The central bank has a lot of work to do before it can bring inflation under control, according to the president of the Fed.

A voting member of the Federal Open Market Committee, he spoke about a rules based approach to policymaking. The moves the Fed has made so far are not enough according to the standards set by a professor at the school.

The change in the monetary policy stance appears to have had limited effects on observed inflation, but market pricing suggests disinflation is expected in the near future.

He said in a series of slides that the policy rate is not yet in a zone that may be considered sufficiently restrictive.

The policy rate needs to be increased further to reach a sufficiently restrictive level.

Data shows the pace of inflation may be slowing. The consumer price index for October increased 0.4%, below market expectations, and the annual pace is down to 7.7%, off the 41-year high reached in the summer. Core inflation, which excludes food and energy, is still out of line with the goal and is one of the measures the Fed prefers.

There is no dissent over whether the Fed should continue to raise rates. A few more increases will take the central bank's benchmark overnight borrowing rate to around 5% from its current target range of 3%- 4%, according to most members.

According to the presentation, 5% could be the low range for where the funds rate needs to be, and that the upper bound could be closer to 7%. Current market pricing shows the fed funds rate topping out at 5% by mid-2023.

The link between inflation and economic growth is established by the Taylor Rule. The annual rate of inflation is still the highest in more than 40 years.

Several other Fed officials have expressed the need to keep up the heat against inflation, and several said policymakers could ease up a bit from the recent increases. Markets are expecting the December FOMC meeting to yield a 0.5 percentage point move after the Fed approved four consecutive 0.75 percentage point rate increases.

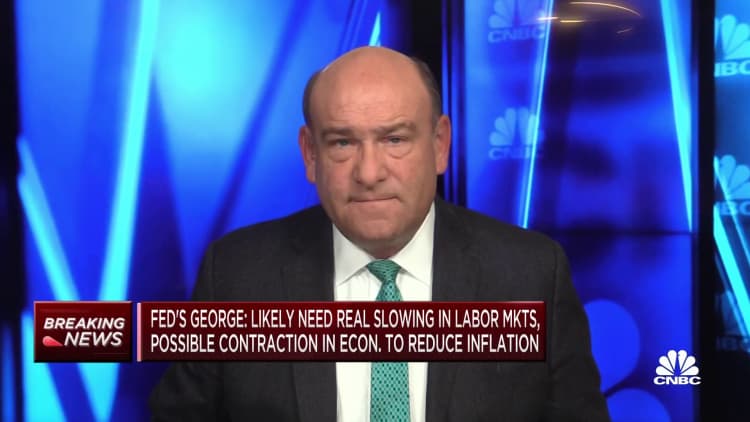

Esther George, president of the Kansas City Fed, told the Wall Street Journal that she is concerned about the impact of the policy tightening on the economy.

George told the Journal that he hadn't seen a time in his 40 years with the Fed when there wasn't a lot of pain.

George is a member of the committee.

The Fed Governor said on Wednesday that he is open to the idea of stepping down the level of rate hikes but will need to see more evidence before he agrees.

The president of the San Francisco Fed told CNBC on Wednesday that she expects more rate increases and that a pause is off the table even with a lower level of rate increases.

Several regional presidents and the governor are scheduled to speak at the Fed.