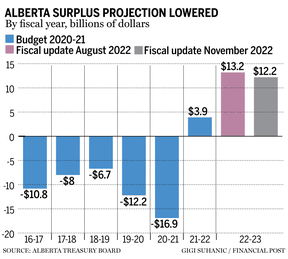

The province is on track to record a surplus of $12.3 billion this year, down from its previous forecast of $13.2 billion, due to a softer energy price and a large package of new spending initiatives.

The province said in its mid-year fiscal update that non-renewable resource revenue continues to buoy its coffers, outweighing contributions from corporate and personal income taxes.

Despite the recent drop in oil prices, tight global energy supplies and Russia's invasion of Ukraine are keeping energy prices high. Resource revenue is expected to decrease next year, according to the province. The benchmark West Texas Intermediate crude will finish the fiscal year at US$91.50 per barrel, but will fall to US$78.50/bbl in the fiscal year ending March 31, 2024 and US$73.50/bbl the following year, according to a prediction by the province.

Finance Minister Toews said at the press conference that the economy of the province is doing well. He said that the fiscal situation has improved since he tabled this year's budget.

There has been an increase in expenses as well.

More than half of the increase in expenses will go towards the recently announced inflation relief package, according to the province's second quarter report.

In a TV address to the people of the province earlier this week, Smith said that the government would provide fuel tax relief, electricity rebates, natural gas consumer protection, indexation of personal income taxes, and means-tested payments to families and seniors.

The majority of the money is going to be spent this year.

The Heritage Savings Trust Fund, the province's main long-term savings fund, was reduced from $3 billion in the last quarterly update to $1.2 billion.

Toews said the province didn't trade long-term savings for short-term inflation relief. The province expects to have $5.8 billion in surplus cash by the end of the year.

There was a question about the decreased allocation to the Heritage Savings Trust Fund. We decided to put that decision in our plan around the fiscal framework.

Debt will be paid down by the province this year. The largest debt repayment in the province's history is expected to take place in 2022-23.

The decision to defer allocations to the Heritage Savings Trust Fund was criticized by the New Democratic Party. ShannonPhillips said at a press conference that this is how you piss off a boom.

The province deviated from its previously planned allocations to the Heritage Savings Trust Fund in order to prioritize debt repayment.

The drop in oil prices and Smith's new affordability measures have eaten into the pool of available funds for debt repayment and long-term savings.

They had $5.8 billion in unallocated cash that could have been used to contribute to the Heritage fund. I can only assume that there are discussions about the best use of the money.

Some analysts think the province could use unallocated cash for debt reduction or inflation protection.

Sébastien Lavoie, an economist with the Laurentian Bank, said in a research note Friday that more measures have been put in place in Quebec to shield citizens from inflation.

Lavoie said that a recession could hurt future economic growth. The government's growth projections for the next three years are higher than the private sector's.

The global economic environment, and near-term fiscal trends on both revenue and spending sides, could be different when the next provincial general election is held.

The email was mpotkins@postmedia.