American Express is rolling out a feature that will make applying for cards simpler. The trial has been going on for quite some time now.

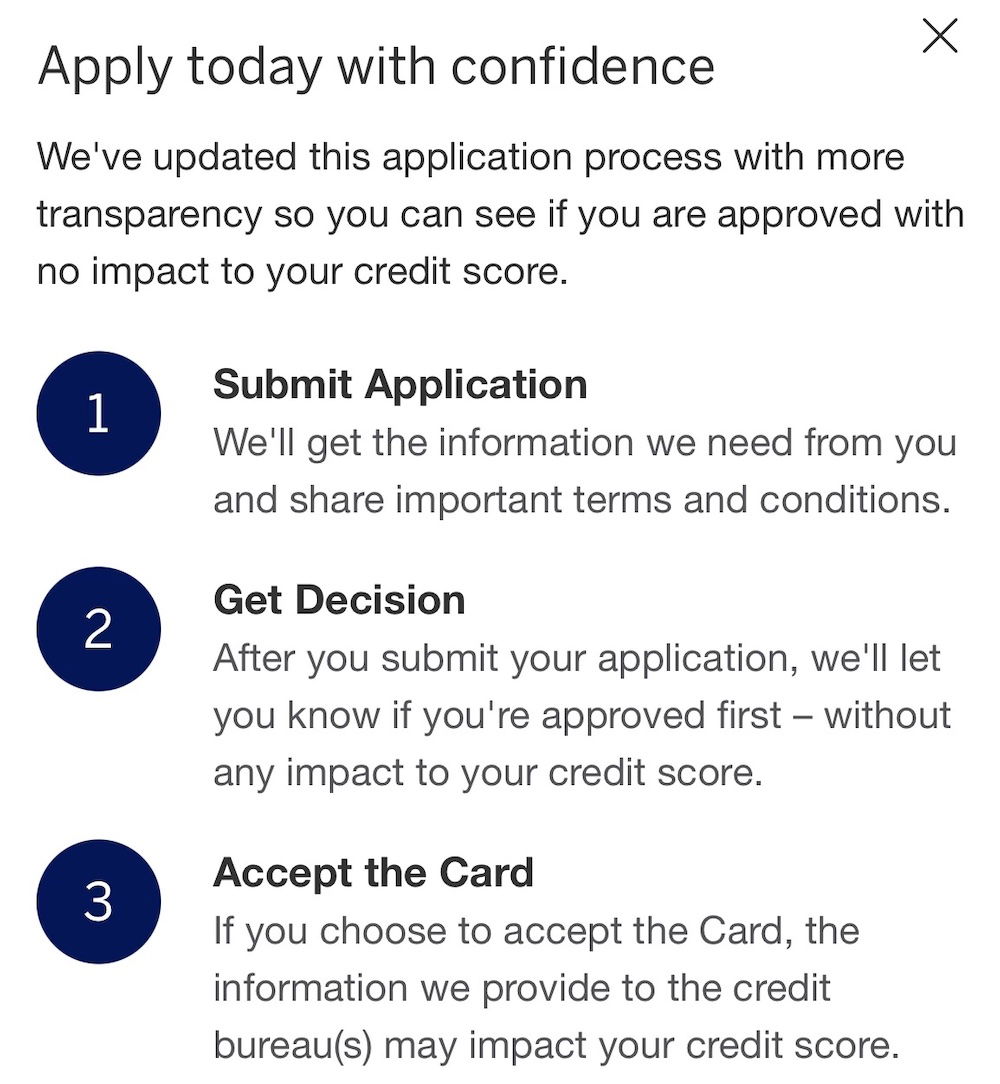

If you're approved for a card with no impact on your credit score, you'll be able to apply with confidence.

This is intended to be more transparent. The process is explained here.

The feature is only available to select applicants. When applying for a card, this feature isn't available. If you want to get access to this, you need to be not a member of the cardmember network.

This feature is described by Amex's executive vice president of U.S. consumer marketing.

“We know that consumers value transparency and certainty. With our new application experience, prospective Card Members can apply for a specific Card — and know if they are approved — without having to worry about whether their application will change their credit score until they accept the Card. We hope this new, more transparent application experience encourages anyone with an interest in American Express membership to apply.”

The concept of applying with confidence is a great idea that will make applying for an American Express card much easier. The Apple Card has a feature that allows you to know if you will be approved without a hard pull.

I think applying for a Amex card is the best way to get one.

Personally, I have never considered a hard pull from a credit card application to be a big deal. Some people are worried that applying for a card will hurt their credit score, but it shouldn't be a big issue in the scheme of how credit scores are calculated, assuming you have a great score. Getting approved for a card can help your credit score.

What is the point of a hard pull after approval? If a hard pull shows some major red flags, what is the point of the hard pull?

Amex has a feature called "Apply With Confidence" that will allow you to get a decision on your card approval before it's too late. Many people will be more comfortable with this feature. Amex is my favorite issuer because of its pop-up feature and easy card approval.

What do you think about this new feature?