Russia won't accept a cap on its oil exports.

The cap is meant to stop countries from paying more than $60 for a barrel of Russian crude oil.

The measure will come into effect on Monday.

Moscow had prepared for the move, according to the Kremlin spokesman.

He said that they wouldn't accept the ceiling.

The price cap was put forward in September by the G7 nations in order to hit Moscow's ability to finance the war in Ukraine.

The European Union and Australia said in a joint statement that the decision was taken to prevent Russia from benefiting from its war of aggression against Ukraine.

The White House said the deal would help limit Putin's ability to fund the war machine.

UK Chancellor Jeremy Hunt said the UK would not abandon its support for Ukraine and would look for new ways to curb Putin's funding streams.

Russia's move to sell its oil to other markets such as India and China, which are currently the largest buyers of Russian crude oil, will be somewhat mitigated by the measures.

The Western-proposed cap should be halved, according to the Ukranian government.

"Russia's economy will be destroyed, and it will pay and be responsible for all its crimes," said the chief of staff for the Ukrainian president.

He said a cap of $30 would have destroyed it quicker.

On 5 December, an EU-wide ban on Russian crude oil imports by sea will come into effect.

The price cap is supposed to complement that.

The G7 policy states that countries that sign up will only be allowed to purchase oil and petroleum products that are sold at or below the price cap.

Russia's oil will be denied insurance to be delivered to countries that do not adhere to the price cap. It will be difficult for Russia to sell oil above that price.

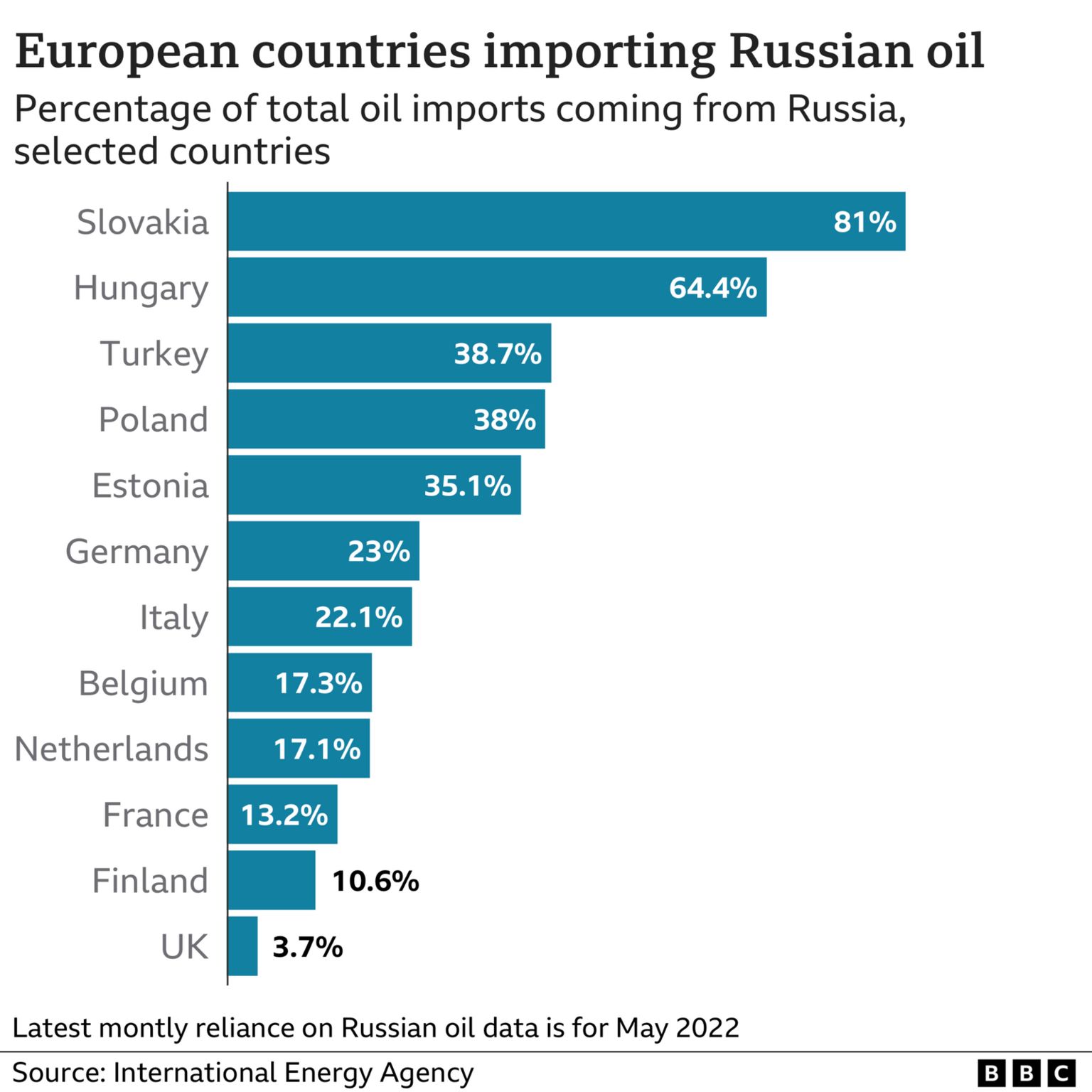

More than half of Russia's oil exports went to Europe before the war. The Netherlands and Poland imported the most.

The EU countries have been trying to decrease their dependency. The US and UK both banned Russian crude oil by the end of the year.