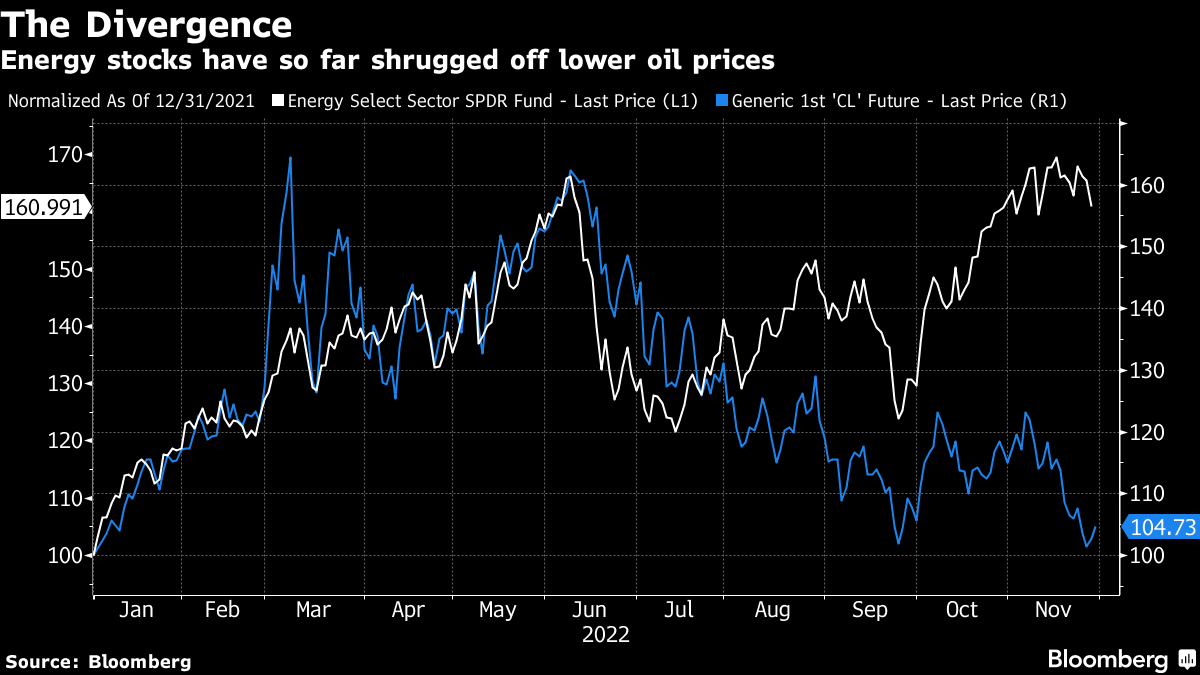

So far, energy stocks have not been affected by the price of oil.

There are stacks of steel pipes used for drilling oil wells at a drilling site on the land of the University of Texas System.

Photographer: Jordan Vonderhaar/BloombergPick which fighter you want.

While the price of West Texas Intermediate crude oil for immediate delivery has dropped almost 18% since the middle of July, energy stocks have jumped more than 32% in the same time frame.

There is an unusual divergence between how investors view companies in the carbon business and the underlying commodities they produce.

It is a noteworthy break in a historic relationship.

As crude prices have declined, they haven't driven down energy stocks much, which is a surprise given how correlated energy relative performance was with crude until the summer

While the divergence could be a small blip as investors struggle to adjust to the reality of lower oil prices after a summer of surging crude prices, it could also hint at a secular shift in how they view the overall prospects of such companies.

A huge drop in the price of crude oil in the mid-2010s led to billions of dollars worth of losses for energy investors and many energy companies have spent the subsequent years deleveraging and reducing costs to better weather fluctuations in commodities prices.

The highest percentage of companies reporting earnings above estimates in the most recent quarter was claimed by the energy sector.

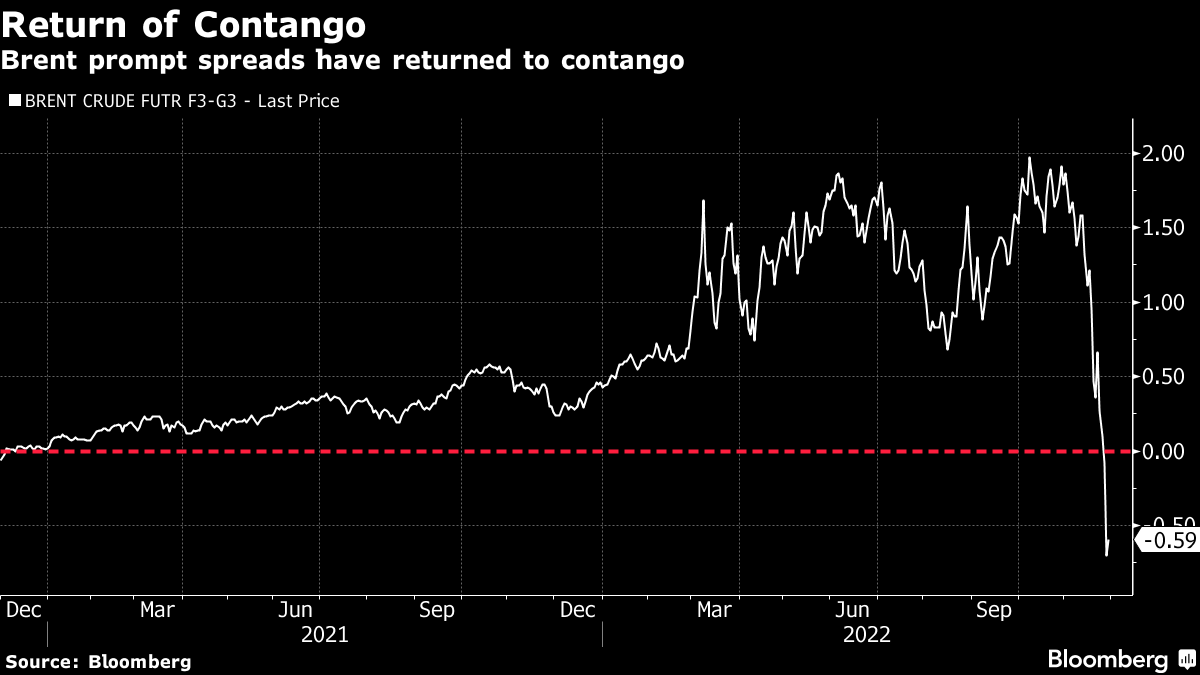

Even though spot prices are falling, the underlying structure of the oil futures curve could signal good times to come. For the first time in over a year, the prompt spread of the international benchmark has flipped into contango, meaning prices for oil longer out on the futures curve are higher than current spot prices.

Since the beginning of October, the overall decline in prices has been less severe than the drop in spot prices, and there has been some modest firming.

It can be beneficial for oil producers who are still able to lock in higher prices for deliveries later on in the future.

Some analysts think that energy investors might be getting this one wrong, and others think that energy stocks will play catch up to spot prices soon.

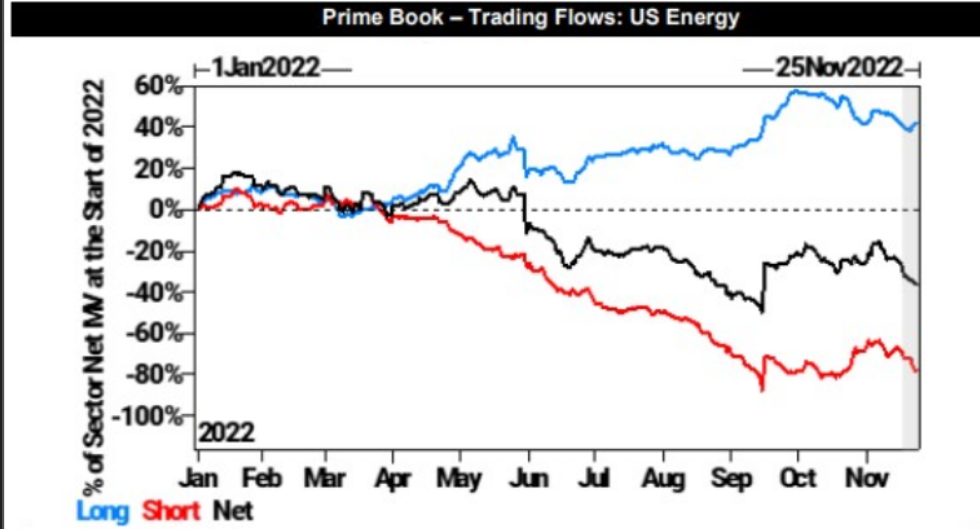

Energy was among the most notionally net sold sectors on the Prime book this past week, primarily driven by risk on flows with short sales out pacing long.

Much of the recent weakness in oil has been around China demand weakness. There is an investor view that we should look through near-term demand risks in the region to focus on a likely reopening in the second half of next year. Outside of E&P, companies have delivered a generally strong set of third-quarter earnings results, with majors such as Exxon Mobil Corp. benefiting from global gas and refining tailwinds.

The Goldman analysts said that they do believe that oil markets will need to stabilizing in order for the stock market to move higher.

Links that are related

Natural gas is being used to rescue energy stocks with oil.

The capital markets have a lot to do with surging oil prices.

The prices of oil are brought down by actual nuts and bolts.

Watch Live TVListen to Live Radio