's collapse on poor risk management during his recent press tour from a remote location.

At least a dozen times in a conversation with Andrew Ross Sorkin, he seemed to blame his counterpart at Alameda for his actions. He didn't know how bad Alameda was, and he didn't know much about his empire.

Bankman- Fried denied committing fraud at his exchange.

If you are found guilty of fraud, you can be sentenced to life in prison. With Bankman-Fried, the question is whether he misled FTX customers to believe their money was available, and not being used as collateral for loans or for other purposes.

It seems like there is a fraud case here. I would tell Mr. Bankman- Fried to be very concerned about prison time. It should be a top priority for him.

Bankman- Fried seems to be unaffected by his legal exposure. He wouldn't say if he was worried about criminal liability.

It sounds weird to say it, but I think the real answer is it's not what I'm focused on. There will be a place for me to think about myself and my future. I don't believe this is the end.

The lack of apparent action by regulators or authorities has helped inspire fury among many in the industry. The collapse of FTX and SBF shocked everyone.

Bankman- Fried didn't reply to the request for comment. His former law firm did not respond to his comment. Greg Joseph was Bankman-Fried's new attorney, according to a report.

Bankman- Fried's parents are professors at the law school. David Mills was advising Bankman- Fried.

The parents of Bankman-Fried did not respond to requests for comment.

Legal experts told CNBC that Bankman-Fried could face a number of charges, including civil and criminal.

This is all hypothetical at this point in time. Bankman- Fried hasn't been charged, tried, or convicted of a crime.

The chair of the fintech and regulation practice is Richard Levin. He has represented clients before the Securities and Exchange Commission and the Commodity Futures Trading Commission. The entities have begun looking at Bankman- Fried.

There are at least three legal threats that Bankman-Fried faces in the US alone, according to CNBC.

Criminal action from the U.S. Department of Justice is the first thing.

A person for the U.S. Attorney's Office for the Southern District of New York wouldn't say anything.

Securing a conviction is not easy.

The former federal prosecutor is familiar with how the government builds cases. Theprosecutors would have to prove beyond a reasonable doubt that Bankman- Fried and his associates committed criminal fraud.

The argument would be that Alameda tricked these people into giving them money so they could use it to prop up another business.

You have a fiduciary duty to the customer if you accept customer funds.

FTX could be accused of breaching its fiduciary duty by artificially stabilizing the price of its own coin.

Bankman- Fried insists he didn't know about fraudulent activity, but intent is a factor in fraud cases. He told Sorkin that he didn't know about it.

Bankman-Fried denied trying to commit fraud.

Bankman- Fried could face civil enforcement action. State banking and securities regulators could bring that to the attention of the Securities Exchange Commission.

There are multiple levels of potential exposure for the executives involved with FTX.

According to the Wall Street Journal, the DOJ and the SEC are investigating the collapse of FTX.

That kind of cooperation allows both criminal and civil probes to go at the same time.

The lead in securing civil damages may be taken by the SEC or theCFTC.

The SEC doesn't comment on the existence or non-existence of an investigation. There was no response to a request for comment.

The question of who would take the lead depends on whether or not there were securities involved, according to the former federal prosecutor.

Gary Gensler, chairman of the SEC, met with Bankman-Fried and FTX executives in the spring of 2022. Many exchanges, including FTX, have derivatives platforms that sell financial products that fall under the jurisdiction of the Commodity Futures Trading Commission.

If you sell securities without a registration or exemption, you could be sued by the SEC for monetary penalties.

They could claim that FTX was operating an unlicensed securities market.

Any of the FTX subsidiaries were overseen by the overseas regulators.

The Securities Commission of The Bahamas believes it has the authority to file a case in New York. The case has been folded into the main Chapter 11 proceedings of FTX.

Customer digital assets have been moved from FTX custody to their own, according to court documents. Unlike other countries, the Bahamas has a robust legal framework for digital assets.

They aren't sold on their ability.

The Bahamas lack the institutional infrastructure to tackle a fraud like this, and have been completely negligent in their duty, according to Nic Carter. Carter told CNBC that he wasn't an FTX investor.

There is no need to stand. The U.S. courts have access to this area and the U.S. leaves it in the hands of the Bahamas.

People who have lost their savings don't wait. There have been class-action suits filed against FTX endorsers. The celebrity endorsers were excoriated for failing to do their due diligence.

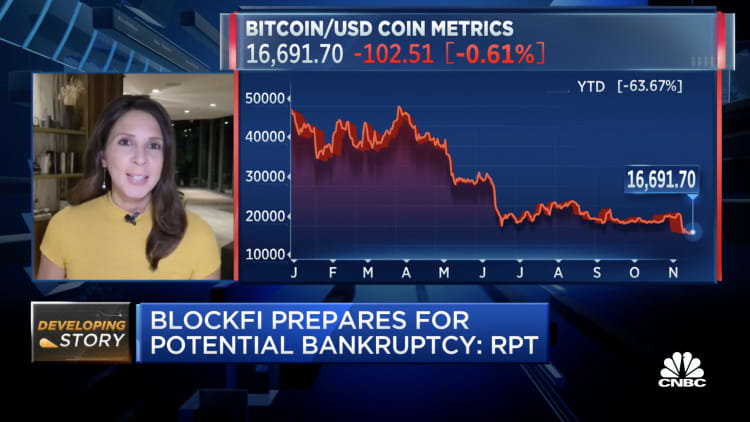

FTX's peers are also filing suits against Bankman- Fried. Bankman-Fried was sued by BlockFi in November for providing the firm's security.

BlockFi was saved from insolvency by FTX and Bankman-Fried in June but was left with a similar problem when FTX failed.

Bankman- Fried has been sued in several states. He is facing class-action suits in both states over one of the great frauds in history.

The largest securities class-action settlement was in the case of Enron. There are civil and criminal fines that Bankman- Fried faces.

Carter told CNBC that the onus should be on the US government to pursue Bankman- Fried.

The U.S. isn't shy about using foreign proxies to go after someone.

Bankman- Fried is most likely to be charged with wire fraud. If the DOJ were able to get a conviction, a judge would look to a number of factors to decide how long to sentence him.

FTX's only official U.S. regulator was once headed by a senior trial lawyer named BradenPerry. He is a partner at KennyhertzPerry, where he advises clients on compliance and enforcement issues.

If Bankman- Fried is found guilty of fraud or other charges, he could be in prison for the rest of his life. Predicting the length of a potential sentence is difficult.

Each crime in the federal system has a starting point.

The system for determining the maximum and minimum allowable sentences can be confusing. Theense level starts at one and goes up to 43.

The minimum sentence for a wire fraud conviction is anywhere from zero to six months.

Enhancing the rating can be done.

The dollar value of loss is an important factor. 30 points are added to the base level offense for losses over $550 million. Customers of FTX have lost a lot of money.

The use of certain regulated markets adds 4 points.

Bankman- Fried would max out the scale at 43 if there were enhancements. If he is convicted of a single wire fraud offense, Bankman-Fried could face life in federal prison.

Mitigating factors can be used to reduce the severity of any alleged crimes.

Many white- collar defendants are sentenced to lesser sentences than what the guidelines dictate.

The founder of a $90 million hedge fund was sentenced to more than seven years in prison after pleading guilty to a securities fraud charge. A Swedish national was sentenced to 15 years in prison for securities fraud, wire fraud and money laundered in the US.

Bankman- Fried could be fined a lot of money. Bankman-Fried told CNBC's Sorkin at the DealBook Summit that he was down to his last $100,000.

Depending on what is discovered as part of the investigations by law enforcement and the civil authorities, you could be looking at both heavy monetary penalties and potential imprisonment for a long time.

It won't happen in a hurry.

In the most famous fraud case in recent years, the mastermind of a multi-billion dollar Ponzi scheme was arrested within 24 hours. On the spot, he admitted to his crime.

The FTX founder isn't admitting wrongdoing. Any attempts to catch him would need to be extradited.

It will take a long time for prosecutors and regulators to work through everything.

It took a long time for similar cases to be put together. It was difficult to collect enough data to prosecute at FTX. It was difficult to know how and when money flowed out for legitimate expenses due to the way expenses were handled.

Senior executives were not charged until after the company went under. Some in the community don't like that kind of timelines.

Carter said that the fact that Sam is walking free is a travesty.

That doesn't mean they're standing down.

People shouldn't jump to the conclusion that something isn't happening because it hasn't been made public.

He could just disappear.

"That's always a possibility with the money that someone has." He doesn't think it will happen. "I believe that there has been some negotiation with his attorneys, and the prosecutors and other regulators that are looking into this, to ensure that when the time comes, he's not fleeing somewhere."

Bankman- Fried won't be resting easy as he waits for the hammer to drop. The congressman invited him to appear before the hearing.

Bankman- Fried told Waters that he would appear if he understood what happened at FTX by then.

The person who is Bankman- Fried's counterpart at Alameda is datememe datememe. Her name was spelled wrong.