Sam Bankman- Fried was said to be the one man who could save it. The former FTX CEO took over firms as the market for cryptocurrencies fell. FTX won the bidding for the bankrupt firm in October.

Firms which were saved by Bankman-Fried are now uncertain. It was put up for sale last week. After weeks of speculation that the FTX collapse had crippled it, Blockfi filed for Chapter 11 in New Jersey.

Mark Renzi said that the FTX has now spread to another entity. In a detailed 41-page filing, Renzi walks creditor, investors, and the court through his perspective at the helm of Block Fi.

According to Renzi, exposure to two successive hedge fund failures, the FTX rescue, and broader market uncertainty all led to BlockFi's downfall.

From Renzi's perspective, BlockFi doesn't face the issues apparently facing FTX. Renzi pointed to a $30 million settlement with the SEC and the company's corporate governance and risk management protocols, writing that BlockFi is "well-positioned to move forward despite the fact that it has been a terrible year for the industry."

FTX's lack of financial, risk, anti-money laundering (AML), or audit systems may be one of the issues that Renzi refers to. John Ray said in a court filing that he had never seen a complete failure of corporate controls like in FTX.

Renzi believes that FTX's intervention in summer 2022 worsened outcomes for BlockFi. Renzi is a managing director at Berkeley Research Group, which BlockFi has enlisted as a financial advisor.

Both BRG and Kirkland & Ellis have experience with bankruptcies in the digital currency space. During the failed auction to FTX, both BRG and Kirkland were present. According to court documents, both firms have collected millions of dollars in fees from Blockfi.

Renzi points to the collapse of Three Arrows Capital as the root cause of BlockFi's liquidity crisis.

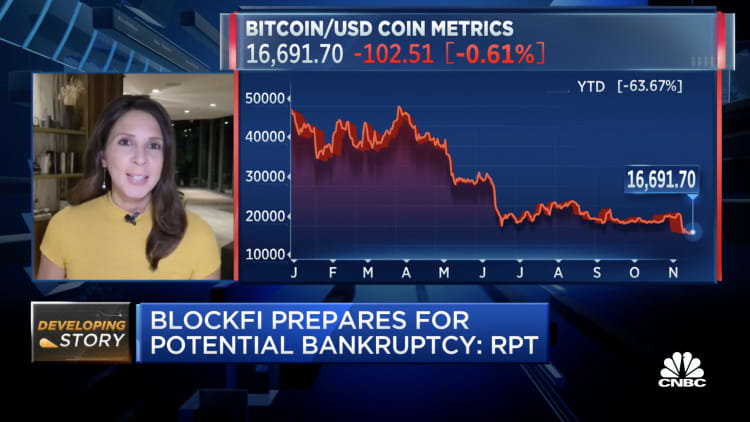

There is a chart.

Line chart with 330 data points.The chart has 1 X axis displaying Time. Range: 2022-01-02 00:00:00 to 2022-11-27 00:00:00.The chart has 1 Y axis displaying values. Range: 10000 to 50000.End of interactive chart.

Blockfi had high interest rates on customer accounts. The firms were able to do so thanks to the use of cryptocurrencies.

A new round didn't work out. Renzi said that traditional third-party investors were scared off by unfavorable market conditions so they turned to FTX to make good on customer withdrawals. BlockFi didn't stop customer withdrawals at that time.

Loans up to $400 million were delivered by FTX. FTX reserved the right to acquire BlockFi in July of 2023.

BlockFi was initially buoyed by FTX's rescue package, but dealings with FTX's Alameda Research limited further undermined the stability of the organization. BlockFi tried to execute margin calls and loan recalls on their Alameda exposure.

The court filing said that the recovery on which is unknown was caused by Alameda's default on $680 million of loans.

Blockfi was forced to do what it had resisted doing. Customer withdrawals were paused on the day FTX filed for bankruptcy. With no access to their funds, investors are left in limbo.