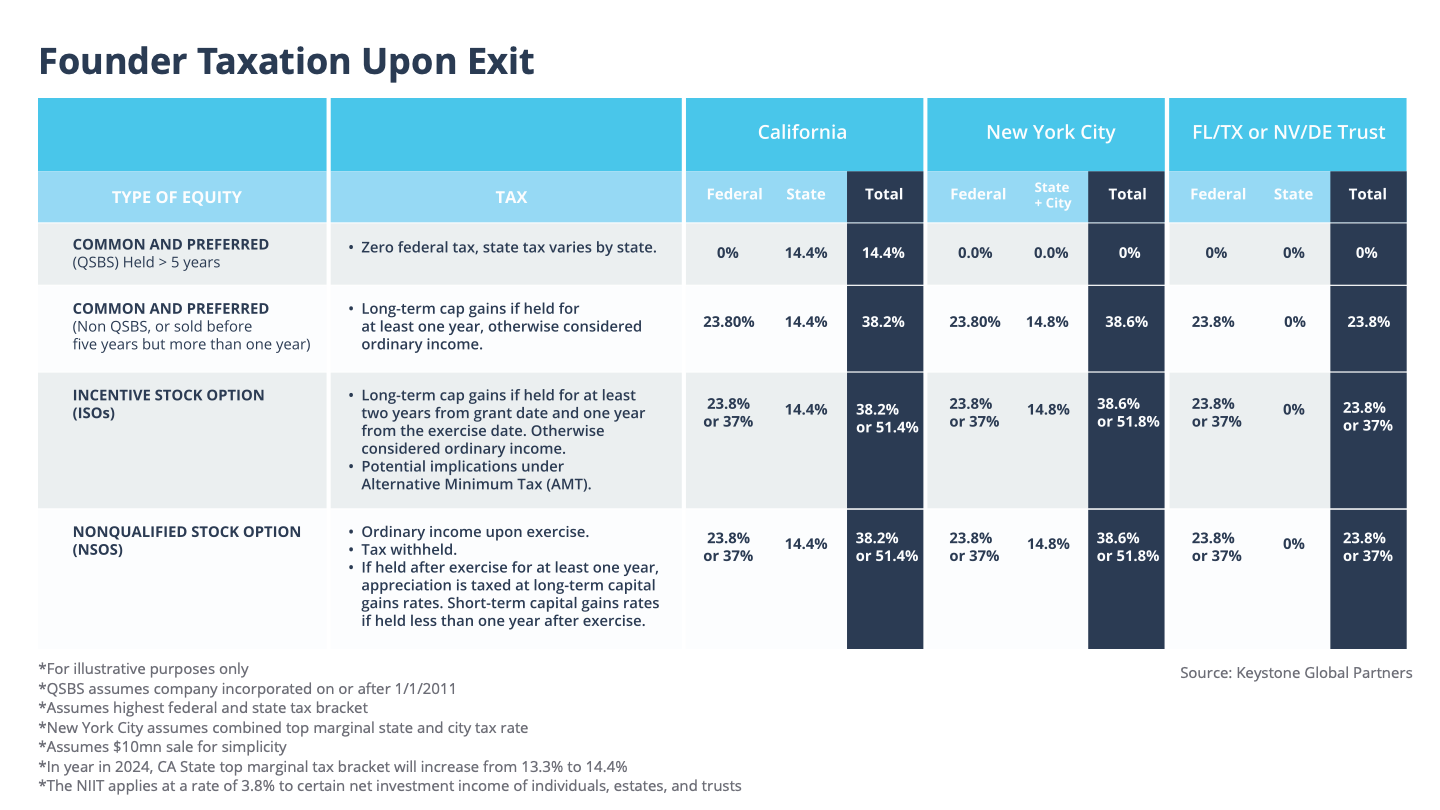

A founder's valuation gets a lot of attention when it's sold. Too little consideration is given to what stockholders and stakeholders pay in taxes after the sale.

Some founders pay no tax while others pay a lot of their sale proceeds. It's possible for a founder to walk away with two times the amount of money as another founder at the same sale price. A founder's take- home proceeds can be impacted by personal tax planning.

What happens when this occurs? Depending on the type of equity owned, how long it's been held, where the shareholder lives, potential tax rate changes in the future and tax-planning strategies, taxes owed will ultimately depend on those factors. Chances are you are ahead of the game right now. It isn't easy to determine how much you owe.

State tax and future tax risks will also be discussed. This isn't tax advice. Before you make any tax decisions, you should talk to your CPA or tax adviser.

When it comes to minimizing capital gains tax, QSBS (qualified small business stock) can be a game-changer for people that qualify.

Assume you are a founder and own equity or options in a venture backed C-corp. There are a number of factors that can affect whether you will be taxed at short-term capital gains or long-term capital gains. Understanding the differences and where you can improve is important.

There are different types of taxation that apply. If applicable, I'll show the combined federal, state, and city taxes.

Some of the advanced tax strategies I covered in my previous article should be explored by anyone with an exit that will raise more than $10 million.

The image was created by Keystone Global Partners.

Some of the more common levers that influence how much tax a founder owes are QSBS, trust creation, how long you've held your shares, and whether or not you exercise your options.